EyeOfPaul/iStock Editorial via Getty Images

Investment Thesis

Domino’s (NYSE:DPZ) was founded back in 1960 by Tom Monaghan. The company’s differentiated operating model saw wide success in recent years, substantially outperforming peers such as Pizza Hut and Papa John’s.

Unlike most pizza chains, Domino’s doesn’t provide in-house dining. Currently, 57% of sales are from delivery while 43% are from carryout. This allows the company to be more agile and have smaller stores, lowering costs and expenses. With lower costs, it is then able to offer attractively priced pizzas, significantly outpricing its competitors. It also operates with a digital-first approach. Over 75% of its sales are made via digital channels, with over 29 million active users globally. These factors combined made Domino’s one of the most popular pizza brands in the world.

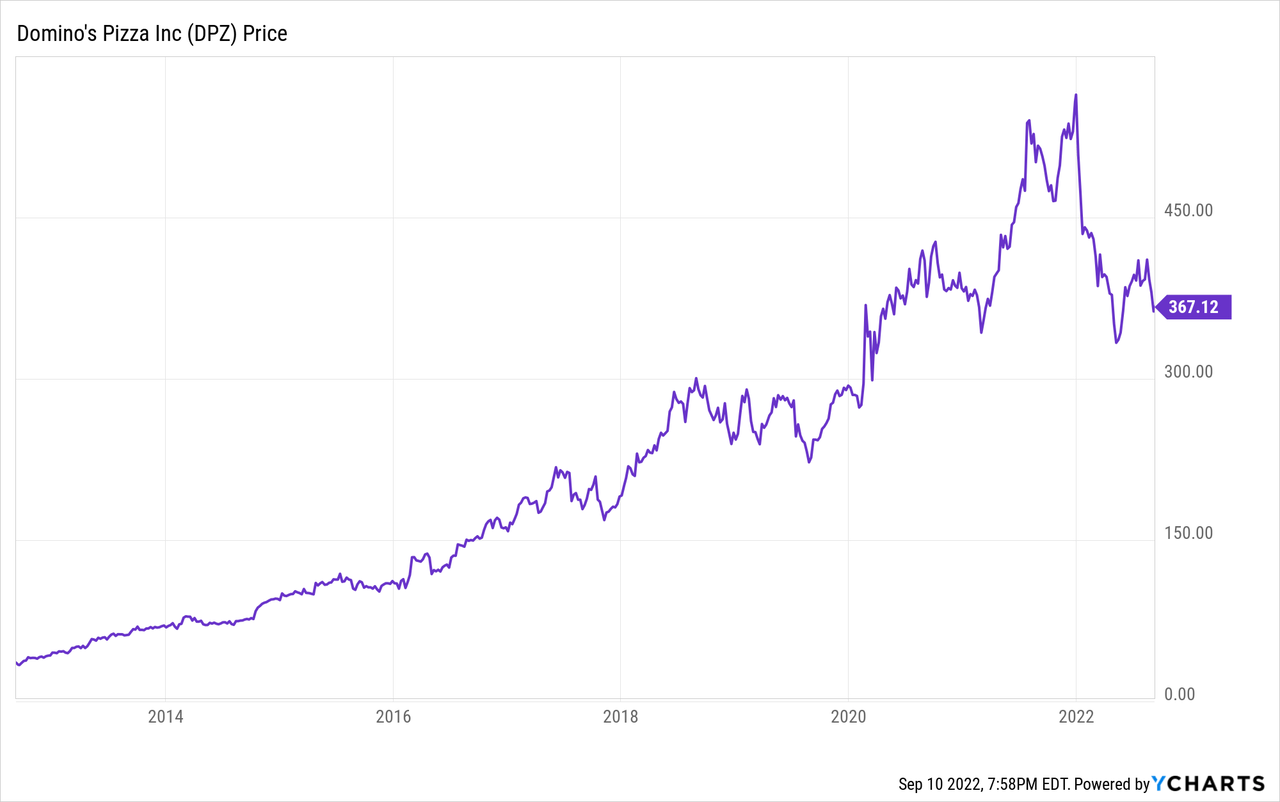

Domino’s has been one of the best compounders in the past decade. The company’s shares were up over 970% during the period, compared to just 176% from the S&P. Amid the broad market sell-off, Domino’s had been slumping and is now down almost 35% from its all-time high last year. Despite the large drop, I believe investors shouldn’t hop in right away. The company’s sales growth has slowed significantly and EPS declined, as shown in the latest earnings. It is facing strong headwinds from inflation, supply chain, and negative currency impact. The current valuation is also very stretched compared to peers, signaling potential multiples contraction. Therefore I rate Domino’s as a sell at the current price.

Q2 Financial Results

Domino’s reported its second-quarter earnings back in July and the results are very disappointing. The growth rate continues to slow while the bottom line deteriorated significantly. The company reported global retail sales growth of 1.5%, compared to the growth of 17.1% in the prior year. US same-store sales declined 2.9% while international same-store sales declined 2.2%. The drop is offset by the growth in store count, as the company opened 233 new stores globally during the quarter.

Russell Weiner, CEO, on second-quarter results:

Our results for the quarter faced challenges consistent to those I outlined back in April. We continued to navigate a difficult labor market, especially for delivery drivers, in addition to inflationary pressures combined with COVID and stimulus-fueled sales comps from the prior two years in the U.S.

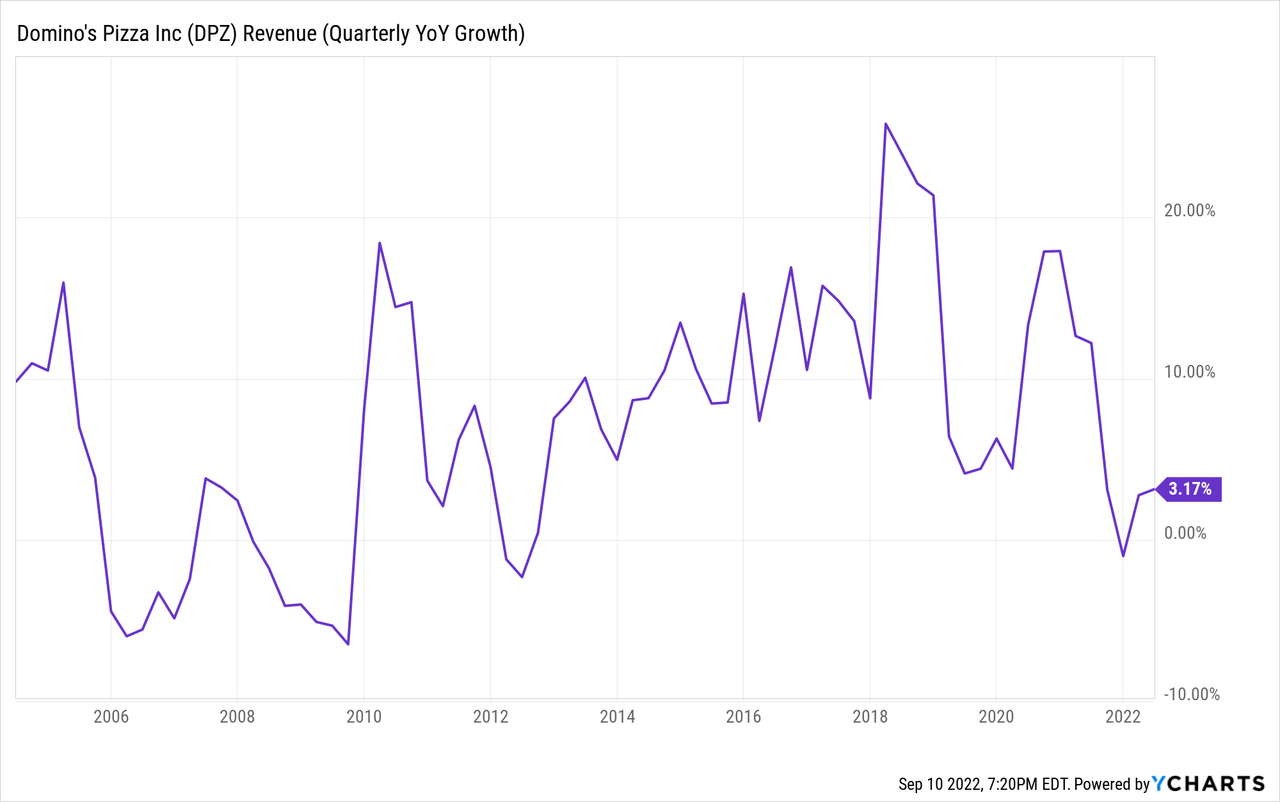

Total revenue for the quarter was $1.06 billion, up 3.2% YoY (year over year) from $1.03 billion. The increase is largely driven by higher market basket pricing to stores, which increased 15.2% YoY as inflation continues to take hold. The company took a $5.9 million revenue hit due to the negative impact of changes in foreign currency exchange rates, caused by the strong dollar. The revenue growth this quarter is much lower than the company’s historical average, as shown in the chart below.

The bottom line for the quarter was quite concerning. Net income decreased 12.1% YoY from $116.6 million to $102.5 million, as the gross margins continue to drop. The gross margin was down 320 basis points from 39.5% to 36.3%, as the cost for the supply chain jumped 8.9% YoY to $585 million. Diluted EPS was $2.82 compared to $3.06, representing a 7.8% decrease. The lighter drop in EPS is due to share repurchases, which amounted to $50 million. Cash flow dropped significantly, down over 48% YoY from $295.4 million to $153.4 million.

Dividends and Buybacks

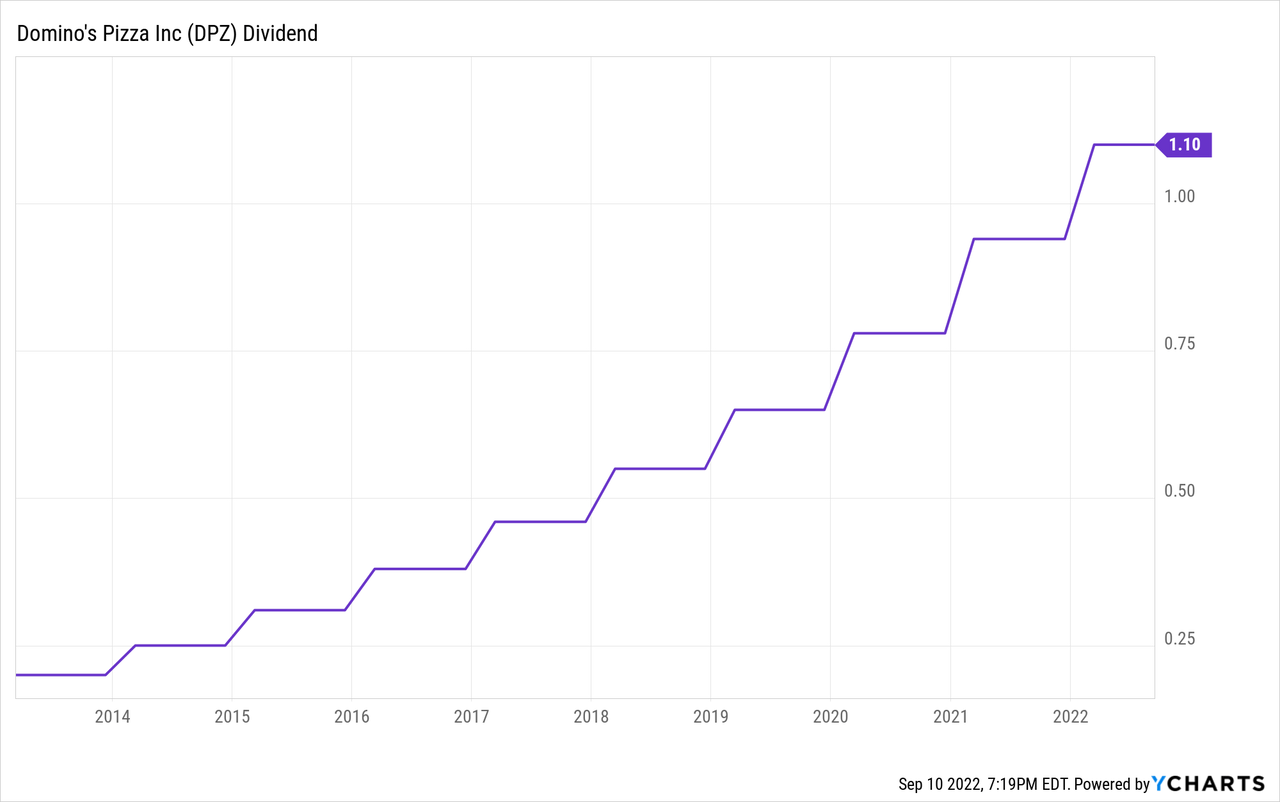

Domino’s has very shareholder-friendly policies. It has been consistently returning cash back to investors through dividends and buybacks. I believe the company will continue to do so which will provide some support for the share price. The company has been growing its dividend significantly during the past few years, recording a 5-year dividend growth rate of 19.4%. From the chart below, you can see that the quarterly dividend continues to trend up steadily. Despite the strong increase in dividends, the payout ratio remains very healthy at around 31%.

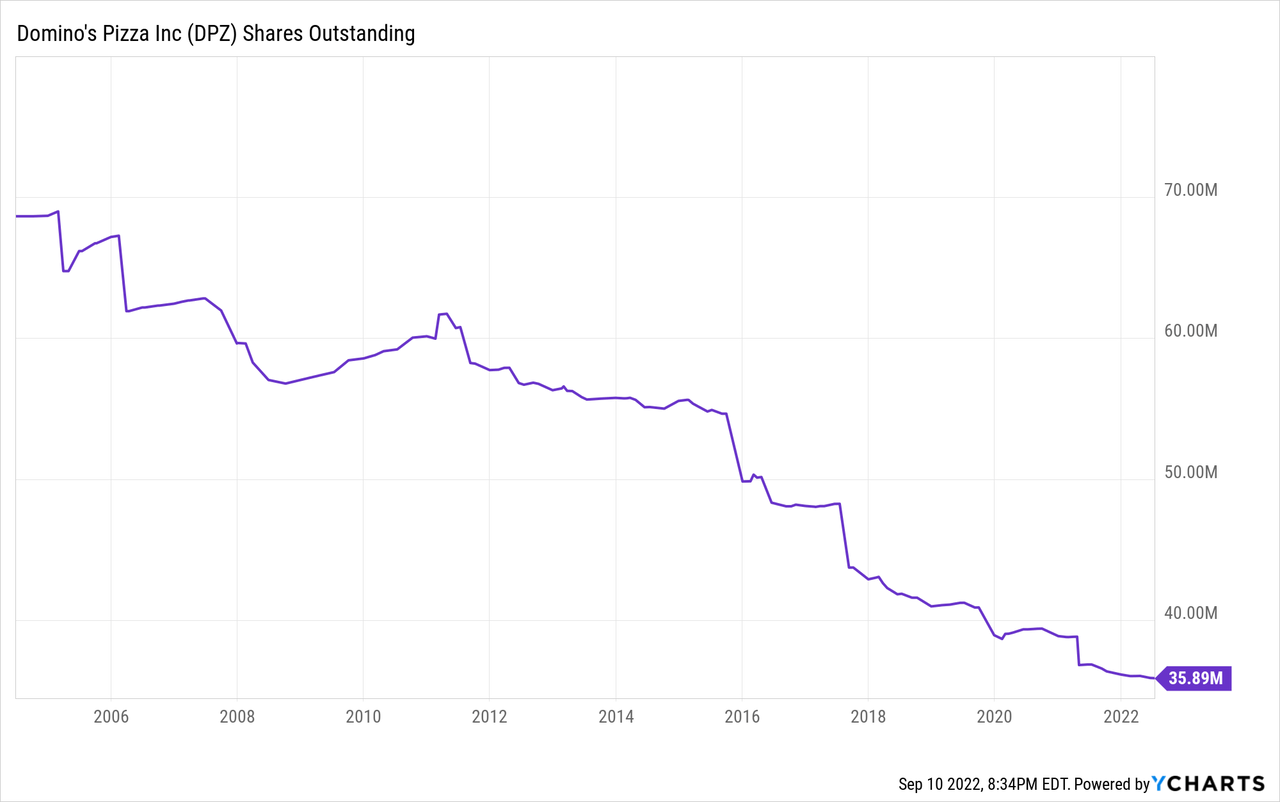

The company has also been actively reducing its share count. As shown in the second chart below, the number of shares outstanding continues to trend lower over the years, down almost 50% since 2005. During the last quarter, it repurchased $50 million worth of shares and has a remaining authorized amount of $606.4 million for further share repurchases. I believe the buybacks will continue to help boost its EPS figure moving forward.

Valuation

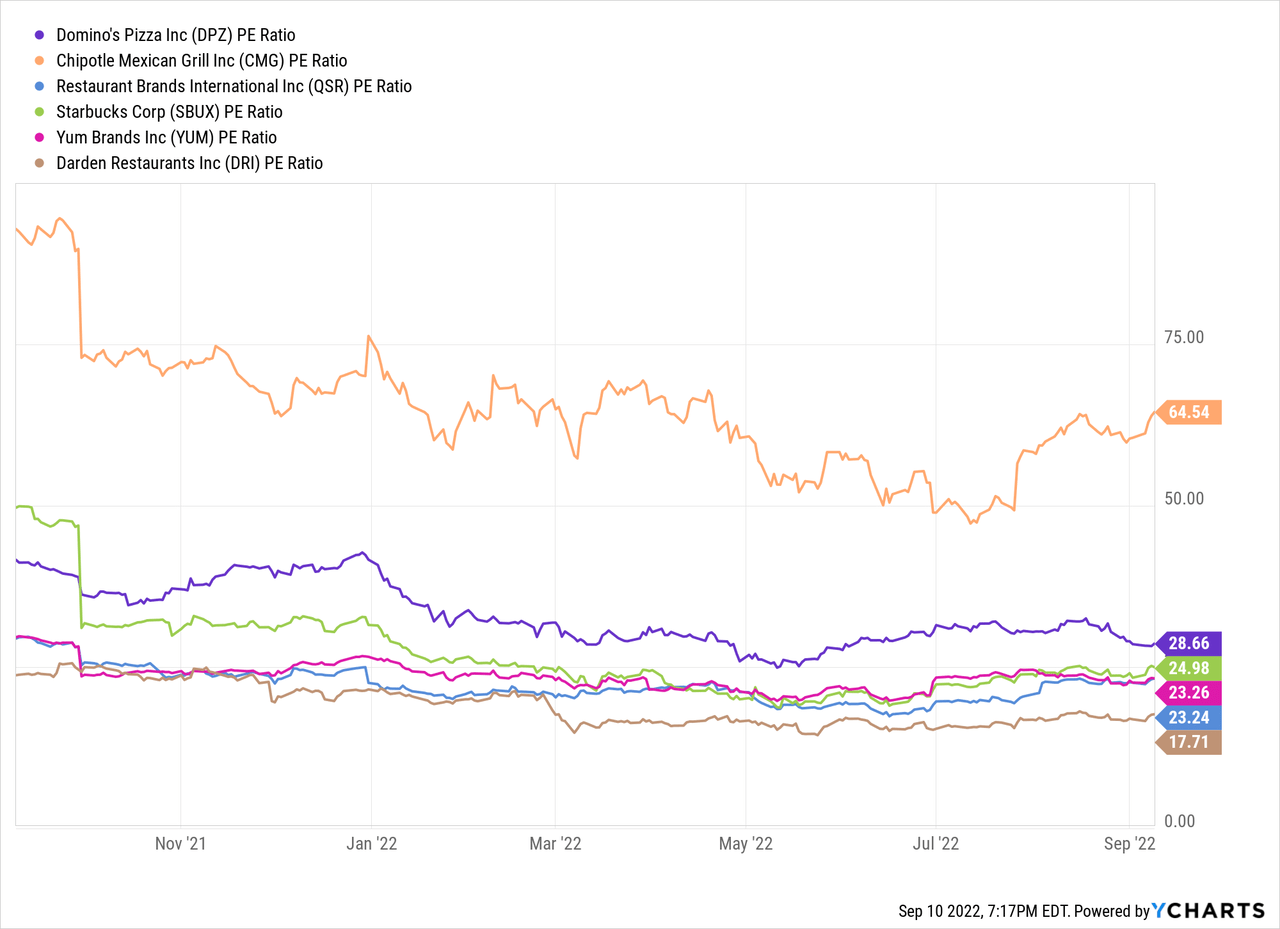

Despite the huge drop in share price, Domino’s valuation remained expensive when compared to other restaurant companies. From the chart below, you can see that the current P/E ratio for Domino’s is around 28.6. While peers such as Restaurant Brands (QSR), Starbucks (SBUX), Yum! Brands (YUM), Darden (DRI), and Chipotle (CMG) mostly have a P/E ratio in the low twenties, with Chipotle being the only outlier at 64x P/E.

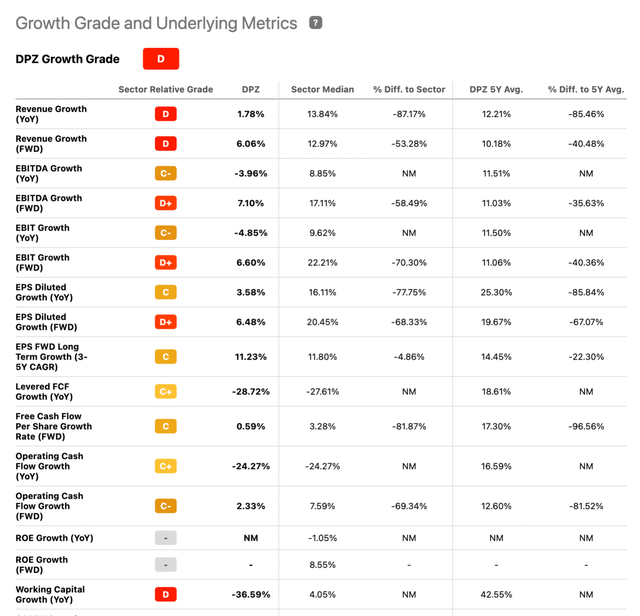

The premium was warranted to Domino’s in the past as it is able to post above-industry sales and EPS growth. However, revenue growth continued to decline in the past year, currently standing at 3.2%. This is substantially lower than the 5-year average of 12.2%. EPS and cash flow figures also saw a large drop during the quarter, as mentioned above. From the second chart below, you can see that all metrics across the board are significantly lagging behind their past averages. Considering the weak recent financial results from the company, the premium shouldn’t be justified. I believe it would be more appropriate for Domino’s to trade at a multiple similar to peers instead.

Seeking Alpha

Headwinds and Tailwinds

A large part of Domino’s growth thesis is based on its international growth. The company outlined its plan to potentially increase its store count from 5,084 to 8,475 in developed markets, and 3,774 to 11,375 in emerging markets. However, I believe there are underlying risks in the expansion. While Domino’s is a household name in the US, the company’s brand recognition is significantly lower in the rest of the world, especially in emerging markets. It is also facing much more competition from local brands which has a stronger customer loyalty. Recently, the company decided to exit the Italy market after seven years as it failed to generate any positive traction.

While in emerging markets such as China and India, the company is failing to gain a price advantage as local brands are often even cheaper. The recent spike in the dollar is also likely to pose strong currency headwinds to its international expansion, especially in the Europe region. As mentioned above, the company has already taken a $5.9 million revenue hit due to negative currency impact and is expecting a further $20 million+ hit throughout the year. Another potential risk is further deterioration in the macro environment. High inflation and supply chain disruption have resulted in higher operating costs and expenses for Domino’s. As price increases, consumers are also more inclined to cook at home in order to save money. If inflationary and supply chain pressure persists, the company’s financial performance is likely to take a further hit.

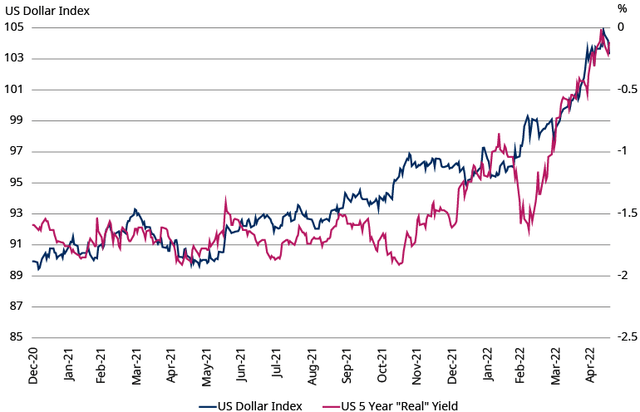

On the flip side, if inflation were to drop quicker than most expected and supply chain disruption eases, Domino’s may see a surprise to the upside. As the real interest rates move down due to lower inflation rates, the dollar should also follow (the chart below showed the recent correlation between real rates and the dollar index). This will in turn reduce foreign currency impact, lower costs, and boosts revenue figures. The company has also been actively launching new products and implementing cost reduction efforts. While I believe it is hard to suddenly turn the tides around, a success will significantly improve the financial figures.

Conclusion

In conclusion, I believe investors should stay away from Domino’s for now despite the large drop in share price. The company’s financial performance in the latest quarter is indicating a sharp drop in sales growth, much lower than its historical average. The EPS and operating cash flow also declined sharply. While the company’s active share buybacks will provide some support for the EPS figure, it is unlikely to offset the increase in costs and expenses.

The company’s plan for international growth may face unprecedented risks as it lacks branding and price advantages in foreign countries. It is facing an immense foreign currency headwind as the dollar continues to remain very strong. The uncertainty revolving around inflation and the supply chain may also post further pressure on the company. Even after the drop in share price, the current valuation remains expensive compared to peers. Considering the macro backdrop and slowing growth, I believe a multiples contraction towards peers’ levels is very likely. Therefore I rate Domino’s as a sell and will revisit once fundamentals start to improve.

Be the first to comment