Haiqing Zhong

They say all good things come to an end but what about bad things? More often than not, all bad things do come to an end as well. DiDi Global Inc. (OTCPK:DIDIY) shareholders have long been waiting for some good news ever since the company became a prime target of Chinese regulators after going public in the U.S. in June 2021. Regulatory scrutiny has had a lot to do with the 77% decline in DiDi’s market value since its IPO, and it would be fair to say that many retail investors have already lost any hope of a recovery in stock prices amid regulatory challenges and macroeconomic headwinds facing the Chinese economy. Amid this discouraging outlook for DiDi, the Wall Street Journal reported yesterday that Chinese authorities are preparing to impose a $1 billion+ fine on DiDi to settle their investigation into the company’s data protection practices. DIDIY stock shot up in pre-market trading yesterday in response to this news, and the stock ended the day up more than 13%. This positive market reaction suggests the consensus market expectation is for this fine to bring the regulatory probe on DiDi to a complete end, which would be great news for the company and its shareholders. As investors, however, it makes sense to question whether we are missing something here. In this article, I will discuss DiDi’s prospects amid the changing regulatory environment.

The Silver Lining is Appearing

They say every dark cloud has a silver lining, but this is not entirely true when it comes to stock market investing. For DiDi, however, a silver lining sure seems to be appearing. Assuming the expectations laid out in the WSJ report materialize, DiDi will soon be able to restore its mobile apps in local app stores and start adding new users to its platform. The company will also be allowed to pursue a listing in Hong Kong, which was earlier banned by Chinese regulators in light of the company’s apparent inability to protect sensitive consumer data. DiDi is no longer part of the New York Stock Exchange as well following its decision to delist amid pressure from Chinese authorities, and this adds to my belief that the regulatory outlook for DiDi will soon improve.

This is, however, not the end of the story. An improvement in the regulatory outlook can certainly be considered a catalyst that could move the share price higher in the short run, but investors need to look beyond this short-term development to gauge a measure of what the future holds for DiDi from a fundamental perspective.

The Chinese Tech Sector is Too Big to Fail

I hope many of our readers have watched Too Big to Fail, a 2011 biopic that discusses the events of the global financial crisis of 2008 through the eyes of Henry Paulson, the secretary of Treasury from 2006 to 2009. Ever since this biopic was released, investors have associated the concept of being too big to fail with large banks. The below illustration very nicely depicts the meaning of this concept.

Finance Watch

Source: Finance Watch

Not just banks, but there are other companies that have become too big to fail as well since a failure of these companies will cripple the entire economy of a nation and probably the global economy as well. Many Chinese tech companies fall into this category, in my opinion. Investors are forced to believe today that the Chinese government is not supportive of the growth of its tech sector, which is not even remotely true. The report presented by Chinese President Xi Jinping at the 19th National Congress of the Communist Party in October of 2017 (the 20th Congress will be held this year) had many references to the tech sector of the country and this report went on to suggest the new-look Chinese economy will primarily focus on the growth of the tech sector and innovation. Below are some of the remarks made by Xi Jinping.

We need to raise total factor productivity and accelerate the building of an industrial system that promotes coordinated development of the real economy with technological innovation, modern finance, and human resources.

We should aim for the frontiers of science and technology, strengthen basic research, and make major breakthroughs in pioneering basic research and groundbreaking and original innovations.

We will improve our national innovation system and boost our strategic scientific and technological strength.

We will foster a culture of innovation, and strengthen the creation, protection, and application of intellectual property.

These are just some of the references to the importance of the tech sector and innovation, and the list goes on. China has become an economic powerhouse today not only thanks to cheap and quality labor but also because of its tech sector that has done the hard yards in establishing China as a nation that leads the charge in innovation. If the tech sector is allowed to fail through economic reforms or regulatory intervention, China would be shooting itself in the foot, and I do not believe this is a very likely scenario.

In the long run, I believe Chinese regulators will continue to promote healthy growth of the tech sector as long as tech giants strike a balance between increasing shareholder wealth while safeguarding the interests of the nation.

DiDi Enjoys Noteworthy Competitive Advantages in a Growing Market

To put it very simply, DiDi has a long runway for growth. DiDi dominates the ridesharing industry in China, and its closest peers are not even remotely close to taking the crown from DiDi.

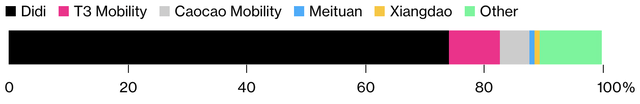

Exhibit 1: Ridehailing market share in China as of September 2021

Source: Bloomberg

DiDi is not going to settle with the massive growth opportunity in China either. The company expanded to South Africa, Egypt, and Kazakhstan last year and the company has a presence in Mexico, Australia, Brazil, Colombia, and Taiwan as well. By strengthening its market position in China alone, the company would be able to deliver handsome earnings growth in the years to come, in my opinion. Markets and Markets projects the Chinese ridesharing market to grow at a CAGR of 16.6% through 2026, and this has a lot to do with the increasing internet penetration in the country and the growing popularity of ridesharing as a means to reduce carbon emissions.

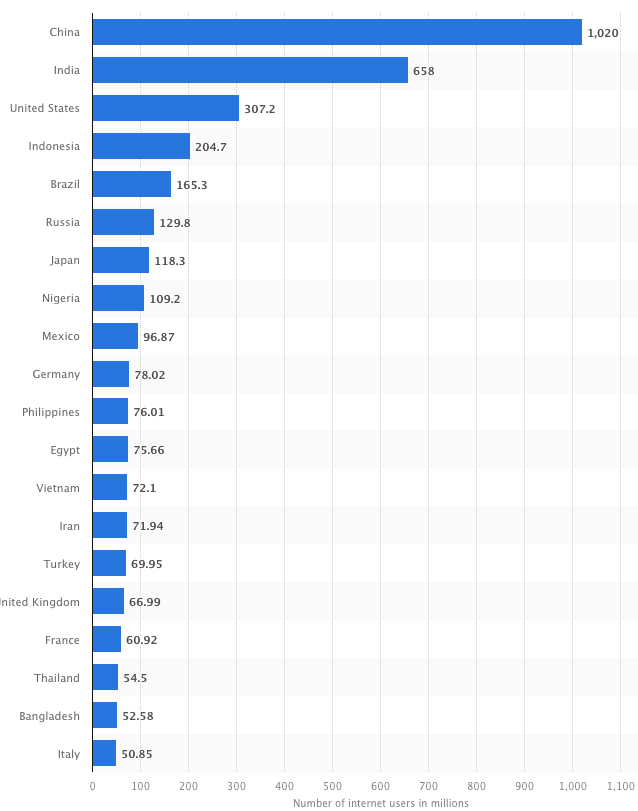

China, in case you didn’t know, has more than a billion Internet users, which is by far the highest number of users in any country.

Exhibit 2: Countries with the largest digital population

Statista

Source: Statista

With regulators taking a back seat, I believe DiDi will soon be able to refocus on growing its business while mitigating the threat of competition in the domestic market.

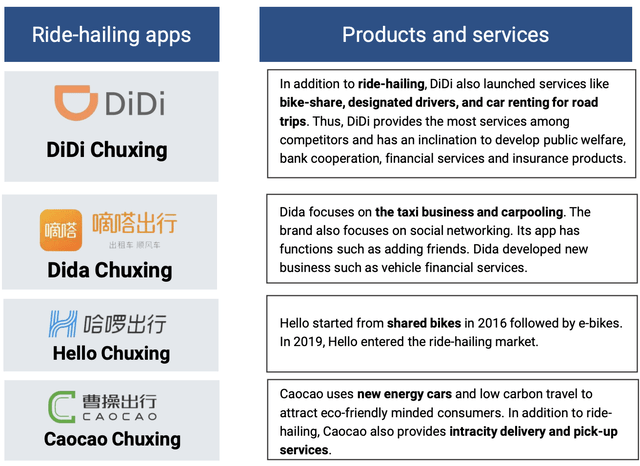

DiDi Global is not just about ridesharing with cars and passenger vehicles. The company is expanding into other business verticals in a bid to diversify its revenue sources while making the most of the growth opportunities available in these fast-growing markets.

Exhibit 3: DiDi Global brands

Source: Daxue Consulting

DiDi is well-positioned to grow in the long run amid favorable macroeconomic developments for the Chinese ridesharing sector, but the company is still not out of the woods just yet, which is why investors may want to be a bit more patient before going all-in.

Takeaway

With regulatory pressures likely to ease, DiDi might be given the green light to go ahead with the planned listing in Hong Kong. I believe investing in DiDi in Hong Kong would be the safest choice for investors given that it will help investors negate the risks arising from tensions between China and the United States. DiDi stock might appeal to traders who are willing to bet on an improvement from the regulatory front as well, but as a long-term-oriented investor, I am ready to wait patiently for a listing in Hong Kong.

Be the first to comment