William_Potter

Investment Thesis

In an earlier article, we explored the semiconductor market outlook, why a slowdown is expected following the massive CapEx increase, and why Intel Corporation (INTC) has probably reached a bottom. In today’s analysis, we dive into Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM), which remains a strong buy for the long term despite the geopolitical uncertainties that seem to subside, at least for now. However, investors should expect a semiconductor inventory adjustment in the first half of 2023, which might create additional attractive entry points for TSM.

Chip Wars & Tech Hegemony

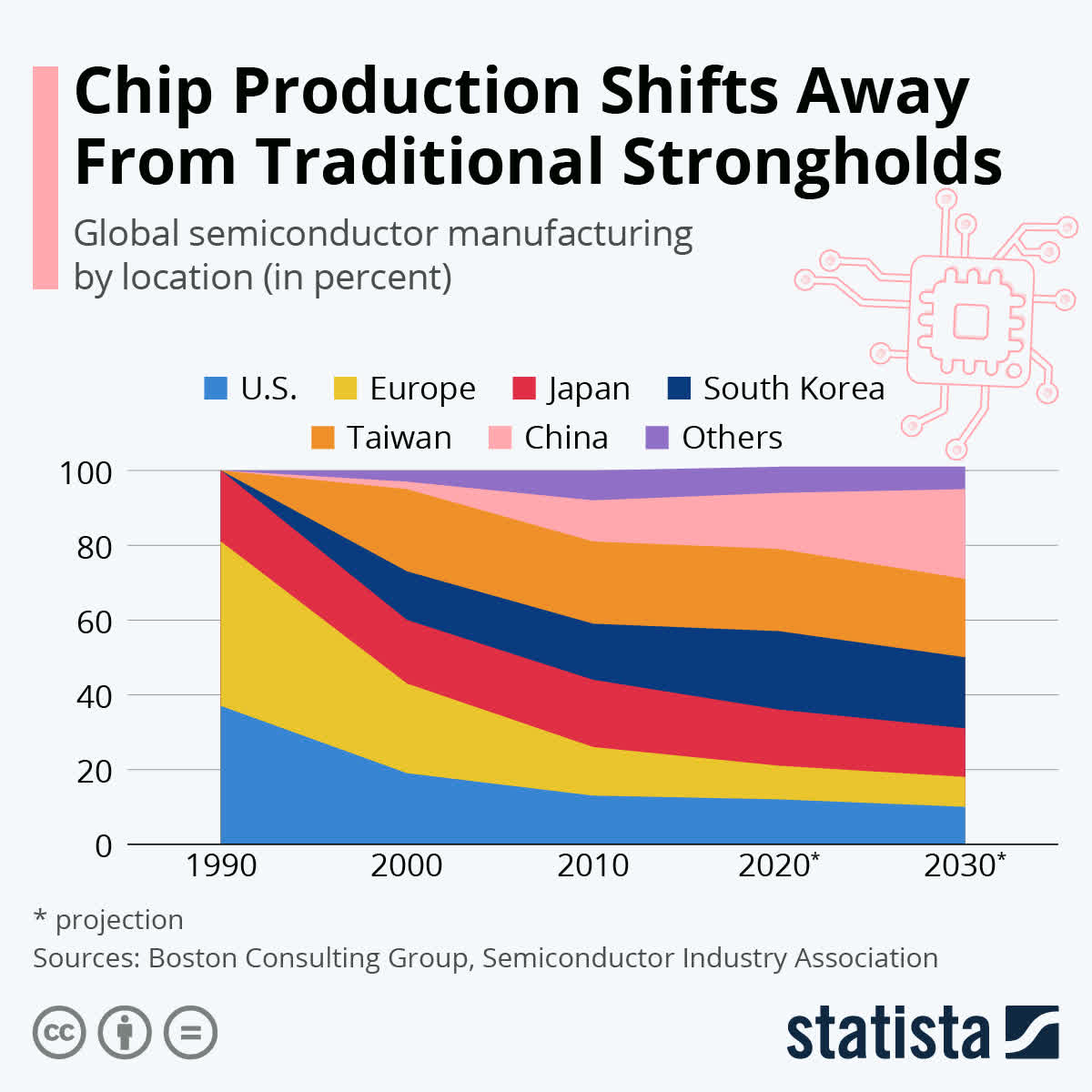

In the past, the US and the EU used to be the dominant players and key production suppliers in the semiconductor industry. However, from 1990 onwards, there was a consistent shrinkage in its dominance, and we saw the rise of Asia. Fast forward to 2020, Taiwan, South Korea, Japan, and China account for 73% of global manufacturing, with the projections favoring China over the following years. The Semiconductor Industry Association expects China to surpass Taiwan by 2030 with a 24% market share, supported by its “Made in China 2025” initiative.

statista.com

We have recently seen rising China-Taiwan tensions and concerns about a China invasion of Taiwan. A study by the “The US Army War College Quarterly” mentions that China threatens to destroy TSMC’s manufacturing facilities. Moreover, the study also notes that the US and Taiwan could install self-destruct systems in TSMC’s factories to prohibit the Chinese from controlling them in an invasion scenario. However, the Chinese are not naive to conduct such an operation in my view, as this would also be catastrophic for their economy and the CCP.

Semiconductors are everywhere, and considering the digitalized world we live in, we are heading towards a scenario where the nation that controls manufacturing will reach supremacy. China and the US are fighting for technological hegemony, and the never ending tensions will likely only get worse from here.

TSMC’s US Capacity Is Expanding

TSMC’s $40 billion Arizona chip investment is one of the largest foreign investments in US history. TSMC plans to manufacture the 4nm chips at the plant in Arizona, an upgrade from the previously-announced 5nm, which will boost output from the original commitment of 20,000 wafers a month. However, until now, TSMC has been tight-lipped about future expansion plans in the US beyond the aforementioned small-scale capacity expansion plan.

However, due to rising geopolitical concerns, leading-edge customers are seeing a rising need for non-Taiwan capacity. With TSMC’s larger capacity, continued technology leadership, more optimized cost structure, and robust ecosystem support, I expect the company’s accelerated US capacity expansions to alleviate market concerns of potential share losses from a worsening geopolitical landscape.

Morris Chang, the founder of TSMC, has pointed out that manufacturing costs in the US are way higher than in Taiwan. Therefore, the US-based capacity should carry ∼50% higher operating costs (such as much higher costs for technicians, equipment engineers, process integration engineers, etc.) than in Taiwan.

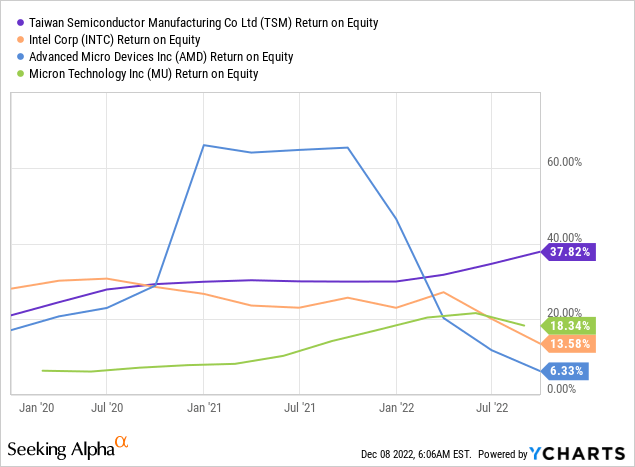

Even with some cost offsets through subsidies, tax breaks, and higher wafer prices, there is a risk of some Return on Equity (ROE) deterioration for TSMC’s US-based capacity. Still, given the small amount of capacity, I don’t expect the impact to be material.

TSMC’s manufacturing costs in the US should be higher than at its Taiwan-based fabs. However, TSMC’s US-based facilities should still be more competitive than other foundry peers (Intel, Samsung Foundry) due to better operating efficiency, higher production yields, more robust process technology, and more comprehensive ecosystem support (such as Open Innovation Platform).

As a result, I expect TSMC to remain the preferred foundry supplier-customer seeking US foundry support. TSMC’s P/E multiple (12-month forward) has de-rated from ~23x at the beginning of 2022 to ~12x, primarily due to rising geopolitical risks. Although there could be some dilution for its US expansion plans, this is likely to be more than compensated for by higher P/E multiples, as risk perception (from market share loss or geopolitics) is likely to ease somewhat.

Structural Pricing Growth In 2023

Despite all the fear, uncertainty, and doubts, management is telling the public that pricing is going up in 2023. Big customers like Apple may have the power to negotiate better terms, but the average wafer price for Apple is also going up as Apple migrates some wafer demand to N3. So other customers are not in a position to reject TSMC’s pricing increases.

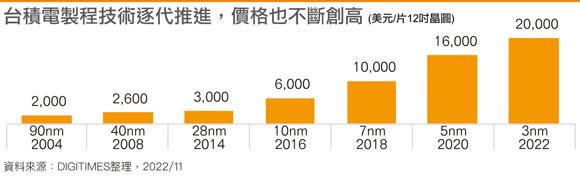

TSMC’s average wafer price has grown at a 2-year and 4-year CAGR of 11.8% and 18.9%, respectively. Perhaps the 2022 wafer price growth is mainly due to TSMC’s 15-20% broad-based pricing increases in the year, but the 2020 and 2021 pricing increases were still significantly higher than the 2012-2019 period. While TSMC may not be able to raise prices broadly forever as it did in 2022, the migration to advanced nodes where TSMC is in a near-monopoly position is likely to be a structural and sustainable driver for TSMC’s pricing growth going forward.

TSMC Wafer Prices (Digitime)

TSMC’s 2023 wafer price may grow by another ~20%, driven by 5nm and 3nm ramps and the 6% pricing increase. But, again, investors need to zoom out and look at the multi-decade picture to understand the trend rather than simplistically attributing the pricing growth of TSMC purely to any aggressive pricing increases on existing nodes, which may prove unsustainable over the long term.

A Correction In Global MSI Is Underway

As the global MSI (millions of square inches) has been above the trend since 2021, a correction to global MSI is likely ongoing. Therefore, it is only prudent to believe that TSMC MSI will also get a correction. However, TSMC’s Q3 solid results and flat Q4 guidance suggest that a correction will not happen to TSMC by the end of 2022.

Yet, management has alluded to 7nm underutilization in 1H23 and said that industry-wide inventory correction would likely impact 1H23. This correction means that TSMC’s revenue will likely fall significantly in Q1-2023 and end the company’s 11 consecutive quarters of growth since March 2020, when the pandemic started.

However, TSMC’s Q1-2023 drop is cyclical and not structural; a quick rebound likely follows a cyclical decline. Moreover, investors should look past the Q1-2023 cliff, as TSMC’s revenue progression in 2023 will likely be in the high double digits. Investors may have sold off the stock recently to de-risk a Q1-2023 fall, but the cautiousness is overshooting to the downside.

While we are still months away from arguably the worst print of this cycle for TSMC, the Q4-2022 call will likely turn out to be the “sell the rumor but buy the news” event. As a result, the time to accumulate shares to position for the arrival of the new semiconductor upcycle is probably not after the Q4-2022 call but over the next three months.

Slower N5 Demand In 1H23

N5 demand has been resilient in 2H22 due to healthy Apple iPhone demand and market share gains in crucial customers (QCOM, NVDA). However, the N5 demand is likely to show some weakness due to order cuts in AMD, QCOM, and NVDA.

QCOM has shifted its flagship 5G SoC (Snapdragon 8 Gen 2) to the TSMC N5 family (based on the N4 process) starting 2H22. However, due to a softer demand outlook for high-end smartphones (i.e., in developed markets such as Western Europe and the US) and disciplined inventory management, QCOM is likely to cut wafers starting at N5 in Q4-2022/Q1-2023 to accelerate the inventory destocking process.

In addition, our research shows that NVIDIA Corporation (NVDA) and Advanced Micro Devices, Inc. (AMD) could push out N5 wafer starts in Q1-2023 due to ongoing weakness in gaming GPUs, inventory correction in the PC market, and a more conservative ramp for new server products in 2023. Finally, iPhone-related orders have been largely resilient so far, but there may be some cuts in Q1-2023 to reflect weaker demand.

Concluding Thoughts

I remain optimistic that TSMC will likely grow by double digits. Therefore, even though I have turned more cautious about TSMC’s Q1-2023, I view the downturn in Q1-2023 as a healthy correction to TSMC’s above-trend unit shipments, and TSMC’s unit volume should subsequently rebound in 2H23.

However, the bigger story about TSMC’s 2023 growth is that the pricing increases could reach 20%, primarily driven by the mix shift to 5nm and 3nm that carry higher prices. As a result, the pricing growth will offset the unit volume decline in 2023.

On the stock, TSMC’s Q3-2022 call did not dispel investors’ fears of a potential cliff in 1H23 despite management reiterating that it expected 2023 to be a growth year. However, it is time to look past potential 1H23 weakness, as mean reversion is arguably the only certainty in a time of uncertainty. I think between now and the Q4-2022 call in January 2023 is a good time to accumulate shares to position for the eventual recovery of the semiconductor industry.

Be the first to comment