Justin Sullivan

Introduction

Volvo Car (OTCPK:VLVOF) produces passenger cars under the Volvo and Polestar brand names. Volvo Car AB should not be confused with Volvo AB (OTCPK:VOLAF), under which the production of trucks, buses, marine engines and construction equipment takes place.

Volvo’s luxury brands are a sought-after luxury item for many businessmen. The company foresees strong growth and is expected to increase EBIT margin from 2.6% to 8% within 5 years. The company is experiencing temporary headwinds from higher costs and reduced production due to component shortages. The temporary headwinds have caused the share price to fall, which benefits investors looking to buy the stock cheaply. The stock’s valuation is very appealing, and growth expectations are high, making the stock a good buy.

Earnings Expectations Are Strong

Demand continued to be robust (Volvo Car’s 3Q22 Investor Presentation)

Figures for the third quarter were mixed, as car production was down and costs were higher. Despite these headwinds, Volvo expects strong demand. Revenues in local currency (SEK) were 30% higher than the same period last year. This was mainly due to favorable volumes, price/mix, exchange rates and joint venture contract production.

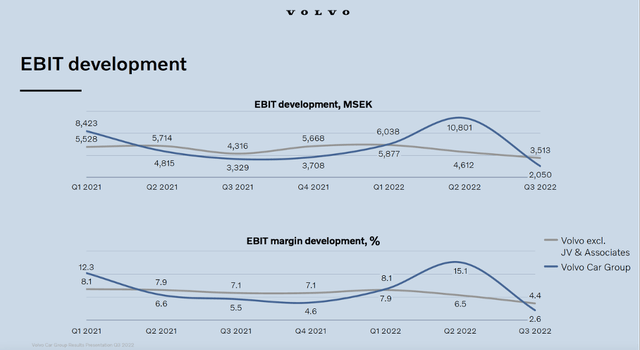

EBIT margin increased slightly to 3.5% from 2.1% last year. EBIT margin was highest in the second quarter of 2022, with an all-time high of 15.1%. Lower EBIT due to higher costs has driven the share price down, this presents a good buying opportunity during these temporary headwinds.

EBIT development (Volvo Cars’s 3Q22 Investor Presentation)

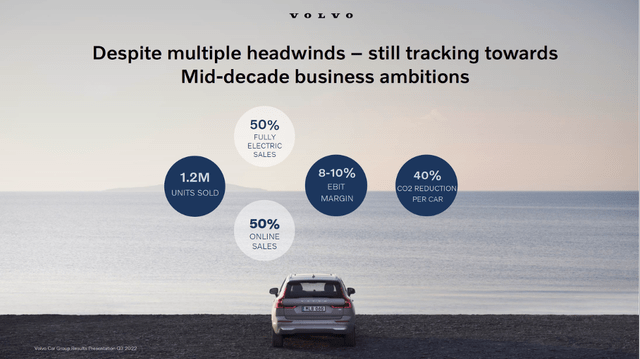

Volvo has high-growth ambitions for the next 5 years and aims for 50% of cars sold to be fully electric. EBIT margin is expected to grow strongly to 8% to 10% (current EBIT margin = 3.5%). Demand for Recharge cars is very high, but Volvo is facing a severe shortage of parts to complete these cars. On average, a quarter of sales consist of Recharge Cars, and about 7% of sales come from sales of fully electric cars. These high-growth ambitions are favorable for future share price growth.

Mid-decade growth ambitions (Volvo Cars 3Q22 Investor Presentation)

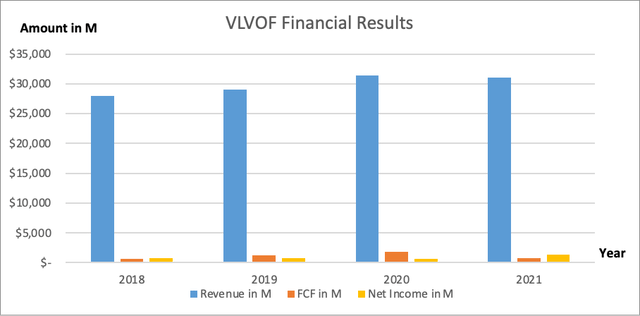

As with all other automakers, margins are quite low; automobile production is a capital-intensive process. Investors should therefore be wary of mediocre macroeconomic figures because the car manufacturing industry is a volatile industry. High overhead costs can cause significant losses. Nevertheless, Volvo has performed strongly in recent years. Volvo Car’ financial results for the past three years look good with positive free cash flows and net income.

Volvo Car Financial Results (Annual reports and Author’s own graphical representation)

One growth catalyst is the full acquisition of two Chinese joint ventures. Volvo Car signed an agreement with parent company Geely Holding in 2021 to take over Geely Holding’s stake in the joint ventures in China. This will give Volvo Car full ownership of the car manufacturing plants and sales operations in China. The acquisition of 50% additional shares in Daqing Volvo Car Manufacturing Co, Ltd and Shangai Volvo Car Research and Development Co. Ltd strengthens Volvo Car’ position in China, its largest market. It is a notable transaction because Volvo Car becomes the first major non-Chinese automaker to gain full control of its Chinese operations. Although the two joint ventures are already fully included in Volvo Car’s financial statements, their share of net income will increase after the transaction.

Dividend Distribution

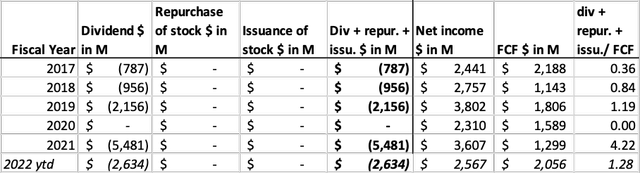

Volvo Car offers a fluctuating dividend, and therefore the dividend payout ratio has also fluctuated widely in recent years. It is difficult to get a clear picture of their future dividend payments. But what can be said is that income investors will not be satisfied with its widely fluctuating dividends; they expect a stable growing dividend. Volvo Car is thus interesting for investors who see the company’s share price rising. Therefore, it is a risky stock.

Free cash flow highlights (Volvo Car annual report and author’s own calculations)

Valuation

Unfortunately, there is little data available from Volvo Car to chart its share valuation. Earnings per share in Dec 2021 are $1.04. Currently, in the first half of 2022, earnings per share is $0.86.

Historically, the first half is the best year for Volvo Car. 2021 H1 brought earnings per share of $0.77, while H2 brought earnings per share of $0.33. Therefore, I expect the second half of this year to be one soft one. Assume that earnings per share remains the same at $1.04, then the PE ratio is 6.3. A very attractive valuation.

|

Year |

EPS |

Growth |

|

2018 |

$ 0.59 |

|

|

2019 |

$ 0.59 |

0% |

|

2020 |

$ 0.55 |

-7% |

|

2021 |

$ 1.04 |

89% |

|

2022 H1 |

$ 0.86 |

Investors should be aware of over-the-counter stocks because the pink sheet has low trading volume, it will be difficult for large investors to buy or sell a significant position. Low trading volume poses a risk; investors may be left with their shares for quite a long time because there are few sellers in the OTC market. Investors should buy the shares directly on the Swedish Stock Exchange. Investors will have to exchange their currency for Swedish krona and taking into account currency risk.

Conclusion

Volvo Car expects EBIT margin to increase from 2.6% to 8% in about 5 years. Temporary headwinds such as higher costs related to reduced component deliveries lowered the EBIT margin. The share price reacted negatively to the news and fell. The cheap share price presents a buying opportunity as the company tries to increase sales and reduce costs. Volvo Car’s finances look strong in recent years, as net income and free cash flow remained positive. Generally, automakers operate on low margins because of their capital-intensive operations. Overhead is high, which can lead to huge losses when macroeconomic figures are mediocre. Volvo Car is doing quite well, as earnings and FCF remained positive during the corona crisis. The dividend payout fluctuates through the years, so this is not a stock favored by income investors. The stock’s valuation is favorable, and earnings are expected to rise over the next 5 years. Therefore, the stock is worth buying (on the Swedish stock exchange).

Be the first to comment