Melpomenem/iStock via Getty Images

Discipline in the market means that you have to say “no”, far more often than you have to say “yes”. Often good is not good enough. We felt exactly like that when we covered John Hancock Financial Opportunity Fund (NYSE:BTO). The fund hit the right notes and had great managers, a sector we liked (on a relative basis) and paid a sweet yield. It also used relatively modest leverage, something which is increasingly missing from the world of closed end funds. Yet, we stayed away as a few factors made us queasy. Specifically we said,

We are impressed by what we see, but we would only look to give this fund a buy rating when we have seen a market correction alongside a revisit to a 0% premium on NAV. We remain neutral for now.

Source: Right Fund, But Not The Right Time

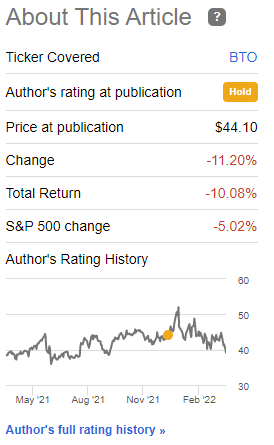

While we got a few “boos” from the fans (you are not really doing your job if you don’t get those), we were unmoved. The decision was correct as the fund not only delivered negative returns but also lagged the broader market.

Returns Since The Last Article (Seeking Alpha)

We look today to see if there is some joy to be had in this quality fund.

Fundamentals

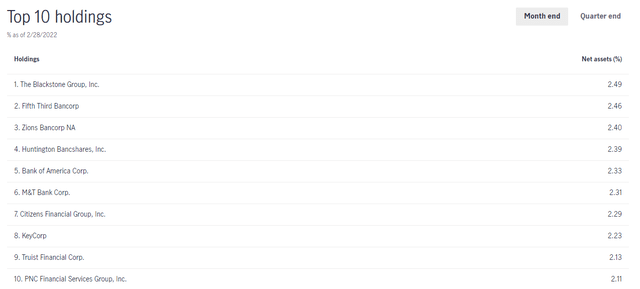

A look at the current top 10 holdings of the fund shows the familiar names still in place. Blackstone Inc. (BX) continues to hold the top place, followed by a smattering of regional and national level banks.

BTO Top Holdings (JH Investments)

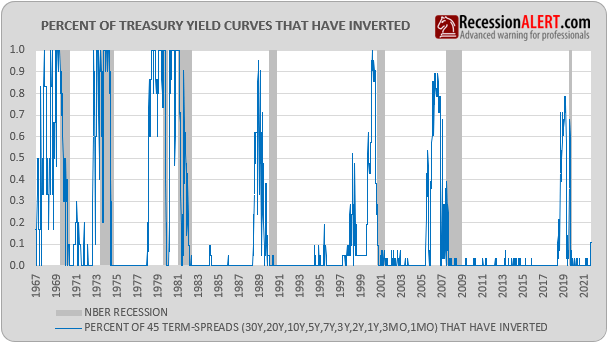

One notable change was that the KKR & Co. Inc. (KKR) which disappeared from second place that we saw it at the last time we covered this. With banks dominating the screen the underperformance was expected. The sector has been taken a moderate drop with yield curve inversions dominating the press releases. While we think that a slowdown is highly likely, we don’t see the recession fears that everyone else is currently seeing. Inventories remain abysmally low across the board and rebuilding will take a few quarters at the minimum. We will add the mild inversions are not at all uncommon at this stage of the cycle.

Percent Of Yield Curve Inverted (Twitter)

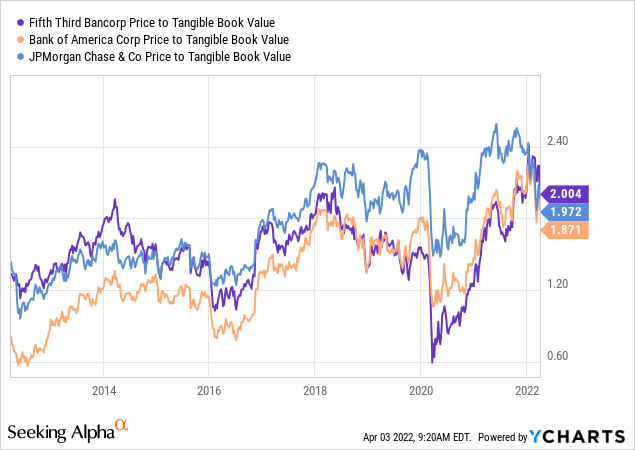

Of course in the longer term recessions are obviously inevitable. Real unemployment rate is close to a 4% level and you obviously are getting to a stage where that number has nowhere to go but up. So buying financials requires making sure you are not overpaying at this stage of the cycle. Are you? One way to look at that is to see how these financials trade in relation to a normalized price to tangible book multiple. We picked three random picks from the top 10, Fifth Third Bancorp (FITB), Bank of America (BAC) and JPMorgan (JPM).

The recent declines in the stock prices have corrected some of the froth that we say in early December but no one can look at those multiples and remotely call them cheap. Keep in mind that while we may not see an outright recession, the flattening curve will definitely pressurize earnings in late 2022 and 2023. These banks will have to raise interest rates rapidly to compete for customer funds and demands for loans will slow as well. In such an environment net interest margin will flatten quickly. Hence P/E ratios and 1 year earnings remain the most useless tool to evaluate buy points for banks (and most stocks).

Fund Premium

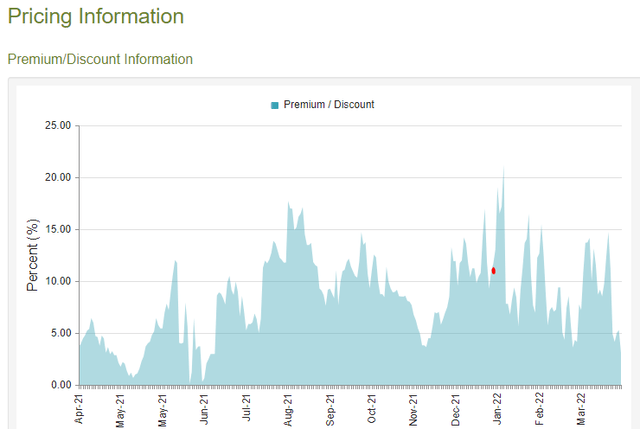

One good aspect of the recent decline is the fund has moved to a less onerous premium. The red dot shows the premium when we last covered this fund.

BTO Premium To NAV (CEF Connect)

That is actually the prime reason if you bought in late December, you are smarting from the pain. A big portion of the decline has been the premium compression. Buying without regard to premium is a great way to get exceptionally poor total returns. At the current 3.11%, at least you are not paying through your nose. While that is no longer the headwind it was three months back, we still think this will be available at a discount down the line.

Verdict

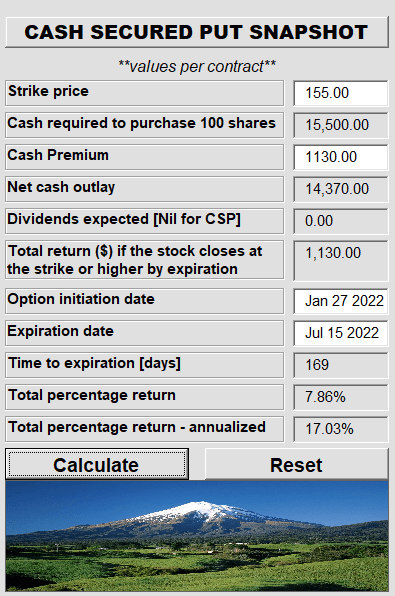

We do like banks and think that the Fed Balance Sheet unwind will give investors some spread on the yield curve. We will write more about this topic in a separate article. For now, we are being selective and picking our spots where financials are more attractive. For example, we found the reinsurance segment particularly cheap in late January and took the opportunity put in our bid for RenaissanceRe Holdings Ltd. (RNR). The stock traded at less than 1.2X tangible book value back then and offered an attractive opportunity to pick up the company by selling the $155 cash secured puts.

Trade Alert 236 (Conservative Income Portfolio)

One other reason we chose that one was that it was yield curve indifferent. Insurance and reinsurance companies will benefit from a general rising rate environment as their investments earn more income. They really could not care less about the yield curve. That is also probably the reason Warren Buffett picked up another reinsurer we highlighted. Getting back to BTO, we are tempted to give this a higher rating but we will stick with neutral/hold rating for now. Valuations are definitely moving in the right direction and we certainly found a few banks that we put in bids for. The fund lacks exposure to the insurance sector and that is where we find better overall value. This one remains far from a buy for us.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment