peshkov/iStock via Getty Images

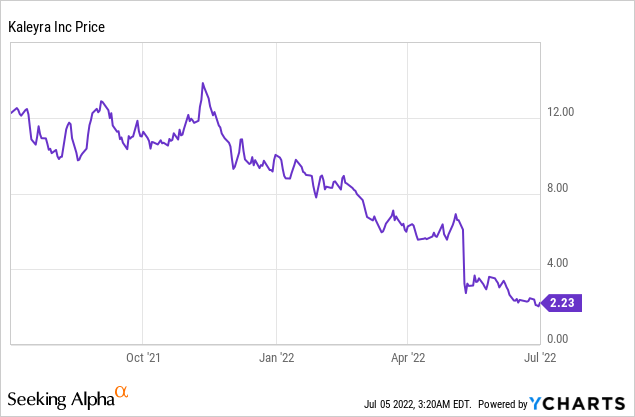

Kaleyra (NYSE:KLR) is a promising CPaaS provider with a turbulent stock market history. The shares shed 77% since the start of the year. The company started the year off optimistically and quickly had to adjust as it published the first-quarter results. A mix of challenges hit the company simultaneously. It suffers from foreign exchange headwinds, the war in Ukraine, and intense pricing competition in Brazil.

I believe the stock market overreacted to these headwinds and provides a good entry point into this fast-growing company.

The whole CPaaS market took a significant hit, with competitors like Twilio (TWLO) and Bandwidth (BAND) also down significantly.

Consider this article an update of my earlier write-up in January.

About Kaleyra

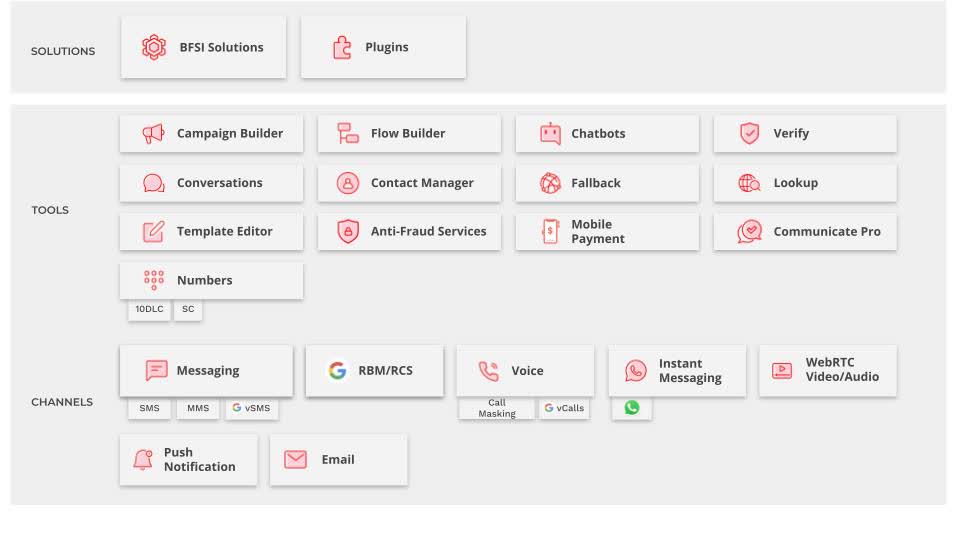

For those unfamiliar with the company, I’ll deliver a short introduction. Kaleyra is a CPaaS (Communications Platform as a Service) vendor. It enables businesses to connect with customers through text messages, WhatsApp, voice calls, video calls, emails, etc.

KLR 10-K (Seeking Alpha)

It has a strong foothold in its origin country Italy. It’s also well-positioned in India and the U.S. since acquiring mGage.

In terms of verticals, it’s firmly positioned amongst European banks. Kaleyra is a trusted service that can attract confidential businesses like financial institutions and healthcare.

KLR Investor Presentation (Seeking Alpha)

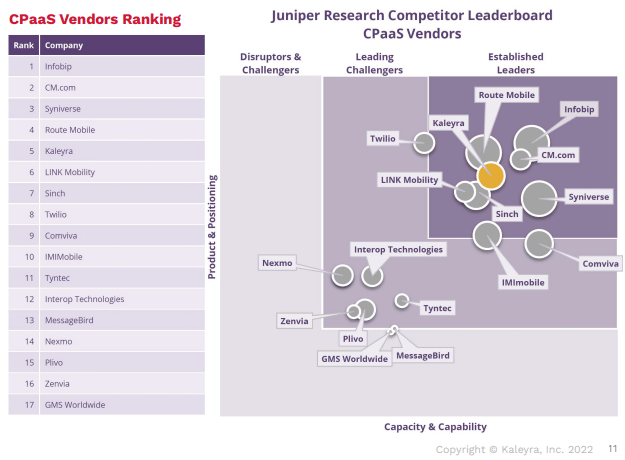

Kaleyra receives regular recognition for its services from research companies like Juniper and Gartner.

Growth

Strong 2021 Growth Through Acquisitions

Looking back at 2021, Kaleyra posted 267.7M in revenue for 82% revenue growth. An impressive feat but primarily boosted by the acquisitions of mGage and Bandyer. Its legacy business displayed 25% organic growth.

Reduced Outlook Since Q1

Kaleyra’s $80.5M revenue came in notably below the $84M – $86M outlook. It grew only 12.4% organically. It also reduced the full-year outlook to $360M – $365M from $400 – $405M. A sharp 10% reduction. The new view implies 35% growth at the midpoint. That’s the bad news.

The good news is that the margins came in better than expected. It also managed to squeeze out a slightly positive free cash flow.

Looking Forward To 2022 And Beyond

The updated outlook with 35% growth in 2022 points towards ~11.8% organic growth as mGage and Bandyer contribute for the first full year. Organic growth should pick up again in 2023 as the CPaaS market expands further and Kaleyra executes its growth strategy. It will expand geographically, expand its omnichannel offering, and focus on being a secure, trusted, and reliable service.

Analysts currently expect 20% and 22% revenue growth in 2023 and 2024, respectively.

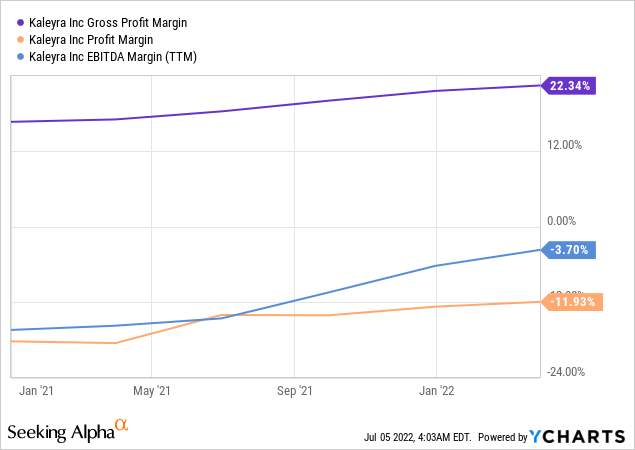

Margins Improve

Kaleyra consistently improved its margins since going public. The acquisitions helped as they added higher-margin products like voice and video. These are also growing faster. In Q1, messaging grew 20%, voice 33%, and video wasn’t disclosed. The Voice margin is double of messaging, and the video’s margin is 3x or 4x the messaging.

The company expects to improve these margins with a better product mix.

The situation in Brazil showed how Kaleyra favors margins over revenue. The company couldn’t achieve the margins it wanted and decided to avoid comprising its business fundamentals.

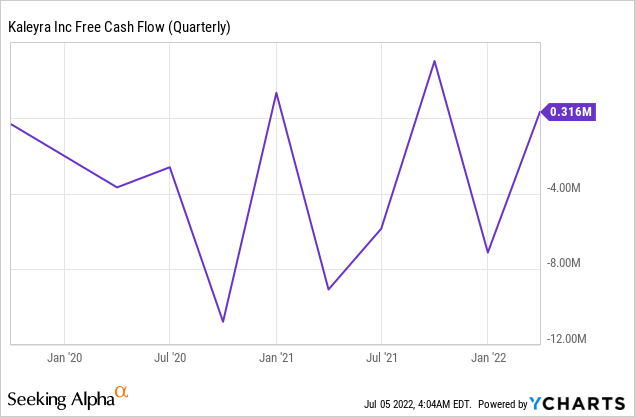

Free Cash Flow Follows

Free cash flow is vital as this is what a company could use for shareholder returns. Potential buybacks or dividends are only possible if the company produces enough cash.

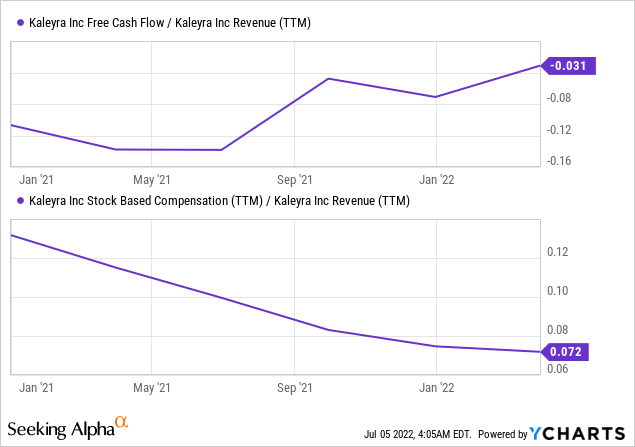

Looking at the free cash flow conversion in the past, Kaleyra hasn’t had a positive twelve-month period yet. Recently, it swings quarter to quarter between negative and slightly positive free cash flows. The trend looks good, obviously. It focused on positive cash flows from Q1 and expected a positive full year as well.

An important note about the free cash flow is the exclusion of SBC. Kaleyra has a reasonable amount of stock-based compensation. It has dropped as a percentage of revenue and should come down further.

Shareholder Returns

I don’t expect any shareholder returns soon. The free cash flow first needs to be consistently positive. The SBC will continue to dilute shareholders slightly. A dividend won’t be declared soon either, as Kaleyra states in its 10-K.

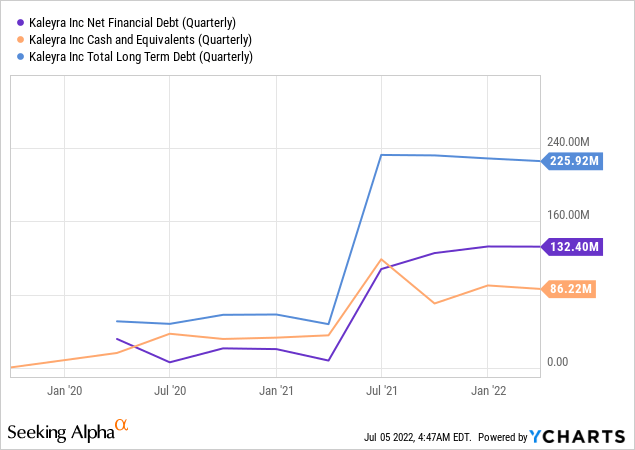

Kaleyra also has a decent amount of debt that it looks to service first. It plans to pay down $10M in 2022.

Balance Sheet

Kaleyra expanded its debt position significantly to acquire mGage. It issued $200M convertible notes that mature in 2026. It also has a small amount of conventional debt with banks.

It does have enough cash to continue its business. As it expects to be cash-flow positive, the cash position should remain pretty stable as it pays down a bit of debt.

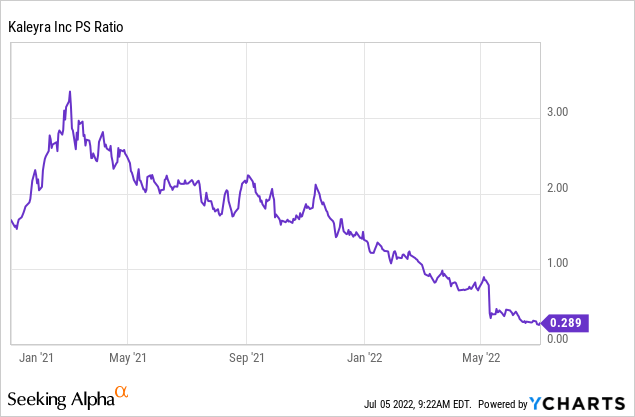

Valuation

Kaleyra’s only measurable metric is the PS ratio. It doesn’t produce positive earnings yet and the FCF is also negative. The PS isn’t my favorite metric. It excludes debt and doesn’t tell anything about the profitability. It’ll have to do, though.

Using the P/E ratio, KLR looks incredibly cheap. A fast-growth company available below 0.5 P/S was impossible to find just a year ago. The cheap valuation is one of the most attractive feats of the stock today. I believe confirmation of Kaleyra’s revenue and cash flow outlook would be enough for a revaluation of the stock.

Risks

The stock price didn’t drop without a cause for Kaleyra. The slowing growth is disappointing and the recent events and macro outlook could incite more fear and a further reduction of the 2022 targets.

Kaleyra has a significant amount of debt and is highly leveraged with the current low margins. The company could also face write-downs. It carries $230M of goodwill and intangibles on the balance sheet. It has enough cash to continue, but such a write-down could have a cascading effect on debt covenants.

Kaleyra operates with the lowest margins among CPaaS peers. I see it as a risk because of possible difficulties in converting revenue into cash flows. It’s also an opportunity as it could probably increase margins a lot further by chasing the right customers and products.

Wrap-Up

There are substantial headwinds for Kaleyra as shown in Q1. A price war made the company exit Brazil and dampened a part of its revenues. It has significant exposure to the war in Ukraine and is sensitive to the European economy. There are also bright spots with its expanding margin and growth in the U.S.

The long-term outlook looks good as companies increase their omnichannel approach to (potential) customers. Kaleyra has a broad offering and should be able to expand its higher-margin voice and video business. It has a safe offering that remains attractive to financial institutions and could become more important to other sectors.

As I see it, Kaleyra could become a multibagger upon rediscovery by investors.

Be the first to comment