SimonSkafar

Investment Thesis

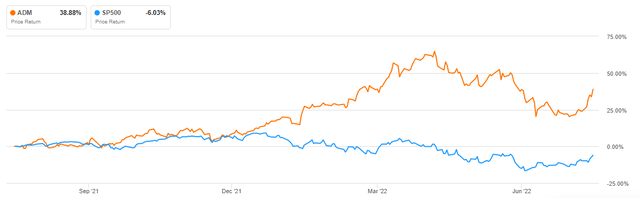

Archer-Daniels-Midland Company (NYSE:ADM) has gained about 39% in share price over the last year and almost 22% YTD.

The stock is now priced at $82.77 per share, outperforming the market due to its excellent strategies and management. The stock gained nearly 39% compared to the market, which lost approximately 6% during the same time period.

Over the last three years, the company’s top and bottom lines have grown consistently. Even in tough economic times characterized by soaring inflation, ADM has done well, as seen by strong performance relative to the overall market.

The company’s solid performance led to increased revenue estimates for FYs 2022 and 2023, displaying an optimistic attitude within a tumultuous market, which should boost investor confidence in the company’s shares.

The Company

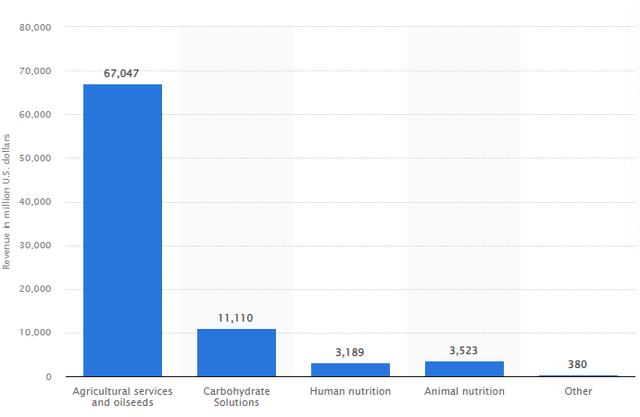

Archer-Daniels-Midland Company procures, transports, stores, processes, and sells agricultural goods such as barley, oilseeds, corn, milo, oats, and wheat, across the world. The company’s three main segments are agriculture Services & Oilseeds, Carbohydrate Solutions, and Nutrition. In addition to the above significant functions, the company offers numerous other services and products in agriculture.

The chart below shows revenue contributions for each of the segments.

Productivity and Innovation: The Secret to Overcome inflation

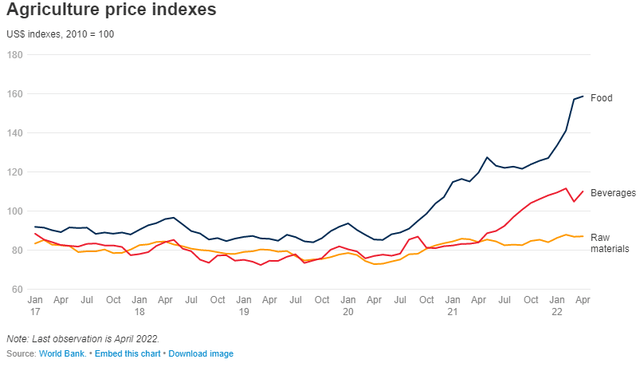

When inflation is at a record high, agricultural products experience significantly inflated prices due to rising production costs. This poses a challenge to companies operating in the agriculture industry.

ADM aims to overcome the challenge posed by inflation and keep its prices relatively low by minimizing production costs. The company is relying on productivity to achieve this goal. Here is a quote from the CEO, Juan Luciano:

Productivity is how we are improving our execution and optimizing costs, is key to our long-term success but equally and importantly our productivity work is helping us mitigate the impact of inflation. We have a very strong pipeline of productivity initiatives and I will be updating you on them regularly.

The company executes this strategy in two ways: output and financial productivity. For the output, they have employed mechanization. During their Q1 2022 transcript call, the company reported completing a modernization project in their Minnesota corn facility, increasing productivity through improved automation, control systems, and analytics. The investment has yielded double digits in return. The returns result from increased volumes, safe delivery, and more efficient operations.

On the financial productivity side, management is working on the “billion dollar challenge,” which includes boosting ROIC and monetizing assets with the aim of generating $1 billion in cash reserves. During their Q1 2022 call, the CEO reported that they have already realized more than $400 million, which has further helped drive ROIC to 10%.

This initiative should serve to benefit them for the following 2 reasons:

- Mechanization brings about efficiency and lower production costs. In light of rising costs across the board, both their revenue per unit sold and operating expenses will increase. If they can control the increase in operating expenses through initiatives such as mechanization, their margins will increase.

- The revenue realized from the billion dollar challenge can be reinvested in the business to fund the opportunities available or even fund more mechanization in the company. Alternatively, they can be kept in the firm to improve its liquidity. Either way, the company stands to benefit.

With these strategies, ADM is set to increase the bottom line, ROIC, as well as cash reserves. It is important to note that the strategy will not eliminate inflation, but:

- It will cut production costs and lower inflation-related pricing fluctuations for ADM products.

- Increased efficiency increases productivity, so the company can offer more for less and remain competitive.

Deerland Probiotics’ acquisition

While many reasons exist for acquisitions, ADM seems to eye more than one ranging from diversification, increased synergy, and more significant market share.

Juan Luciano on the call said:

“Deerland with a broad portfolio of probiotics, prebiotics and enzymes provides a wide array of commercial, R&D and operations-related synergy opportunities to help us meet that demand…”

Below is an insight into the probiotic market.

Probiotic Market and Demand

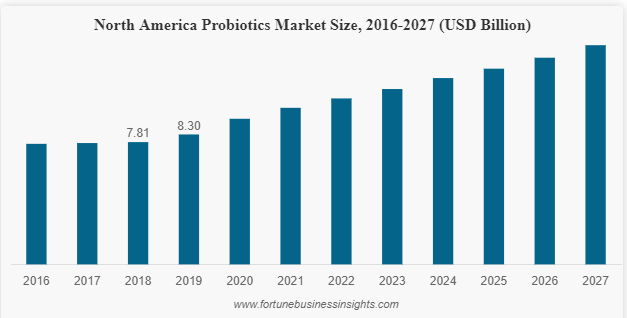

The probiotics market size was ~$49 billion in 2019 and expect to hit ~$95 billion by 2027, ~8% CAGR. Rising buyer awareness of preventive healthcare and demand for natural, safe health products drive the growth. The demand for the products has been growing steadily since 2016, as shown in the table below.

Fortune

ADM approximated that ADM’s Health & Wellness segment annualized revenue will top $500 million with Deerland’s acquisition. With this increasing market, this figure may be an underestimation. Investors should expect the company to exceed these estimations as the market is rapidly growing due to increased awareness of preventive healthcare and demand for natural, safe health products.

Risk Management: Derivative Instruments and Hedging Activities

Agricultural markets are prone to price fluctuations resulting in risks; ADM operates in numerous countries, thus facing currency concerns. Unresolved, these issues might have negative consequences. ADM management has adapted successfully to these problems.

The corporation employs several derivatives as hedging mechanisms. They use exchange-traded futures and options contracts to mitigate price risk induced by market changes in agricultural commodities and foreign currencies.

Cash flow and net investment derivatives

AOCI delays net investment hedging gains and losses until they sell the underlying investment. The corporation uses cross-currency swaps and foreign exchange forwards as net investment hedges for a foreign subsidiary. As of Jun 30, 2022, and Dec 31, 2021, the company completed USD-fixed to euro-fixed cross-currency swaps worth $0.8 bn and $1.2 bn, and foreign exchange forwards worth $2.5 billion and $2.6 billion. As of Jun 30, 2022, and Dec 31, 2021, the corporation announced $125 million in after-tax AOCI from net investment hedging activities. AOCI-deferred till investment sale. The company’s structured trade financing uses interest rate swaps to hedge certain bank letters of credit.

The company employs futures or options contracts in commodity trading to hedge future grain purchases and processing. This hedging arrangement reduces cash flow fluctuation linked with the company’s grain imports. Last year, the corporation hedged 17 to 33% of its monthly grind. By June 30, 2022, the corporation has hedged 1% to 32% of its monthly corn grind.

The recent weakness of the euro to the U.S. dollar does pose a problem for companies that sell in Europe and have to convert the euro back into USD. This unique hedging style shows that management is aware and trying to reconcile this issue, but investors should still watch out for weakness in revenue from sales abroad when converting back into USD.

Valuation

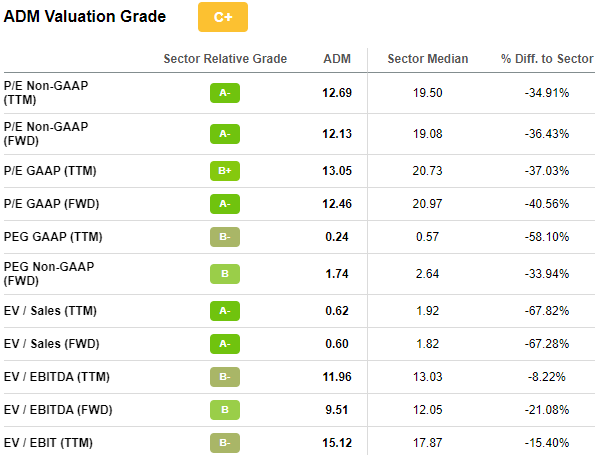

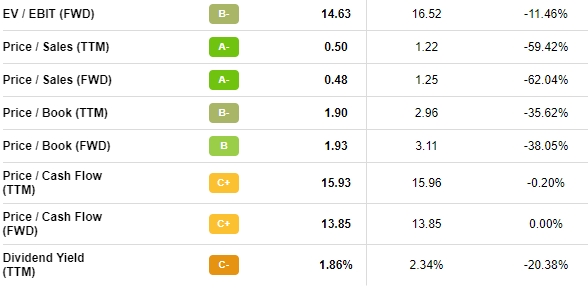

The company seems undervalued despite solid results. Nearly all pricing ratios are below the industry median, sometimes by more than half.

Seeking Alpha Seeking Alpha

ADM’s TTM P/E, P/S, P/B, P/CF, and PEG are below industry medians. FWD-based valuation ratios also find the stock attractive. This low valuation gives a cheap inroad to a company with strong development potential.

Conclusion

It’s clear that ADM management has conducted a thorough environmental scan and is aware of the threat and opportunities in their industry. To the company’s credit, the administration has taken a proactive approach to prepare for current and future issues. As a result of the company’s long-term and good short-term plans, investors can expect top and bottom line growth, particularly with the acquisition of Deerland. Investors looking for business expansion and growth certainty should consider taking a position in ADM.

Be the first to comment