peshkov

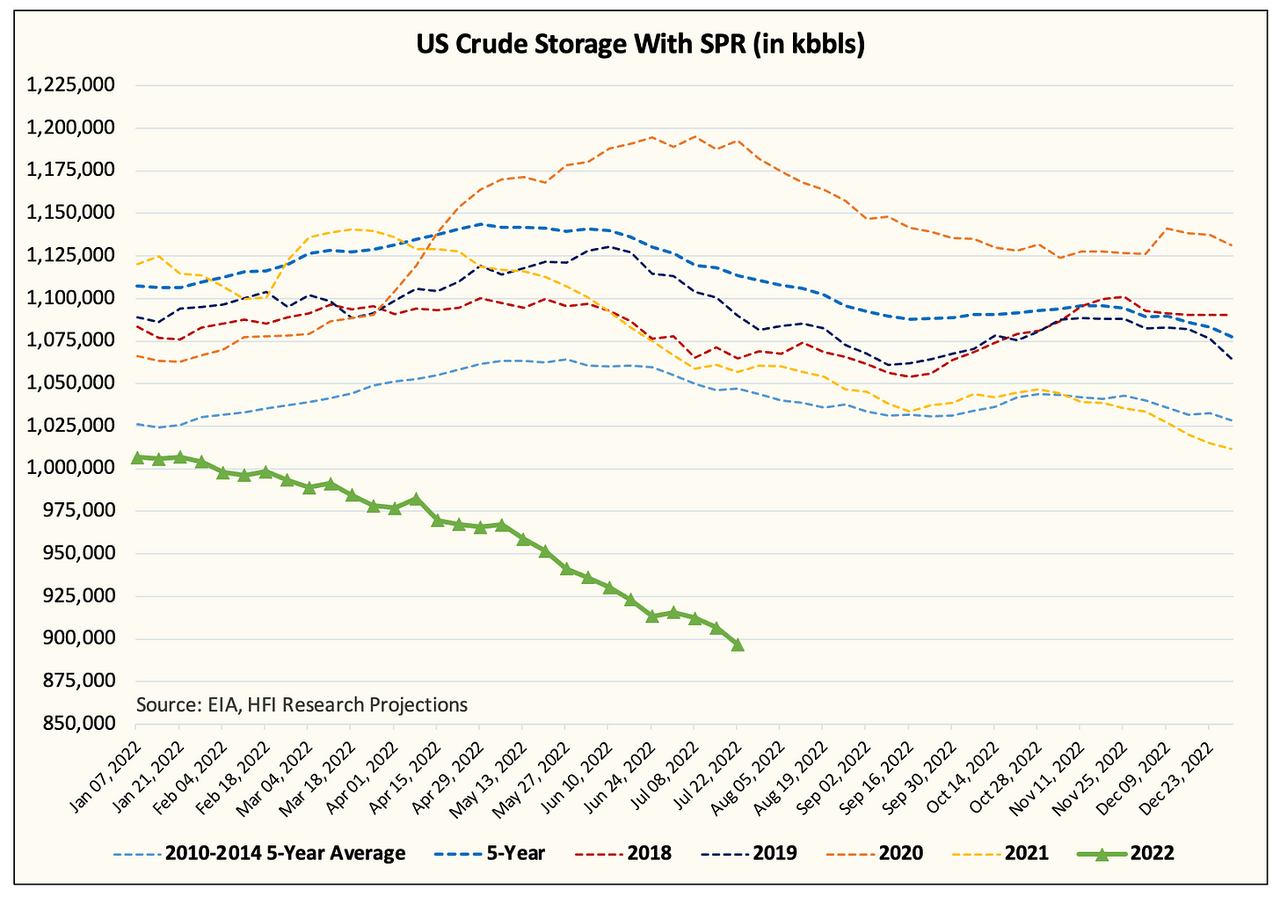

EIA oil data yesterday was very bullish. U.S. crude with SPR fell 10.1 million barrels, pushing total crude inventories below ~900 million bbls.

EIA, HFIR

As you can see in the chart above, if it wasn’t for the fact that we are draining our SPR reserve, U.S. commercial crude storage would have been decimated this year.

EIA, HFIR

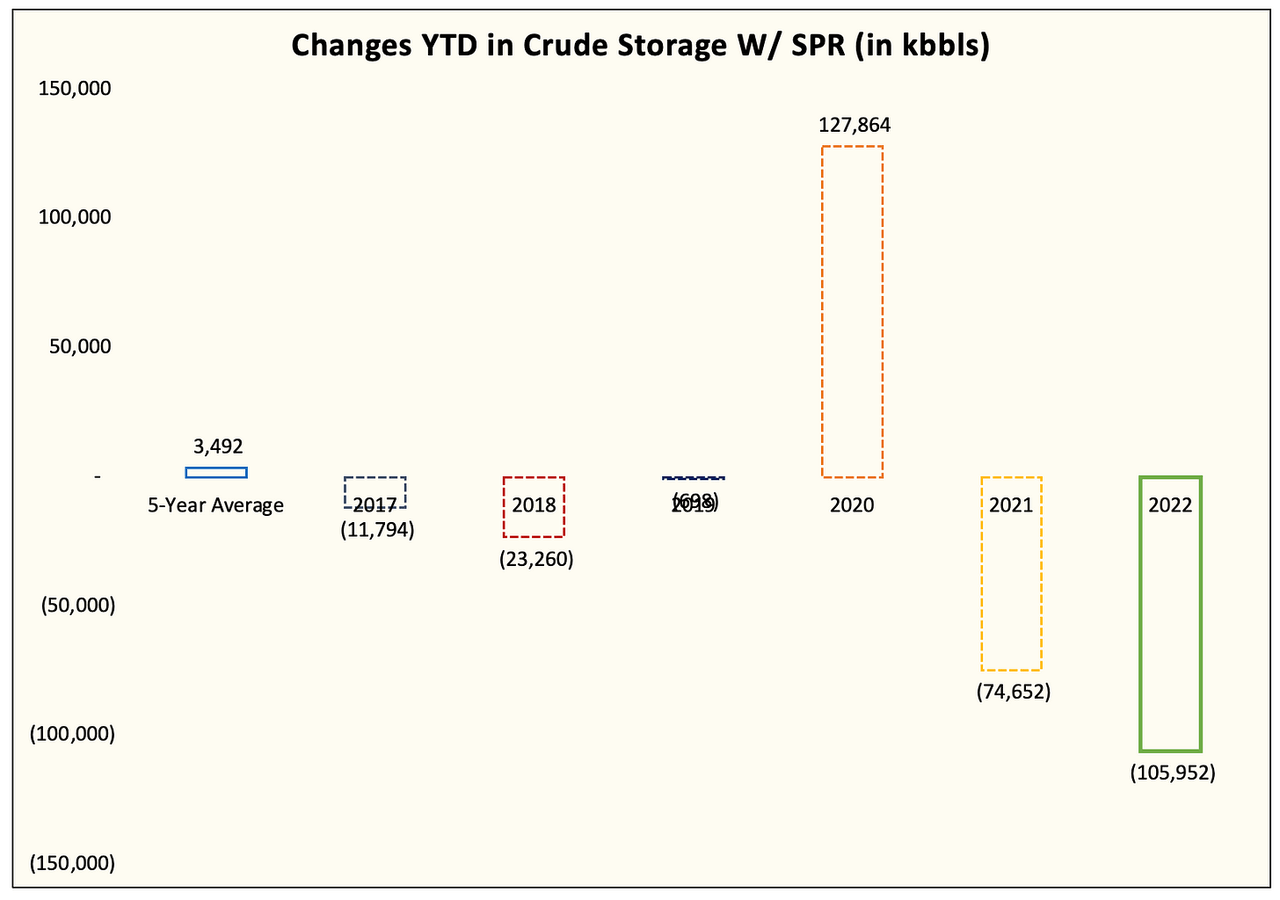

On a year-to-date basis, you can see that we’ve never had this steep of a draw in crude storage. Last year was by comparison the steepest decrease in US crude storage, but this year’s figures are now some ~30 million bbls ahead of last year.

But while crude continues to paint a very bullish picture, the oil market is, unfortunately, more complicated than just looking at the US crude with SPR chart. We believe demand continues to be the critical driver for where prices are headed. And in light of the recent demand weakness, we are starting to see some signs of a recovery.

EIA, HFIR

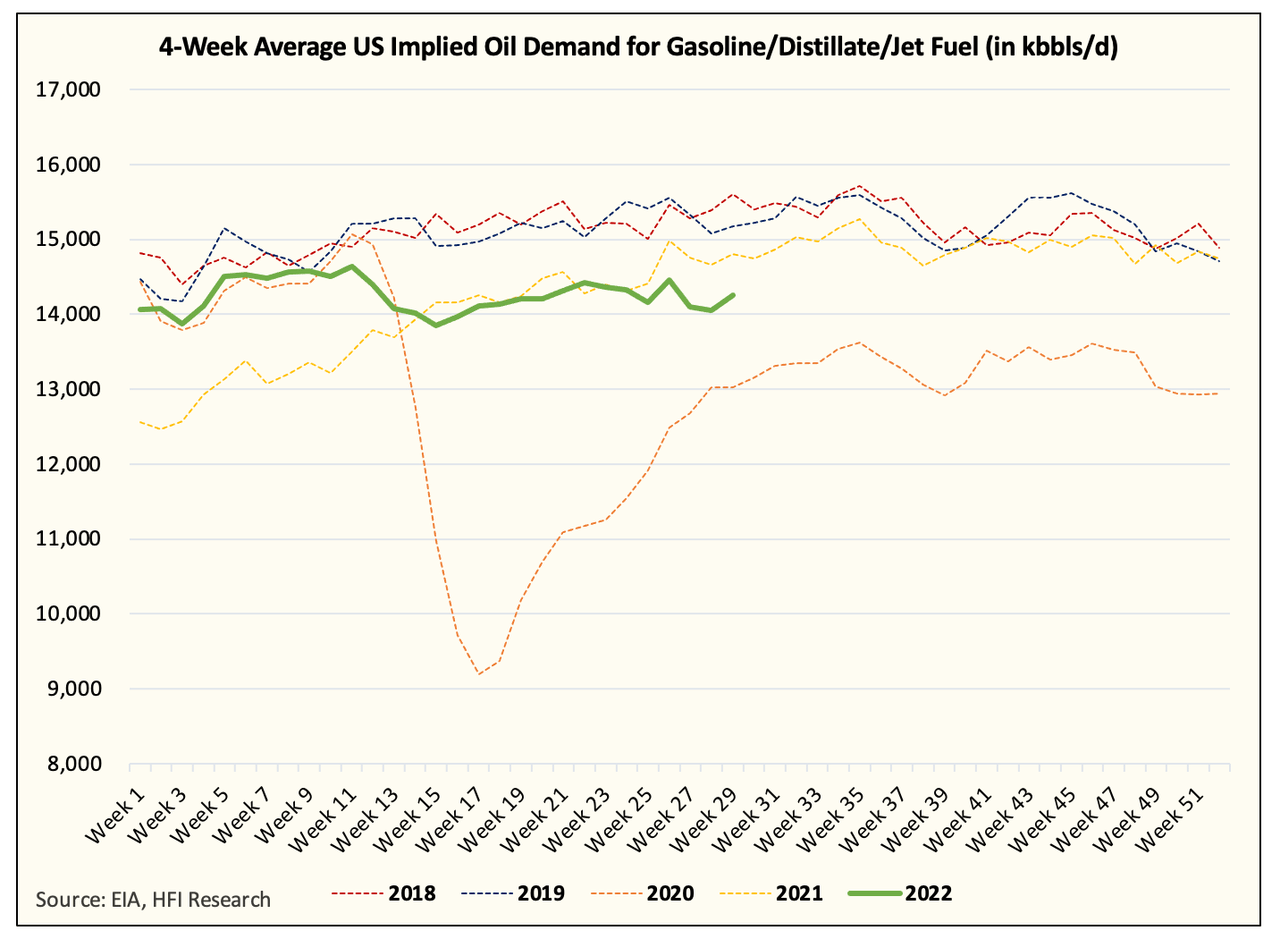

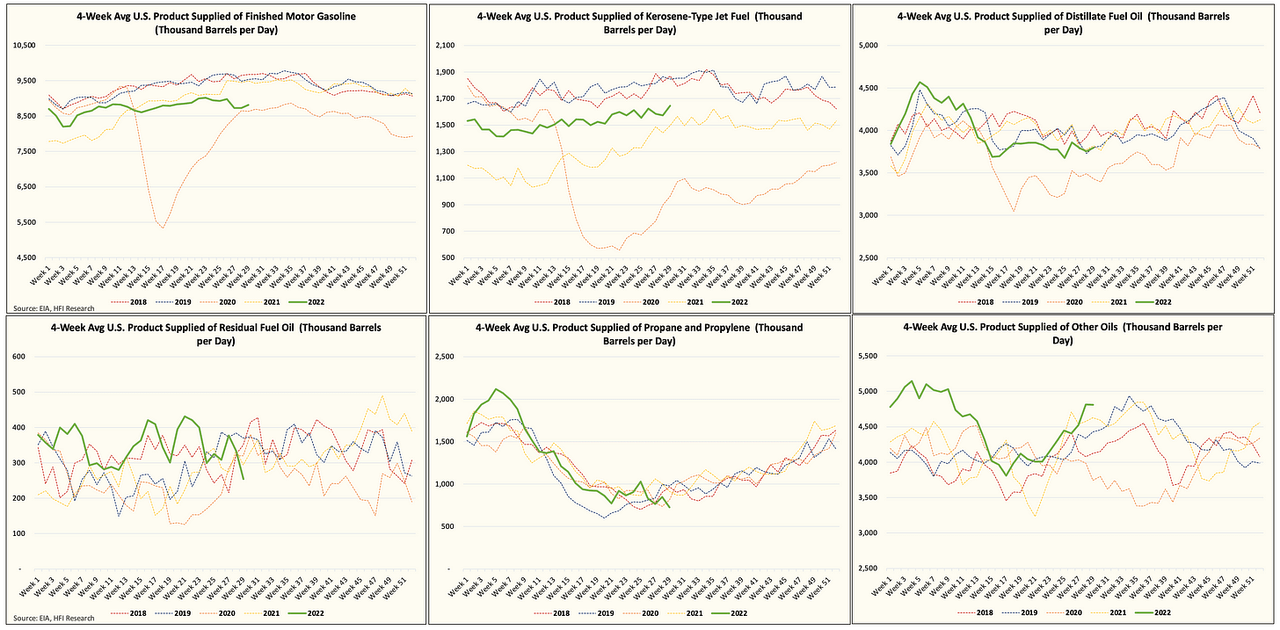

Above is the 4-week average chart of implied demand for gasoline, distillate, and jet fuel, and you will note that we’ve had a meaningful uptick. The weakness in the core 3 really started in March following the Russian/Ukraine invasion that pushed WTI above $100/bbl. But with the recent price drop, I suspect we are close to that “lower band” where demand starts to improve to the upside.

EIA, HFIR

But in the eyes of the market, this process will take time. What will need to happen over the course of the next few months is for demand to slowly and gradually recover as oil prices hover around this $100/bbl range.

Implications for Energy Stocks

Once the market is convinced that we have found the bottom in oil, energy stocks should reap unproportionate benefits to the upside. Many of the investors are still pricing energy stocks as if they are trading at $65 to $70/bbl, so once investors realize that $90/bbl is likely the floor going forward, there is going to be some serious re-rating that takes place.

In addition, with energy companies now releasing Q2 results, it is going to become evident to the market that these companies are generating a lot of free cash flow, which will, in turn, be returned to shareholders via a buyback or dividend.

As a result, we continue to remain very bullish on energy stocks as the fundamentals are simply too strong to ignore.

So for energy investors, all we need now is for the market to figure out where demand starts to respond to the upside. Give it a few weeks for the data to keep trending that way, and that’s where the lower band is. Once we find that, we think energy stocks are going back higher.

Be the first to comment