cemagraphics

Summary

I recommend going long Confluent (NASDAQ:CFLT) for a potential 157% upside over a four-year period. Confluent’s platform aims to serve as the “intelligent connective tissue” of an organization by enabling real-time data streaming and analysis across the organization. I believe the growth of data-in-motion is being driven by industry and technological trends, which will benefit CFLT.

Company overview

Confluent provides a new type of data infrastructure by uniting an organization’s various systems, applications, and data layers into a single, real-time central nervous system.

Having the capability to manage data appropriately has become table stacks

In my opinion, the growth of data-in-motion is being driven by important industry and technological trends that provide strong tailwinds for the CFLT industry.

To boost productivity in the workplace, software is no longer used solely as a collection of programs. Instead, customer interactions and back-end processes are being orchestrated directly by software. Consequently, an increasing number of companies are going the software route. For instance, a customer’s only point of contact with a multibillion dollar online retailer can be an app on their smartphone – and this requires a lot of software engineering behind the scenes to make it work. In order to achieve the necessary level of automation and efficiency using a legacy approach, a large number of processes must be constructed via the interaction of numerous applications, which in turn increases the complexity of data flow. In my opinion, businesses today require cutting-edge methods that can connect diverse forms of data and applications at scale and analyze them in real time.

In addition, modern shoppers expect products that can be customized to their specific needs. Customers and businesses alike have come to expect instantaneous responses and customized content from their digital interactions. It used to be that you could successfully run a company using only yesterday’s data. Today, customer frustration and business risk can result from a company’s inability to respond to customer demand or even from being minutes late in incorporating prevailing business data. On the flipside, because of the availability of real-time data, retailers can now use machine learning algorithms to provide highly customized clothing recommendations to their millions of customers. Therefore, customers can take advantage of the knowledge and insights garnered from countless thousands of real-time purchases to enjoy a truly unique shopping experience.

The availability of data and machine learning capabilities underpins these and other trends. The use of machine learning applications has grown in significance as a means of setting businesses apart from their rivals. As a result of its use of complex algorithms and large datasets, machine learning can discover insights much more quickly and broadly than conventional techniques. Data is the engine that drives machine learning, but it can be limiting to only have access to stored information. In order to provide the most useful insights, modern machine learning applications and systems must process, connect, and analyze vast amounts of data in real time. Data in motion, such as that from social networks, online sources, and internal apps, can help develop machine learning models. Such information is useful for developing and deploying models that can forecast the demand for a wide variety of products across a wide variety of geographical areas. The models can respond to shifts in demand with the help of these forecasts, which can be developed and updated in real time. Incorporating input during transit generally improves the precision and utility of machine learning models, leading to insightful conclusions and useful suggestions.

Confluent solution is a new category itself

Focusing on data in motion, Confluent is creating a new category of data infrastructure for developers and businesses. Having seamless integration between all of an organization’s operational functions, software platforms, and data repositories is, in my opinion, a prerequisite for creating memorable customer experiences. Confluent’s goal is to serve as the “intelligent connective tissue” of an organization by enabling real-time data from multiple sources to be continuously streamed across the organization and analyzed in real-time.

To fully realize the potential of data in motion, businesses need the CFLT platform to fill in the systemic, functional, and technology gaps that have previously prevented them from doing so. Data in motion can be easily harnessed by software developers with the help of CFLT, and large, complex enterprises can make it central to all that they do. By using CFLT, businesses can create more and more programs that make use of data in transit as they advance through the adoption cycle. This allows companies to operate on a data-driven basis while also enhancing their capacity to provide superior experiences for customers. In my opinion, Confluent has the potential to become the brains of tomorrow’s digital businesses by enabling enterprise-wide real-time applications and delivering ubiquitous real-time connectivity.

Strong network effects

Businesses like CFLT have a leg up on the competition thanks to the network effects that speed up demand for their product or service. I believe that CFLT’s technical knowledge, innovation process, and laser attention to customer outcomes contribute to this network effect by enabling them to forge strategic partnerships with customers along the way.

Typically, customers start out with a single use case, see the economic advantages of CFLT platform, and then roll it out across incremental use cases, business units, departments, and geographic regions. This growth typically causes an organic network effect. I believe there will be a greater volume of data in motion for the CFLT platform to handle as more use cases are adopted and more applications and systems are interconnected. It’s a self-reinforcing cycle: as one data stream grows, it attracts more applications, which in turn generates more data streams. Both individuals and the group as a whole benefit from this network effect. CFLT not only helps customers take advantage of streaming data, but it also has the potential to serve as the brains of an organization by allowing all departments to access and process data as it is being produced in real time.

S-1

Dedicated sales motion to fully capitalize on this new category

There is a specific path that customers take as they adopt and scale data in motion inside their companies, and CFLT’s go-to-market strategy is designed to reflect this. New applications are often well received before any sales attempts have even begun, thanks to the popularity of Apache Kafka among developers and the self-service solutions made available through the CFLT cloud offering and community downloads. It is the job of the CFLT enterprise sales team to convert leads into paying customers and use cases into production. They steer the development of the organization and the platform as it transitions from facilitating users’ adoption to becoming the nerve center of business operations. I think it’s crucial for firms to have the information and direction that CFLT offers in order to make the transition to a data-centric model.

Further, the competitive advantage gained from covering the complete client lifecycle is substantial. It will be tough for legacy technology suppliers to adapt their go-to-market strategies to the low-friction, high-volume open source and SaaS sectors. Startups don’t have the complete complement of go-to-market strategies and tools necessary to enable this journey. I think the approach used by these organizations is too broad and superficial without a more in-depth revamp of their go-to-market strategy, and it does not effectively address the individual demands and experiences of clients embracing data in motion.

Strong team of founders with deep technology expertise reduces execution risk

The core team behind CFLT includes LinkedIn engineers who worked on the technology that would become Apache Kafka. The fact that Apache Kafka has become the de facto standard for the underlying technology to manage data in motion is a testament to the vision of CFLT’s founders. The cloud, in this situation. When compared to competitors who offer cloud-based versions of their products with fewer guarantees, CFLT stands out. In contrast to the vast majority of databases, which are designed to maximize the value of data once it has been stored, the CFLT product is optimized to maximize the value of data while it is in transit. In contrast to traditional data infrastructures, CFLT can provide unique value via streaming data through queries.

In my opinion, CFLT has a substantial head start over the competition thanks to their experience and knowledge in the data in motion market.

Valuation

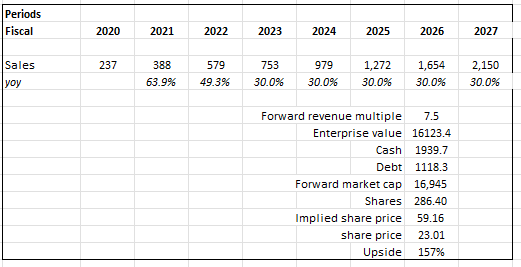

According to my model, CFLT is undervalued. At this price, investors can expect a 157% return over 4 years.

My model assumption is CFLT on management’s FY23 revenue guidance and my belief that the company will continue to grow at a rapid post afterwards. My growth expectation is underpinned by a strong secular trend in the category that CFLT is targeting today. CFLT is not profitable today as it is reinvesting in the business, and I expect CFLT to continue its growth by reinvesting in the business. This also means CFLT will not see any profits in the near term (something that investors need to bear in mind).

CFLT is worth $59.16 in FY26 if it continues to trade at 7.5 times forward revenue (which is where it is trading at today).

Own calculations

Risks

Apache Kafka reliance

Apache Kafka, an open-source software platform, serves as the foundation for Confluent’s offering. The development of alternatives to Apache Kafka could hinder Confluent’s expansion.

Competition

Confluent competes with major public cloud providers including Amazon Web Services (AMZN), Google Cloud Platform (GOOGL), and Microsoft Azure (MSFT)in the middleware and data management areas. Confluent’s future prospects could be harmed if the industry becomes more competitive or if rivals are able to successfully reproduce the company’s core capabilities.

Conclusion

In my opinion, a long position in CFLT has potential upsides. The goal of Confluent’s platform is to serve as the “intelligent connective tissue” of an organization by facilitating the continuous streaming and analysis of data at all levels. Industry and technology trends, in my opinion, are driving the expansion of data-in-motion, which is good news for CFLT.

Be the first to comment