Detry26/iStock via Getty Images

Johnson & Johnson (NYSE:JNJ) is often a big contributor at large scientific conferences, which can often include the release of new data sets and future plans for parts of their pipeline. This year’s 2022 AASLD Liver Meeting in Washington D.C. from November 4-8 could be an exciting catalyst for the company as it could be in the position to release some exciting new liver candidate results that could be great for the company as well as partner companies such as Arrowhead Pharmaceuticals, Inc. (NASDAQ:ARWR). Getting in now on Johnson & Johnson or Arrowhead Pharmaceuticals could get investors in early before hype builds around the event and additional data arrives concerning a potential blockbuster treatment for hepatitis B virus (HBV).

JNJ presented a late-breaking oral presentation at 2021’s AASLD meeting on its Phase 2b candidate for chronic hepatitis B infection. The REEF-1 study showed a dose-related response to its drug candidate and was generally well-tolerated with a favorable safety profile. The REEF-1 study results featured different combination regimens of its star ingredient in JNJ-3989 (formerly Arrowhead’s ARO-HBV) along with JNJ-6379 and a nucleos(t)ide analog. Here’s an article I wrote then previewing the 2021 AASLD meeting.

According to the U.S. government’s clinical trials website, JNJ’s REEF-1 study officially concluded on April 26, 2022. This could mean additional or final study results could soon be coming, perhaps at this year’s AASLD meeting. With a key Phase 2b study now finished, the question becomes when and if a Phase 3 study gets announced if the data continues to impress. In 2021, JNJ’s subdivision Janssen Pharmaceuticals and Arrowhead announced the collaboration of a new Phase I study for NASH soon after the conclusion of last year’s AASLD meeting featuring JNJ-75220795 based on Arrowhead’s TRiM platform. Another key presentation of data at this year’s AASLD meeting might mean the perfect opportunity for JNJ to officially move into a Phase 3 mode for its HBV candidate with an official announcement during or after the meetings.

Chronic hepatitis B is a very serious disease affecting the health of over 257 million people worldwide with over 887,000 deaths in 2015 alone from complications of the disease. JNJ’s goal with its HBV candidate is to find a functional cure for the disease. A functional cure for chronic hepatitis B is defined by Janssen as a sustained loss of hepatitis B surface antigen (HBsAg) with or without seroconversion to hepatitis B surface antibody. The main takeaway is that JNJ’s candidate, if it gets approved for commercialization, should be a candidate that does not cure the infection, but makes makes it so the infected can live a pretty much normal life while taking JNJ’s drug the rest of their lives to control it.

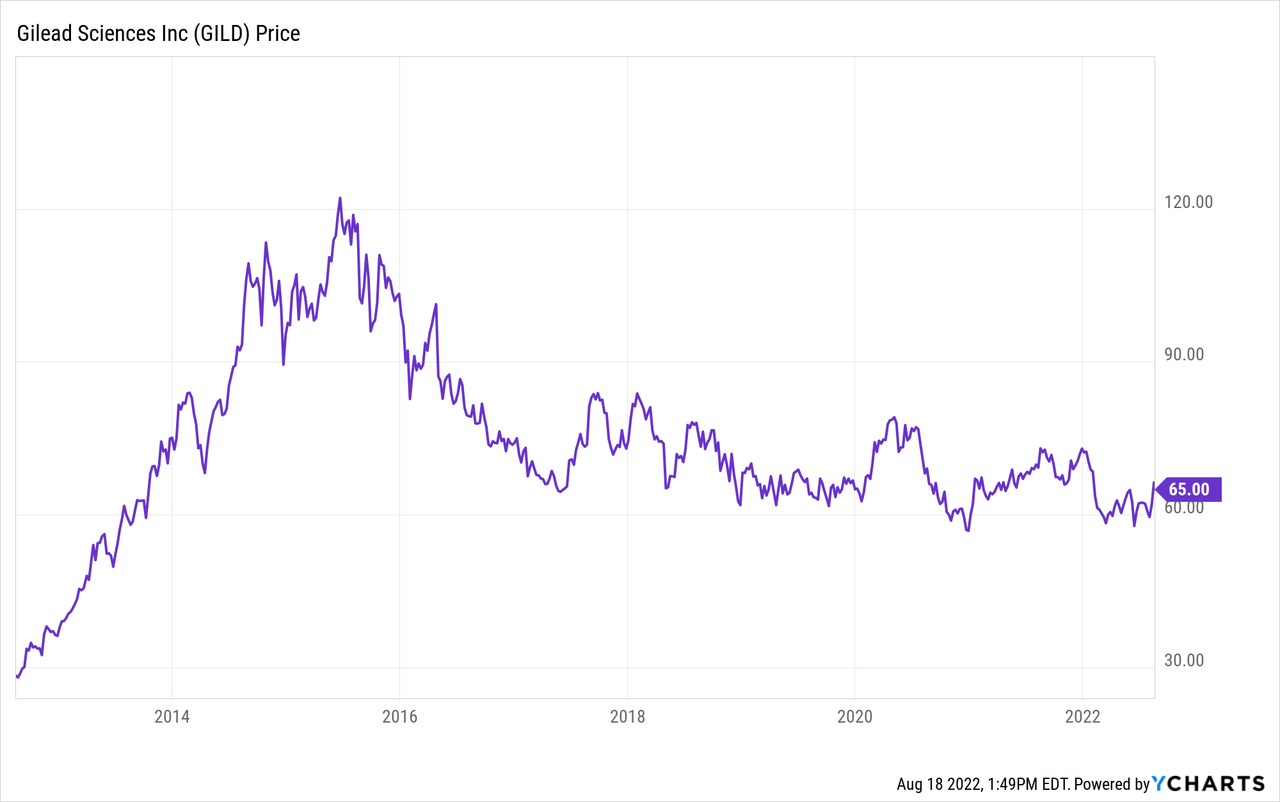

Remember what happened to Gilead Sciences’ (GILD) stock when it happened to cure hepatitis C in 2016?

The stock had a moon shot the years leading up to its drug’s approval, as Gilead was going to make more money in the years after approval than most companies can make in decades. Since then, the stock has yet to recover to anywhere near its approval highs, as once most patients were cured of hepatitis C, the money stopped rolling in.

JNJ’s potential functional cure means a lot less of a moon shot on potential FDA approval and candidate progress, but a lot more potential for sustained cash flows for years if not decades after as hepatitis B has been a very tough virus to treat so far. The start of a Phase 3 trial could be a small to modest potential pop for JNJ on the news, but could be a lot bigger pop for Arrowhead Pharmaceuticals as a sub-$5B market cap company.

As one of the largest healthcare companies in the world, $440B market cap JNJ is already on the ball and is preparing for potential Phase 3 trials. According to global trial finder, Janssen is already is setting up 62 sites across the globe for long-term follow up studies for participants treated with JNJ-3989. The site lists these studies as Phase 3 with a current status of Not Yet Recruiting. The final Phase 2b results still have to come in, but it is nice to see that Janssen has at least finished the framework for some future potential Phase 3 studies.

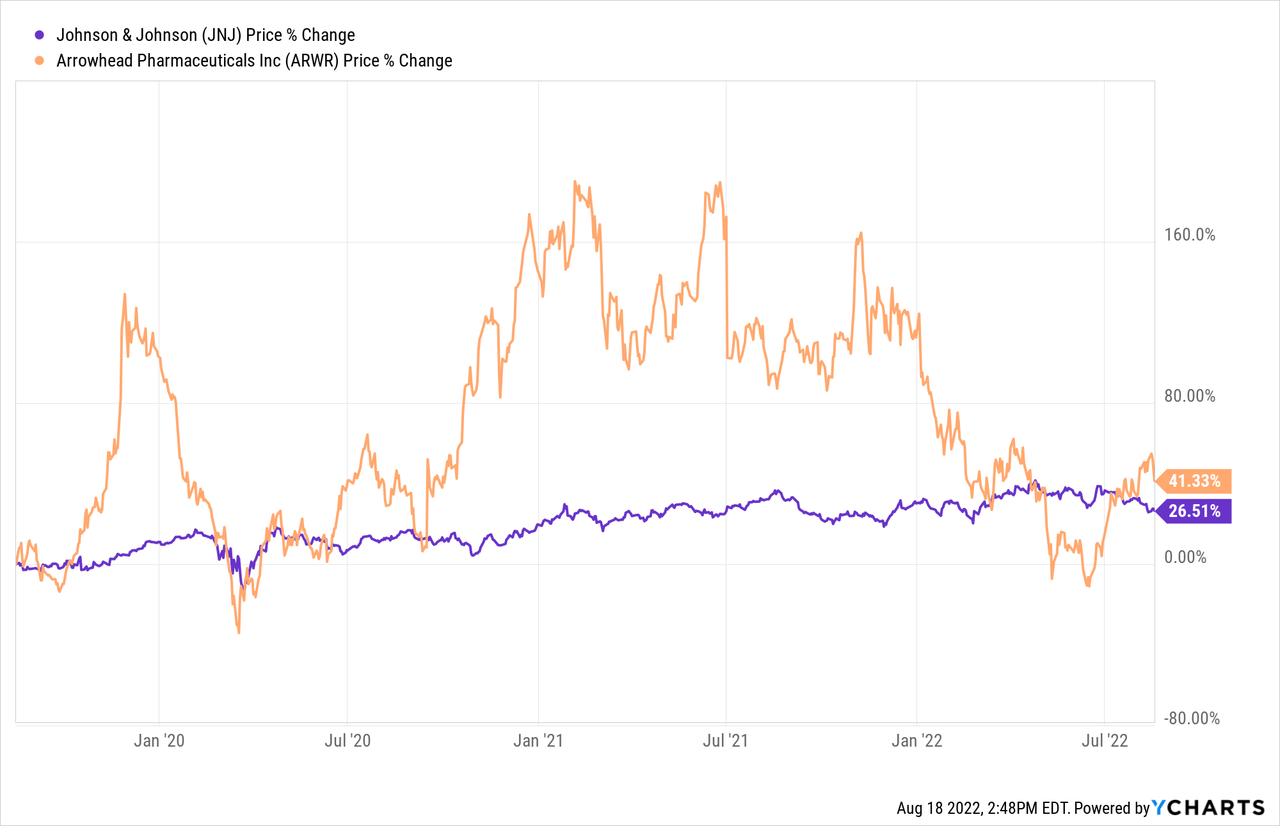

Being a major healthcare company means JNJ is a lot less volatile of a stock than most even going through the ups and downs of Covid-19 the past couple of years.

Arrowhead Pharmaceuticals is a lot more volatile stock though which has significant upside back to recent 52-week highs from its current stock position. JNJ-3989 is one of Arrowhead’s lead partnered candidates amidst an impressive and growing pipeline of wholly owned and partnered candidates with several of the largest healthcare companies in the world.

Arrowhead Pharmaceuticals Pipeline (Arrowhead Slide Presentation from its 2022 Investors Day)

Arrowhead’s pipeline of clinical candidates includes possible future drugs to help with diseases in not only the liver, but the lungs, tumors, and muscle cells as well. Having such a growing and diversified portfolio of targets means that Arrowhead will not be running out of opportunities in the coming decades as its TRiM platform continues to impress across many cell types from Phase 3 candidates like ARO-APOC3 down to pre-clinical possibilities for Covid-19 and newer pulmonary targets like ARO-RAGE

JNJ’s massive commercial portfolio along with its massive pipeline of potential candidates means that its risk of a JNJ-3989 failure is minor, especially after being a potential primary leader in the fight against Covid-19 the past couple of years. Arrowhead’s market cap at under $5B means that the success or failure of JNJ-3989 is a lot riskier as one of the company’s lead candidates. The original $3.7B deal for the candidate between Janssen and Arrowhead showcases the upside for Arrowhead as the deal itself is worth a good portion of Arrowhead’s current market cap excluding all of its other wholly owned and partnered candidates.

According to Arrowhead’s last conference call, it projects next quarters operating cash burn to come in around ~$70M – ~$80M while it sits on a cash hoard of ~$580M. This means that the fate of JNJ-3989 will have a major impact on Arrowhead Pharmaceuticals, but it won’t break the company if the candidate does fail.

This Fall’s AASLD meeting could set the stage for some explosive new data releases including more potential information on Johnson & Johnson’s JNJ-3989 collaboration candidate between its Janssen subdivision and Arrowhead Pharmaceuticals. With a key Phase 2b study completed earlier in 2022, some final data sets might be available soon preparing the companies for possible Phase 3 study announcements. If you have an appetite for risk, consider this upcoming potential catalyst for a bet either on JNJ or Arrowhead Pharmaceuticals. Best of luck.

Be the first to comment