Joaquin Ossorio-Castillo/iStock Editorial via Getty Images

Warner Bros. Discovery (NASDAQ:WBD) is selling at a deep discount to intrinsic value based on its capital structure, ability to generate consistent cash flows, leading industry position, promising growth, and exceptional management team headed by John Malone. At $13.72 per share and $33.3b market cap, it is worth $27 per share and $66b market cap in 12 months (100%+ upside) in a base-case scenario.

Description/Background

On April 8, 2022, AT&T (T) and Discovery closed the WarnerMedia Transaction and the entity started trading on the Nasdaq with the symbol WBD as the second-largest media company in the world. AT&T dividend investors rotating out of the stock, recession, and expected difficulties integrating streaming services are causing IB downgrades. JPMorgan (JPM) is neutral on the stock and recently dropped the target from $24 to $22.

John Malone – one of the most well-known and successful media/cable company investors – led the tax-free Reverse Morris Trust stock transaction. Malone is a brilliant financial engineer with a vision for the future and a Buffett-like ability to allocate capital. He understands the imperative of the media conglomerates to offer over-the-top services while maintaining solid financial discipline. The market is perplexed about the asset base the investors are buying into, and the opportunity exists with the next quarter’s announcement of the financials clearing up a lot of confusion for retail investors and traders. The $33b market cap is worth $66b+ in 12-24 months without straining on valuations. In WBD’s 424B3 SEC prospectus filing, JPM pegged the company’s enterprise value in the $132-172b range (200%+ upside). How can we trust JPM’s $22 price target now?

WBD is a cash flow story with room to grow in streaming as the company competes for the total addressable market (TAM) with Netflix (NFLX). The scale of WBD’s linear and direct-to-consumer offerings (74m+ subs) is enhanced with HBO and Warner Brothers studio productions layered with live sports and news content. Guided by an experienced team, WBD is selling at .59 book value, ignoring goodwill accumulated through Warner Media’s history.

Capital Structure

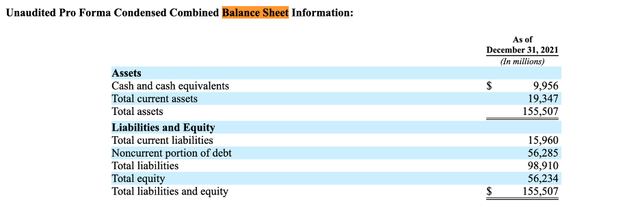

- Assets: $155b

- Liabilities: $99b (debt $56b)

- Equity: $56b

- p/b= .59

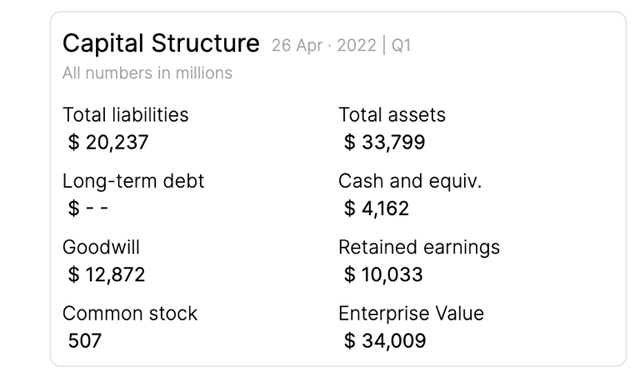

Most financial websites tailored to retail investors display old capital structure metrics (Yahoo, SA, ROIC.ai, GuruFocus, etc.). Without a deep dive into the capital stack, investors have a tough time understanding what they are buying because the market cap is accurately reflected on a day-to-day basis, but this cap represents over $155B of assets, not the $33.8B of assets taken from Discovery’s Q1 balance sheet in April.

Institutional investors allocate teams to comb through prospectuses, but the float also holds substantial retail interest without the ability and/or time to wade through 400-page documents. John Malone has a history of tracking stocks, splits, spinoffs, and Reverse Morris Trust transactions like WBD with favorable tax treatment for the shareholders.

As such, investors must analyze sources and uses of funds to determine WBD’s intrinsic value and compare it to peers. Streaming businesses are going through a valuation transformation from growth stocks to “show me the money” value plays. Netflix was the ultimate growth story until an abrupt change in the first quarter of 2022. Netflix’s asset base is $44b vs WBD’s $155b, yet the company is selling for $80b (after a 70% drop YTD) vs. $33b. Warner Bros. Discovery’s shareholder dislocation compounds several issues:

- Rotating investor base after the spin

- Difficult to value (overdependence on IB targets)

- Concerns over growth, price wars with competitors

- Recession fears affecting the advertising business

- Scaling streaming business might be more expensive than projected

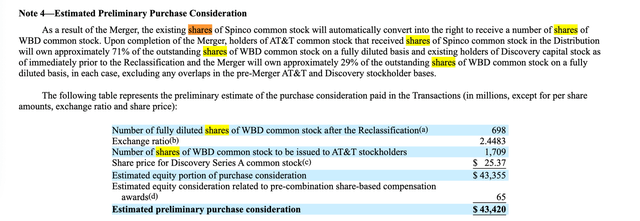

Focusing on the capital stack, Malone purchased Warner Media from AT&T for $43b in Discovery’s stock. No cash exchanged hands, and now the market values the combined company at $33b, a $10b discount and zero value assigned to Discovery.

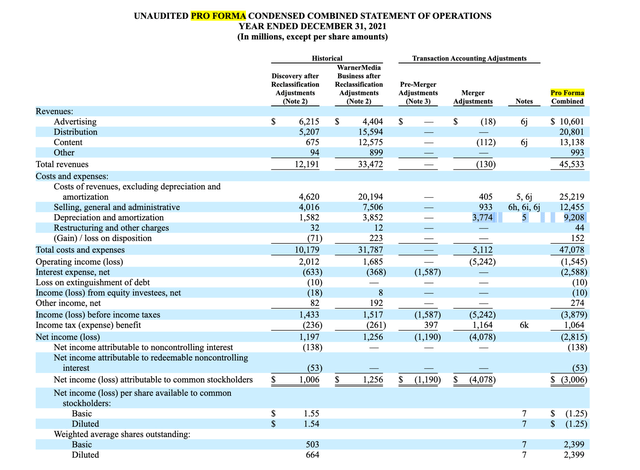

424B3 SEC Prospectus, April 2022.

Why is the market discounting WBD? Too much debt when interest rates are rising, inflation forces expenses up, and the trifecta: recession.

What are the company’s free cash flow generation capacity and user growth potential?

On operating metrics, management predicted annual ~$8b FCF, $15b EBIT with $50b revenues a few months ago, though the numbers have been reduced in the final prospectus. They also target 2.5-3x leverage in 24 months, down from 4.8x post-transaction.

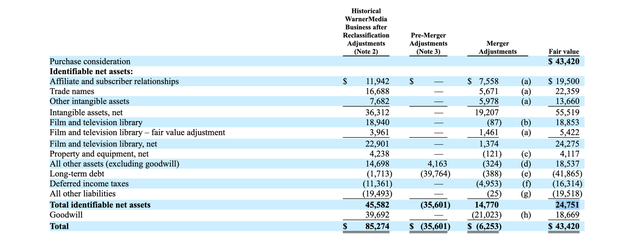

Malone purchased Warner Media’s net assets with a fair value of $25b plus $18b goodwill. When added to Discovery’s cash flow generating assets and right-sizing the cost structure, squeezing out a few billion in operating expenses, and growing the streaming subscriber base, the fair value of the combined enterprise will exceed today’s market cap. The .59 price/book ratio discounts the $18b goodwill from the $56b equity value of the combined company, and includes an additional $5b discount ($33b at $13.55 per share).

Fair value table (Warner Media standalone):

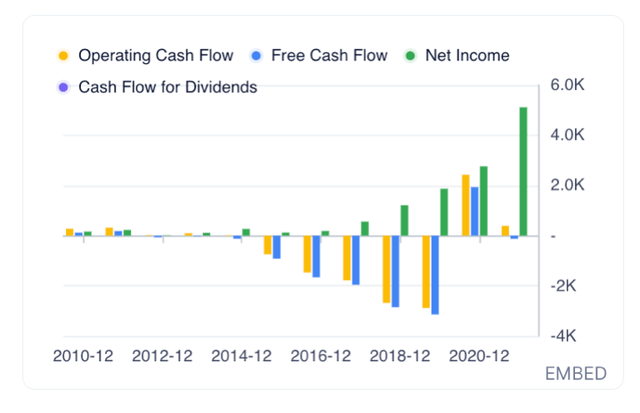

Using his cable company financial engineering experience, Malone likes to utilize depreciation in the income statement as a tax shield: net income negative, FCF positive.

Deleverage Targets

WBD has $56b of debt. With rate hikes, financing new debt will be more expensive this year and the company is unlikely to replace it. Cost synergies of $3b by the end of the second full year after transaction closing will further de-lever the company and will free up cash for other uses. Since the merger was debt-financed, Discovery took on $42b of AT&T’s debt. Fitch downgraded L-T IDR to BBB- and Sr. Unsecured to BB+ from BBB+ based on the 4.0x+ leverage, which is expected to drop in 2023 and the company will be rerated higher. 25% of debt is prepayable and maturities are staggered at a manageable 10% in 2024, $800m in 2025, and $700m in 2026. WBD paused stock buybacks in favor of debt reduction.

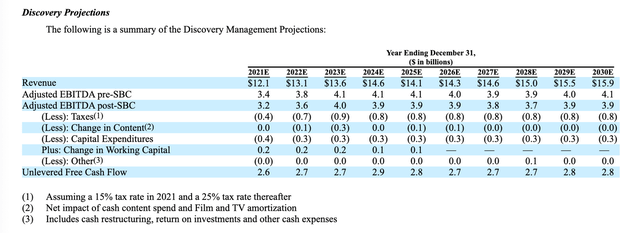

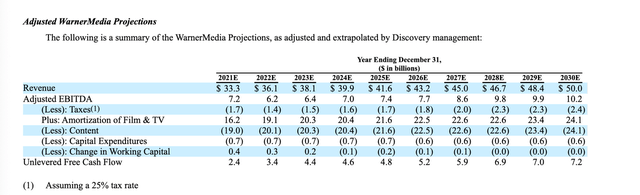

Free Cash Flow Generation Capacity

Combined, the entity should generate $6.1b unlevered FCF in 2022. Conservatively taking $6.6b FCF in 2023 (below the projected $7.1b), WBD will be valued at $66b+ with a 10x FCF multiple, 100%+ upside. Netflix by comparison produced $1.9b FCF in 2020 (during the pandemic), and is aiming to go positive this year. Is WBD worth less than half of NFLX’s depressed valuation while generating positive cash flows and growing market share? Probably not.

Netflix lost 70% YTD specifically because the growth story is broken, the company lost 200k subs in the last quarter and the losses are expected to accelerate on the 221.6m base as competition increases. Netflix’s enormous scale is being tested with higher-priced packages, the potential introduction of ad-based business, and a crackdown on password sharing.

WBD on the other hand is a value growth story. The subs, 76.8m in Q1 2022, will increase with time. Disney+ demonstrated it is easier to grow from a smaller base, gaining 7.9m in Q1 2022 to 87.6m total. Competition is fierce, but would you rather be fighting to capture TAM or defending the market position like Netflix? As recession hits, customers will begin to pick and choose their services and HBO has unrivaled, high-quality content for viewers (“Game of Thrones,” “Westworld,” “Winning Time,” etc.).

WBD will package sports, HBO, and Discovery content into multiple tiers with a deep library backing the service. The moat to enter the streaming business to compete with WBD is prohibitively high. VCs like Matthew Ball viewed Netflix as a dominant platform with the ability to create massive buzz from shows like “Tiger King” and “Squid Game.” Arguably, WBD will be in a similar position in a year or two, but with better economics. The company will be profitable along the way, writing off maturing debt while growing free cash flows and buying back shares if they are priced under book value.

Risks

A recession can affect the advertising revenue vertical. But this risk is overblown. Warner Media generates $10B from advertising, and they recently announced a 30% workforce reduction in the ad sales arm. Package price sensitivity might prove difficult to calibrate and optimize. The value proposition of brand new services will involve some A/B testing.

Product quality can be affected by poor execution under new management as executive production teams might experience discomfort during the transition from AT&T to the new company. WB Studio’s reputation could be damaged by currently unknown factors. And customer lifetime value metrics could be eroded by inflated acquisition costs.

An inability to refinance debt at attractive rates could stress the balance sheet. Interest rate spikes might be problematic for 4.8-5.0x debt/EBITDA businesses. WBD isn’t planning to refinance, but the option to do so needs to be on the table.

Catalysts

Clarity regarding the capital stack provided by next quarter’s earnings will provide a congruent financial picture to retail investors. $3b of synergies will be realized sooner than expected as a recession will provide cover for management to make tough personnel decisions immediately.

Time is a catalyst for WBD as free cash flows will be used to cut debt, and the balance sheet strength will draw in institutional investors. As a new service provider and an immediate global media powerhouse, WBD doesn’t have a set price point for its packages and can adjust the new tiers with inflation.

Conclusion

Warner Bros. Discovery is worth $66b based on 10x 2023 FCF projections. The company should be a part of a diversified portfolio, representing streaming services and media content and distribution companies. Under Malone’s experienced guidance, investors can be confident in leadership’s ability to weather multiple down cycles. At the current price, the margin of safety is built in, and the equity is selling for 59 cents on the dollar.

Be the first to comment