FeelPic

JOANN (NASDAQ:JOAN) recently reported lower-than-expected third-quarter FY23 financial results. The revenue in the quarter declined 7.9% Y/Y to $562.8 mn (vs. the consensus estimate of ~$570 mn). The adjusted EPS declined significantly Y/Y from $0.73 in Q3 FY21 to $0.06 (vs. the consensus estimate of $0.23). The decline in revenue was due to the pullback in demand for fall seasonal products as well as softness in the craft technology business, partially offset by increased sales related to Halloween. The adjusted EBITDA margin declined 480 bps Y/Y to 7.1% due to supply chain constraints, increased SG&A costs, and higher fuel rates. This led to a year-over-year decline in adjusted EPS in the quarter.

JOANN Revenue Analysis and Outlook

The total comparable sales in Q3 FY23 declined by 8% due to the decrease in transaction volume, partially offset by an increase in average ticket size. The ticket size increased by 1% Y/Y driven by price increases, partially offset by fewer items per basket. The company saw declines in sewing, crafts, and home decor, with declines being more pronounced in the craft technology business. Craft technology includes label makers, photo studio equipment, etc. The fall seasonal decor and floral categories underperformed as customers were less inclined to indulge in craft activities and decorate homes compared to the prior year, when they were spending more time in their homes and the stimulus checks led to increased spending on discretionary items. However, the company saw strength in fashion apparel, special occasions, needle arts, and fleece categories. Additionally, the Halloween business grew ~8% Y/Y.

In the third quarter of FY23, the company continued to advance on its key strategies like enhancing its store experience by bringing in better assortments and relocating its current stores. The company is also expanding its e-commerce platform to grow omnichannel operations. The company’s new multipurpose distribution center in Ohio is a cornerstone for e-commerce as it will help drive significant operational efficiencies and improve fill rates.

In addition to the store refresh program and omnichannel platform, the company is also working on initiatives to drive long-term profitable revenue growth. The first initiative is DITTO, a 50-50 JV with SVP Worldwide to revolutionize the way customers create, design, and complete all sewing and crafting pattern projects. DITTO is a platform for sewers and craft enthusiasts that will allow them to turn patterning into a fun part of sewing using AI. The second initiative is the wholesale initiative which is still in the early stages. The company signed up over 200 new B2B customers in Q3 FY23 and has a commercial website that will launch over the next two months.

Looking forward, the fourth quarter of FY23 should be positive for the company given the seasonality of the business due to the holiday season. The company has good inventory levels and is competitive in its promotional offerings. The sales in November started slow for the company. However, it picked up the pace with Black Friday and Cyber Monday and continued the momentum into December. Beyond Q4 of FY23, the ongoing inflationary environment should continue to pressurize customers’ discretionary spending. Customers are likely to buy essential and basic items and focus less on discretionary purchases. This should impact the company’s sales in over the next couple of years.

Margin Outlook

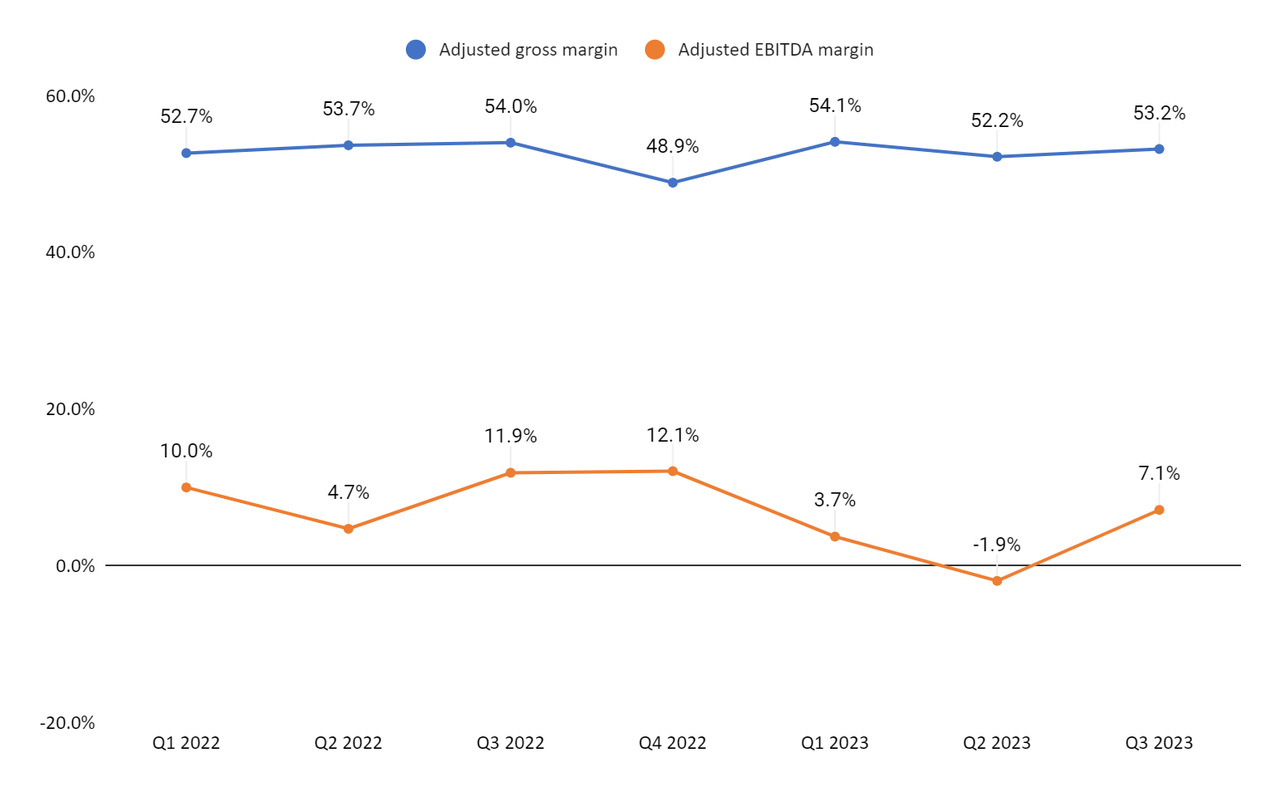

In Q3 FY23, the gross margin declined 230 bps Y/Y to 49.9% due to excess import costs ($18.5 mn) impact, higher domestic freight expenses due to carrier rates, and fuel costs. After adjusting for excess import freight costs, the gross margin (adjusted) declined 80 bps Y/Y to 53.2%, driven by the timing of inventory clearance activity and increased carrier and fuel rates. The operating expense in the quarter increased due to the costs related to a new multipurpose distribution center in Ohio.

JOAN’s adjusted gross margin (Company data, GS Analytics Research)

Looking forward, improving supply chain, stabilization in commodity costs, and a strengthening dollar should help reduce some of the cost headwinds. The fourth quarter of FY23 should also benefit from improving ocean freight rates. The ocean freight expenses are expected to be approximately $15 mn to $20 mn favorable Y/Y in the quarter. JOAN is also taking steps to reset its cost structure, simplify and streamline its operations, and refocus its efforts on growth opportunities. The company launched a program to target $200 mn in annual cost reductions to be fully delivered by early FY25. According to management, approximately 50% of these savings will be supply chain-related, 30% will be from COGS improvement, and the balance will be from reductions in overhead costs. In the long term management is targeting double-digit EBITDA margins.

JOAN Stock Valuation and Conclusion

If we look at the current stock valuation, it is trading at 17.15x EV/EBITDA (FWD) and a 33.99x FY24 (JAN) P/E.

The company had $27.5 mn in cash and cash equivalents at the end of Q3 FY23 and long-term debt of close to $1.1 bn. The leverage ratio is close to 6.6x on a trailing 12-month basis.

While the company has good long term growth and margin improvement plans, in my experience these management plans become very difficult to implement when the company is deep in debt. Also, while the company’s $200 mn cost reduction plan is impressive, its execution is yet to be seen. Further, due to less consumer spending on discretionary items, JOAN’s sales are expected to be under pressure and the volume deleverage due to declining sales should limit how much cost cutting gets reflected in the margins. No doubt with sales of over $2.2 bn and market cap of ~ $150 mn, there may be a good upside if the turnaround plans are successful and the company’s margins see a meaningful improvement. However, I believe the risk is too high here and it is better to remain on the sidelines for now. Hence, I have a neutral rating on the stock.

Be the first to comment