ronniechua

One of the worst investments ever

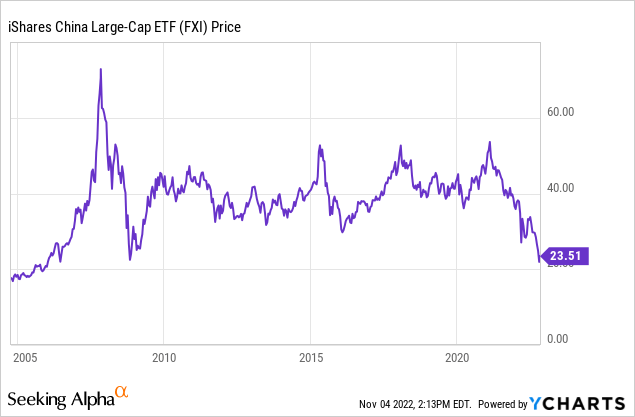

The iShares China Large-Cap ETF (NYSEARCA:FXI) is possibly one of the worst stock ETFs investments ever, down over 38% over the last 10 years, down 41% over the last 12 months, and up only 38% since the inception in 2004, currently trading below the 2008 Great Financial Crisis lows. Here is the chart:

What’s in it?

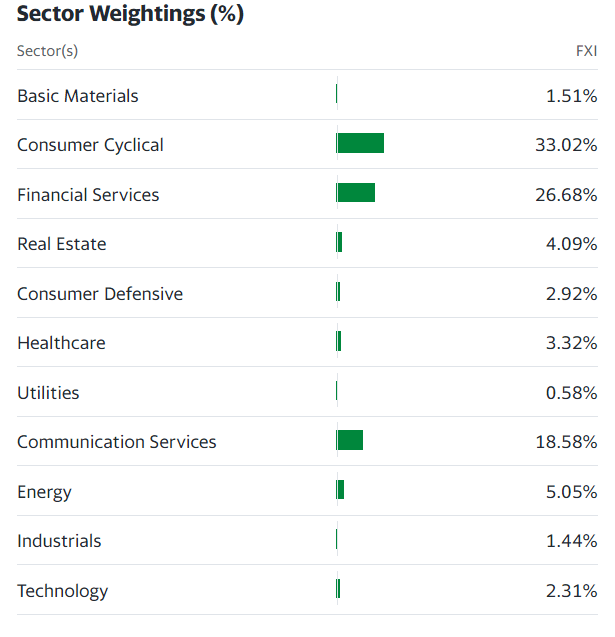

The iShares China Large-Cap ETF seeks to track the investment results of the FTSE China 50 Index composed of large-capitalization Chinese equities that trade on the Hong Kong Stock Exchange. Currently, almost 80% of the index is in consumer cyclical stocks (33%), financial services (27%), and communication services (19%).

Yahoo

Top 10 stocks represent almost 58% of the index, with the three large tech stocks Alibaba (BABA), Tencent (OTCPK:TCEHY) and JD.com (JD) representing almost 25% of the index.

Tempting to Buy?

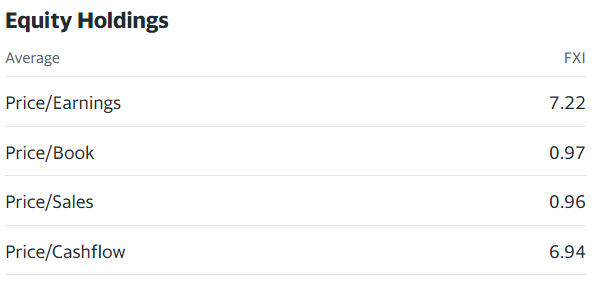

The iShares China Large-Cap ETF is cheap, with the PE ratio at 7.22 and PS ratio at 0.97, absolutely, and especially relatively to the US stocks (SPY) which is still trading at the PE ratio above 19. Thus, it is tempting to buy it, as a deep value investment.

Yahoo

However, in my opinion, FXI is still a value trap.

The emerging market thesis

The investment in iShares China Large-Cap ETF has been under the emerging market thesis. Specifically, since the earlier 1980s, the developed markets, led by the US, started to outsource some production to “emerging markets”. Scared by the high inflation of the 1970s, the developed markets realized the potential to tap into an abundant cheap labor force and other resources to 1) lower inflation and 2) boost the exports to these countries. This started the most recent wave of globalization.

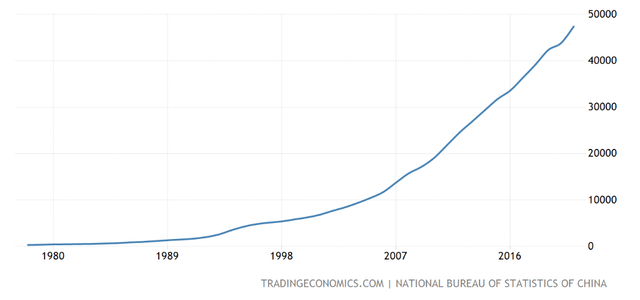

The emerging markets investment thesis was based on the expectations that these emerging markets would grow the domestic middle class over time and expand the domestic consumption, which would benefit the domestic companies. Further, the expectations were that the global manufacturers from these emerging markets would also grow in size as the globalization unfolds.

China has been the major beneficiary of globalization, reaping the most benefits from outsourcing and significantly grew the domestic economy.

What went wrong

All economic expectations with respect to China came true. As an illustration, this is China Urban Households Disposable Income per Capita, since 1980. The Chinese consumer significantly expanded the purchasing power since 1980s.

However, China did not evolve politically. China is still a 1-party system, with the Communist Party in total control.

Further, China got too successful and too strong. In 1980s, China was producing and exporting a low-quality Shanghai sports shoes to PE classes in some developed countries. Now, China is getting competitive in producing the highest-level technology products. China became technologically advanced enough to become the real threat to the United States.

Thus, the peak in globalization was reached possibly in 2008, and since the globalization has been reversing, with the accelerated de-globalization (and the China-US decoupling) since the Trump administration imposed the trade tariffs on China in 2017, and especially after the COVID-19 pandemic, which in fact started in China.

The ultimate act of de-globalization has been unfolding in 2022 with the Russian invasion of Ukraine, and the China’s apparent support for Russia.

As the real-time evidence, the Biden administration is continuing with the Trump administration trade tariffs, even escalating the technology war with the further semiconductors export bans, and even starting the process of delisting the Chinese stocks from the US exchanges.

In short, the US and China are in the economic war, which is only escalating, and there is no clear end to it with the 2024 elections approaching and the possible return of the Trump administration. Also, the US and China are on the opposing sides of the real war, with the issue of Taiwan heating up as well. There is no clear end to the geopolitical issue between the US and China, or even a hint of minor de-escalation.

The Chinese stocks, as represented by the iShares China Large-Cap ETF, are correctly reflecting this reality. The turnaround, if the ever happens, must be supported with the major policy change from both sides, and the probability of that is really 0%.

China will eventually relax the COVID-19 restrictions, but this is not the policy change needed to fundamentally justify the investment in iShares China Large-Cap ETF.

What about the US Dollar?

The emerging market thesis is based on the prediction that emerging markets would grow at a much higher rate compared to the US growth, which would cause the US Dollar (UUP) to weaken. In fact, at the height of FXI bubble in 2008, the Euro (FXE) was trading at 1.60. Now, the Euro is below 1, and this also reflects de-globalization, which at this stage implies a relatively stronger US economy and a stronger US dollar.

Beware of short-covering rallies

The market positing and sentiment in FXI reflects the gloomy outlook. In fact, the short interest in FXI is very high, with 25% of shares outstanding is sold short. Chinese stocks also have heavy weight in the iShares MSCI Emerging Markets ETF (EEM), which also has 23% of the shares sold short.

FXI jumped almost 8% on Nov 4th, due to the rumors of the China’s COVID-19 reopening. The same rumor appeared few days earlier. At this point, this is likely only a short-covering rally.

Short-term traders could attempt to time the short squeeze in FXI, but investors should stay away.

Implications

The iShares China Large-Cap ETF is cheap, but at this point this is a value trap. The turnaround in FXI must be supported with the policy turn favoring re-globalization, which has a 0% probability right now. The rumor of COVID-19 reopening in China is a short-squeeze trigger. Even when China confirms the reopening plans, it could extend the bear market rally, until the unfavorable fundamentals overweight.

However, given the high short ratio, I would not short FXI at this point either. Thus, I am neutral on FXI.

Be the first to comment