Diego Thomazini/iStock via Getty Images

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on June 20th, 2022.

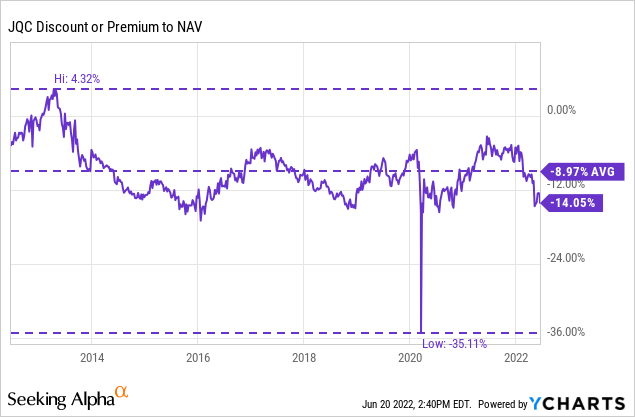

Nuveen Credit Strategies Income Fund (NYSE:JQC) has had its discount expanded greatly from our previous update. This has been happening in the senior loan fund space as a whole, not something specifically wrong with JQC. In fact, the whole CEF space has been experiencing expanding discounts. This is one of the characteristics of CEFs; during times of volatility, discounts often expand. Additionally, we are coming off of 2021, where discounts were historically narrow.

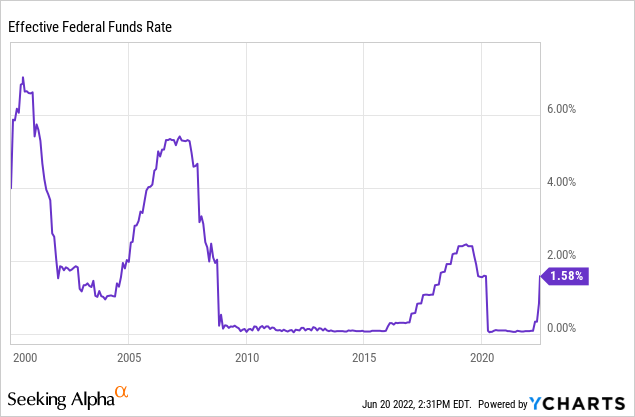

I’ve followed this fund for quite some time as they were going through their capital return program. They ended this program early and implemented a managed distribution policy at a level rate. This has since been maintained. Being a fund exposed to senior loans with floating rates means they should have a good chance of preserving this rate for now. The Fed is ramping up rates to fight off inflation, which should increase yields for the fund.

This rate hiking cycle is more rapid than the previous and also expected to top out higher.

Ycharts

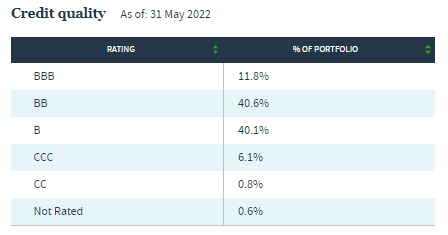

However, The other side of this would be that their borrowing costs will also increase for JQC. They are a highly leveraged fund too. The credit quality is also mostly lower-rated debt, below-investment-grade debt. This is also a common feature of senior loan funds.

The Basics

- 1-Year Z-score: -2.22

- Discount: 14.05%

- Distribution Yield: 8.88%

- Expense Ratio: 1.42%

- Leverage: 32.09%

- Managed Assets: $1.395 billion

- Structure: Perpetual

JQC’s investment objective is “high current income; and its secondary objective is total return.” To achieve this, “under normal circumstances, the fund will invest at least 80% of its “Assets,” at the time of purchase, in loans or securities that are senior to its common equity in the issuing company’s capital structure, including but not limited to debt securities and preferred securities.”

They also add; “invest at least 70% of its “Managed Assets” in adjustable-rate senior secured and second lien loans, and up to 30% opportunistically in other types of securities across a company’s capital structure, primarily income-oriented securities such as high yield debt, convertible securities and other forms of corporate debt.”

As we can see, the fund is highly leveraged. The expense ratio would come to 2.04% when including the leverage expense. The fund utilizes both borrowings and reverse repurchase agreements to make up its leverage.

In 2018, the fund had a total of $561 million in borrowings. This was reduced in 2019 to $480 million. Then again reduced in 2020 to $402 million, where it is at today. The reverse repos account for $142 million on top of this. As the fund’s capital return program was reducing assets, it would make sense the leverage would be reduced. Since the 2020’s market crash, it also makes sense borrowings were reduced in that period too.

The interest rate for the fund is at 3-month LIBOR plus 1.10%. This is on the high end for funds that we typically follow. So their expenses were already running higher for leverage than we’ve seen elsewhere. Since LIBOR is being discontinued, there will likely be a new base rate, but for now, LIBOR was listed.

Performance – Attractive Discount

Since my previous coverage of JQC, the discount has only expanded even further. At that time, I thought we were looking at an attractive discount, but the volatility this year has really driven the discount wider. I also suspect that the discount has increased due to the uncertainty of the economy going further. Since the fund holds a junkier portfolio, that’s taking some of the appeal away from the benefits the fund should receive from higher rates.

We are trading at a discount well below the last decade’s average. Besides the March 2020 market collapse, this is near the fund’s historic lows for the last decade.

Ycharts

I believe that this represents a fairly attractive entry-level. At least the losses from further discount expansion should be reduced.

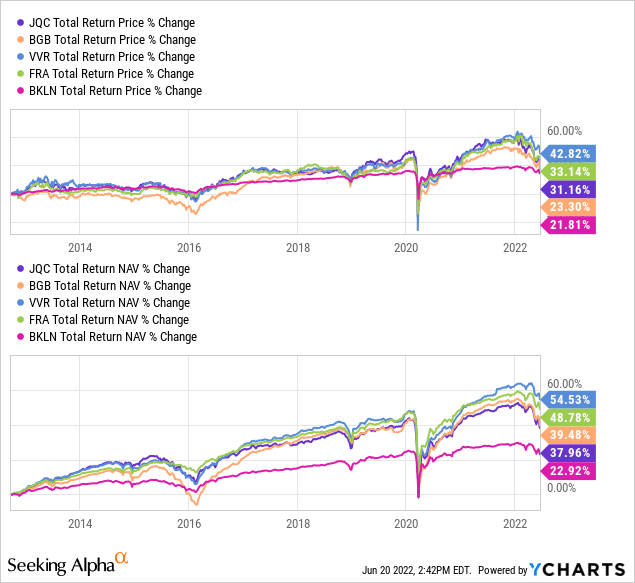

Still, against some of its peers, it hasn’t done so well over the last decade in terms of total return performance. Below we are comparing Blackstone Strategic Credit Fund (BGB), Invesco Senior Income Trust (VVR) and BlackRock Floating Rate Income Strategies Fund (FRA). I hold positions in all three of these funds. I’ve also included the passive, non-leveraged Invesco Senior Loan ETF (BKLN).

Ycharts

On a total NAV return basis, the fund has underperformed the three peer CEFs but outperformed the ETF.

One reason that JQC could still be appealing is that the fund has a bit of a deeper discount than the other funds at the moment. That could be one reason worth considering, as going forward, JQC could outperform on a total share price return if they all returned back to their NAV per share. Additionally, I personally like diversifying not only my exposure to assets but my exposure to different fund sponsors.

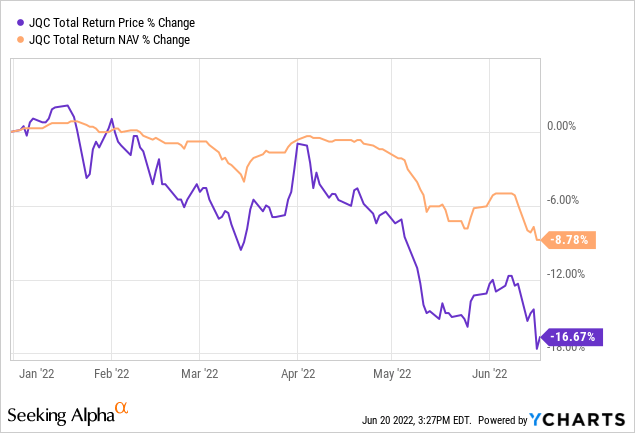

I would also like to highlight that the majority of the declines have come from the discount expansion for JQC. On a total NAV return basis, we are seeing the fund hold up relatively well. Remember, the market (S&P 500 Index) itself is now off over 20% YTD too.

Ycharts

Distribution – One Of The Highest In The Group

Another area that JQC could beat those peers above is because the fund’s distribution rate is higher at the moment. This is partially thanks to the larger discount. Higher rates don’t mean better returns, of course, but some investors still prefer the higher yields.

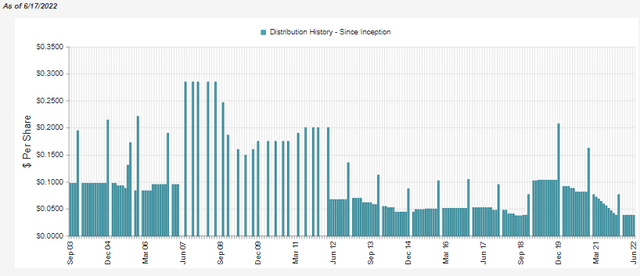

JQC Distribution History (CEFConnect)

Funds in the senior loan space have a long history of varying payouts. This is because they are tied more closely with interest rates overall. Additionally, the capital return program for JQC adds even more volatility to the payouts.

At this point, the $0.0385 monthly amount should be in place for the foreseeable future. This was an amount higher than I would have expected as it was over the amount of NII they were generating.

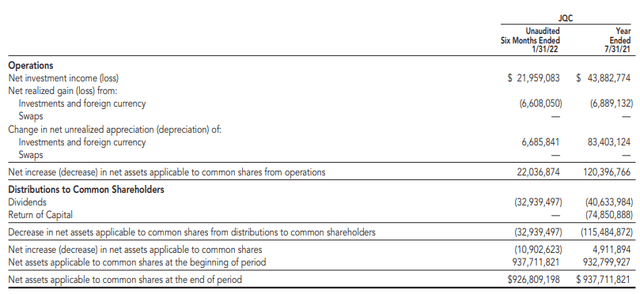

They have 135,609,290 shares outstanding as of their last Semi-Annual Report. Given the $0.462 annual distributions, that would work out to need $62.652 million in earnings to be covered.

JQC Semi-Annual Report (Nuveen)

That wasn’t the case for fiscal 2021. It also doesn’t appear to be the case with the updated report. Again though, the income on the fund should rise now that rates are rising. This means that we should still expect higher NII in their next report.

The reason I don’t believe they will change it is that this is the amount they selected when rates were lower. Although, that can never be certain. I thought that BGB also wouldn’t cut its distribution since it had 100%+ coverage, and heading into higher rates meant they should generate more income. Yet, they’ve cut in each of the last quarters.

For tax purposes, the distributions will generally be classified as ordinary income. In 2021, the largest characteristic was return of capital. This relates back to their planned overdistribution due to the capital return program. Now that this has been completed, a larger portion should be classified as ordinary income. Return of capital can still show up as the fund doesn’t generate enough income.

JQC’s Portfolio

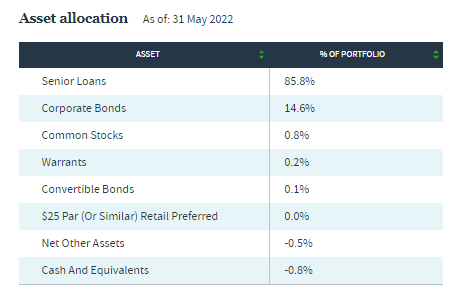

The senior loan allocation makes up the bulk of this funds asset allocation. Though there is some exposure to corporate bonds.

JQC Asset Allocation (Nuveen)

This helps keep the funds’ duration down to a low 0.64 years. Meaning that for every 1% change in interest rates, the fund’s underlying portfolio should only decline by about 0.64%. The average bond price in the portfolio is $94.66. That’s about what we should expect as the loans are holding up fairly well in this environment. As a comparison, my recent update on DoubleLine Income Solutions Fund (DSL) showed us that the duration there was 4.51 years. The average price of the bonds in that portfolio comes to $79.18.

These discounts to par for the underlying bonds and loans come about as rates rise. The price of the bonds falls to align with newer issuers that have higher yields.

Additionally, there is the added risk that the underlying portfolio names will start to default. This is expected to hit the junkier-rated companies the most, which is exactly what these kinds of funds invest in.

The overwhelming majority of the fund is in below-investment-grade holdings.

JQC Portfolio Credit Rating (Nuveen)

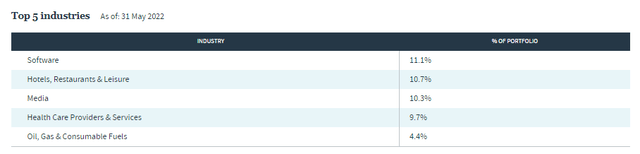

To help compensate for these additional risks, they invest quite broadly. They hold 412 different positions. That makes each position in the portfolio not a major part of the portfolio. If defaults are limited to a handful of names, it won’t take the whole fund down with them. They also diversify across industries, with each industry representing a fairly low total allocation of the capital.

The largest issuer in the portfolio is UKG Inc, at 2% of the portfolio. This is then followed by even smaller exposures to United Airlines Holdings (UAL) at a 1.6% weighting and CSC Holdings at 1.5%.

Conclusion

JQC is at one of the deepest discounts in the senior loan fund space. It is also representing a discount much wider than its longer-term average. In fact, it is right near the deepest discount the fund has ever had in the last decade, excluding the March 2020 collapse. This could represent an attractive time to pick up a position in this name. However, the discount comes about as we move into an uncertain economic period. A recession could put pressure on this fund with its lower rating portfolio. At the same time, it is highly diversified across many different issuers and industries.

Despite my hesitation about the distribution rate they’ve set due to a lack of coverage, it has been maintained. This is also what they’ve set before rates were ticking higher. Now that rates are higher, it would seem that coverage should improve – and therefore, the chance that they want to cut at this point would also diminish. Still, the current deep discount also compensates for the chance of a distribution trim.

Be the first to comment