nielubieklonu

An upward trend in marketed utilisation and idle newbuilds leaving yards are some sure signs that the offshore rig market is tightening up. Also witnessed in recent months are a flurry of activities for some jackup- and floater-dominant markets but what this means is that a sell-out situation in some regions could, at the same time, trigger a supply crunch in others.

The global demand for jackups is expected to stay strong, with the largest increase to come from the Middle East. Marketed utilisation stands at just under 90% for now. This is expected to increase beyond 90% by late 2023 or early 2024. The incremental demand in jackups in the Middle East is largely driven by Saudi Arabia, where its demand is anticipated to increase by 60-80%, correlating to around 40 units.

Reactivated and working rigs leaving for the Middle East

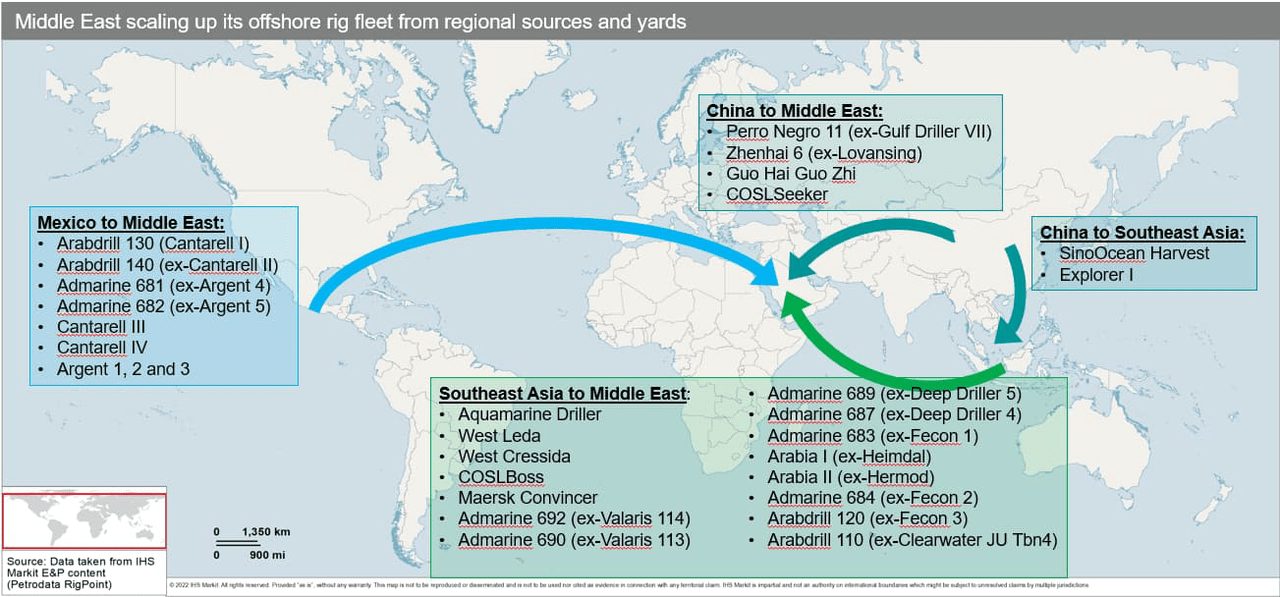

Following recent large-scale jackup tenders from Saudi Aramco and Abu Dhabi National Oil Company (ADNOC), both working rigs and stacked rigs in the surrounding regions, especially Southeast Asia, have been steadily acquired or chartered in preparation for campaigns in the Middle East starting in late 2022 and into 2023.

Hot rigs bound for the Middle East from Southeast Asia include COSLBoss, which was mobilised to replace COSLStrike and complete the latter’s remaining charter with Saudi Aramco. COSLBoss is currently at Lamprell shipyard in the UAE for contract preparations and upgrades before it is put to work in November 2022. Maersk Convincer was one of many jackups sold to Advanced Energy Systems (ADES) for this work. The unit is expected to be released upon completion of its Bruni Shell drilling programme in August. Ex-Vantage (OTC:VTGDF) jackup Aquamarine Driller was also acquired by ADES. The rig was working in Southeast Asia until February before it was chartered to work in Qatar, prior to the sale.

Three hot jackups from China bound to the Middle East are COSLSeeker, Guo Hai Guo Zhi, and Zhenhai 6 (ex-Lovansing). All three were drilling for CNOOC (OTCPK:CEOHF) offshore China before they entered a yard to prepare for their respective charters in Saudi Arabia at the end of the year. Guo Hai Guo Zhi and Zhenhai 6 are on bareboat charter to COSL during the contract.

Meanwhile, two hot-stacked, KFELS B Class units in Mexico, Arabdrill 130 (ex-Cantarell I) and Arabdrill 140 (ex-Cantarell II), were purchased by Arabian Drilling. Sister units Cantarell III and Cantarell IV are also expected to be mobilised from Mexico to the Middle East for work. Warm-stacked, KFELS B Class jackups Admarine 681 (ex-Argent 4) and Admarine 682 (ex-Argent 5) will also be moved to the Middle East from Mexico to start their charters in the fourth quarter of 2022. Like so many others, these rigs were purchased by ADES. PPL Shipyard Pacific Class 400 jackups Argent 1, Argent 2 and Argent 3 have also been purchased by ADNOC and all three will arrive in the region by September. In addition, one more jackup currently working in Mexico, which cannot be named yet, has been chartered by Saudi Aramco.

Reactivated units that are getting snapped up to fill Middle Eastern demand include Valaris 113 and Valaris 114, now renamed Admarine 690 and Admarine 692. The two PPL Pacific Class 400 units had been cold stacked in the Philippines since 2015 before they were acquired by ADES. Seadrill (OTCPK:SDRLF) jackups West Leda and West Cressida have also been mobilised from Labuan to be re-activated in preparation for their three-year campaigns with Saudi Aramco starting in the third quarter of 2023. Also acquired by ADES are ex-Aban jackups Admarine 689 (ex-Deep Driller 5) and designed Admarine 687 (ex-Deep Driller 4). Jackup West Prospero, currently stacked in Labuan, is also expected to find its way to the Middle East.

Newbuilds delivered and leaving the yards

One newbuild jackup departing China for the Middle East is Perro Negro 11 (ex-Gulf Driller VII). Saipem has taken the unit on bareboat charter for Saudi Aramco.

Other newbuild units departing Southeast Asia for the Middle East include KFELS B Class jackups Admarine 683 (ex-Fecon 1) and Admarine 684 (ex-Fecon 2). Both are on bareboat charter to ADES. Also on bareboat charter from Keppel (OTCPK:KPELF) O&M are KFELS B Class newbuilds Arabdrill 110 (ex- Fecon 3) and Arabdrill 120 (ex-Clearwater JU Tbn4). They will be managed by Arabian Drilling. Borr Drilling’s (BORR) KFELS B Class newbuild jackups Arabia I (ex-Heimdal) and Arabia II (ex-Hermod) have secured maiden contracts with Saudi Aramco. Both are currently undergoing contract preparations in Singapore. Borr has also recently signed a letter of intent (LOI) to sell three newbuild units in Singapore: KFELS Super B Class Bigfoot design Tivar as well as KFELS B Class design Huldra and Heidrun.

However, some newbuilds leaving China for Southeast Asia, not the Middle East, include SinoOcean Harvest and, possibly, Explorer I. SinoOcean Harvest (also called Guo Hai Guo Shuo), which is of the Friede & Goldman JU-2000E design, has been handed over to COSL on a bareboat charter for a Pertamina campaign offshore Indonesia. This unit is the last of the rigs built by Shanghai Waigaoqiao Shipbuilding that were ordered over a decade ago. As for Helm Maritime’s Le Tourneau Super 116E Class jackup Explorer I, the unit is understood to have turned up in some Malaysian tenders and could be mobilised to Southeast Asia for its maiden charter.

With the supply of hot and idle rigs dwindling, contractors and potential buyers have started looking around in the yards for options. Would that, in time, spell new newbuild orders? Maybe, but just maybe.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment