NUSI lying cold.

stevecoleimages/E+ via Getty Images

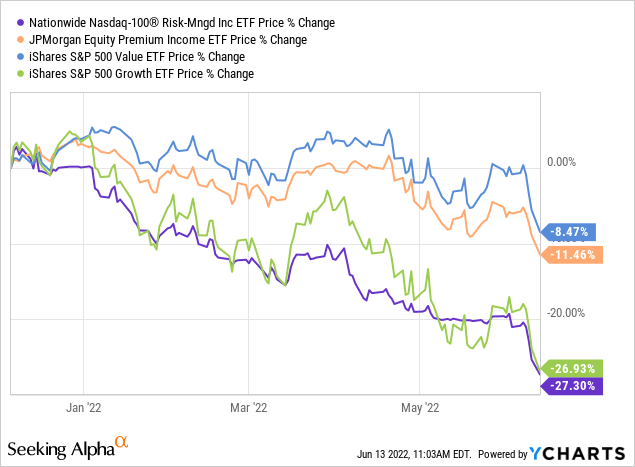

The era of easy money is coming to an end. As we see those good old days in the rear-view mirror, we also get to see the casualties as we make that transition. When we last covered Nationwide Risk-Managed Income ETF (NYSEARCA:NUSI) and JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI) we stuck to our guns.

JEPI continues with its strategy in a sound manner and we have no reason to change our verdict on the relative performance. Our Long JEPI/Short NUSI call remains in effect and we have a long way to go until value stocks peak relative to growth stocks. While NUSI looks beaten and bruised, we don’t think the trade is done and we would stick to JEPI for generating income for those that are not keen on doing their own work.

Source: Adventures In Option Strategies

NUSI is one where we think the immediate bearish thesis is now close to coming to an end. We update our paired trade on this and JEPI.

The Core Bear Thesis On NUSI

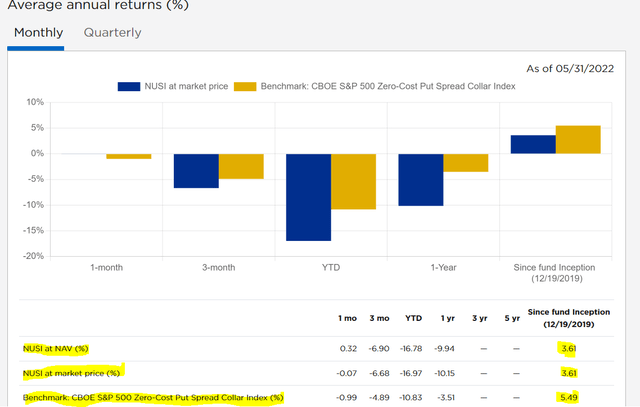

Our rationale for preferring JEPI over NUSI came down to fundamentals of both the underlying strategy and valuations. JEPI executed a value conscious pursuit of high-quality stocks and then sold calls on the indices. This was a pseudo, long value-short-growth strategy. NUSI used collars on the NASDAQ 100 index which we previously showed were completely useless on bubble valuations. The closest ETF which resembles NUI’s holdings (without the collars) is Invesco QQQ ETF (QQQ). NUSI has now lagged the CBOE S&P Zero-Cost Put Spread Collar index since inception.

NUSI

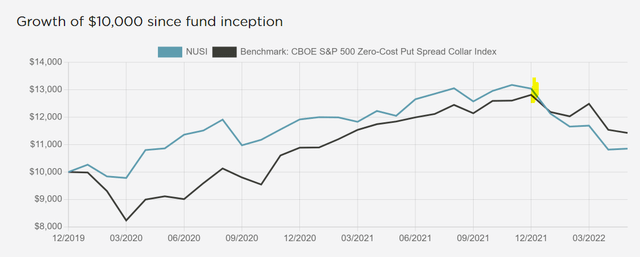

Keep in mind that as recently as December it was actually ahead.

NUSI

So as far as we are concerned, everything is playing out perfectly. Why the change of heart then?

Deeply Oversold

Since December 2021 (when we wrote up the bear thesis), there has been just a one way move of value versus growth.

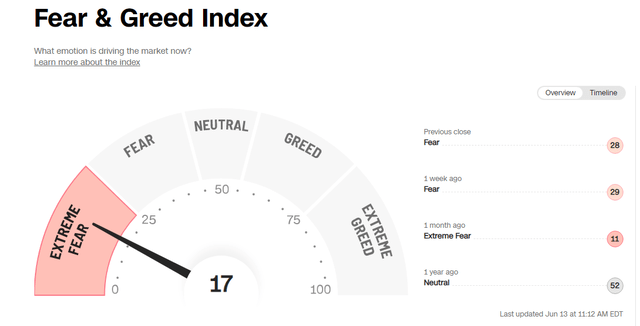

Even the strongest trends tend to pause for a time, and we have just not had that. The Fear and Greed Index, which is an adequate measure of fear in the growth trade, has been hovering under 30 for some time now.

CNN

Change in Strategy

While those make us relatively cautious in pressing the downside case, the biggest change has come from NUSI itself. NUSI is now positioning increasingly on the defensive side. In the last two months, it has deployed its puts rather close to the money and we think managers are taking less risks. They rather lose upside than get more downside risk and this means even if the market keeps moving lower, NUSI’s collars may now outperform JEPI if markets go to SPX 3,200 (our year-end target).

Longer-Term Outlook – NUSI

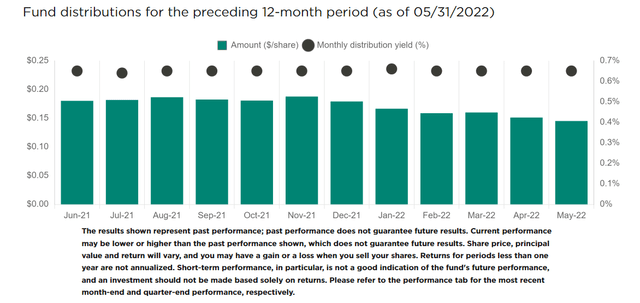

NUSI has been progressively cutting the distribution over time.

NUSI

This is something investors need to understand as that distribution does not magically appear out of thin air. The collars are a complicated options strategy. A lot of finesse is required to generate income from them. On one hand, NUSI is being helped by higher implied volatility and a soaring VIX index. On the other hand, that same VIX makes it more expensive for purchased options as well. Remember that a collar requires a sold call and a purchased put. So volatility is less helpful than a covered call strategy (our choice) that JEPI deploys. Also, and we have said this for some time, as the NAV erodes, expect distributions to shrink over time. This has been the biggest error of those labelling this as a bond-like return structure. Bond par value does not shrink over time. NUSI’s NAV has and likely will in the longer run.

Longer-Term Outlook – JEPI

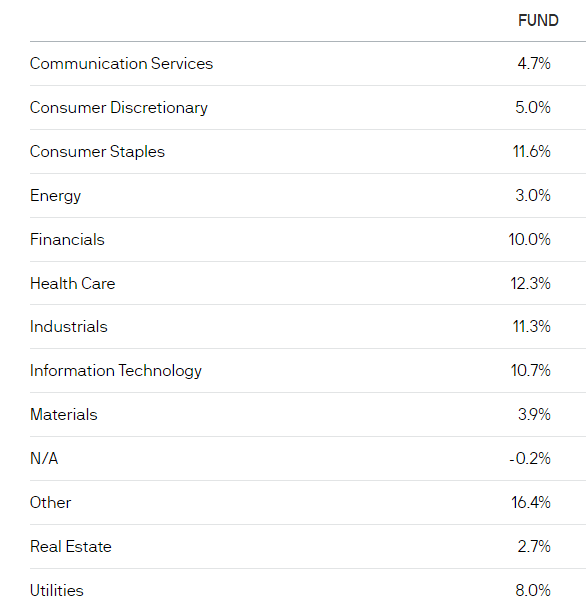

JEPI continues to heavily underweight Consumer Discretionary (XLY) and Technology (XLK) sectors.

JEPI

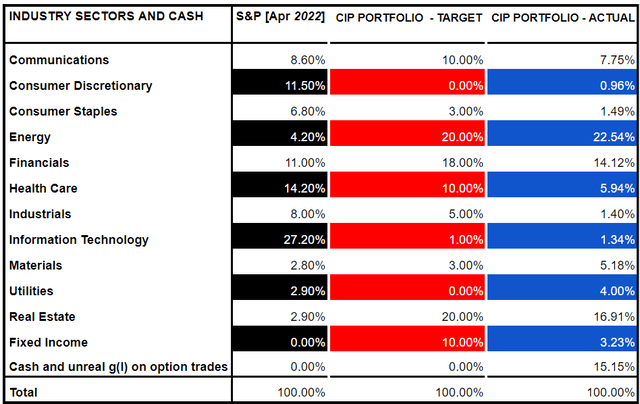

S&P 500 (SPY) weighting on these two is miles ahead of where JEPI is. We have shown our actual allocation as well and JEPI and Conservative Income Portfolio are thinking along the same lines.

Conservative Income Portfolio

We think that JEPI will continue to squeeze out good income. It does have some growthy exposure so we don’t think total return will equal income handed out. In other words, expect some drop in price over the next 1-2 years.

Verdict

A Short NUSI, Long JEPI strategy provided fantastic alpha. Those that were long NUSI and switched to JEPI also avoided a lot of pain. At this time, we are ending the trade and think there is room for both horses to perform equally well over the next few months. Once the smoke of these oversold conditions has cleared and we observe the deployment of collars over the next few months, we will update whether we want to get into this trade once more. For now, we are upgrading NUSI to a Neutral/Hold Rating from the Sell we had it at. We are maintaining JEPI at a Neutral/Hold rating.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment