Sundry Photography

Summary

Johnson & Johnson (NYSE:JNJ) is the first significant biopharmaceutical company to report results for this quarter. On Tuesday, the company reported its positive second-quarter results. The company beat analysts’ estimates on both the earnings and sales sides. However, the strengthening of the dollar harmed the results and led Johnson & Johnson to lower its guidance through 2022.

Numbers

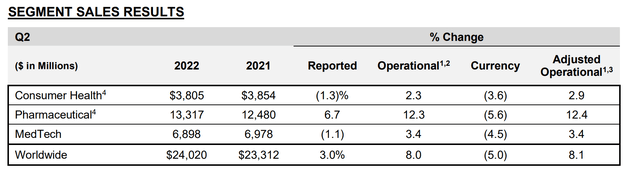

During Q2, JNJ achieved sales of $24.020 billion worldwide, including $12.197 in the U.S. and $11.823 worldwide, a 3% increase over Q2 2021. currency impact was negative 5%. Earnings per share were $1.80, down 23.4% from the previous year, and adjusted earnings per share were $2.59, up 4.4%.

The effective tax rate was 17.6% compared to 5.8% for the same period last year. This different result was mainly driven by a one-time 2021 tax benefit from an internal reorganization of some international subsidiaries. In addition, JNJ continues to invest heavily in research and development, investing 15.4% of revenues this quarter. A total of $3.7 billion was invested, a 9.1% increase over the previous year, due mainly to portfolio progression in the pharmaceutical and medical sectors.

Consumer Health

Worldwide Consumer Health sales totaled $3.8 billion. The decrease was 1.3%, with a 3.6% decline in the United States and 0.6% growth outside the United States.

According to the CEO’s remarks during the earnings call, The results were driven primarily by strategic price increases, growth in OTC products outside the U.S. due to a solid cold, cough and flu season, and recovery in the Digestive Health category. However, the Consumer Health business was negatively impacted by regional COVID-19 mobility restrictions, which mainly affected the Skin Health/Beauty franchise. Consumer Health margins fell from 28.6% to 25.9% due to higher raw material costs.

Pharmaceutical

As for the pharmaceutical segment, global sales of $13.3 billion increased by 6.7%, with a growth of 4.2% in the United States and 9.8% outside the United States. Excluding sales of the COVID-19 vaccine, operating revenue growth was 8.6% worldwide. The company stunned analysts with its results for its Covid-19 vaccine, which brought in nearly twice as much as expected. Sales were $544 million compared to forecasts of $278 million.

According to the earnings call, the growth was due to the strength of DARZALEX, STELARA, ERLEADA and TREMFYA. Specifically, Darzalex’s sales were $168 million higher than analysts expected, bringing growth to 46.1%, while ERLEADA’s operating sales growth was 56.9%. STELARA’s growth of 18.6% was driven by strong market growth and significant share gains in Crohn’s disease and ulcerative colitis. In contrast, Imbruvica and pulmonary hypertension treatments missed estimates (by $130 million and $74 million, respectively). In addition, IMBRUVICA’s operating sales decreased 7.2% worldwide due to increased competition, particularly in the United States. The pharmaceutical segment margin increased from 39.4% to 42% due to a favorable product mix and lower marketing expenses.

MedTech

Regarding the MedTech business (the former medical device division), worldwide sales were $6.9 billion. The decrease was 1.1%, with 1.6% growth in the United States and a 3.6% decrease outside the United States. As in the previous quarter, the covid-19 situation significantly impacted the ability to proceed with interventions. MedTech segment margins declined from 28.6% to 26.5% due to inflation, higher investment to support new product launches, and increased research and development spending.

Guidance

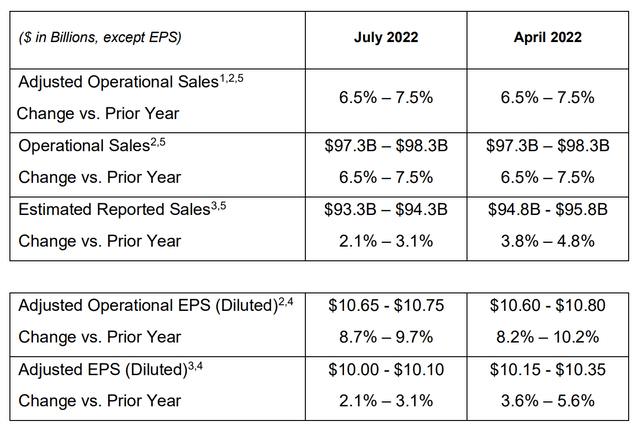

As of April 2022, the company expected between 3.8% and 4.8% sales growth. With the strengthening dollar, the macroeconomic difficulties of this period, and the Covid-19 pandemic hurting the company’s healthcare segment, the company now expects to increase sales by between 2.1% and 3.1%. This correction also affects adjusted earnings in the company, which in April were expected to grow between 3.6% and 5.6% while now between 2.1% and 3.1%.

What happens next

The market greeted JNJ’s quarterly earnings report with caution, dropping by 1.46% on the day of the results. Inflation and covid-19 imposed lockdowns in some parts of the world, especially China, have harmed the company, but can they continue? As long as China continues to pursue a zero-covid-19 policy, localized lockdowns will be made with each more aggressive variant of the previous one. In addition, a far more critical fear is related to rising commodity prices that have already affected JNJ. Of course, the company will have no problem raising its prices, but if inflation gets out of control, even a giant like JNJ will find it challenging to keep up. In addition, increased pressure on wage costs prevents the company from hiring the employees it needs to grow.

Adding to these two main problems is the strengthening of the dollar against other currencies, which negatively impacts much of the company’s sales that are made overseas. Such a significant lowering of guidance only mirrors these three problems, which are unlikely to find a solution in 2022. Currently, JNJ seems valued in line with expectations of moderate growth, and its multiples do not seem to deviate excessively from historical data. However, the company is also not incredibly undervalued. The dividend yield of 2.5% and the relative stability of the price may be attractive to some investors despite market turmoil.

Be the first to comment