Nathan Howard/Getty Images News

Thesis

At the beginning of the year, Abbott (NYSE:ABT) ran into problems in its baby food production and was forced to close a plant in Michigan due to possible bacterial contamination, but this had only a limited impact on Abbott’s stock performance as investors did not attach much importance to this incident.

Infant formula shortage

At the beginning of the year, Abbott Laboratories found itself in the spotlight in the US due to problems with the supply of baby formulas. Dangerous bacteria that cause meningitis, salmonellosis and sepsis have been found in infant formulas manufactured at the Abbott Laboratories factory in Michigan. This was announced by the US regulator. Abbott has recalled Similac, Alimentum and EleCare brand products manufactured at this factory.

The closure of a large Abbott infant formula plant due to the death of two babies from a bacterial infection provoked a catastrophic shortage of baby food in the United States. To import baby formula from Europe, the States even had to use military aircraft.

edairynews.com

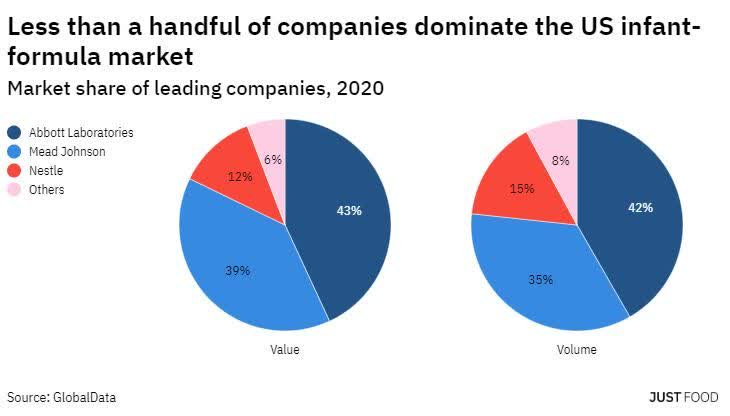

A very non-trivial situation has been developing in the American market for infant formula milk – 92% of the market is occupied by 3 companies, namely Abbott Laboratories, Mead Johnson Nutrition and Nestle USA (2020 data), and the import of infant formula in the United States is close to zero due to the extremely stringent FDA requirements for these products. Abbott controls 43% of the infant formula market. Therefore, the closure of the Abbott plant alone turned out to be a disaster for the entire country, especially since it produces specialized food for children with special needs.

JustFood

Effect on Abbott stock price

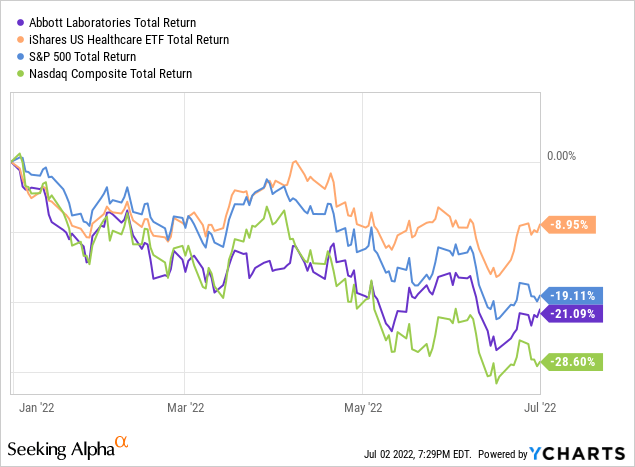

The closure of the Abbott plant did not have a strong impact on the dynamics of the company’s shares. Since the beginning of the year, they have sank 21%, almost on par with the market – the S&P 500 lost 19.1% over the same period, and the NASDAQ Composite lost 28.6%. The infant formula crisis has almost nothing to do with this though: investors are worried about the COVID-19 testing revenue.

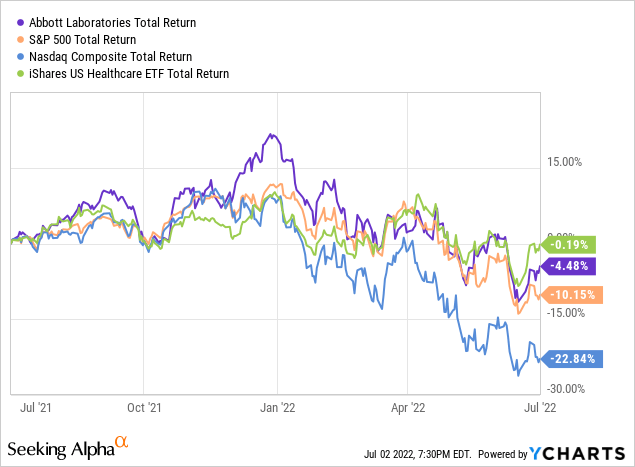

If we consider the dynamics of returns over the past 12 months, then Abbott stocks are in much smaller trouble than the S&P 500 and NASDAQ Composite indices and show the dynamics only slightly worse than the US healthcare sector as a whole.

The company’s business is largely diversified: in addition to nutritional mixtures, it produces medical products. It earns only about 8% of its revenue from pediatric nutrition.

The fact that the problem with the plant, which provoked a nationwide crisis in the baby food market and a high-profile scandal, was relatively easily “forgiven” to the shares of Abbott Laboratories indicates a high level of investor confidence in and the absence of doubts about the good prospects for the company, despite what happened.

Reputation risk?

If we dig deeper though, it seems that not everything is so rosy. This story could have reputational implications for Abbott. The FDA inspected the factory. It was possible that after this inspection, the company will be fined or new unpleasant facts will be discovered that will lead to the closure of production. However, Abbott Nutrition reached an agreement with FDA in May to resume production of its infant formula.

It became known that the problem plant in Michigan had already resumed work after all inspections and the elimination of sanitary violations. True, the epic did not end there – a week later the same plant was partially closed due to flooding and flooding of some workshops. The natural disaster will delay shipments of the new product, EleCare’s Specialty Amino Acid Lactose-Free Blend, by several weeks, the manufacturer said.

We can now say that Abbott has successfully handled the infant formula crisis as its cooperation with FDA regulators and timely action helped address shortages and improve supply. Potential consumer lawsuits related to the formula could pose a reputational risk to the company, but the chances of this happening are very slim.

Conclusion

The situation with the temporary closure of the Abbott plant in Michigan and the acute shortage of infant formula in the US market did not have a significant impact on the dynamics of the company’s shares and was relatively easily “forgiven” by investors. The drawdown of Abbott shares since the beginning of the year is close to the market.

This situation really shows the difference between Abbott and other healthcare companies. It uses diversification as its largest strength, and the company holds its own even in times of crisis.

I believe that losses will be recouped in the coming year. The situation with the plant in Michigan is already priced in Abbott stock and the restoration of pediatric nutrition supplies at the beginning of the third quarter will allow the company to breathe a sigh of relief and return to a growth trajectory. Over the next year, Abbott shares may bounce back and show better dynamics than the market.

Be the first to comment