Orbon Alija/E+ via Getty Images

Thesis

The Nuveen Short Duration Credit Opportunities Fund (NYSE:JSD) is a fixed income closed end fund. The fund has current income as its main objective. As per the fund literature:

Under normal circumstances, the Fund will invest at least 80% of “Assets,” at time of purchase, in loans or securities in the issuing company’s capital structure that are senior to its common equity, including but not limited to debt securities, preferred securities. The Fund invests at least 70% of its managed assets in adjustable rate corporate debt instruments, including senior secured loans, second lien loans and other adjustable rate corporate debt instruments

The CEF runs a high leverage ratio of 39% and has Nuveen as its manager, a well-known name in the space. The fund has a low 0.5 years duration, which is a bit misleading in the leveraged loan space. Leveraged loans have embedded American options, meaning they are callable at any time. A duration calculation for this asset class assumes a certain call date, which is subject to assumptions. If we told an investor at the beginning of the year they would buy an asset class with a sub 1-year duration, they would have assumed they are safe from the rise in yields. Not the case here. JSD is down -11% year to date. Just keep in mind, duration is misleading in this space.

The fund has a middle of the pack performance in 2022 and on a 3-year look-back, but lags long term. We feel the fund is currently running too high a leverage ratio, and its historic performance is mediocre (sub 3% annual total return on a 10-year look-back). These results are ultimately the responsibility of the asset manager. From a technical stand-point JSD has a granular, normal build, but the results are poor. Ultimately, it is a story of poor credit selection and trading acumen here. We are not very impressed with JSD. If you are already a holder in the fund, hold until the end of 2023 given the expected recovery. New money looking to enter the space would do well to explore JSD’s competitors, as outlined below in the article.

Leveraged Loans Call Date

Duration is an asset’s sensitivity to interest rates. For fixed rated bonds, both junk and investment grade, a defined maturity date and a fixed coupon make the math fairly straight forward. For loans, duration is not a well-defined concept. That is because leveraged loans sometimes have variable coupons and are continuously callable. The vast majority of leveraged loans have an American option embedded in the structure, meaning the issuer can call them at any time. Every time a market participant talks about a “yield” in respect to a leveraged loan, they either make an assumption regarding a call date or quote a yield to maturity.

There are many factors that go into determining when a loan is called, but the general market assumption is that loans do not get called back in the first year after issuance, and generally never are outstanding if the term to maturity is less than one year, unless there is a distress scenario. Some of the factors that determine loan call dates are related to market spreads versus the underlying loan yield, prevailing conditions, quality of covenants and general risk-on modes for risk markets.

Although leveraged loans can be considered a low-duration asset class, the duration metric is not the standard format we encounter in fixed rate debt and thus allows for some ambiguity and more optimistic pricing than correlated with market conditions.

Holdings

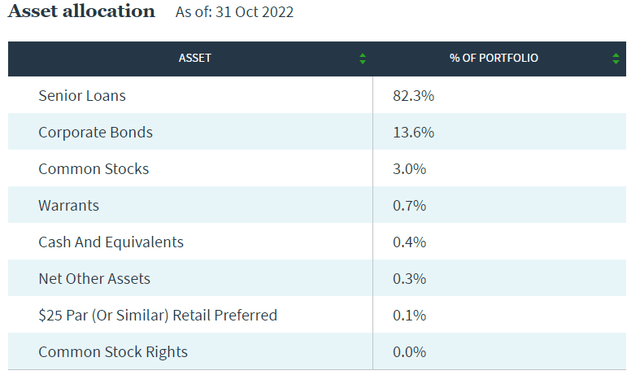

The fund is mainly composed of leveraged loans:

We can see that over 82% of the portfolio is allocated to bank loans. The remainder of the fund is invested in corporate bonds, with a very tiny sliver composed of common stocks.

The vehicle has a granular composition, with only one name exceeding a 2% portfolio threshold:

From the top issuer concentration, we can see that the vast majority of the portfolio contains individual issuers with an allocation of around 1% or less against the portfolio notional. We like granular builds because it exposes the fund to less systemic risk.

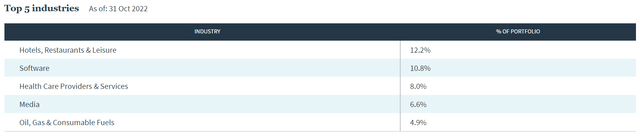

The fund takes overweight positions in the Hotels and Software industries:

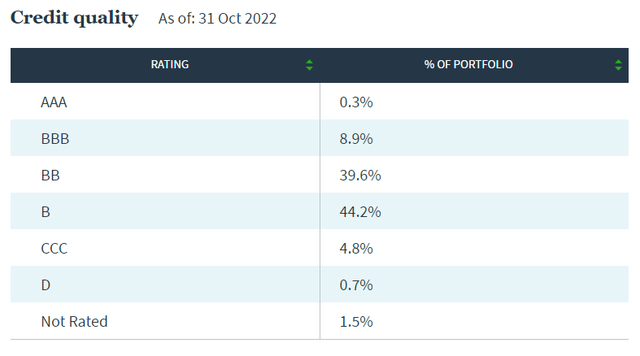

The CEF has a middle-of-the-road credit quality build, with the majority of the credits falling in the “B” and “BB” buckets (over 83% of the portfolio):

It is worth pointing out that the CEF is taking a very conservative approach with its “CCC” exposure, which is currently sub 5% of the portfolio.

Performance

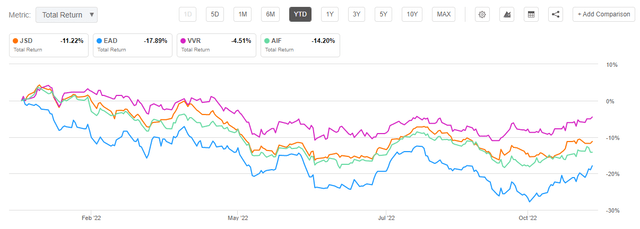

The fund is down -11% year to date, in line with most other leveraged loan CEFs from the utilized cohort:

Above are a number of CEFs which we have analyzed recently, being utilized for the performance comparison.

* Allspring Income Opportunities Fund (EAD) which we analyzed here

* The Invesco Senior Income Trust (VVR) which we reviewed here

* and lastly the Apollo Tactical Income Fund, Inc. (AIF) which we parsed out here

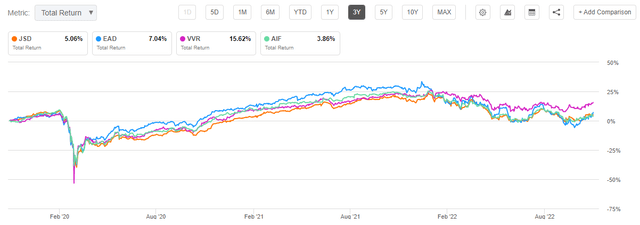

We can see that on a year to date basis, JSD is in the middle of the cohort, with VVR the clear outperformer. On a 3-year basis, the CEF posts a similar mid-cohort total return:

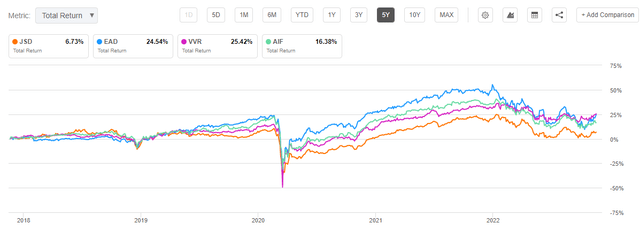

Longer term, though, JSD lags:

On a 5-year time-frame, the CEF is the worst performer, with a total return of only 6.7%. On a 10-year basis, the fund tends to show mediocre annualized total returns:

The 5- and 10-year total returns are extremely poor for this fund. We would have expected more here.

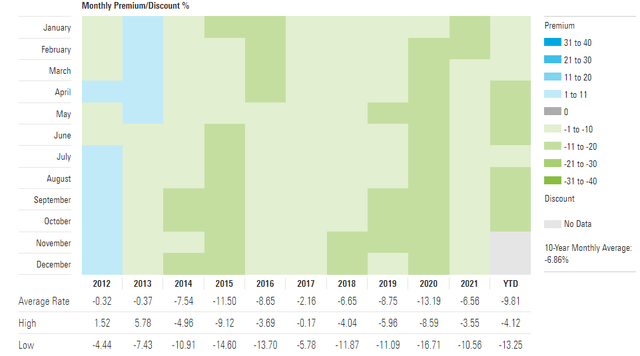

Premium / Discount to NAV

The fund tends to trade at a discount to net asset value:

Premium / Discount to NAV (Morningstar)

We can see that the CEF has not traded at a premium to NAV in the past decade. On average, the fund posts an 8% discount to net asset value. This trend tells us that the market is not perceiving the asset manager as doing a good job in trading and positioning the collateral. Leveraged loans are a low volatility asset class, with numerous players adding leverage to boost returns. Specialized hedge funds / PE funds tend to target 15%+ IRRs from this business. They usually engage in TRS (Total Return Swaps) facilities with investment banks to obtain the necessary leverage. The fact that JSD has a mediocre annualized long term return corroborated with the discount to NAV points to an uneasiness with the asset manager.

Conclusion

The Nuveen Short Duration Credit Opportunities Fund is a fixed income closed end fund. The vehicle has over 80% of its portfolio in leveraged loans, with a low duration of 0.5 years. The duration figure for leveraged loans is misleading, however, given the continuous callability for the asset class. JSD is down -11% in 2022, despite its low duration figure. The fund runs a high leverage ratio of 39% and has been trading at a discount to NAV for the past decade. Its long term results are fairly mediocre, and compare poorly with the rest of its peers. If you are already a holder in the fund, hold until the end of 2023 given the expected recovery. New money looking to enter the space would do well to explore JSD’s competitors, as outlined in the article.

Be the first to comment