ArtistGNDphotography/E+ via Getty Images

Hunting For Covid Boom-&-Bust Opportunities

Early on in the pandemic, it became clear that there would be many companies (Covid Winners) that would be gifted major boosts to revenue streams; in some cases this also translated through to profit booms. The vast majority of Covid Winners emerged thanks to sudden and major changes in consumer behavior, rather than through strategic genius or brilliant execution.

Equity markets rewarded Covid Winners handsomely. For Covid Winners that were already profitable prior to the pandemic, share prices benefitted from the compounding effect of higher earnings and higher earnings multiples. Share prices of earlier-stage, loss-making Covid Winners that were able to publish rapidly growing revenue and/or customer numbers, soon factored in a level of sustainable earnings that appeared to be extremely optimistic. Well-known names such as Peleton and Netflix were classic examples of Covid Winners. In the UK, I watched the share price of Halfords Group (the UK’s largest retailer of cycling equipment) reach heights implying that British roads would in future be permanently clogged by millions of happy cyclists. In Australia, it appeared as though buyers of shares in Marley Spoon were expecting Australian supermarkets to be put out of business by meal-box mania.

Given my preference for value investing, I side-stepped such Covid Winners and waited for what I assumed would be a post-Covid normalization. My expectation was that overpriced Winners might become underpriced bargains, thanks to a fading of Covid-boosted earnings/revenue benefits and the associated negative investor sentiment and balance sheet pain that nearly always emerges when over-optimistic growth rates prove unachievable. Unfortunately, my plan to swoop in at the right time and mop up some overly beaten-up faded Covid Winners when the world returned to ‘normal’ was largely scuppered by a highly uncertain outlook due to rampant inflation and conflict in the Ukraine. That said, my sense is that there are still likely to be some good investment opportunities around that have been created by the Covid Boom-&-Bust cycle; this note takes a look at one such US-listed stock.

Johnson Outdoor Inc – Background & Overview

Johnson Outdoors Inc. (NASDAQ:JOUT) was founded by Sam Johnson in 1970; his daughter, Helen Johnson-Leipold, is JOUT’s current Chairman and CEO. The company came to market via an IPO in 1987. JOUT is a leading global manufacturer and marketer of outdoor recreation products. If you are keen on fishing, diving, watercraft recreation or camping, there is a good chance that you will be familiar with some of JOUT’s products and brands. JOUT attributes its success to continuous innovation, marketing excellence, product performance and quality.

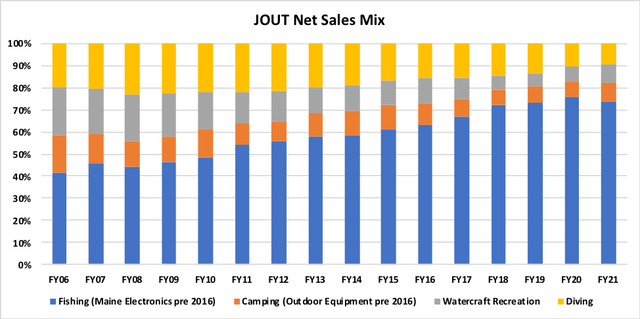

As shown in Chart 1, Fishing is by far JOUT’s largest segment, with around 74% of group sales in FY21. Sales for Diving, Camping and Watercraft Recreation were all roughly equal in size in FY21, each contributing around 8% to 9%. As well as being the biggest contributor to sales, Fishing has generally been the highest margin segment for JOUT over the last decade or so. Chart 2 shows how the group’s sales mix has changed over time and highlights the growing contribution of Fishing.

Chart 1:

Source: JOUT IR website, Investor Presentation, slide 7.

Chart 2:

Source: Created by author using data from JOUT quarterly reports.

In Table 1, I set out the average sales growth rate per annum over the 2-, 10-, and 15-year periods to FY21. These calculations show that Fishing has historically generated solid sales growth, but that sales growth in JOUT’s other segments has been quite soft. The Covid-boom effect is very clear in the 2-years column. Diving struggled during Covid, as sales are heavily linked to travel; with the easing of travel restrictions Diving sales improved materially in 2H21 and have stayed buoyant during FY22.

Table 1:

Source: Created by author using data from JOUT quarterly reports.

Brands & Products

JOUT’s Fishing segment key brands:

- Minn Kota – electric motors for quiet trolling or primary propulsion, marine battery chargers and shallow water anchors.

- Humminbird – sonar and GPS equipment for fish-finding, navigation and marine cartography.

- Cannon – downriggers for controlled-depth fishing.

JOUT’s Camping segment key brands:

- Eureka! – consumer, commercial and military tents and accessories, camping furniture and stoves and other recreational camping products.

- Jetboil – portable outdoor cooking systems.

JOUT’s Watercraft Recreation segment key brands:

- Ocean Kayaks – canoes and kayaks.

- Old Town – canoes and kayaks, personal flotation devices.

- Carlisle – branded paddles.

JOUT’s Diving segment key brands:

- SCUBAPRO (premium recreational and high-performance technical diving equipment) – underwater diving and snorkeling equipment, including regulators, buoyancy compensators, dive computers, gauges, wetsuits, masks, fins, snorkels and accessories.

Distribution

JOUT’s Fishing equipment is sold globally, however the bulk of sales come from North America via large outdoor specialty retailers, large retail store chains, independent marine service outlets, sporting goods dealers, and original equipment manufacturers (OEM) of boat brands such as Tracker, Skeeter and Ranger. JOUT also sells direct to consumers via Minn Kota, Humminbird and Cannon websites. Sales beyond North America are made through a network of international distributors.

Eureka! consumer products are mid- to high-price range camping products sold in North America, mainly to camping/backpacking specialty stores, sporting goods stores and internet retailers. Direct to consumer sales occur via the Eureka! brand website.

Eureka! commercial tents and accessories are sold mainly to general rental stores, with some direct sales made to tent erectors. Eureka! designs and manufactures large, heavy-duty tents and lightweight backpacking tents primarily for the US military at its Binghamton, New York location.

JOUT’s canoes and accessories sales are mainly in North America, with an emphasis on independent specialty dealers and outdoor specialty chain retailers. Direct to consumer sales are made via the Old Town and Ocean Kayak websites, and through Amazon/other internet retailer sites. A network of distributors sell JOUT products outside of North America.

JOUT’s Diving products are sold via independent specialty dive stores worldwide. Such specialty dive stores typically provide a wide range of services to divers, including regular maintenance, product repair, diving education and travel programs. Direct to consumer sales are made via the SCUBAPRO website and to dive training centers, resorts, public safety units and armed forces. In contrast to the heavy North American focus of JOUT’s other segments, SCUBAPRO has a stronger global profile.

Family/Founder-Owned Companies

The argument that family/founder-owned businesses can be good investments is rather persuasive. Obviously there are plenty of counter-examples to this view; family/founder ownership is by no means a guarantee that a business will be well-managed. But generally speaking, for investors seeking out companies that can drive sustainable earnings growth over time, family/founder-owned businesses are a useful area of focus. Typical features of family/founder-owned businesses that support sustainable earnings growth include: consistent and strong corporate culture, longer-term time horizons, innovation driven by continual reinvestment, robust balance sheets, skin in the game. Family ownership is well and truly present with JOUT. As at 01 October 2021, Chairman and CEO Helen Johnson-Leipold and members of her family and related entities held approximately 75% of JOUT’s stock.

Credit Suisse performed an analysis of family/founder-owned companies in 2020, and observed the following (returns were calculated to 30 June 2020):

- Our updated analysis of family-owned companies suggests that their “alpha credentials” remain intact. Using our database of over 1,000 publicly listed family- or founder-owned companies, we calculate an annual average alpha of around 370 basis points since 2006. Reasons for this include superior revenue growth and cash flow returns. Family owned companies offer safety in periods of market stress – during the first six months of this year, they outperformed non-family-owned companies by 300 basis points.

Source: Credit Suisse Research Institute (2020), The Family 1000: Post the Pandemic.

There are downsides to high levels of family/founder ownership. Lack of liquidity may be an issue in some cases (more on this below). Should the family/founder’s management of the business prove to be poor quality, it may be difficult for minority shareholders to exert the necessary influence to install new ‘outside’ leadership. Also, the potential for a company that is tightly held by family/founders to be seen as a viable takeover target is diminished.

In JOUT’s case, there is an additional aspect of family/founder ownership to consider. As well as being Chairman and CEO of JOUT, Helen Johnson-Leipold is also Chairman of the unlisted financial services business, Johnson Financial Group. Acting as Chairman for a company operating in banking, wealth management and insurance markets is a demanding role; frankly, I would prefer to see JOUT being managed by a leader who did not have such additional demanding external commitments.

Flying Under The Radar

JOUT does not appear to be well-followed by the sell-side. The JOUT IR website lists only one analyst as covering the company, and in recent quarters that analyst has been the only attendee who asked questions in JOUT’s post result Q&A sessions. JOUT’s high level of family ownership and the associated lack of liquidity is likely to deter large institutional investors from taking positions in the stock. It can be argued that the lack of institutional and sell-side focus creates an opportunity for smaller investors – ideally those who are willing to conduct research themselves – to acquire JOUT stock more cheaply than would otherwise be the case. The flip-side of this argument is that if an investor wishes to exit a JOUT position, there may be limited demand from buyers. In regard to the risk of a major fall in JOUT’s share price being driven by smaller holders, I’m inclined to think that (unless the company was at genuine risk of financial failure) the Johnson family interest serves as something of a floor support. Also, intuitively speaking, the lack of liquidity in JOUT shares carries the risk that the stock’s price will be more volatile than more liquid peers.

Operating Performance Slips Post Covid-Boom

After an exceptionally strong first three quarters of FY21, JOUT’s operating performance started to run into difficulty in 4Q21, with challenges continuing through FY22 to date. Unlike many other Covid Winners, according to JOUT’s commentary, the group’s reduction in earnings has not been driven by a steep drop off in demand. The key issue for JOUT has been an inability to deliver product to meet demand, caused by supply-chain and logistical disruptions.

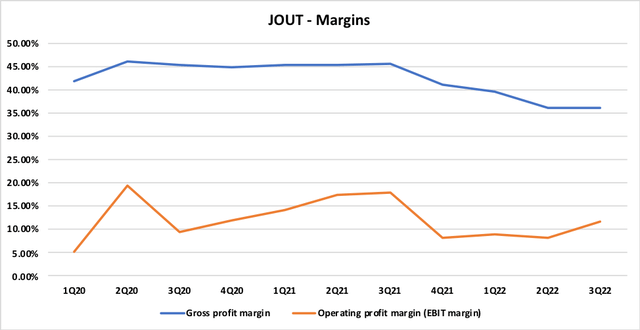

Sourcing of electronic components used in the manufacturing of fishing equipment has been particularly problematic. To address the combination of limited availability of materials/components and pricing pressure, JOUT increased levels of inventory and raw materials in a bid to be able to manufacture and deliver sufficient product to meet customer demand. Despite these mitigation efforts, JOUT’s production output took a hit; this negative was compounded by margin squeeze due to JOUT needing to pay higher prices to secure raw materials/components than has historically been the case (primary raw materials used by JOUT are metals, resins, electronic components, packaging materials). Chart 3 illustrates the margin decline since 3Q21.

Chart 3:

Source: Created by author using data from JOUT quarterly reports.

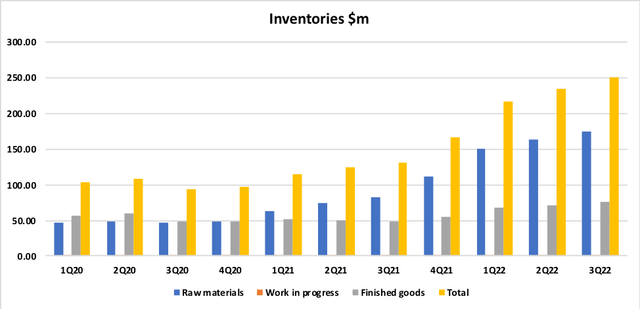

Balance sheet inventory levels averaged ~16.3% of net sales for the five-year period ending FY20. As at FY21, this metric spiked to 22.2% of net sales. Inventory levels continued to grow materially during FY22, as shown in Chart 4, and have increased by $121m from 3Q21 to 3Q22. This inventory build has been the primary driver in a reduction of balance sheet cash of -$131m over the same period. Despite this cash drain, JOUT’s balance sheet remains very strong, with 3Q22 reported cash of $118m and no debt.

Chart 4:

Source: Created by author using data from JOUT quarterly reports.

Risks

The main longer-term downside risk for JOUT is that the company fails to innovate in order to deliver products that outdoor recreation consumers desire. Technological advances in fishing equipment are moving rapidly and JOUT must remain focused on R&D in order to keep up with peer offerings. Over the last decade, JOUT has consistently invested in R&D at the rate of ~3.5% to 4% of net sales, and so there is no obvious sign of underinvestment on this front.

The main short-term downside risk is that JOUT needs to heavily write-down its expanded inventory balance. Changes in consumer demand and delays in product delivery have the potential to create obsolete/excess inventory. JOUT’s 3Q22 inventory level of $251m is high relative to its market cap (currently ~$550m), implying that inventory write-down risk is material.

A further near-to-medium-term risk is that continued inflationary pressures create cost headwinds for JOUT that are unable to be fully passed through to customers. Obviously JOUT is far from alone in facing such margin squeeze risks.

A recession in North America and/or Europe is likely to result in lower consumer demand for the discretionary consumption items that JOUT produces. This is a risk that is currently faced by the majority of manufacturers in the discretionary products space.

Supply chain disruptions may continue to be a drag on JOUT’s operational performance and cash flow. There has been reference in the company’s materials to consideration of other options beyond inventory build in order to ensure that JOUT can meet customer demand. JOUT might therefore be looking to acquire certain businesses involved in its supply chain – this may be a source of both upside and downside earnings risk depending on the price paid and how well any integration is executed.

Valuation Analysis – Normalized Earnings Approach

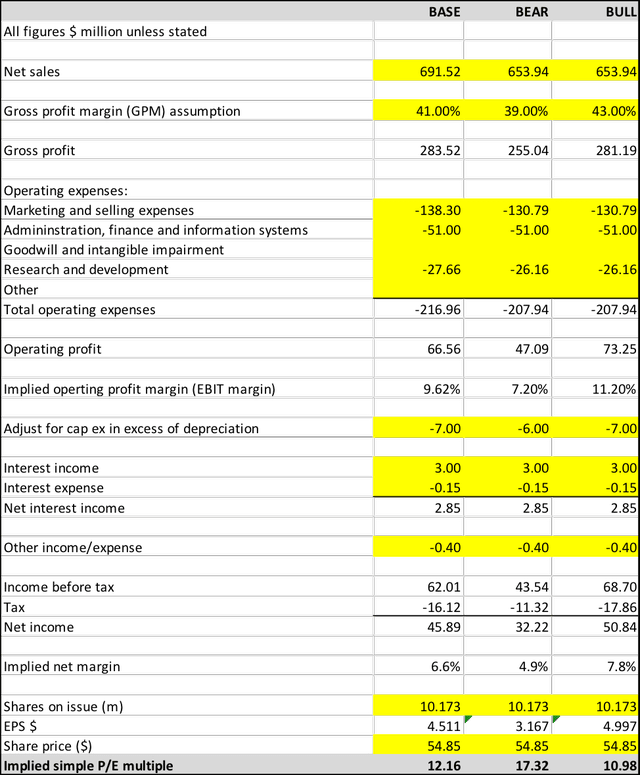

In making an assessment of normalized earnings, I’m essentially arriving at a point-in-time estimate of how I expect a company to perform on a through-the-cycle or sustainable-earnings basis. Table 2 sets out my Base Case for JOUT’s normalized earnings, along with Bear Case and Bull Case scenarios. Note that I have made an allowance for the fact that JOUT’s current capital expenditure is running materially higher than the group’s depreciation charge. At $54.85 per share (NASDAQ close 25 November 2022), the valuation analysis indicates that JOUT is trading at a P/E of between 11.0x and 17.3x, with a Base Case of 12.2x.

Table 2:

Source: Created by author using data from JOUT quarterly reports.

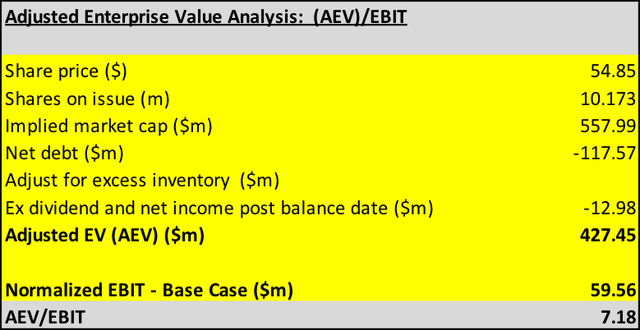

For manufacturing and retail stocks, my preferred valuation metric is EV/EBIT. Table 3 sets out my calculation of AEV/EBIT, where AEV is the adjusted enterprise value, and EBIT is my normalized EBIT.

To arrive at AEV, I have allowed for dividends and profits post balance date but I have not made an adjustment for excess inventory levels (which have potential to normalize downwards and boost cash levels).

Table 3:

Source: Created by author using data from JOUT quarterly reports.

For a small-cap manufacturer of consumer goods such as JOUT, I would typically regard an EV/EBIT multiple in the range of 9x to 11x as representing around fair value. Based on a current share price of $54.85, my analysis points to JOUT trading on an EV/EBIT multiple of ~7.2x.

Summary & Conclusion

- JOUT is a long-standing outdoor recreational equipment manufacturing business with a solid range of brands and products.

- The founder’s family remains in control of operations and dominates the share register.

- JOUT’s balance sheet is strong, with no debt and cash of ~$118m as at 3Q22. A downward normalization of abnormally high inventory levels can be expected to lift cash levels materially.

- Ongoing supply chain disruptions and a recessionary-linked downturn in demand for consumer discretionary goods imply that the near-term outlook for JOUT is challenging.

- JOUT has sufficient balance sheet capacity to manage through an economic downturn and the stock offers attractive long-term value at current pricing of around $55 per share.

- Based on a normalized earnings valuation framework, I rate JOUT as a BUY (at around $55 per share).

Be the first to comment