HJBC

After cratering in the 2020 Covid Crash, Natural Gas has been enjoying a price surge over the past 2+ years. It went over $9.00 in August 2022, but has declined to the ~mid-$5.00 region since then. Still, it’s much higher than it has been in many years:

fnvz

ONEOK Inc. (NYSE:OKE) is one of the larger integrated players in the Natural Gas industry. It engages in gathering, processing, storage, and transportation of natural gas in the US. As one of the premier natgas companies, it has benefited greatly from rising natgas prices.

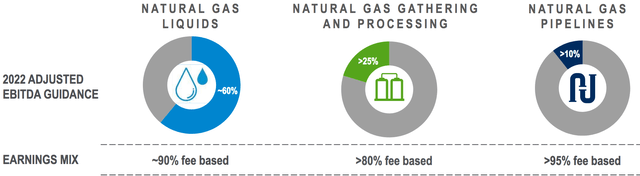

OKE has 3 segments – Natural Gas Gathering and Processing, Natural Gas Liquids – NGL, and Natural Gas Pipelines. The NGL segment is its largest, with ~60% of annual EBITDA, followed by Gathering and Processing, at ~25%, and Pipelines, at ~10%+.

OKE site

Segment Volumes:

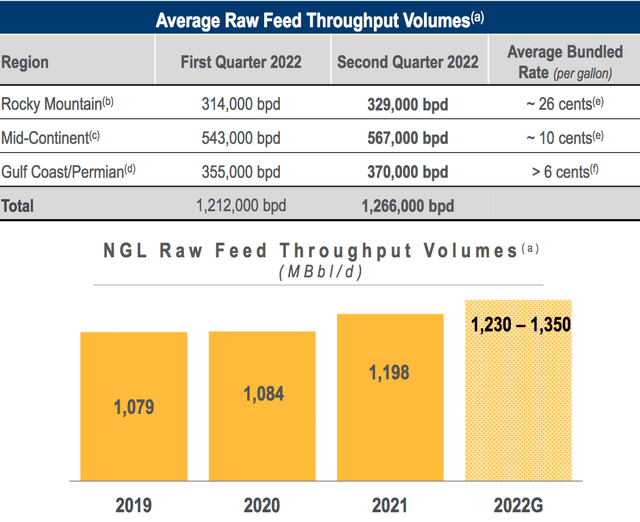

The NGL segment had ~ 4.5% overall raw feed volume growth in Q2 ’22 vs. Q1 ’22; and management is expecting anywhere from ~2% to over 12% average growth for full year 2022, with ~90% of its NGL revenues fee based.

OKE site

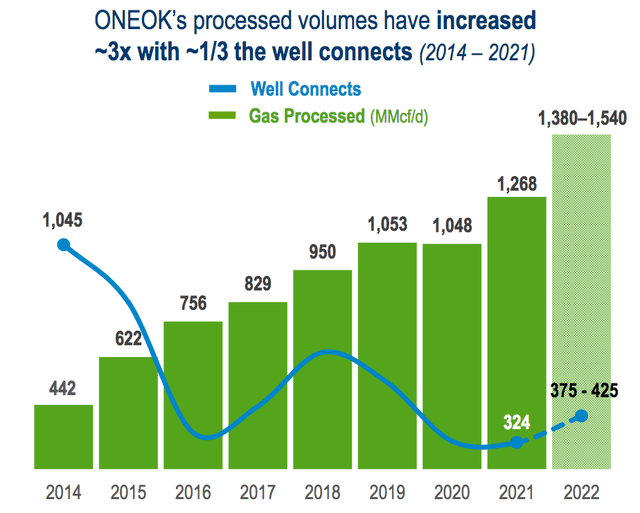

OKE’s Gathering & Processing segment has benefited from rapidly increasing efficiency over the past several years – it now takes only ~1/3rd as many well connects to produce 3X the amount of processed volumes, with much higher gas-to-oil ratios in the Williston Basin. As of 6/30/22, OKE had 157 wells connected. Management expects to connect 375-425 wells in 2022.

OKE site

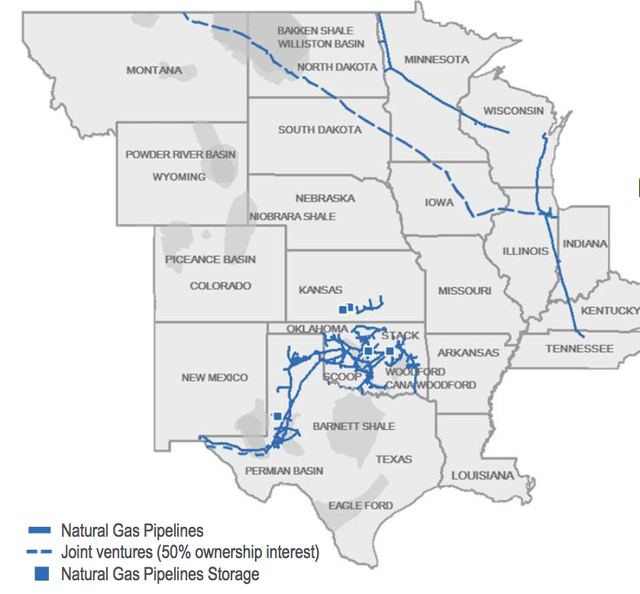

OKE’s Natural Gas Pipelines are connected directly to end-use markets – local gas distribution companies, electric-generation facilities, and large industrial companies. This segment usually has >95% of its transportation capacity contracted on a fee basis.

OKE site

Earnings:

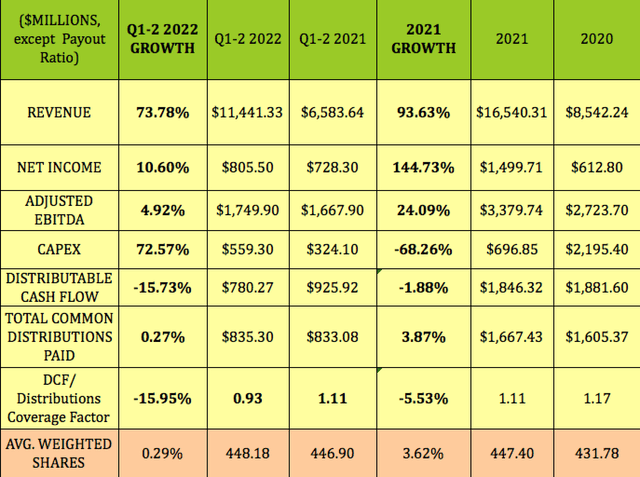

Q1-2 ’22 saw continuing strong topline growth, with Revenue up ~74%. Net Income was up 10.6%, while EBITDA rose ~5% – milder growth rates than in full year 2021. Management greatly expanded Capex in Q1-2 ’22, after cutting it back by 68% in 2021 – the 72.5% rise in Capex costs explains the 15.7% decline in DCF, and the sub-1X Distributions coverage factor for Q1-2 ’22:

Hidden Dividend Stocks Plus

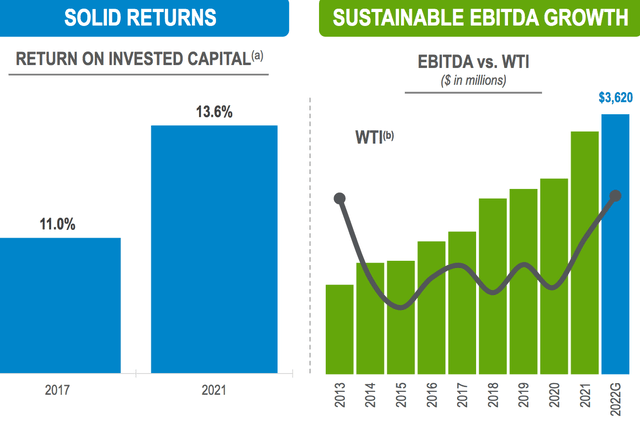

Looking back further shows a good jump in ROIC in 2021 vs. 2017; and good EBITDA growth through various commodity price cycles since 2013:

OKE site

Guidance:

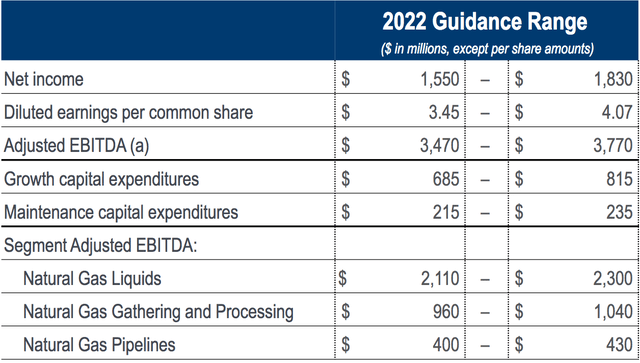

Management’s full year 2022 guidance calls for a Net Income midpoint of $1690M, which would be 6% growth vs. 2021. Adjusted EBITDA’s midpoint of $3620M implies 7% growth in 2022.

Diluted EPS guidance of $3.45 to $4.07 calls for a broad growth range of 2.7% to 21% vs. 2021. Q1-2 ’22 EPS was $1.79, so OKE needs to generate $1.66 – $2.28 in EPS in the 2nd half of 2022 in order to achieve management’s full year 2022 guidance figures:

OKE site

Dividends:

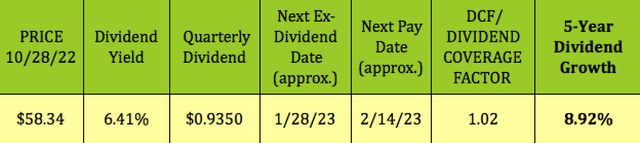

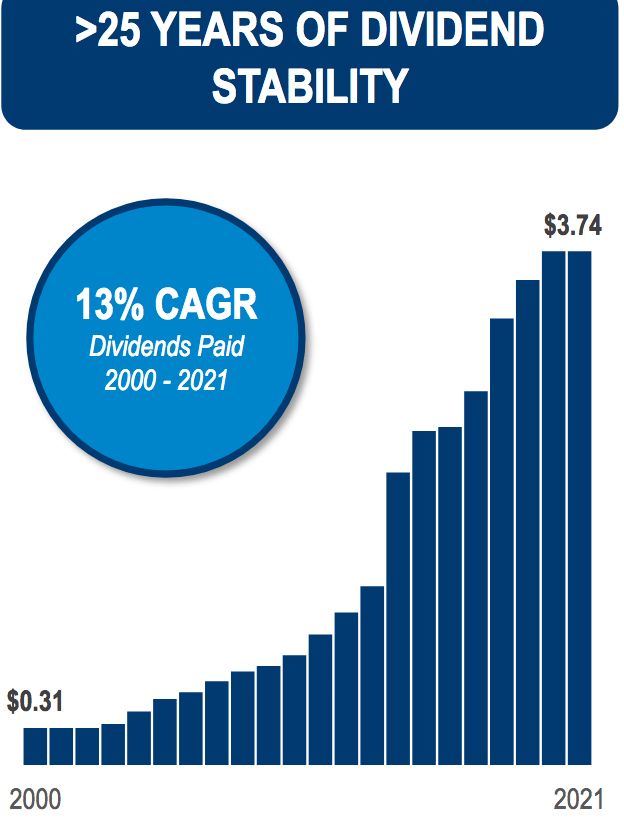

At its 10/28/22 intraday price of $58.34, OKE yielded 6.41%. Its trailing coverage factor is 1.02X, due to higher Capex. It goes ex-dividend on Monday, 10/31/22, and then should go ex-dividend next on ~1/28/23.

Hidden Dividend Stocks Plus

At 8.92%, OKE has one of the better 5-year dividend growth rates in the midstream industry, with a 25-plus record of not cutting dividends.

OKE site

Profitability & Leverage:

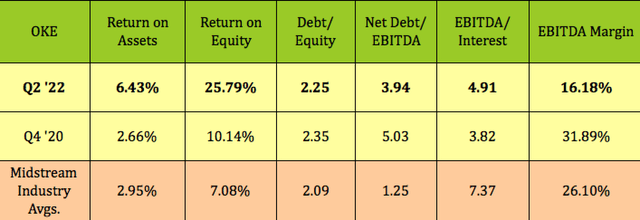

OKE’s ROA and ROE have both improved a great deal vs. pre-Covid figures, with both much higher than industry averages. EBITDA Margin has declined, as EBITDA growth % has trailed Revenue growth over the last 6 quarters.

Net Debt/EBITDA has improved quite a bit, as has Interest coverage.

Hidden Dividend Stocks Plus

Debt & Liquidity:

OKE has a $2.5 Billion Credit Agreement, which expires in June 2027. It also has access to $1.0 billion, via its “at-the-market” ATM equity program.

As of June 30, 2022, OKE had no borrowings under its $2.5B Credit Agreement and had $135.8M in cash and cash equivalents.

In July 2022, management redeemed the remaining $895.8M of its $900M, 3.375% senior notes due October 2022 at 100% of the principal amount, plus accrued and unpaid interest, with cash on hand and short-term borrowings. As of July 31, 2022, OKE had $860 million of short-term borrowings outstanding.

OKE’s debt has an Investment Grade Credit Rating of BBB-/Baa3.

Valuations:

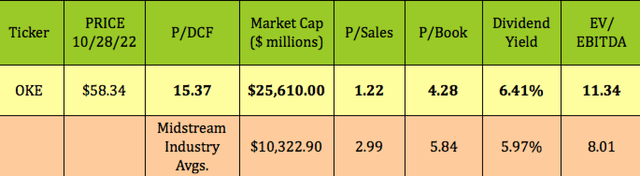

At 1.22X, OKE’s P/Sales is its deepest undervaluation vs. industry averages, while its P/Book of 4.28X is also lower than average. It has a higher than average dividend yield and EV/EBITDA. While there’s no comp for P/DCF, 15.37X doesn’t look cheap, vs. valuations we’ve seen in the past.

Hidden Dividend Stocks Plus

Analysts’ Price Targets:

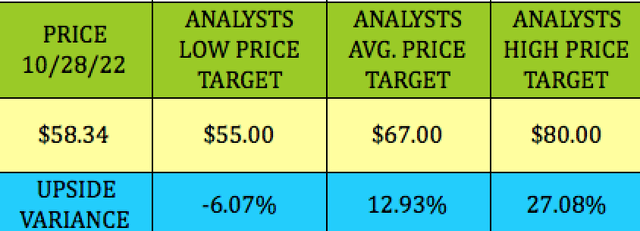

At its 10/28/22 intraday price of $58.34, OKE is 6% above analysts’ $55.00 lowest price target, and ~13% below the $67.00 average price target.

Hidden Dividend Stocks Plus

Performance:

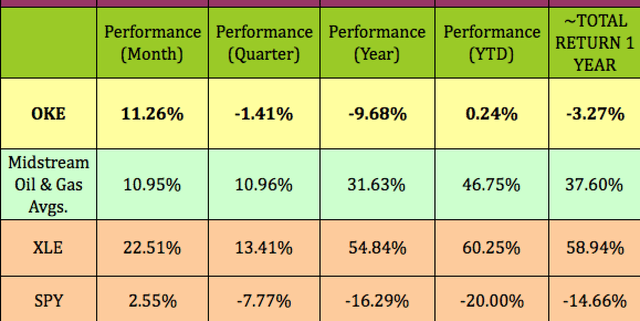

Although it has mostly trailed the Midstream industry and the broad Energy sector, OKE has outperformed the S&P 500 over the past month, quarter, year, and so far in 2022. Its total 1-Year return is ~-9.68%, vs. -14.66% for the S&P.

Hidden Dividend Stocks Plus

Parting Thoughts

OKE will report its Q3 ’22 earnings after the market closes on Nov. 1, 2022. Given the current environment, you may want to wait for that report. OKE is a well-run company, with a good long term record – we advise waiting for the next market panic before jumping aboard.

If you’re interested in other high yield vehicles, we cover them every Friday and Sunday in our articles. All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment