Mohammed Haneefa Nizamudeen

Investment summary

As the macro thematic continues to mould itself in FY22 investors should look to position alongside factors of quality and resiliency. We are on the hunt for long-term cash compounders that can beat the WACC hurdle and offer investors some pricing asymmetry to the upside. As such, we look to The Joint Corp. (YNT) and find it displays a loose affinity to the equity premia we are seeking exposure to in FY22. With weakening bottom-line fundamentals and looming pressures within the marketplace from its growth plans, we rate JYNT neutral.

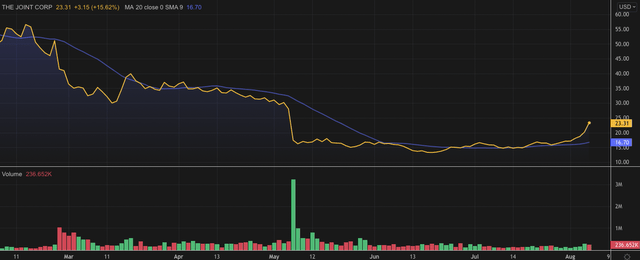

Exhibit 1. JYNT 6-month price action

Q2 earnings: Weakening bottom-line fundamentals

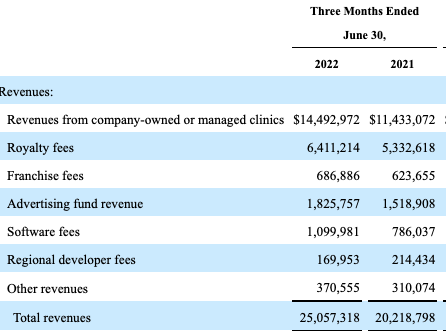

Turnover came in 24% higher in Q2 FY22 with a $5.1 million gain in revenue across the quarter to $25 million. JYNT recognizes revenue from 7 sources, as seen in Exhibit 2, and each of these saw meaningful growth YoY as well.

Exhibit 2. JYNT books revenue from 7 sources and each saw meaningful upside YoY last quarter

This didn’t carry through to the bottom line however, and this is where we find initial challenges with the JYNT investment debate.

Data: JYNT 10-Q August 4, 2022

Growth was underscored by new store openings and growth of the company’s underlying operations. JYNT did see a 20% YoY headwind in cost of revenue, although this is in-line with macro expectations of cost inflation, supply chain headwinds and the rest. However, it also built out additional expenses with its new IT platform and recognized costs from its franchised clinics. The number of clinics with sales more than $550,000 is now 308, up more than 82% from FY20.

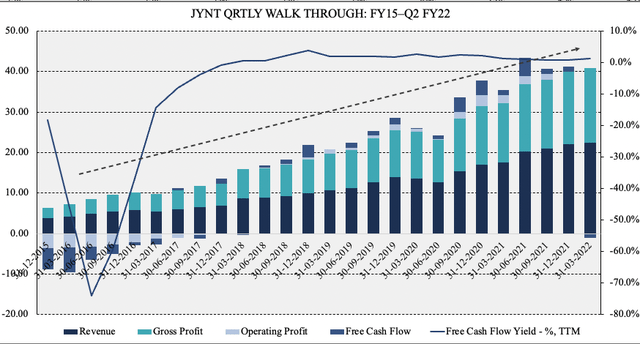

As seen below, operating metrics continue to stretch up for the company on a sequential basis. It has averaged ~$1.4 million [$5.6 million annualized] in quarterly FCF conversion since FY18 and investors currently realize a 1.2% FCF yield. However, FCF has been softening in recent years alongside net profit margins which have thinned to single digits.

Exhibit 3. Quarterly operating performance, whilst LT growth, has recently rolled over and been stagnant

Data : HB Insights; JYNT SEC Filings

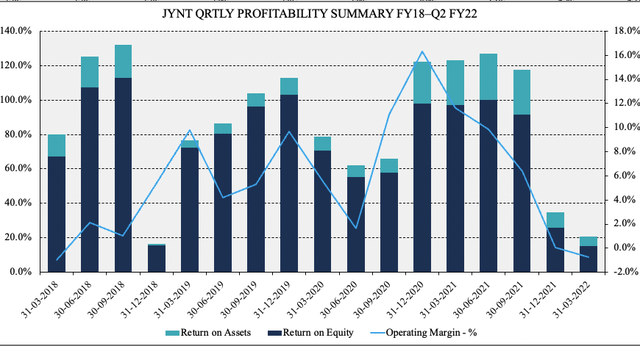

Meanwhile, operating costs gained 23% YoY as the number of new franchised and managed clinics continued to ramp up (discussed later). As a result, operating income came in at $473,000 versus a $2 million this time last year. This carried down to net income of $345,00 and $0.02 in EPS. Given the acquisition of R&D territory rights during the quarter, amid other capital budgeting moves, cash from investing activities came in at $11 million due to these investments. Alas, the company is profitable however profitability measures have narrowed substantially since peaking in Q4 FY20. We are looking for increasing measures of profitability, not decreasing. As it stands, the company’s WACC is 11.7% and it therefore must compound capital at that level looking ahead to present as compelling value.

Exhibit 4. Ideally we’d look to see an increasing set of trends in profitability measures

Data: HB Insights, JYNT SEC Filings

Management felt confident to reaffirm FY22 full guidance and expects $102 million at the top this year for the upper range. It also forecasts non-GAAP EBITDA of around $14.0 million whereas it says it is on track to grow franchised clinic openings between 110-130 more locations and another 30-40 in company owned clinics.

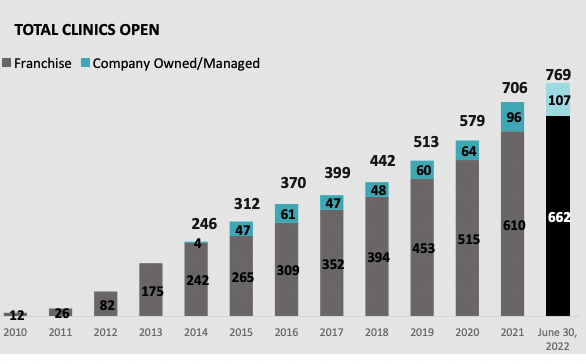

The pace at which JYNT opens new clinics is a noteworthy key performance indicator (“KPI”) for the company. As seen in the image below, taken from JYNT’s Q2 FY22 investor presentation, it continues to increase the number of new clinics it opens annually. This is important in its revenue model as shown above, as the bulk of its revenue stems from franchised or managed/owned locations.

It must do it this way because the amount of upside can become capped when running allied health service practices such as chiropractic centres. In other words, there are only so many patients that can be seen per hour; only so many clinicians per site can be hired; and only so much that can be charged per consult, effectively placing a ceiling on growth of a single centre. Therefore, in order to expand turnover and beef up the top-line, the best strategy by estimate is ongoing store and franchise openings to drive additional turnover whilst retaining more of the EBIT margin.

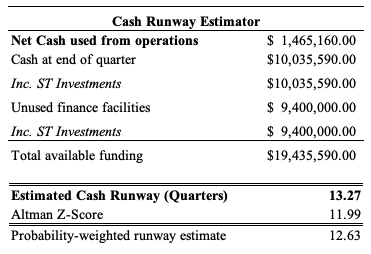

Thinking a little more laterally as well, if there is a slowdown or recession (depending on how discretionary chiropractic is deemed in a recession), JYNT could sweep up distressed assets at a discount and potentially widen the return on its investment this way. It will be interesting to see management’s strategy in that scenario, with unrestricted cash of $9.4 million at the quarter’s exit. As seen in Exhibit 5, the company looks well capitalized and at its current cash run rate has more than three years of runway left, by estimation.

Exhibit 5.

Data: HB Insights Estimates

Exhibit 6. Pace of clinic openings integral to JYNT’s business model looking ahead

Data: JYNT Q2 FY22 Investor Presentation

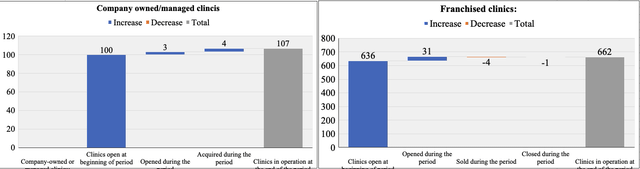

In Q2 FY22 it sold 24 franchise licenses, two more than last quarter but down on Q2 FY21’s 63. The number of clinics increased to 769 from 706 as seen above and of this, 662 are franchised whereas 107 are company owned. It also opened three greenfield clinics and acquired another four franchised clinics, versus eight in Q2 FY21. As seen in the chart below, the company grew both revenue segments following portfolio management activity throughout the quarter.

Exhibit 7. New clinics waterfall

In short

In summation whilst it was a solid quarter at the top-line for the company a worse-than expected performance at the bottom line has us trigger shy on the name. We are searching for evidence of resiliency in the current climate and with softening net margins and a weakening FCF profile don’t get us there with JYNT, despite its profitability.

Providing a concrete valuation is difficult, and shares are trading at more than 9x book value and 3.6x forward sales. Notably, these are each above the GICS industry peer median suggesting investors are pricing sales to grow at an above market rate next year. Nevertheless, it becomes a question of opportunity cost in holding a smaller, underperforming name with a speculative punt, or position in a larger, more durable offering that is FCF heavy and ROIC positive. With that in mind, we rate JYNT a hold.

Be the first to comment