Chaz Bharj

Cinema chain operator Cineworld (OTCPK:CNNWF) has done a good job at getting its business back into shape at the operating level. But at the financial level, the balance sheet remains horrendous, and I regard the shares as uninvestable.

In January, (in Cineworld: Clear Opportunity But Still Large Risks), I argued that business recovery trends at that point were promising but the debt pile was so big that it might end up wiping out shareholders. I remain firmly of that view.

Demand is Recovering

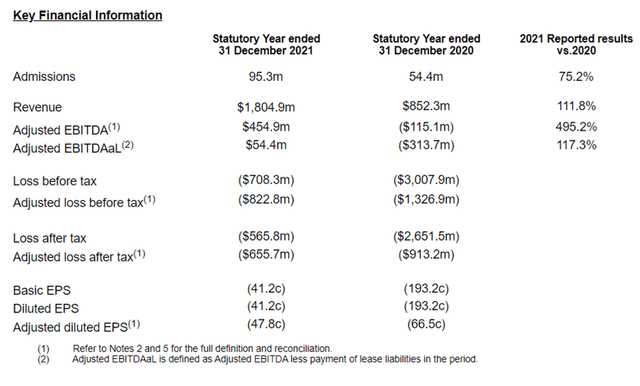

The company’s preliminary results for last year showed strong demand recovery from the disastrous prior year. That said, revenues were still only 42% of their 2019 level. There was definite progress, but there remains a long way to go.

Company Announcement (Company Results)

However, that still was not good enough to break even, so arguably Cineworld is just getting into an ever-deeper hole. A post-tax loss of over half a billion dollars only looks good in the sense that the prior year has been more than four times worse.

Free cash flow came in at $22m. That compares to $2.7bn of outflows the prior year, so was a massive improvement. The company said in its results that “Our financial strategy continues to be focused on cash flow generation and ensuring the business has sufficient liquidity.” Given the hand they are working with, they did do a great job to generate any free cash flows at all last year. Still, there is a long way to go.

The company is appealing a C$1.23 billion court finding against it in connection with its previously planned Cineplex (OTCPK:CPXGF) takeover. That is a sizeable sum if it is upheld, but for now, the company seems to be trying to kick it into the legal long grass of an appeals process, as it already has enough financial challenges on its plate with which to contend.

The Balance Sheet is Horrible

At the end of the year, Cineworld had net debt of $8.9bn, an increase of $0.6bn from the end of 2020.

At the moment, the market capitalisation is around $350m. Set against that, the net debt looks enormous. My fear with Cineworld remains that the ordinary shareholders will end up getting wiped out altogether. Even if results this year improve dramatically – and I do expect much higher revenues than were achieved last year – $8.9bn is a massive debt pile. In 2019, before the pandemic, the firm managed earnings of £180m. The year before was better, at £284m. But those numbers are miles away from the debt pile. Even if we assume that Cineworld can recover on the revenue front and that it pays its interest without diluting shareholders in any way – which I see as big assumptions – what is left here for shareholders? Where is the long-term value creation for shareholders if the company’s earnings end up being effectively hostage to massive debt (which I think they would be)?

More than the lack of upside, though, my concern is at the downside. The balance sheet gives the company so little room for error despite its clear financial negotiating prowess, as proven over the past couple of years particularly. But that might not be within its control: another sustained lockdown in key markets could end customer demand overnight, for example, and while there is no reason to expect that right now the vulnerability to such risks is evident (the company said January and February were affected by the Omicron variant, for example) but they are essentially outside Cineworld’s control.

Valuation Continues to Look Optimistic

In my January piece, Cineworld: Clear Opportunity But Still Large Risks, I rated the shares as a “sell”. Since then, they have lost 51% of their value.

So are they now fairly valued? I do not think so. It is very easy to see how the shares could go to zero. That does not mean that they are worth zero now, but it does affect my approach to valuation. There is a huge risk here.

At this point, the enterprise value is approximately ~$8.5bn. That looks unattractive to me as a potential ordinary shareholder, even though the company’s thousands of outlets do give it an opportunity to generate significant cash flows.

Cineworld could jump around a lot as a meme stock, but from an investment perspective I think it is effectively worthless and so see further price downside from here in the short- to medium-term.

Be the first to comment