Juan Jose Napuri/iStock via Getty Images

We’re just over a week away from the beginning of the Q1 Earnings Season for the Gold Miners Index (GDX), and one of the first companies to release its preliminary results is K92 Mining (OTCQX:KNTNF). While H1 2021 was a challenging period for the company due to significant headwinds out of its control, H1 2022 has started off much better, with a record monthly throughput figure in March. Based on K92 Mining’s key differentiators as a high-quality organic growth story with significant exploration upside, I would view any pullbacks below US$5.90 as buying opportunities.

Kainantu Mine Mineralization (Company Presentation)

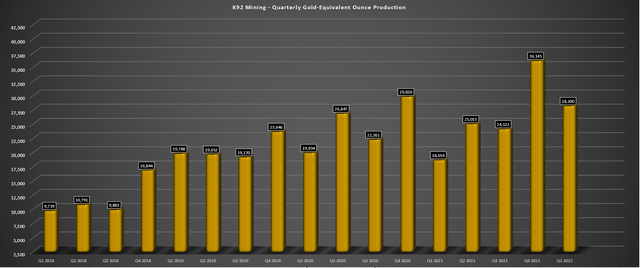

K92 Mining released its preliminary Q1 results this week, reporting quarterly production of ~28,200 gold-equivalent ounces [GEOs], translating to a 51% increase from the year-ago period [Q1 2021: ~18,700 GEOs). The massive year-over-year increase in production was partially related to being up against easy year-over-year comps due to the headwinds in Q1 2021. This was related to travel restrictions, a shortage of bulk emulsion explosives, and an underground loader incident. However, easy comps or not, the results were still impressive. Let’s take a closer look below:

K92 Mining – Quarterly GEO Production (Company Filings, Author’s Chart)

As shown in the chart above, K92 Mining has continued to grow its production like a weed since beginning commercial production, and while there has been some noise in the quarterly results, the trend is clearly higher. This is evidenced by the company’s industry-leading compound annual production growth rate of ~12.5% (Q1 2022 vs. Q1 2019), and given recent developments; we should see an acceleration in this rate by Q1 2023.

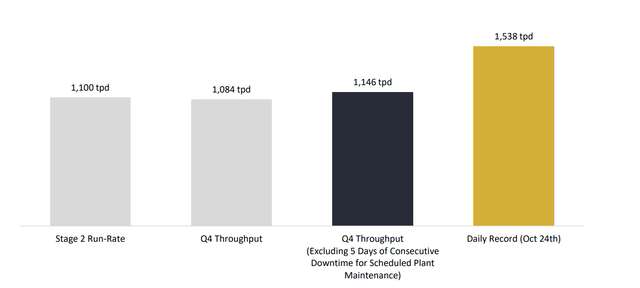

One catalyst for this continued growth is that K92 Mining continues to see outperformance at its mill, operating well above the expected Stage 2 run rate. With its solid performance, the company is in the process of expanding throughput to 1,370 tonnes per day (Stage 2A), with plans to increase free cash flow short-term to help its planned Stage 3 Expansion (3,200 tonnes per day) with commissioning expected by 2025. As the chart below shows, the Stage 2 run rate was targeted at 1,100 tonnes per day, but Q4 throughput averaged 1,146 tonnes per day (ex-downtime) with a daily record of 1,538 tonnes per day in October.

K92 Mining – Mill Throughput (Company Presentation)

If we look at the Q1 results, this outstanding performance has continued, with a record monthly throughput of 1,219 tonnes per day (11% beat vs. the Stage 2 target). Notably, 45% of days in March exceeded 1,300 tonnes per day, 18% above the Stage 2 target run rate. This certainly places increased confidence in the company’s ability to deliver on its Stage 2A Expansion this year, with nearly half of March’s mill performance already well on the way to meeting the 1,375-tonne per day target. At this rate, and assuming an average feed grade of ~10.0 grams per tonne gold-equivalent, K92 Mining has a path to increasing production by more than 50% in FY2023 vs. FY2021 levels.

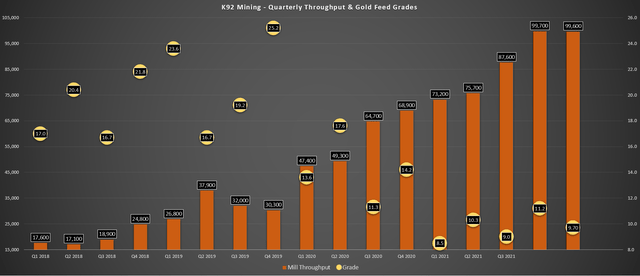

K92 Mining – Quarterly Operating Metrics (Company Filings, Author’s Chart)

Looking at the quarterly operating metrics above, we can see that mill throughput in Q1 came in just shy of the Q4 record (~99,700 tonnes) at ~99,600 tonnes. However, production declined sequentially due to lower than budgeted grades in the period. It’s important to note that while K92 Mining didn’t have the same headwinds as last year, it was still contending with a couple of headwinds in the quarter. This included the delayed receipt of a new twin boom jumbo, 45-tonne truck, and 17-tonne loader. In addition, COVID-19 cases rose sharply in Q1, which led to elevated absenteeism.

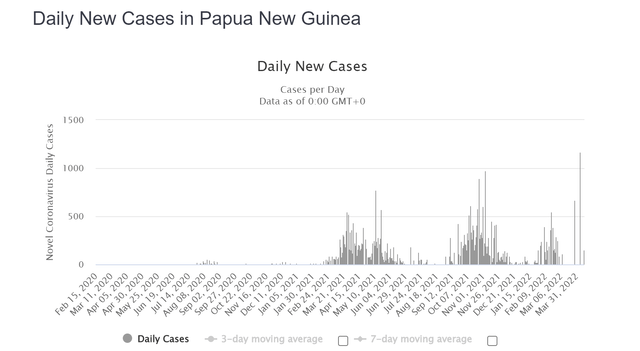

COVID-19 Cases – Papua New Guinea (Worldometers.info)

These headwinds make the solid Q1 performance even more impressive, and the fact that development on the twin inclines is ahead of budget. This is evidenced by incline #2 being advanced to 1,100 meters, and incline #3 advanced to 1,060 meters. Fortunately, with COVID-19 cases appearing to be improving in Papua New Guinea, the mobile equipment now on site, and the company moving into higher grades this quarter, we should see a very strong finish remainder of 2022. So, while Q1 production may be tracking slightly behind its guidance of 115,000 – 140,000 GEOs, I would be surprised to see a guidance miss this year and believe 125,000 GEOs is more than achievable.

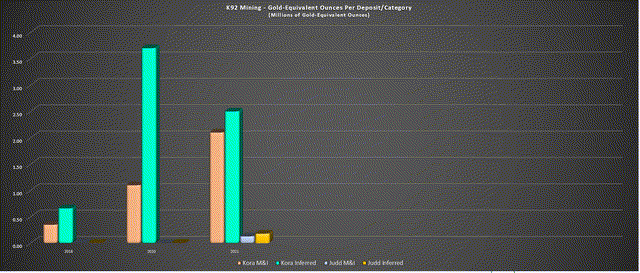

Stage 3 Expansion & Resource Growth

The major story for K92 Mining is its Stage 3 Expansion, and while Q1 production may have come in slightly behind investors’ expectations, the company certainly surprised on the upside with its resource. This was based on M&I resources at its Kainantu Mine increasing 90% to ~2.1 million GEOs at a grade of 9.2 grams per tonne gold-equivalent. The growth in the resource base combined with near-mine exploration upside (Kora South) certainly supports the company’s ambition to become a ~350,000-ounce per annum producer, with a ~6-year mine life based on M&I resources, with significant inferred inventory as well to back up M&I resources.

K92 Mining – Resource Base Progression (Company Filings, Author’s Chart)

Meanwhile, operational flexibility has also improved, with mining beginning at the nearby Judd deposit (200 meters from Kora), and a maiden resource has been reported here as well (~310,000 GEOs). Even assuming continued supply chain headwinds, the company should be able to commission its Phase 3 Expansion by 2025, which would more than triple production from FY2021 levels (~104,000 GEOs). If the company explores a higher throughput rate than initially envisioned (1.2 million tonnes per annum vs. 1.0 million tonnes per annum), there is further upside to this production target.

Finally, while K92 Mining has an impressive track record of resource growth, it is not resting on its laurels and has an aggressive $12+ million exploration budget planned for 2022. This should help the company build further on its resource base, test the key Kora South A1 Gap and Judd South, and better define the porphyry potential on its property by drilling Blue Lake. The higher production, work towards the Stage 2A Expansion, and release of an updated Phase 3 Feasibility Study should give investors plenty to look forward to this year. Let’s take a look at the stock’s valuation below:

Valuation

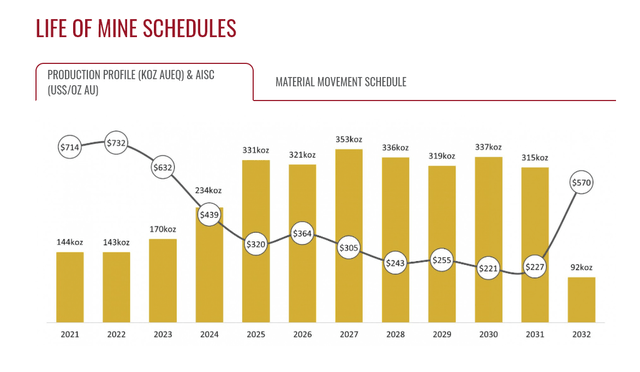

Based on ~237 million fully diluted shares and a share price of US$7.56, K92 Mining trades at a market cap of ~$1.79 billion. This may seem like a steep valuation for a junior producer. Still, it’s important to note that K92 Mining is a mid-tier in junior’s clothing, given that it has a clear path to annual production of ~350,000 GEOs with its Phase 3 Expansion. The company’s industry-leading growth rate alone justifies a premium multiple, with its industry-leading cost profile also being a key differentiator (sub $600/oz all-in sustaining costs in Phase 3).

K92 Mining Phase 3 Expansion PEA Results (Company Presentation)

Suppose we combine an estimated After-Tax NPV (5%) of ~$1.75 billion ($1,700/oz gold price) with $300 million in resource/exploration upside for Judd and multiple other targets. In that case, this translates to a fair value for K92 Mining of $2.05 billion. This fair value declines to ~$1.96 billion after subtracting an estimated $90 million in corporate G&A, but it is still north of K92’s current market cap (~$1.79 billion). So, even after the recent rally, K92 Mining trades at a discount to its fair value of US$8.30.

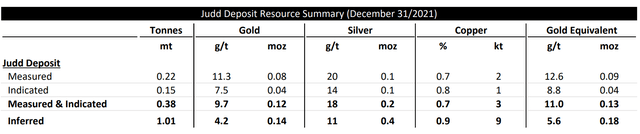

Judd Resource (Company Presentation)

One example of this upside that cannot be understated is the Judd deposit and new mining area, shown above, which is not included in the Stage 3 Expansion After-Tax NPV (5%), which is home to ~310,000 gold-equivalent ounces at an average grade of ~7.10 grams per tonne gold-equivalent. Other examples of upside include Kora South and several near-mine porphyry targets.

So, is the stock a Buy?

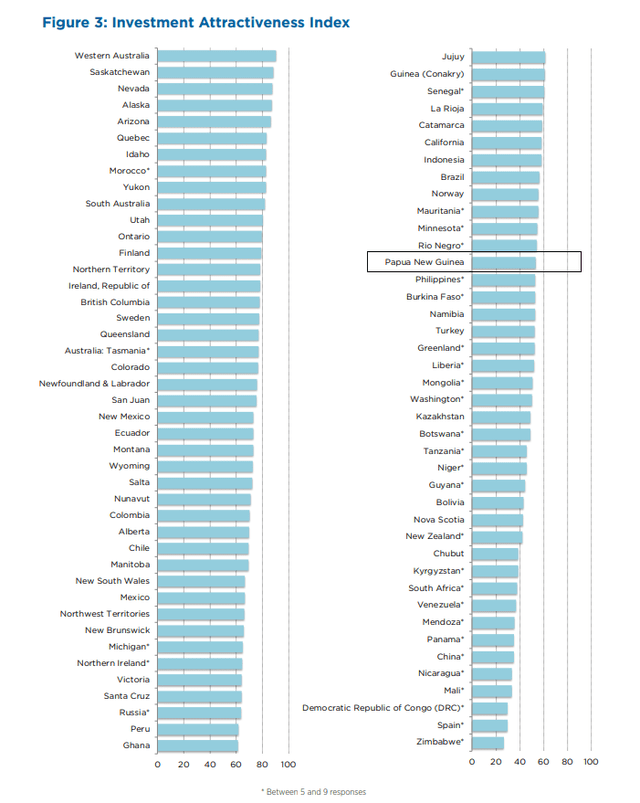

While K92 Mining trades at a discount to fair value, I prefer to buy at a minimum 30% discount to fair value for single-asset producers, especially those in non-Tier-1 jurisdictions. This is because single-asset producers already carry higher risk, with any potential issues magnified due to having only one operation. Meanwhile, K92 Mining operates in one of the least attractive mining jurisdictions as ranked by the Fraser Institute Annual Survey, with Papua New Guinea sitting near the bottom-third of all jurisdictions.

Fraser Investment Attractiveness Index (Fraser Institute Annual Survey)

The lower ranking for Papua New Guinea does not mean that K92 Mining must be avoided. Instead, it means that investors should ensure that they have an adequate margin of safety when buying the stock. Given that K92 Mining trades at just a 10% discount to fair value, I don’t see the current discount as adequate to justify paying up for the stock here near US$7.60. This doesn’t preclude the stock from heading higher, but at current levels, it does not meet my rigid criteria to justify purchasing the stock at these levels.

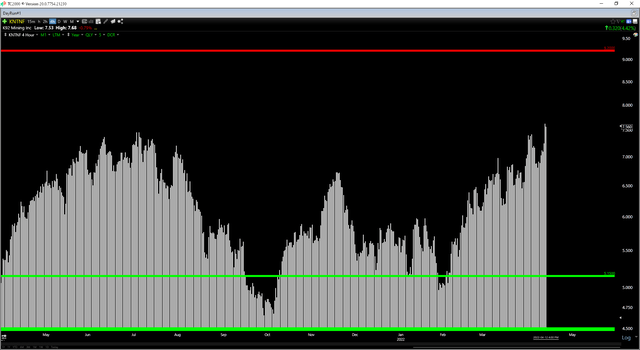

KNTNF Daily Chart (TC2000.com)

The technical picture corroborates the view that the stock is no longer in a low-risk buy zone, with K92 Mining in the upper portion of its expected trading range. This is based on the stock having strong support at US$5.15 and an overbought zone overhead at US$9.20. Given that the stock is currently trading at US$7.56, it has a reward/risk ratio of 0.65 to 1.0, well below the 5 to 1 reward risk ratio I require to enter new positions. So, with the ideal buy zone coming in below US$5.90 from a technical/fundamental standpoint, I am Neutral on the stock currently.

K92 Mining Operations (Company Website)

K92 Mining started off 2022 strong, despite COVID-19 headwinds and delayed receipt of mobile equipment. Fortunately, case counts are declining, the Stage 2A Expansion is well underway, and mobile equipment is now on site. This has set the company up for a strong remainder of the year, with investors also able to look forward to steady exploration results with an aggressive exploration budget. Given the solid outlook, I see K92 Mining as a solid buy-the-dip candidate, but I am neutral short-term after a sharp rally since February.

Be the first to comment