VioletaStoimenova

[The company reports in U.S. dollars, so the figures in this article are in USD unless otherwise noted.]

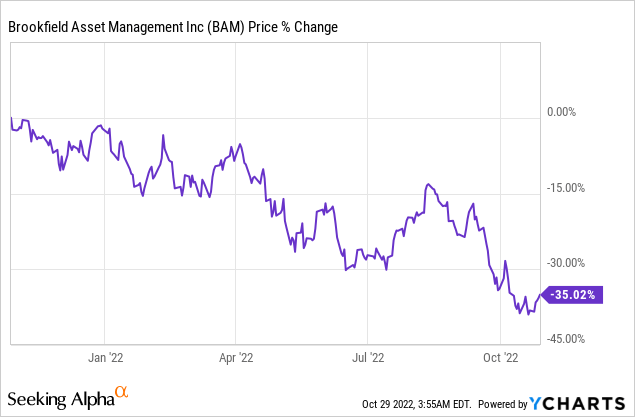

Brookfield Asset Management (NYSE:BAM)(TSX:BAM.A:CA) stock has corrected 35% in the last 12 months.

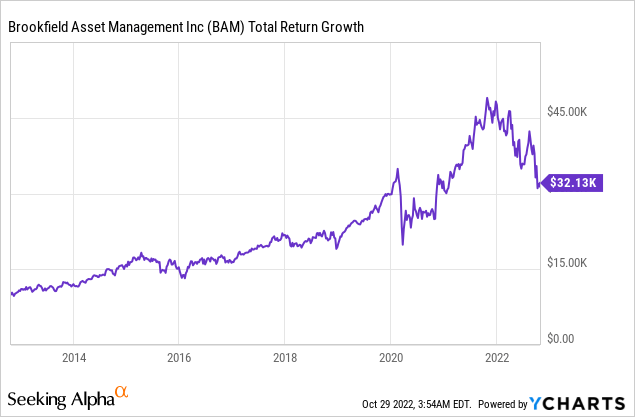

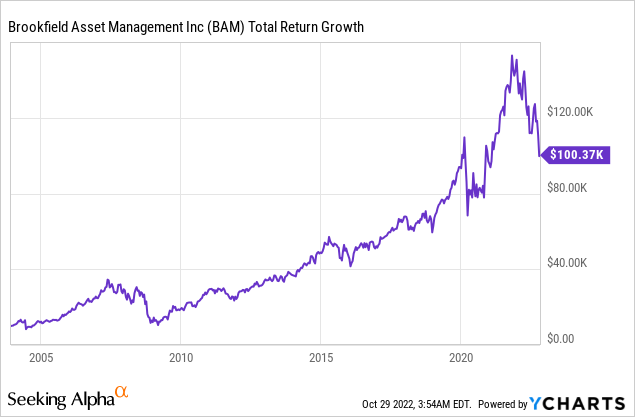

The 20-year returns are similar at 12.2%. Notably, in the long run, the stock has trended higher. In the past, it was a good idea to buy the large-cap growth stock on substantial corrections. This time shouldn’t be any different.

In fact, very exciting times lie ahead of the fabulous business. It’s about to spin off its asset management business. Let’s call it “the Manager.” You can tell it’s a big part of the business given that “asset management” is a part of the company’s name.

However, asset management actually came later into the scene. Brookfield’s roots stretch as far back as 1899. It owned and operated businesses directly way before it began providing asset management services, which became a meaningful part of its business in the late 1990s.

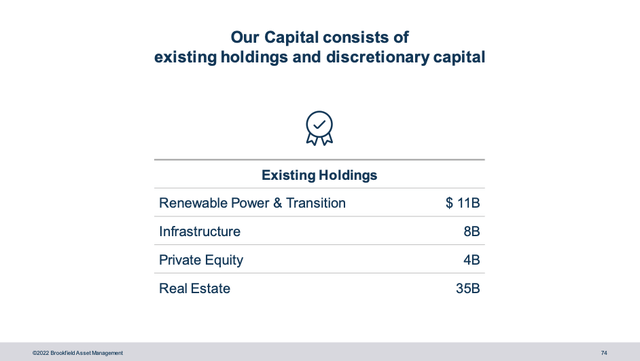

Along the way, Brookfield focused on real estate, renewable power, infrastructure, private equity, and credit & insurance. This includes owning significant portions of these businesses, of which some are independently listed on the TSX and NYSE.

About half of Brookfield’s assets under management (“AUM”) are fee-bearing capital that generates stable management fees. Its asset management business has gotten to a large scale of $750 billion of AUM that it has arrived at an inflection point where it makes sense to spin it off. Similar to its other spinoffs, Brookfield would continue to hold a large stake (of 75%) in the business.

For every 4 shares of Brookfield, investors would get 1 share of the Manager in an expected tax-deferred transaction later this year. Brookfield Corporation, the parent, will trade under the symbol “BN” on the TSX and NYSE, while the Manager will trade on the TSX and NYSE as “BAM.”

Brookfield highlights that the separation of the two enables investors to “access a pure-play asset manager with a leading global alternative asset management business, through the Manager, and an asset owner focused on deploying capital across its operating businesses and compounding that capital over the long term, through the Corporation.”

The separation should also provide more flexibility for management, as each business can better focus on their growth strategies while benefiting each other as they’re doing now. The Manager will continue to provide asset management services for Brookfield after the separation.

As a standalone business, the Manager would be able to trade at a valuation that better aligns with other asset management businesses. Right now, the same can’t be said because it’s more than an asset manager that includes Brookfield’s operating businesses.

Strong Profitability

Because many of Brookfield’s operating businesses are cash cows, it’s able to generate strong cash flows.

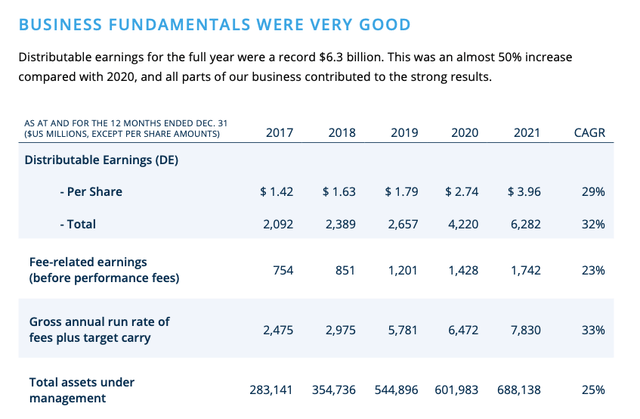

Here are some of Brookfield’s key performance indicators in the past five years. I’d like to highlight the double-digit compound annual growth rate across its distributable earnings (“DE”), fee-related earnings (before performance fees), gross annual run rate of fees plus target carry, and total AUM.

The DE provides insight into earnings that could be used for dividends or be reinvested into the business. Notice that the fee-related earnings (before performance fees grow at a similar rate as AUM.

Brookfield earns a fixed percentage of investment gains generated within a private fund if it achieves a pre-determined minimum return for the investors of the fund. Brookfield’s share of such investment gains would be realized carried interest.

For example, 2021 was an exceptional year in which it realized a record carried interest of $1.7 billion, and its gross accumulated unrealized carried interest at the end of 2021 was just under $6.8 billion.

Valuation

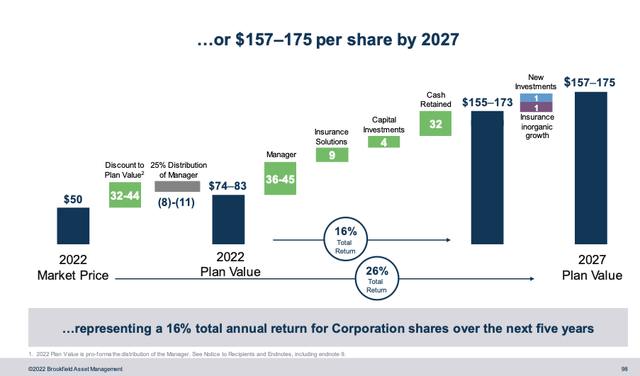

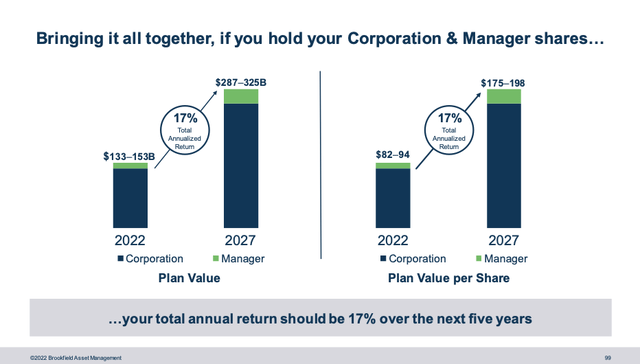

In its September presentation, Brookfield projected that common stockholders of both the parent and the Manager could generate annualized total returns of 17% over the next five years. Since BAM stock is trading at close to $40 per share (instead of $50 at the time of presentation), investors today have hopes of achieving returns of over 17%.

Corporate Presentation Corporate Presentation

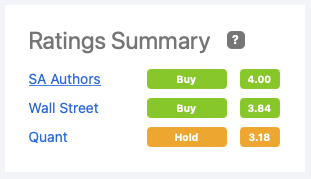

Across 12 analysts, BAM has an average 12-month price target of $60.20, which suggests a meaningful discount of 33% or near-term upside potential of almost 50%.

BAM also earns a Buy rating from SA Authors and Wall Street. I’ll soon add my Buy rating to the mix.

Seeking Alpha

Risks

If Brookfield is attractively priced, why isn’t more investors piling into the stock? Every stock comes with risks.

Rising interest rates

As you probably have noticed, many sectors/industries have been depressed including in the areas that Brookfield is invested in — real estate, renewable power, infrastructure, and private equity.

The decline has partly to do with rising interest rates, which increases the cost of capital and triggers stock valuations to be re-rated lower.

Some investors may also dislike the fact that about 60% of Brookfield’s capital is invested in real estate. For example, investors would rather invest in REITs (or other higher-yielding dividend stocks or preferred shares) directly for more income, as Brookfield’s dividend yield is only about 1.4%, which is not compelling in a high inflation and rising interest rate environment. So, Brookfield wouldn’t appeal to income investors.

Management argues that “inflation is positive and expands margins for real assets with pricing power,” including its real estate assets, which primarily comprise of retail and office assets. It has demonstrated that it has quality assets and top-notch operational expertise. In the past year, it “completed $14 billion of asset sales at a premium to [the] IFRS [accounting value].”

Recession risk

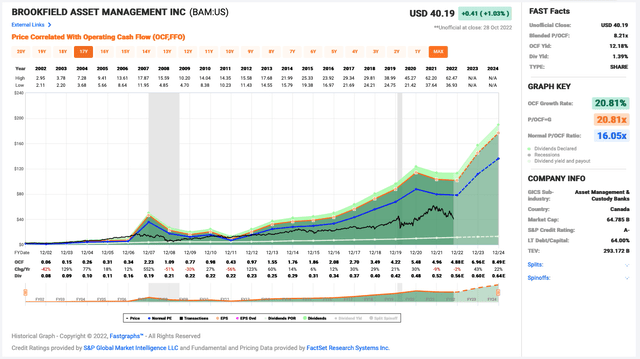

Many key economies around the globe are experiencing inverted yield curves from central banks rising interest rates meaningfully in a short time to combat high inflation. As a result, the U.S. has technically entered a recession. As shown in the F.A.S.T. Graphs graph earlier, Brookfield stock does poorly during recessions (illustrated with grey bars in the graph).

During recessions or economic contractions, it may be more challenging for Brookfield’s capital recycling program. Specifically, it’d be more difficult to sell mature assets at good valuations. Last year was superb for selling assets. This year is a stark contrast.

If history is indicative, it’s the perfect time to accumulate Brookfield shares.

A global business

Brookfield is a complex business with a large enterprise value of about $293 billion — it’s a global business with operations in more than 30 countries across North and South America, Europe and Middle East, and the Asia Pacific. It has approximately 180,000 operating employees and over 1,000 investment professionals to help run the business smoothly.

(The separation of Brookfield and the Manager would make both simpler and more agile.)

Investor Takeaway

Brookfield earns a decent S&P credit rating of A-. Its business performance has been resilient. As reported in August for Q2, in the last 12 months, its funds from operations per share dropped 23% year over year to $3.69. However, its distributable earnings before realizations (gains from asset/business sales) climbed 25% to almost $3.9 billion in this period. Additionally, institutional investors remain confident in management as the company experienced record inflows of $56 billion since Q1.

Brookfield targets 12-15% long-term total returns on its investments. The stock trades at a discount to its average 12-month analyst price target of about 33%, which can drive more incredible returns for investors over the next 5 to 10 years. Management believes annualized returns of +17% is possible over the next 5 years.

References

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment