xavierarnau/E+ via Getty Images

Thesis

Intuitive Surgical, Inc. (NASDAQ:ISRG) stock has lost most of its post-earnings gains due to the recent pullback, giving investors another opportunity to parse another entry point for the leading robotic surgical systems leader.

We noted that ISRG faced multitudinous headwinds in Q2 relating to its supply chain, economic downturn, China’s COVID lockdowns impact, and challenging comps.

However, robust buying support resolutely absorbed the initial post-earnings sell-off before surging to its August highs. We posit that ISRG has likely bottomed out in June/July. Therefore, we are confident that a medium-term re-rating for ISRG is in store as comps get lighter and some of its headwinds improve over time.

Notwithstanding, we assess that ISRG’s valuation is pretty well-balanced and, therefore, not significantly undervalued. Therefore, investors need to adjust their expectations of market outperformance. Still, we are confident that Intuitive’s long-term growth drivers remain intact, helping ISRG grow into its premium valuation.

Accordingly, we rate ISRG as a Buy.

Q2 Was Hit Hard, But Look Ahead For Better Days

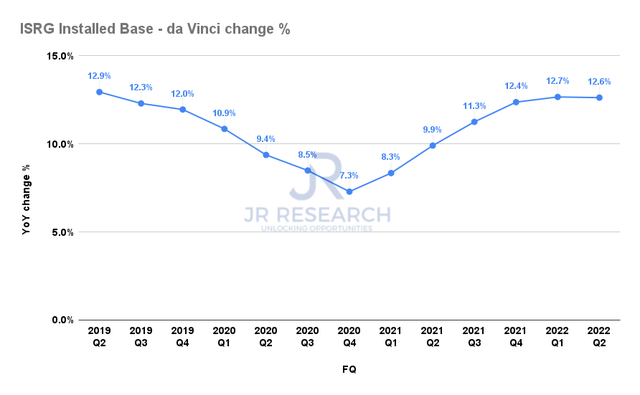

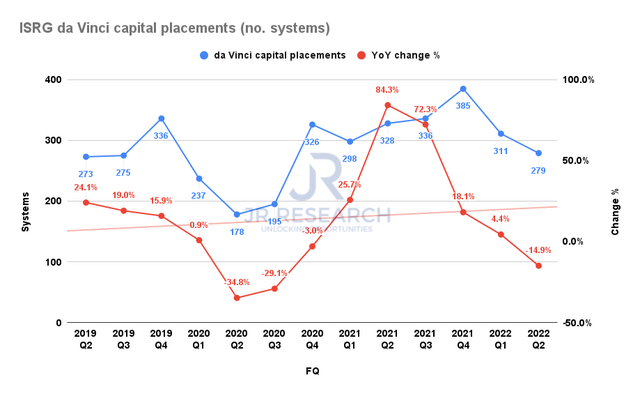

Intuitive da Vinci installed base change % (Company filings) Intuitive da Vinci capital placements change % (Company filings)

As seen above, Intuitive reported a marked fall in da Vinci capital placements in Q2 due to lower trade-in and supply chain disruptions that affected the build completion for Q2. Therefore, Intuitive reported a 14.9% YoY decline in capital placements, following a 4.4% growth in Q1. It also marked the continuation of a sharp reversal from Q3’21, as Intuitive reported another below-trend growth in capital placements.

As a result, its installed base posted a YoY growth of 12.6% in Q2. Its growth has largely normalized after the rapid recovery from Q4’20. However, we posit that the headwinds impacting Intuitive’s Q2 should abate moving forward, as we believe we have seen peak growth in inflationary pressures. Furthermore, the worst of China’s COVID lockdowns were likely seen in Q2, as China has moved ahead to bridge the gap in its original GDP growth target in H2’22.

Furthermore, Intuitive raised its FY22 guidance for procedure growth to between 14% and 16.5%, suggesting management’s confidence in an improved outlook. Therefore, we are confident that management sees certain headwinds as transitory, as Intuitive laps less challenging comps moving ahead.

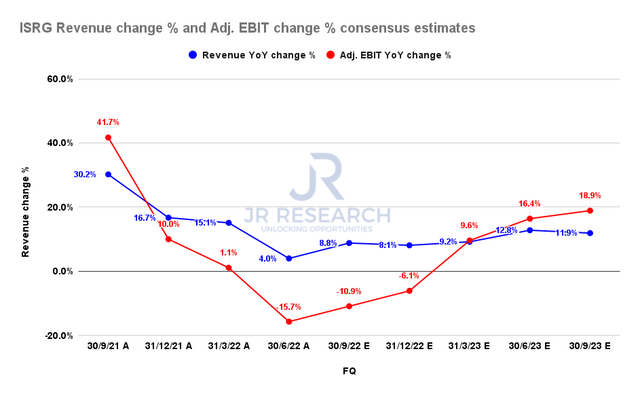

Intuitive revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

Moreover, the consensus estimates (bullish) suggest that Intuitive’s revenue and adjusted EBIT growth could have bottomed out in Q2, recovering markedly through FY23. Coupled with our assessment of ISRG’s bottoming process in June/July, we are confident that it should spur a medium-term re-rating in ISRG moving ahead as its underlying metrics improve further.

ISRG’s Valuations Are Well-Balanced

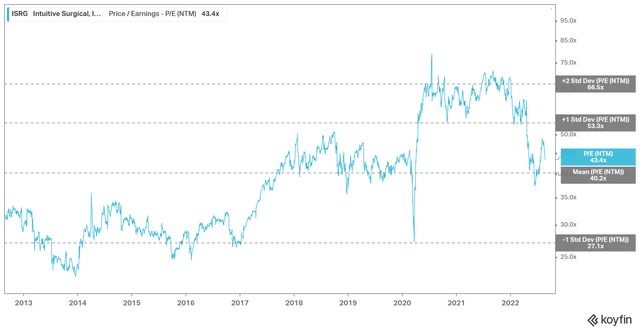

ISRG NTM normalized P/E valuation trend (koyfin)

We used ISRG’s 10Y mean as a basis to assess the appeal of ISRG’s current valuation levels. We noted that Intuitive’s underlying metrics indicate above-trend growth over the past five years, but its forward growth is expected to revert toward its 10Y mean. Therefore, we posit that it’s more appropriate to use its 10Y valuation basis as a yardstick.

Our analysis indicates that ISRG’s NTM normalized P/E is pretty in line with its 10Y mean. Therefore, we postulate that its current valuation is well-balanced but not significantly undervalued, unlike the levels seen in March 2020.

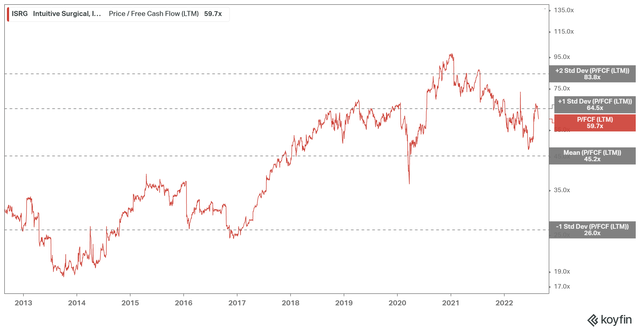

ISRG TTM P/FCF valuation trend (koyfin)

However, our assessment of its TTM free cash flow (FCF) multiples suggests that the market continues to rate Intuitive’s massive FCF margins at a steep premium. Notwithstanding, it has reverted significantly from the overstretched levels in 2021 but still doesn’t appear to be undervalued.

Is ISRG Stock A Buy, Sell, Or Hold?

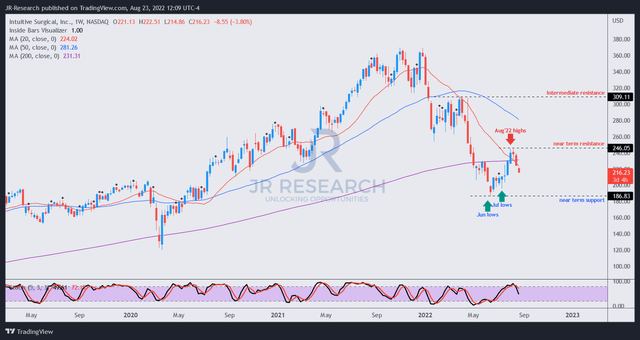

ISRG price chart (weekly) (TradingView)

Our price action analysis suggests that ISRG has likely bottomed out for the medium-term in June. Furthermore, robust buying support seen post-Q2 earnings corroborated our view that ISRG is unlikely to break below its June lows.

Therefore, given the rapid run-up from its June bottom, we view the current pullback from its August highs as constructive. Thus, even though we don’t consider ISRG undervalued, we are confident its June bottom should hold resiliently, supporting a medium-term re-rating.

Therefore, we rate ISRG as a Buy.

Be the first to comment