Alex Wroblewski

JPMorgan Chase (NYSE:JPM) has sold off with the rest of broader market in the face of fears of recession. That makes some sense, as JPM is a bank and may see increased credit losses in a recession. But one mustn’t forget that JPM has a fortress balance sheet in a banking sector which is already subject to strict regulatory scrutiny. The sector has been supervised in order to assure that the Great Financial Crisis can never occur again, making banks arguably in the strongest position that they have ever been. JPM intends to pause share repurchases in the near term in order to further increase its CET1 capital ratio, but the stock trades cheaply, making this a potential double digit shareholder yield once share repurchases resume.

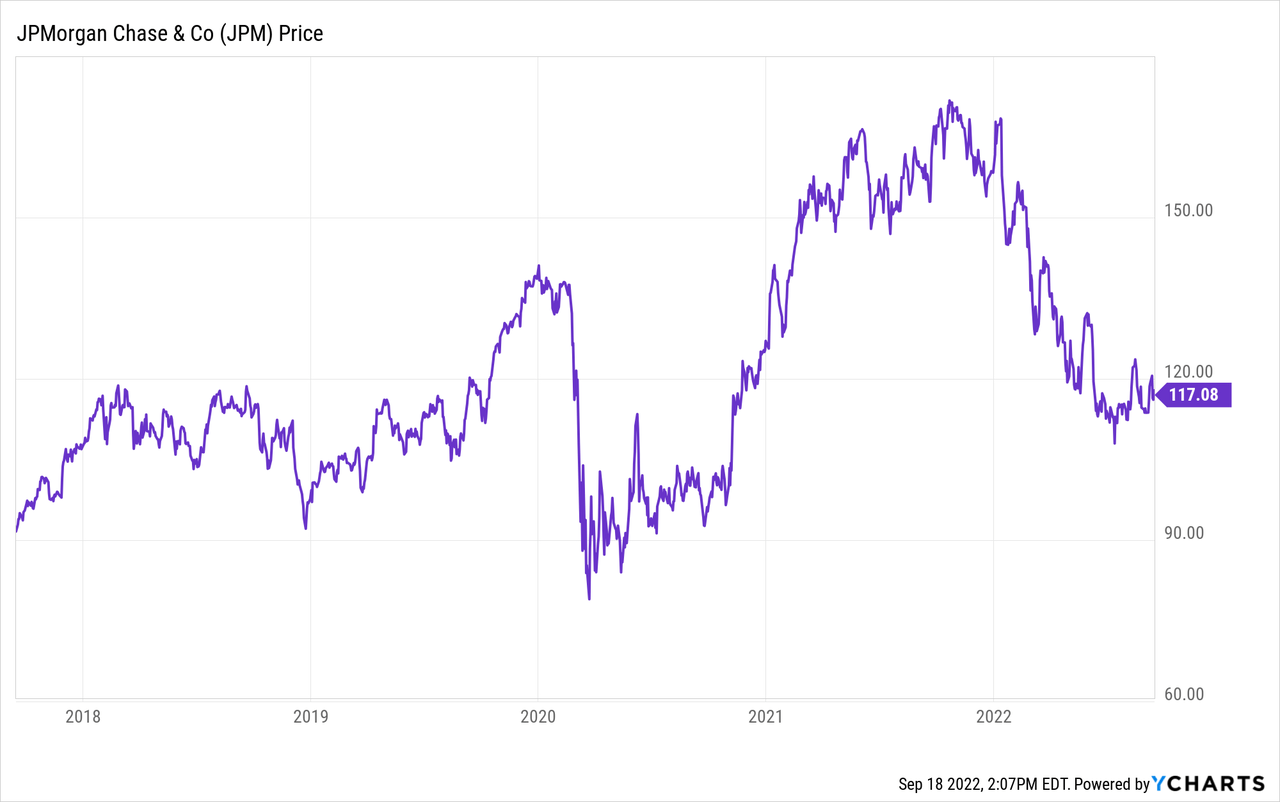

JPM Stock Price

JPM peaked at $173 per share but has since slid 32%. The stock has done nothing over the past 5 years.

I last covered JPM in the May of 2019 where I rated the stock a buy on account of the high shareholder yield. The stock has since returned only 15%, reflecting multiple contraction from an already conservative starting multiple.

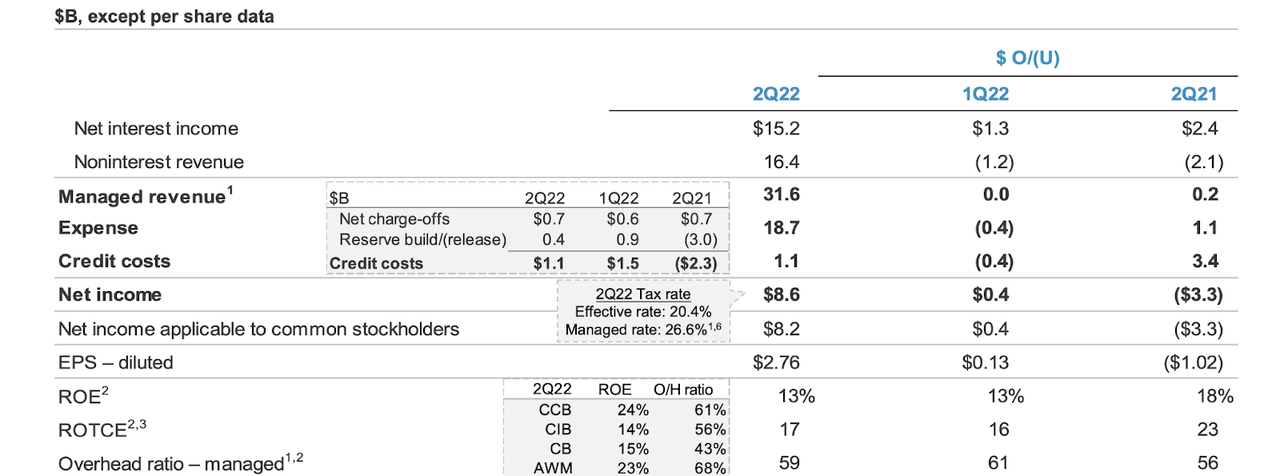

JPM Stock Key Metrics

The latest quarter saw JPM deliver narrow growth in revenue as growth in net interest income (due to higher interest rates) made up for declines in non-interest revenue (due to lower market prices). Earnings of $2.76 per share was lower year over year primarily due to 2021 seeing a large release of credit reserves from the pandemic.

2022 Q2 Presentation

In my view, the most critical growth metric is that of deposit growth, which grew 9% year over year. That strong growth was primarily driven by 12% growth in its largest deposit base from consumer and community banking.

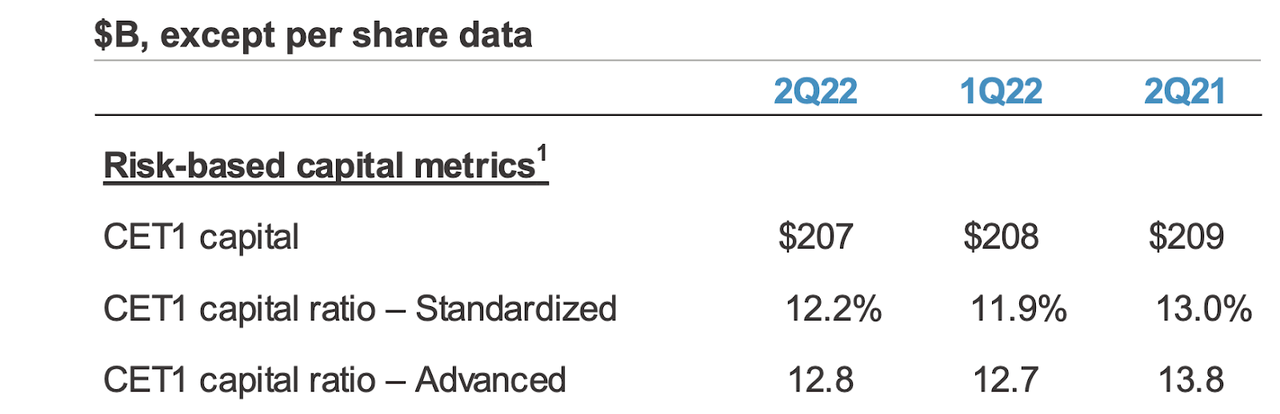

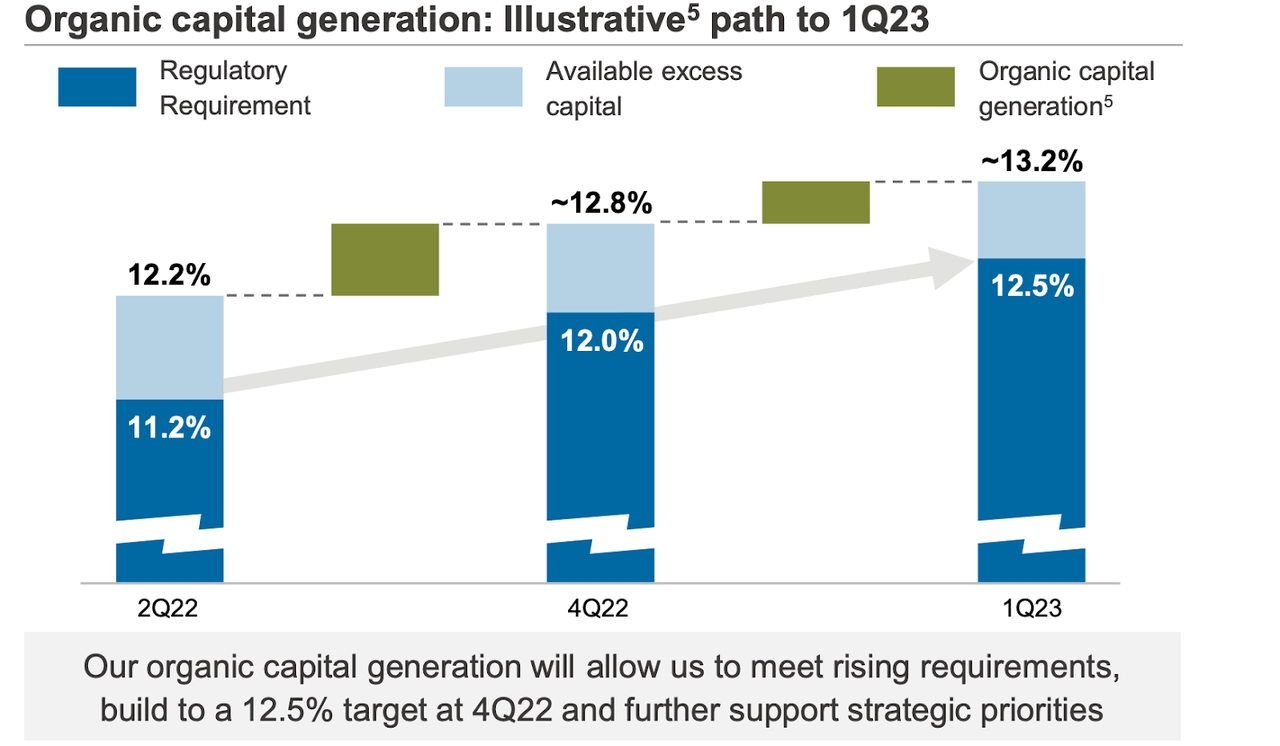

JPM ended the quarter with a CET1 ratio of 12.2%, lower than 13% from last year but still comfortably best in class.

2022 Q2 Presentation

JPM repurchased only $224 million of common stock in the quarter but did pay $3 billion in common dividends. JPM has paused its share repurchase program so that it could further add to its CET1 capital ratio.

Is JPM Stock A Buy, Sell, or Hold?

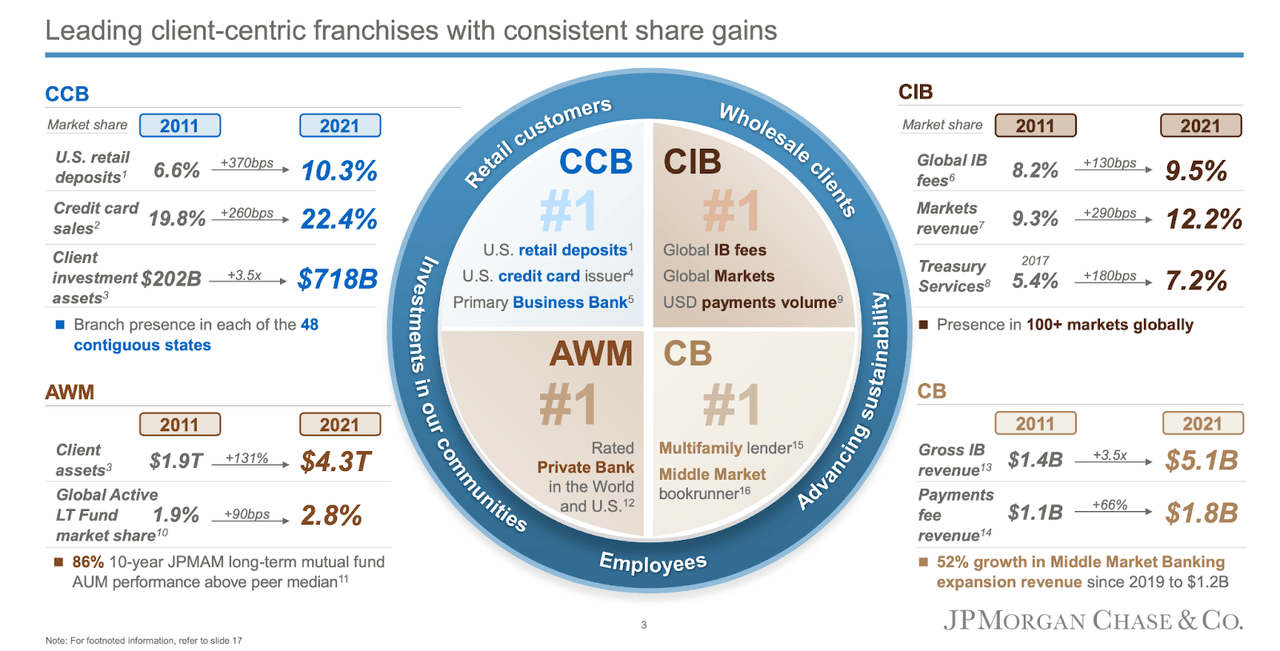

JPM is not the cheapest stock in the financial sector but that is for good reason. JPM is a giant in the industry, one which continues to take market share in spite of its large size (or perhaps, due to its large size).

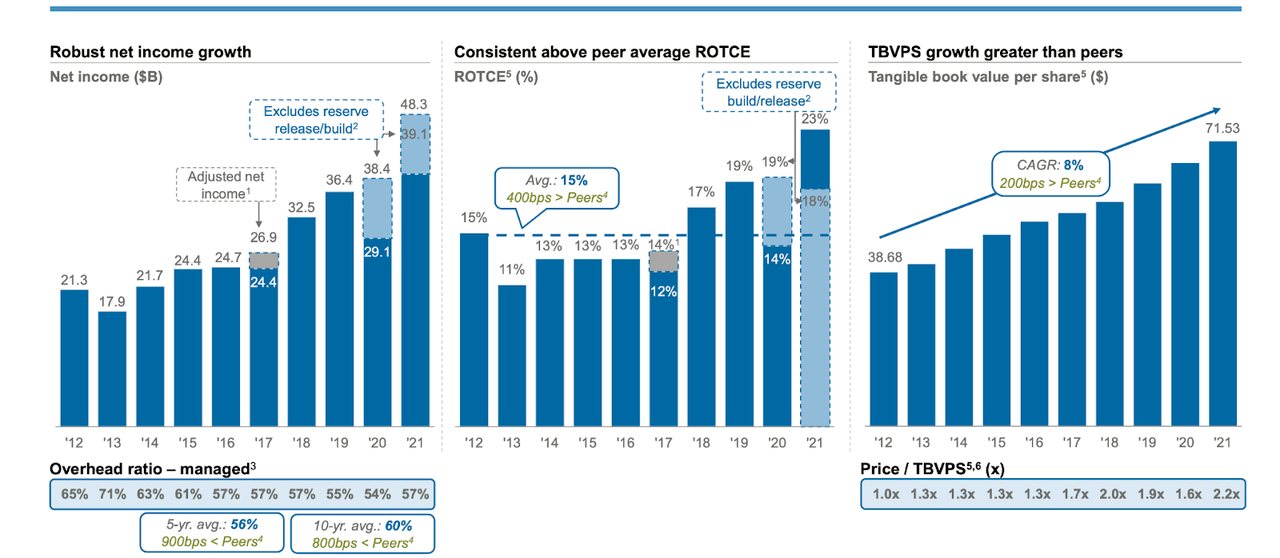

2022 Investor Day

JPM consistently posts profit margins at the top of its peer group which has helped lead to consistent 8% compounded annual growth in tangible book value per share.

2022 Investor Day

I mentioned earlier that JPM has paused share repurchases to boost its already bulletproof CET1 capital ratio. JPM expects its CET1 capital ratio to hit around 13.2% by the first quarter of next year based on organic growth alone. Management stated at a recent investor conference that they’ll re-evaluate their share repurchase program then.

2022 Q2 Presentation

JPM has targeted a 17% ROTCE target. Based on $69.53 in tangible book value per share in the latest quarter, that reflects long term earnings power of $11.82 per share. JPM did generate a 17% ROTCE in the latest quarter and management stated that they may be able to sustain that profit margin this year.

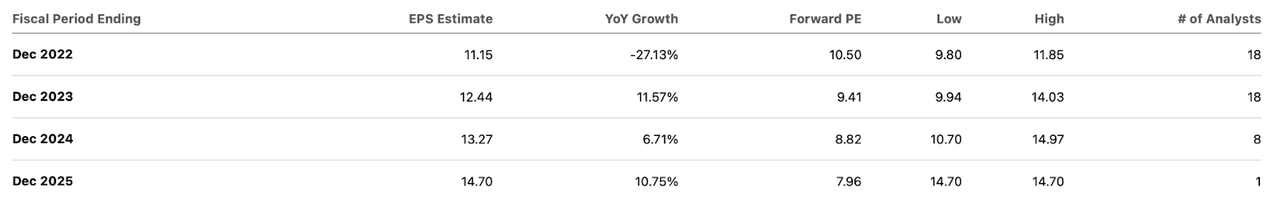

Consensus estimates are more conservative, expecting $11.15 in earnings per share this year before picking up with double-digit growth next year.

Seeking Alpha

What might 2023 bring? On the conference call, management reiterated its “the core view of some upside from that fourth quarter run rate into 2023 is still in place.” Recall at the investor day, management had guided to a fourth quarter run rate of $66 billion in net interest income and $77 billion in non-interest expense. JPM is on pace for around $60 billion of non-interest revenue. This implies around $40 billion in net income in 2023, or earnings of around $13.48 per share – far ahead of consensus estimates. It may be more prudent to look at the $12.44 consensus earnings estimate due to the large uncertainty in the current economy. JPM is trading at just 9.4x that number, reflecting a sizable discount to its 5-year average of 12.2x earnings. I expect the financial sector as a whole to eventually experience some re-rating, leading to JPM to exceed not only its 5-year average but to reach an earnings multiple of 15x to 18x. I expect the principal catalyst to be continued execution on its share repurchase program. That reflects 60% potential upside from multiple expansion, which pairs nicely with the double-digit annual earnings yield.

The main risks here are twofold. First, economic uncertainty remains large, and JPM may post lower earnings than expected in the near term. I expect it to post strong numbers over the long term on account of its consistent deposit growth, but it is thus far unclear if higher interest rates will offset lower demand for loans. The more pressing risk is that of competition – banking is arguably a commoditized industry. Not only that, but my personal anecdote is that JPM does not offer a favorable experience as I have often dealt with longer wait times to speak with customer service and been surprised with unexpected account fees. It is possible that its stronger margins are due to an antiquated business model, which may not hold up in a world where consumers want faster service and minimal fees.

I rate JPM a buy as I expect the company to remain resilient in the face of a recession due to its strong balance sheet and for its share repurchase program to eventually pave the way for multiple expansion.

Be the first to comment