Andres Victorero

We have bought a lot of REITs (VNQ) lately and it is pretty simple to understand why.

- They are priced at the lowest valuations in years.

- Even as rents are growing rapidly.

- Balance sheets are strong.

- Dividends keep on rising.

- And private equity players keep accumulating them.

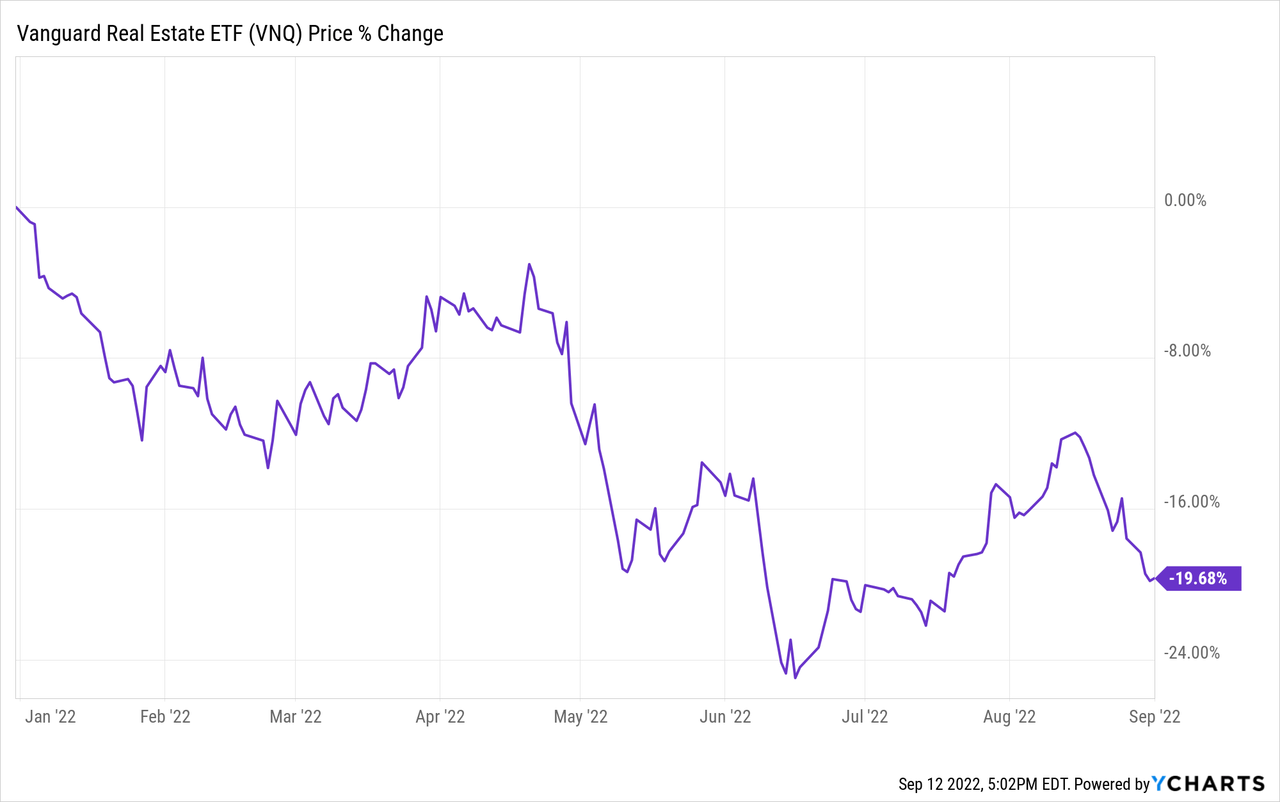

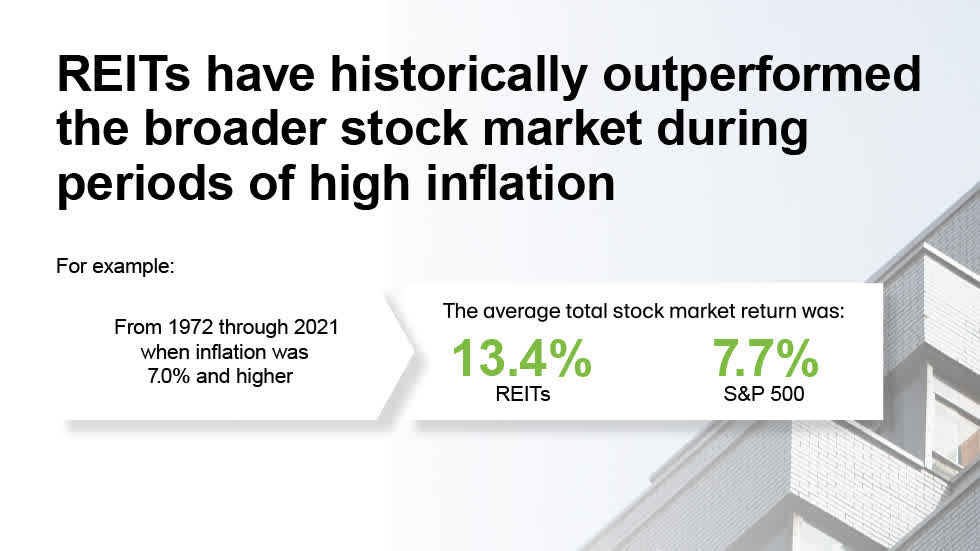

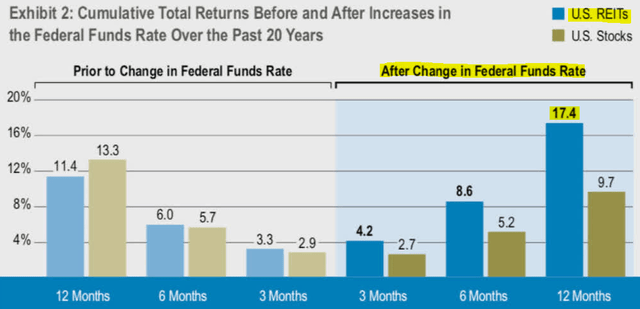

The market got worried about rising interest rates, not realizing that REITs aren’t using much debt these days. LTVs are just 35% and maturities are long at 8 years on average. Therefore, the impact of interest rate hikes isn’t significant. Meanwhile, the high inflation is gradually evaporating the debt, rents keep growing, and property replacement costs as well. This explains why REITs have historically generated strong positive returns during times of high interest rates and rising inflation:

NAREIT

Cohen & Steers

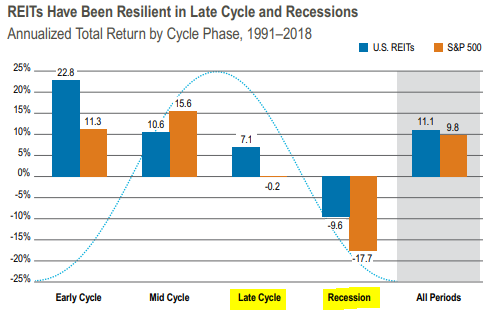

Secondly, the market also got worried about the coming recession, not understanding that most REITs are highly resilient to cycles. Properties are typically leased on a long-term basis and generate steady and consistent rental income that does not change materially in a recession. The rent is typically a fairly small expense in the cost structure of the tenant and they are unlikely to completely rethink their real estate footprint because of a temporary dip in economic activity. This explains why REITs have enjoyed much better downside protection in past recessions, and that’s despite having been more heavily leveraged in the past:

Cohen & Steers

Therefore, we think that the recent sell-off is a great opportunity for REIT investors. A number of REITs have dropped by 20, 30 or even 40% in some cases and are now priced at multi-year lows due to temporary worries that won’t last.

Major private equity players like Blackstone (BX) understand this and have been buying REITs left and right. They have already bought $30 billion worth of REITs in 2022 and it seems that they expect to buy many more in the near term:

The best opportunities today are clearly in the public markets on the screen and that’s where we’re spending a lot of time. – John Gray, COO of Blackstone

Just like Blackstone, I am also accumulating high-quality real estate at a discount via the REIT market. Below, I highlight 3 names that I have been buying lately:

Whitestone REIT (WSR):

Service-oriented, grocery-anchored shopping centers in rapidly growing neighborhoods can generate steady cash flow even during recessions. They provide essential daily goods that you cannot easily get elsewhere with the same level of convenience. Even Amazon (AMZN) understands this as it is heavily investing in these properties with Whole Foods, which is one of WSR’s tenants.

WSR’s properties are particularly attractive because they are mainly located in Phoenix, Austin, and other high-growth Sunbelt markets. Their occupancy rates and rents are growing rapidly right now as the demand in these growing markets exceeds the new supply:

Whitestone REIT

However, WSR’s balance sheet is more heavily leveraged than your typical REIT and as a result, the market has become very pessimistic about WSR.

We think that this is an opportunity because WSR is now priced at a huge 35% discount to NAV, which would only make sense if WSR was distressed.

But with a ~50% LTV, staggered debt maturities, and rapid rent growth, WSR is no distress. Despite being more heavily affected by rate hikes, its cash flow is still growing rapidly. WSR has guided for 10%+ FFO per share growth in 2022.

Put simply, the positive impact of rent hikes is greater than the negative impact of rate hikes. We think that WSR’s rental income is recession-resilient, and that the REIT’s market sentiment has a lot to gain a lot as interest rates eventually stabilize or even better, drop to lower levels.

We expect 30-50% upside and earn a near 10% cash flow yield while we wait.

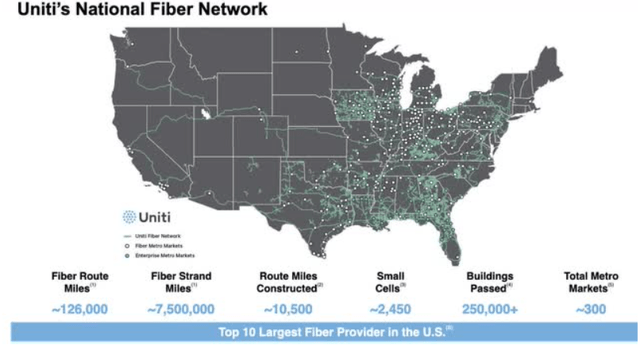

Uniti Group (UNIT):

Uniti Group owns essential communication infrastructure that generates recession-resistant cash flow. Its fiber network is absolutely necessary to the communities it serves:

Uniti Group

Not long ago, there were rumors of UNIT being potentially taken private at $15 per share, but UNIT’s management thought that this would undervalue its portfolio. Today, you buy it at $9 per share, which is less than half the replacement cost of its portfolio. It delivered 7.3% AFFO per share growth in the second quarter, a reminder of the stark contrast between the company’s valuation and its fundamental performance.

Why so cheap?

Legal complications with UNIT’s primary customer, Windstream, could deal a serious blow to the company, but it is difficult to quantify how big this risk is. Such uncertainty is what keeps most investors away from the stock. But if this complication can be resolved once and for all (even if it hurts UNIT in the short run), UNIT has huge upside. Its fiber portfolio has a weighted average remaining contract term of 8.5 years, virtually all (96%) debt is fixed rate with very little maturities through mid-2024, and 2022 AFFO per share guidance was upped from $1.65 to $1.72. That puts UNIT’s price to AFFO at a dirt cheap 5.9x. Unless the Windstream resolution completely cripples or destroys UNIT (which we find unlikely), UNIT could easily double from here. Until then, we enjoy the nearly 6.5% dividend yield and the company continues to grow and diversify its portfolio.

UMH Properties (UMH):

Manufactured housing communities provide affordable housing to blue-collar workers, retirees, and now also increasingly many remote workers who decide to get out of big cities to lower their cost of living.

UMH Properties

Their performance does not change materially in a recession since everybody needs a roof over their head and there often aren’t any cheaper alternatives.

I just recently talked with UMH’s management who noted that they expect to grow their FFO per share by 50% in the next 5 years and yet, they are priced at a near 30% discount to NAV. We will soon share a new interview with the management with members of High Yield Landlord, but in short, UMH is a recession-resistant, rapidly growing REIT trading at a discounted valuation.

You get paid a near 5% dividend yield while you wait for the upside, which could be very considerable.

Just between the yield and growth, you can expect to earn 12-15% annual returns over the coming 5 years, and in addition to that, we estimate that the company has 30-50% upside potential.

Bottom Line

WSR, UNIT, and UMH are just three examples of REITs that are deeply undervalued and screaming “buy me” at the moment.

We are accumulating them aggressively at High Yield Landlord to earn high yield, gain inflation protection, and position our portfolio for upside as the market recognizes its mistake and/or private equity buys us out.

Be the first to comment