jetcityimage

2022 has been a difficult investing environment as the S&P 500 moves in and out of bear market territory while the Nasdaq remains in the thick of it. Some market participants drive themselves crazy, looking at their investments daily, while others who have taken a longer-term approach remain optimistic. One direct correlation to a declining market is an increased yield for investments that pay dividends. There are many investments that have attractive yields due to their declining share prices. One of the income funds I have remained bullish on is the JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI).

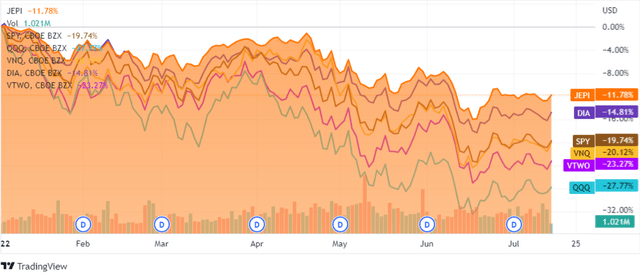

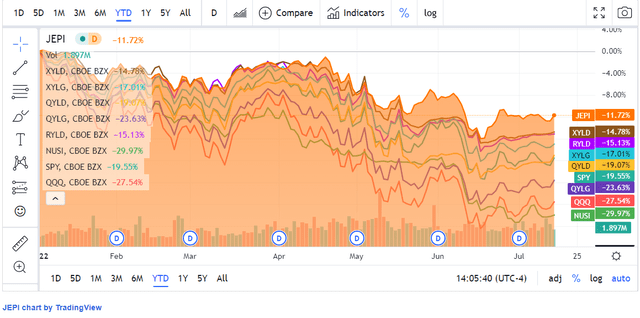

In the past, many have negatively commented on income-focused funds such as JEPI. The rhetorical agreement against income funds has been that they wouldn’t hold up well in a declining market. When the pandemic crash in 2020 occurred, many who were bearish on income funds indicated that it was a flash crash, and these types of funds haven’t been tested throughout a true correction. 2020 has gone past a correction and into bear markets for the S&P and Nasdaq. JEPI is holding up better than the major indexes and real estate from a YTD percentage basis. In 2022 JEPI has declined by -11.78%, while the Dow has declined -14.81%, S&P by -19.74%, real estate -20.12%, the Russell 2000 -23.27%, and the Nasdaq has declined by -27.77%. JEPI is proving that it can mitigate downside risk, so I wanted to reevaluate this investment as we may be getting closer to a bottom.

What the JPMorgan Equity Premium Income ETF does

JEPI is an exchange-traded fund (ETF) managed by J.P Morgan Asset Management which falls under the JPMorgan Chase & Co (JPM). JEPI was designed with two functions, providing current continuous income and maintaining prospects for capital appreciation. The management team creates a portfolio of equity securities they believe have a lower volatility level than the S&P 500 and invests in equity-linked notes (ELNs). JEPI’s primary structure includes investing at least 80% of its assets in equity securities. To generate income, JEPI can allocate 20% of its assets to ELNs. ELNs are structured as notes issued by counterparties, including banks, broker-dealers, or their affiliates, and designed to offer a return linked to the underlying instruments within the ELN.

JEPI employs a strategy that is enticing for income-focused investors as the ELNs provide recurring cash flow to the fund based on the premiums from the call options the ELNs write. JEPI has a rock bottom expense ratio of 0.35% and provides large amounts of income to its shareholders with prospects of future capital appreciation. Since JEPI isn’t a dedicated covered-call fund, it should provide greater aspects of capital appreciation since covered calls aren’t written on individual securities or the overall index. JEPI’s income is derived from the ELN’s which have a maximum 20% allocation, and any dividends/distribution the underlying securities produce within its portfolio.

Looking at what an investment in JEPI would have done over the previous year

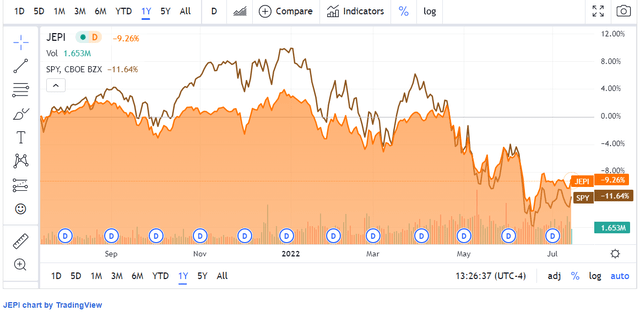

On 7/15/21, shares of JEPI traded at $61.22. Over the past year, JEPI has declined -$5.68 (-9.28%) to $55.54. From a capital preservation perspective, investing in the SPDR S&P 500 Trust (SPY) wouldn’t have led to less of a decline as SPY declined by $50.37 (-11.59%) over this period as it went from $434.74 to $384.38. I believe looking at JEPI from a YTD, and 1-year methodology will nullify comments about cherry-picking data points. In both cases, JEPI has declined less on a percentage basis than SPY.

The investment difference in my eyes is that investors would allocate capital toward an investment like JEPI because they are searching for income. The debate about investing for income rather than capital appreciation and selling off shares to generate income is one that won’t be resolved in this article and will likely be debated well into the future. Some investors have a need for income generation rather than capital appreciation.

JEPI focuses on providing current continuous income and maintaining prospects for capital appreciation. Looking back over the previous year, the questions I want to answer are has JEPI lived up to these investment objectives? Starting with prospects of capital appreciation, I would say yes. It would be unfair to say otherwise, considering the overall markets have fallen with bear markets being reached in the S&P and the Nasdaq. JEPI may not outperform these indexes during a bull cycle, but its structure has allowed JEPI to mitigate the downside slightly better than investing in an index fund such as SPY.

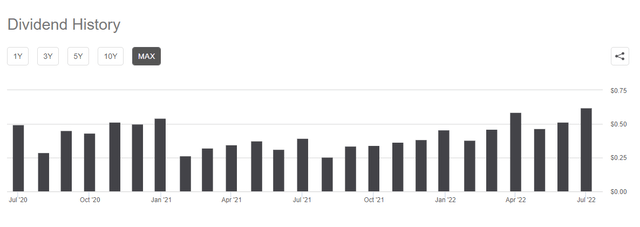

When it comes to income, JEPI has 100% delivered on its objective and established a respectable track record. Investing in SPY on 7/15/21 would have generated $6.01 in annual dividends, which is a yield of 1.38% based on the $434.75 share price. JEPI has delivered 12 monthly dividends that have amounted to $5.18 in dividend income since 7/15/21. This is an 8.47% yield on investment going off the $61.22 buy price on 7/15/21 for JEPI. Based on the $5.18 in income JEPI generated, investors could look at their investment only being down $0.50 per share (rounding up) as $5.18 has been returned in income.

The previous year of dividend payments makes JEPI look very interesting at these levels. Hypothetically if JEPI was to replicate the $5.18 in dividend income it generated over the past 12 dividend payments, it would be a forward yield of 9.28% on the current share price of $55.50. I believe 9.33% is an attractive yield for any income investor.

How JEPI is doing compared to other popular income-focused ETFs

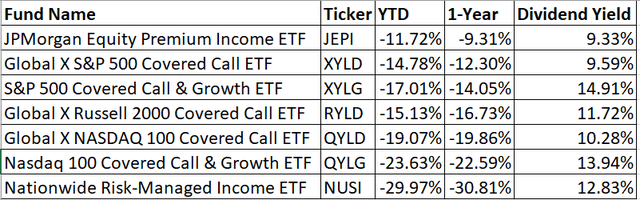

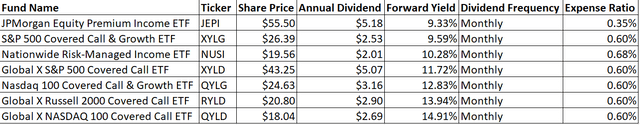

Income-focused ETFs have become more popular over the previous several years so I wanted to compare JEPI to some of the most talked about income ETFs. I will be comparing JEPI to the following:

JEPI has mitigated downside risk in both the YTD and 1-year categories better than the other income-focused ETFs I have selected. The range YTD is -11.72% to – 29.97% and then -9.31% to -30.81% for 1-year. JEPI is at the lowest end of both ranges, having declined by -11.72% YTD and -9.31% over the past year.

Steven Fiorillo, Seeking Alpha

From an income perspective, JEPI is certainly competitive with the rest of these income-focused ETFs. The range is a yield of 9.33% to 14.91%. All of these are considered high-yielding investments. When you look at the downside mitigation that JEPI has delivered, one could argue that sacrificing a few percent on the yield is well worth it to mitigate losses during a tough investing environment.

Steven Fiorillo, Seeking Alpha

Conclusion

After evaluating JEPI against the major indexes and other popular income-focused ETFs, I believe it’s proven to be a viable investment vehicle for income investors. When looking at JEPI against the major indexes, it declined less YTD and over a full year on a percentage basis, and the same holds true when looking at JEPI against other popular income-focused ETFs. If you had invested in JEPI a year ago, you would only be down less than -1% after factoring in the income distributed throughout the past year. JEPI has established a strong track record of paying respectable amounts of income on a monthly basis and has done a better job at protecting capital during declining markets than index funds. If you’re looking for an income investment, it may be worth sacrificing a few percentage points on the yield for downside protection and looking at JEPI as its yields over 9% at current prices.

Be the first to comment