HJBC

Holders of Amazon (NASDAQ:AMZN) have seen plenty of pain over the past year, as the share price has cratered, with it now sitting at almost half of its 52-week high of $180. However, now is the time to remain focused on high quality companies such as this one, which can be had for a bargain.

Having held stocks through two recessions, I can attest to buying high quality companies when the chips are seemingly down, as was the case for REITs such as Kimco Realty (KIM) and Simon Property Group (SPG), which have more than tripled and doubled since their pandemic lows.

I see parallels in beaten-down, heavy hitting tech stocks such as Amazon at the moment, and in this article, highlight why AMZN is a potentially great long-term value buy at current levels.

A Tech Leader With Fortress Balance Sheet

Amazon is an unrivaled leader in the consumer, enterprise and retail space. It is one of a handful of companies that has maintained market dominance for years and continues to grow its market share by leveraging technology, data and customer service.

Moreover, Amazon has an abundance of cash on hand and is projected to continue to generate substantial free cash flow over the next several years. With a huge war chest built up, it can easily invest in new projects or acquisitions that will help increase its market share and profitability. This includes $58.7 billion in cash on hand, sitting against $65.6 billion of long-term debt, helping it to earn an AA credit rating from S&P, just one notch below that of the U.S. Government.

Operating Fundamentals

Amazon is seeing impressive growth in the current economic environment, with revenue growing by 15% YoY (19% constant currency) to $127 billion, which is larger than the market cap of most companies in the S&P 500 (SPY). This was largely driven by robust North America sales, which rose by 20% YoY to $79 billion.

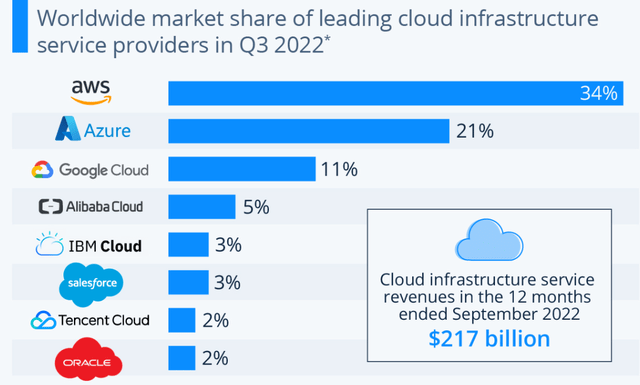

Furthermore, the company’s cloud-computing business, Amazon Web Services is still growing rapidly, and this is likely to remain a key driver of revenue for many years to come, even as competition from the likes of Microsoft Azure and Google Cloud Platform intensifies. AWS saw revenue growth of 27% year-over-year in the most recent quarter (28% excluding currency effects), signaling that demand for its services continues to be strong.

As shown below, AWS continues to dominate the cloud market, with a 34% market share as of the end of the third quarter, sitting far ahead of rivals Azure (MSFT) and Google Cloud (GOOG) (GOOGL).

Headline Risks and Cloud

Besides inflation, one of the narratives that have dominated financial headlines this year is the strengthened U.S. dollar, which has posed currency conversion headwinds for multinational U.S. companies. This is reflected by international segment sales declining by 5% YoY, but increasing by 12% excluding changes in foreign exchange rates.

Moreover, despite a strong showing by AWS, its growth appears to be decelerating, with high inflation and rising energy costs being headwinds. This has resulted in management seeing an uptick in AWS customers focused on controlling costs.

This however, spells opportunity, as the breadth of AWS’ offerings enables it to move storage to lower-priced tiers and shift workloads to Graviton3 processors, which delivers 40% better price performance than comparable x86-based instances. Furthermore, AWS aims to expand into new markets geographically, with the recent expansion into the Middle East and Asia Pacific in Thailand.

The Outlook

I see the long-term growth thesis as being intact, as currency effects should normalize over time. Moreover, AMZN’s wide breadth of services serves as a moat for the company, as it’s able to attract a wide swath of customers into its ecosystem, serving as an enduring moat for the company. These attributes were highlighted by Morningstar in its recent analyst report:

The secular drift toward e-commerce continues unabated with the company continuing to grind out market share gains despite its size. Prime ties Amazon’s e-commerce efforts together and provides a steady stream of high margin recurring revenue from customers who purchase more frequently from Amazon’s properties. In return, consumers get one-day shipping on millions of items, exclusive video content, and other services; this results in a powerful virtuous circle where customers and sellers attract one another.

Valuation

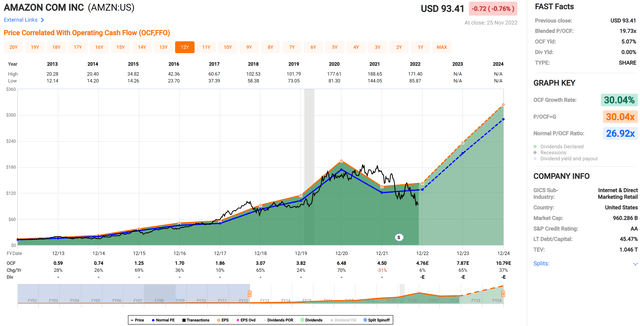

Last, I see value in AMZN at the current price of $93.41, which sits nearly 50% below its 52-week high. Given that AMZN is still very much in growth mode, a price to operating cash flow valuation methodology is more relevant in determining fair value.

AMZN currently trades at a blended price to OCF ratio of just 19.7, sitting well below its normal P/OCF ratio of 26.9. I believe a P/OCF ratio of at least 25x is justified, considering the moat worthy enterprise, recent growth, and analyst estimates for strong growth in the coming years, as shown below.

Investor Takeaway

Amazon is one of the highest quality investments available in the market today, and I believe it’s an attractive buy at current levels. The long-term growth thesis remains intact as currency effects should normalize over time and AWS continues to dominate the cloud market. Furthermore, AMZN’s moat worthy enterprise, well below historical valuation, and analyst estimates for strong growth in the coming years make it a compelling buy at the current price for potentially rewarding long-term gains.

Be the first to comment