Darren415

It is little secret that the inflation currently permeating the American economy has been causing problems with the finances of numerous American families. In fact, it has gotten so bad that many people have been forced to take on second jobs or perform other tasks in order to obtain the extra money that they need to feed themselves. Fortunately, as investors, we have other options available to us in order to generate the income that we need to support ourselves. One of the best options that we can use is to invest in a closed-end fund that specializes in the generation of income. This is because these funds provide easy access to a diversified portfolio of assets that in most cases can deliver a higher yield than anything else in the market. In this article, we will discuss the Nuveen Preferred & Income Securities Fund (NYSE:JPS), which is one such fund that can be used for this purpose. This is evident in the fact that the fund yields 7.27% as of the time of writing, which is not as high as some of its peers but is still respectable. I have written about this fund before but more than a year has passed since that time, so obviously, a great many things have changed. This article will therefore focus specifically on those changes as well as provide an updated analysis of the fund’s finances.

About The Fund

According to the fund’s webpage, the Nuveen Preferred & Income Securities Fund has the stated objective of providing investors with a high level of current income. This is not surprising considering that this is the primary objective of most income-focused closed-end funds, particularly those that invest in fixed-income securities like this one. One of the reasons for this is that fixed-income securities as a rule are somewhat limited in the capital gains that they can deliver and thus deliver nearly all of their return in the form of direct payments to investors. The reason for the limited capital gains is that these securities do not directly benefit from the growth and prosperity of the issuing company. After all, a company will not pay its bondholders a higher yield just because its profits increase in a given year. The price of these securities is instead linked to interest rates. It is a negative correlation so when interest rates increase, fixed-income security prices decline and vice versa. This is because newly-issued securities will have a yield that corresponds to the interest rates at the time of issuance so the price of already existing securities will adjust so that they deliver the same yield as a newly-issued security with similar characteristics.

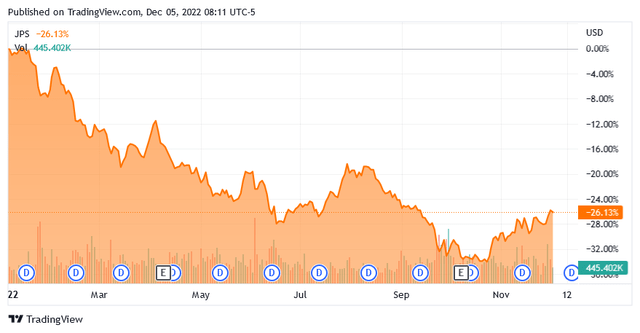

As everyone reading this is no doubt aware, the Federal Reserve has been aggressively raising rates since March with the goal of reducing the high inflation rate that the country is currently suffering from. As of the time of writing, the federal funds rate is at 3.78% compared to just 0.08% in February. As the price of fixed-income securities moves inversely to interest rates, we can expect this to have had a negative impact on the price of the fund. This is certainly true as the fund is down 26.13% year-to-date:

Unfortunately, this is quite a bit worse than the performance of the iShares Preferred and Income Securities ETF (PFF) over the same period as the index fund is only down 17.10% year-to-date. This is certainly disappointing, although the Nuveen fund does have a higher yield. We will discuss the reasons for this underperformance over the course of this article.

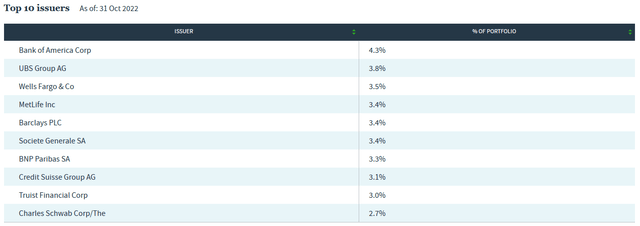

A look at the largest positions in the fund reveals a very large number of banks and other financial companies:

The largest positions here are mostly the same as we saw the last time that we looked at the fund. In fact, the only major changes are that JPMorgan Chase (JPM) and Lloyds Banking Group (LYG) were replaced by Bank of America (BAC) and BNP Paribas (OTCQX:BNPQF). In addition, BB&T was replaced by Truist Financial (TFC) but that was due to a merger so does not really count. The fact that so few assets were changed year-over-year would likely lead one to conclude that the fund has a low annual turnover. This is certainly the case as its 12.00% annual turnover is one of the lowest ones in the industry. This is nice because a high turnover tends to raise the fund’s costs. It costs money to trade stocks or other assets, which of course are billed to the shareholders. These expenses create a drag on the fund’s performance and force management to generate a higher return than a comparable index fund in order to match the performance of the benchmark index fund. This is a difficult task to accomplish consistently, which is one reason why these funds usually underperform index funds, at least in terms of price. The Nuveen fund does not seem too excessive about these expenses though, although it does still likely trade a bit more often than an index fund would.

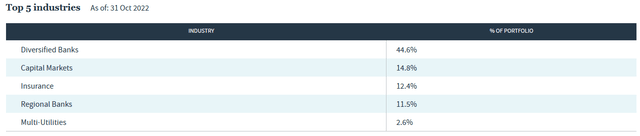

As already noted, and as clearly visible above, the Nuveen Preferred & Income Securities Fund is heavily invested in financial companies. This is not unusual for a preferred fund as the financial sector is by far the largest issuer of preferred securities in the market. The reason for this is international banking regulations, which require a bank to maintain a certain proportion of its assets as Tier one capital. Tier one capital is the bank’s assets that are not a liability to someone else (such as a depositor). The only two ways for a bank to increase its Tier one capital is through the issuance of common or preferred equity. As such, most banks will opt to issue preferred equity when regulations require an increase to Tier one capital in order to avoid diluting the common shareholders. Other industries do not have these regulatory requirements so companies outside the banking sector will often issue debt as opposed to preferred equity when they need to raise capital because debt is considerably cheaper. The index fund that we have been using for comparison purposes has 66.90% of its assets invested in the financial sector, which shows the concentration that this sector has in the entire preferred security universe. The Nuveen fund appears to be even more concentrated to this sector though as it has fully 83.3% of its assets invested in financial companies:

This is slightly higher than the 81.1% financial sector exposure that the fund had the last time that we looked at it. This is something that may concern some readers as there are some fears that margins in the financial sector are declining, which is evident in the stock price declines that we have seen among numerous banks. However, there is little evidence that rising interest rates actually hurt banks. In addition, this fund is buying preferred stock and not common stock. Preferred stock has a superior claim to the company’s cash flow compared to common stock and the dividend payments usually amount to such a small percentage of a bank’s cash flow that the dividends are unlikely to become unaffordable even if the issuing company does have pressure on its margins. Thus, it is very unlikely that we have many risks here other than interest rate risk, which we have already discussed.

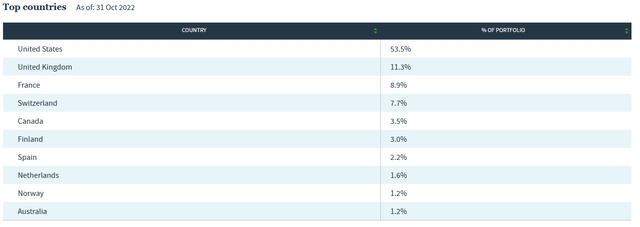

One area in which the Nuveen Preferred & Income Securities Fund differs from the index fund is that the Nuveen fund is very well diversified internationally. We may be able to conclude this somewhat by looking at the largest positions in the fund. In fact, only 53.5% of the fund’s assets are invested in American securities:

The index fund, by comparison, is entirely invested in domestic securities. This could be nice because many of these countries have their own central bank and interest rate policy. Thus, we could see interest rates rise in one country and not in another. For example, the European Central Bank only has an interest rate of 2.00% as of the time of writing, but it has been raising rates much more aggressively than the Federal Reserve. That policy only applies to four of the countries on this list though, since only France, Finland, Spain, and the Netherlands use the euro as their currency. The remainder of the countries has their own central bank and policy. This can cause preferred equity and other fixed-income securities issued in those nations to have different performances over time and thus can, in theory, reduce the overall interest rate risk of the fund’s portfolio.

Leverage

As mentioned in the introduction, closed-end funds are able to use a variety of strategies unavailable to other mutual funds in order to boost their yields. One of these is the use of leverage, which is employed by the Nuveen Preferred & Income Securities Fund. Basically, the fund is borrowing money and using the borrowed money to purchase preferred securities and other fixed-income assets. As long as the interest rate that the fund pays on this borrowed money is less than the yield that the fund receives on the purchased securities, the strategy works pretty well to boost the overall yield of the portfolio. As the fund can borrow at institutional rates, which are significantly less than retail rates, this will usually be the case. However, the use of leverage is a double-edged sword since leverage boosts both gains and losses. This may be one reason why the fund has fallen more than the index year-to-date. As such, we want to ensure that the fund is not employing too much leverage since that would expose us to too much risk. I do not usually like to see a fund’s leverage above a third as a percentage of its assets for this reason. The Nuveen Preferred & Income Securities Fund does have a leverage ratio that is a bit above this level, unfortunately. The fund’s current leverage is 38.68% of its assets. Despite being higher than I usually like, this probably is not too bad because the fund is invested in generally safe fixed-income securities. However, it will continue to see steep price declines as interest rates rise, which will probably be the case for the next year or two.

Distribution Analysis

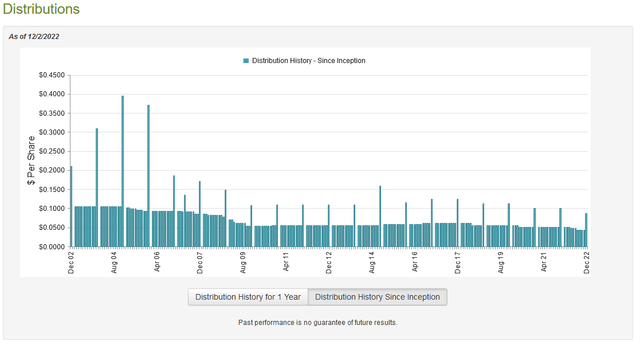

As stated earlier in this article, the primary objective of the Nuveen Preferred & Income Securities Fund is to provide its investors with a high level of current income. It invests in a portfolio of preferred stock and uses leverage to boost its yields in order to achieve this objective. Thus, we can guess that the fund likely has a very high yield. This is certainly the case as it pays out a monthly distribution of $0.0435 per share ($0.522 per share annually), which gives it a 7.27% yield at the current price. The fund’s distribution history certainly leaves a lot to be desired though as it has generally declined over time, with the fund cutting twice in the past twelve months:

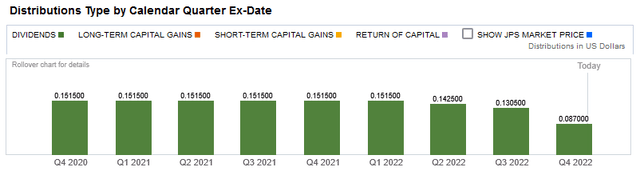

The fund’s somewhat poor history will likely be a turnoff to anyone that is seeking a stable and consistent source of income to use to support their lifestyles. However, the fund also only pays out dividend income, with no return of capital component:

This could be somewhat appealing because a return of capital can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any sort of extended period. We also see no capital gains distribution here, which also may not be sustainable over the long term. We apparently do not have to worry about that here since dividend income is usually sustainable. However, as I have pointed out before, it is possible for these distributions to be misclassified. It is also important to keep in mind that anyone purchasing the fund today will receive the current distribution at the current rate and so does not really have to worry about the fund’s past track record. The most important thing today is how well the fund can maintain its current distribution so let us have a look at its finances in order to answer that question.

Fortunately, we have a very recent document that we can use for that purpose. The fund’s most recent financial report corresponds to the full-year period ending July 31, 2022. As such, it should give us a pretty good idea of how well the fund handled the shift from a zero-interest rate policy to one of multiple interest rate increases. During the full-year period, the Nuveen Preferred & Income Securities Fund received a total of $21,322,198 in dividends and another $136,024,336 in interest from the assets in its portfolio. When we combine this with a small amount of income from other sources, the fund brought in a total of $157,602,354 during the period. It paid its expenses out of this amount, which left it with $118,936,222 available for investors. This was not sufficient to cover the $121,278,321 that the fund actually paid out, although it did get very close.

The fund, unfortunately, failed to generate enough capital gains to cover the remainder of the distribution that was not covered by its net investment income. It did have net realized gains of $545,509 but this was more than offset by $338,880,802 net unrealized losses. Overall, the fund saw its assets decline by $331,275,438 over the full-year period after accounting for all inflows and outflows. As capital gains will likely be hard to come by for a while, the fund’s distribution cuts were probably intended to bring its distribution down so that it could cover it completely with income. This is overall a smart move, although it is somewhat irritating for people that have held the fund for a while and saw their incomes decline.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the Nuveen Preferred & Income Securities Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a situation implies that we are purchasing the fund’s assets for less than they are actually worth. That is fortunately the case with this fund today. As of December 2, 2022 (the most recent date for which data is currently available as of the time of writing), the Nuveen Preferred & Income Securities Fund had a net asset value of $7.74 per share but the shares trade hands for $7.16 per share. This gives the shares a 7.25% discount to net asset value at the current price. This is not an unreasonable discount, although the shares have averaged a 10.13% discount over the past month. Thus, it may make sense to wait a little bit and see if the shares fall in price and present an even greater value.

Conclusion

In conclusion, the Nuveen Preferred & Income Securities Fund is one option for investors that are looking to boost their income in order to overcome the impact of high inflation. The fund boasts a reasonably attractive 7.27% yield and that appears to be sustainable following the recent cuts. Unfortunately, it does appear that interest rates will continue to climb for a while yet so the fund will probably underperform in the near term. However, investors that hold it for a long time will ultimately benefit when and if rates begin to decline again. The fund is trading for a reasonable valuation right now but it is more expensive than average, so a patient investor may be able to get a better price in the near future.

Be the first to comment