MarkgrafAve

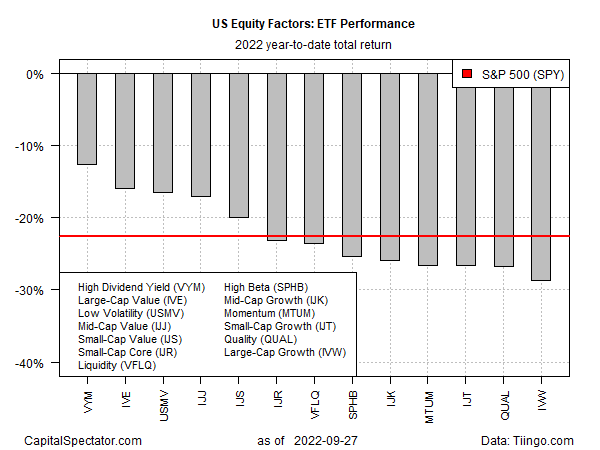

There’s nowhere to hide in US stocks from a risk factor perspective, but high dividend yielding shares are still the first line for blunting losses year to date, based on a set of proxy ETFs through yesterday’s close (Sep. 27).

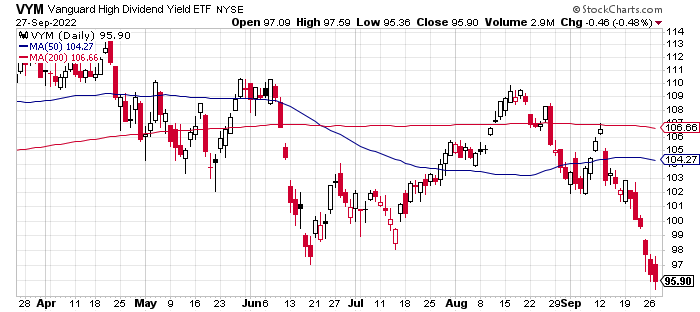

Vanguard High Dividend Yield (VYM) has certainly suffered so far in 2022, but the ETF’s nearly 13% year to date haircut compares favorably against the broad stock market’s 22.6% tumble via SPDR S&P 500 (SPY). VYM is also posting the softest setback vs. other factor ETFs, although in some cases by only modest degrees.

Large-cap value (IVE) and low volatility (USMV) are only slightly deeper in the red vs. VYM. By contrast, the deepest loss in 2022 for our set of factor ETFs: iShares S&P 500 Growth (IVW), which is down nearly 29% this year.

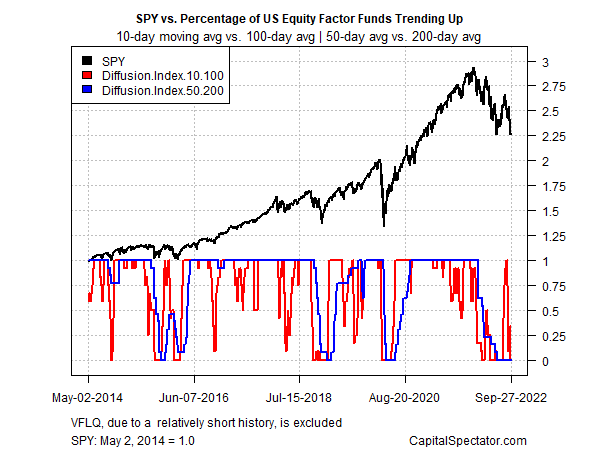

Momentum for the factor funds, unsurprisingly, is deeply negative. Using a set of moving averages to profile the ETFs listed above shows that all the funds are pinned at maximum bearish levels.

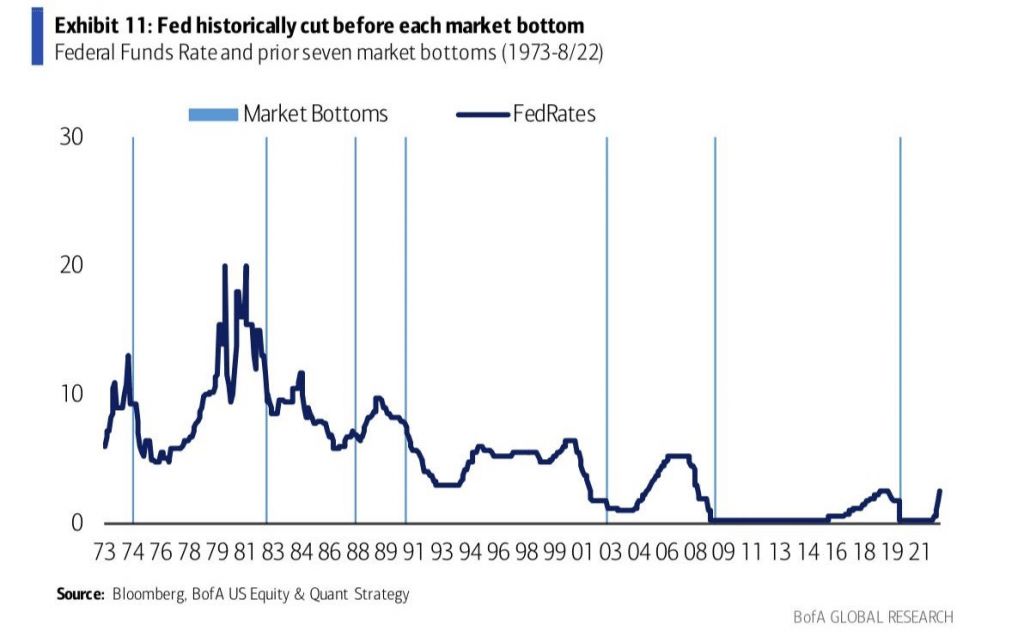

First among equals for reasons that equities are weak: interest rate increases from the Federal Reserve, which continues to signal tighter monetary policy after a string of 75-basis point hikes.

A related threat is rising recession risk. The OECD on Monday advised that the global economy is slowing more than previously forecast.

Although some analysts say the market slide year to date is creating a buying opportunity, there are still reasons to be cautious. One metric for estimating when the stock market will bottom – the start of rate cuts by the Federal Reserve – implies that further losses in equities are a reasonable forecast. Recent research from Bank of America points out that a Fed pivot to reducing its target rate tends to precede market bottoms. On that basis, the market correction has yet to run out of road. For example, Fed funds futures are currently pricing in a near-certainty of another rate hike at the next FOMC meeting on Nov. 2.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment