ithinksky/E+ via Getty Images

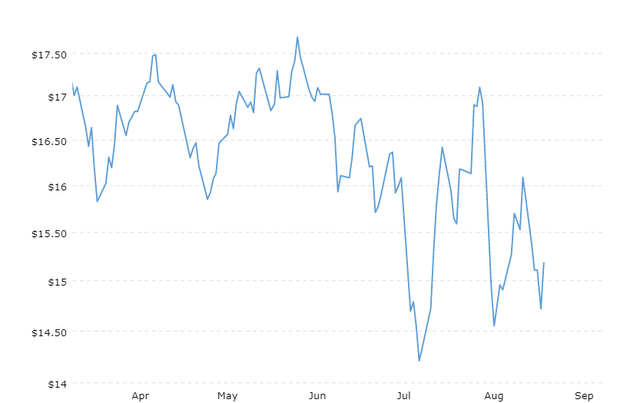

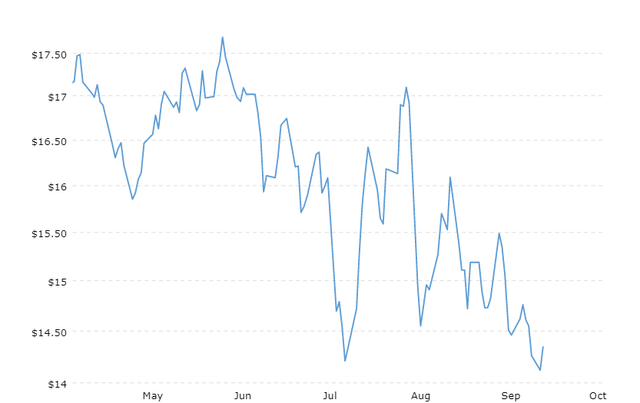

Soybean futures, outperformed during H1 of 2022. As the year began, soybean futures traded well above $13 per bushel. Soybean prices maintained their upward momentum as the months progressed, and as Q1 came to close, futures were trading well above $15 per bushel, prices not recorded since May 2021.

Prices sustained their upward trajectory through to Q2 of 2022, with prices hitting 10-year highs at above $17 per bushel in May, driven by Russia’s invasion of Ukraine. This exacerbated an already volatile market due to weather concerns as well as the effects of the pandemic, causing disruptions to global supply.

The last two weeks of June saw futures spiraling downward, trading well below $17 per bushel attributable to: projected decline in demand from China M/M from 108.72 MMT to 106.72 MMT; projected decline in soybean exports from Brazil to China; as well as an expected increase in production projections from major soybean producers in the 2022/23 season, according to USDA WASDE reports.

As Q3 begun, prices sustained their downward momentum, trading well below $14 per bushel, a major decline from their recent highs during Q2. The highest traded price during this period was during the month of July, trading at $15 per bushel. These prices have not been recorded since.

September futures fell below $14.5 per bushel, pressured by increased worries of a global recession. Exacerbating the situation further were increased crop sales from major producer and exporter Argentina, rising production projections from Brazil, and the U.S. strengthening supply expectations. Additionally, Ukrainian output received an upward revision. Nevertheless, China’s projected soybean demand remains steady in preparation for rebuilding stockpiles ahead of Chinese festivals through the autumn and for the Lunar New Year.

In this article, I will discuss why I believe it is too early for a bear market. First, despite increased supply projections, recent WASDE reports have lowered global supply projections M/M owing to lower than anticipated harvests from major producer the U.S.

Finally, global demand projections for the 2022/23 season have been pegged higher owing to increased demand projections from major consumer China. Investing in Teucrium Soybean Fund (SOYB) is a way for investors to track soybean futures higher and lower, without the need for a futures account.

Global Demand Projections Pegged Higher

As 2022 began, global soybean demand estimates for the 2021/22 season were pegged at approximately 374 MMT, according to USDA WADE reports. As the months progressed, demand estimates declined M/M. According to the recent WASDE report, production estimates have been pegged at approximately 362.96 MMT, a 3% decline in comparison to the beginning of the year.

The decline in global demand estimates was particularly due to a decrease in demand and imports from major consumer China. At the beginning of the year, China’s demand and import estimates were pegged at approximately 116.03 MMT and 100 MMT, respectively, but as the months progressed, USDA revised demand and import estimates lower.

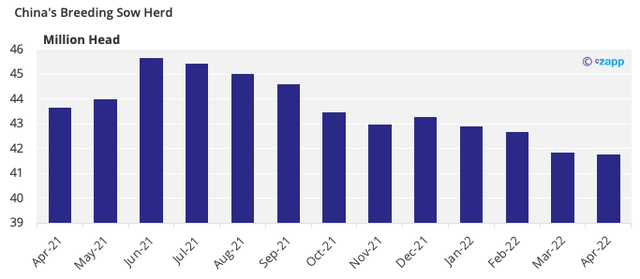

According to the recent WASDE report, demand and import estimates have been pegged at approximately 106.72 MMT and 90 MMT, respectively, a 9.83 MMT and 10 MMT decline respectively, thus negatively impacting soybean futures. The decline in demand and import estimates from China was due to a decrease in sow heard numbers during H2 of 2021, with the decrease ultimately affecting total hog output through to 2022.

Global soybean demand projections for the 2022/23 season are pegged at approximately 377.68 MMT, a 4% increase compared to 2021/22 production estimates of 362.96 MMT, according to the recent USDA WASDE report. The increase in demand is attributed to a rebound in China’s demand projections, due to a rebound in the hog sector, from the decline during H2 of 2021 and H1 of 2022.

For the 2022/23 season, China’s demand projections have been pegged higher to 115.59 MMT, an 8.87 MMT increase compared to the 2021/22 estimates. Despite a decline in import projections M/M in the 2022/23 season, import projections are pegged higher by 7 MMT, to 97 MMT in comparison to the 2021/22 season figure of approximately 90 MMT.

The rise in soybean demand projections from China provides a glimmer of hope for soybean futures, thus helping keep prices afloat. I believe the increase in projected global soybean demand, as well as the rise in projected demand from China, will help prevent prices from falling further, sustaining their lows of $13 per bushel and highs of $14 per bushel current price trend.

Production Projections Pegged Higher

In the 2022/23 season, global soybean production projections were pegged higher according to the first USDA WASDE demand and supply outlook released in May for the current season. According to the report, global soybean production projections were pegged at approximately 394.69 MMT, an 11.4% increase compared to the previous 2021/22 production estimate.

The projected increase in production is primarily attributed to an increase in acreage and supply from major producers the U.S, Brazil and Argentina. In the 2022/23 season, according to the May report, projected soybean production from the U.S was pegged at approximately 126 MMT, a 2.1% increase from previous production estimates of approximately 120.71 MMT.

The rise in projected production from the U.S was due to an increase in acreage, as a result of farmers opting to plant more soybean to corn, galvanized by rising soybean futures during the past year, and lower input requirements, in comparison to corn.

In Brazil, production projections have been pegged higher to 149 MMT, an 18.3% increase in comparison to the previous 2021/22 season estimate of 126 MMT. A bump in projected production is also anticipated from Argentina, a 7MMT increase, to approximately 51 MMT.

Export activity is also anticipated to be led by Brazil, as exports are projected to increase by 11.3% to approximately 89 MMT, in comparison to the previous season’s estimate of approximately 80 MMT.

Despite the projected increase in global production projections, recent USDA WASDE reports have pegged global production projections lower M/M to approximately 389.77 MMT, a 4 MMT decrease, owing to lower than anticipated harvests from the U.S, to approximately 119.16 MMT.

Notwithstanding, production is still projected to surpass demand, and if anticipated production projections are realized, this will put strain on soybean futures.

Conclusion

Soybean futures outperformed during H1 of 2022. The rising trajectory in prices was short lived as H2 begun which saw futures drop, trading well below $14.5 per bushel. The decline in futures was primarily due to a decline in demand and imports from major consumer China. In the 2022/23 season, according to the May USDA WASDE report, global production projections were pegged higher, putting more strain on soybean futures.

Despite the projected increase in global soybean production, the recent WASDE report has lowered anticipated production, due to lower than anticipated harvests from the U.S as a result of unfavorable weather conditions during the month of August, their critical growing month. Thus I believe production projections will be lower than anticipated. Additionally, an increase in projected demand from major consumer China, ahead of its festivities, could help keep soybean futures afloat, thus prevent them from falling further.

Be the first to comment