Darren415

Thesis

The JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI) is a relatively new ETF that was incepted in May 2020 and predicated on the S&P 500 Total Return Index (SP500TR).

JPMorgan’s (JPM) fund managers designed the fund to “deliver monthly distributable income and equity market exposure with less volatility.” Therefore, it’s critical for investors to recognize the fund’s strategy is to build a sustainable income stream with derivative securities while participating in the upside of its underlying equity securities.

Notably, JEPI builds its income stream by investing through equity-linked notes (ELN), which may comprise up to 20% of its net assets. Therefore, JEPI derives its income stream through the written call options (typically out-of-the-money S&P 500 Index call options) from the ELN.

As such, the income stream is designed to help reduce the volatility of JEPI, leveraging on the fund’s primary characteristics of investing in more “defensive” companies to reduce portfolio volatility.

Notwithstanding, JEPI managers highlighted that investors should consider a “full market cycle” of between three to five years to assess the success of the fund’s strategy. Therefore, we encourage investors to give JEPI the time it needs before evaluating its Sharpe or Sortino ratios relative to the S&P 500 (SP500).

Our analysis suggests that the fund’s defensive characteristics have helped mitigate the downside risks for investors in the current bear market. Notwithstanding, we assessed that a sustained bottom in the S&P 500 (SPY) (VOO) in our recent article could be forming. Hence, the tech-heavy S&P 500 could potentially outperform the JEPI in the medium term, as its written call options could hold back the ability of the fund to participate fully from the impending bottom.

Notwithstanding, our assessment of JEPI’s price action suggests that it could also have formed its medium-term bottom, behooving income-focused investors to consider adding exposure. Hence, we suggest investors looking for a dual strategy of income, and capital appreciation can consider leveraging JEPI as an additional tool to their equity portfolio while lowering portfolio volatility.

As such, we rate JEPI as a Buy.

Less Volatility From More Defensive Sectors

Given JEPI’s fund design, it would be unreasonable for investors to expect the fund to expose much of its holdings to the tech sector, given its higher valuations relative to the index.

Therefore, JEPI has a higher defensive exposure, accounting for 38.6% of its portfolio (as of October 20, according to YCharts). In contrast, the SPDR S&P 500 ETF has a much lower defensive exposure, accounting for 25.3% of its holdings (as of October 20, according to YCharts). Notably, JEPI has exposure of just 9.2% to technology stocks, while SPY has 23.8% exposure to tech.

Coupled with a current stock exposure of 82.9% (with the rest in bonds and cash), it provides less volatility for investors seeking a more defensive configuration for their portfolios.

JEPI Top 10 holdings % (YCharts)

Also, JEPI’s top ten holdings are markedly different from the SPY’s composition, with more defensive and healthcare names such as UnitedHealth Group (UNH), Coca-Cola (KO), and PepsiCo (PEP) making the top ten. Tech companies are noticeably missing from JEPI’s current top ten list. Also, JEPI’s stock weightings are more broadly-diversified, with the top ten holdings accounting for 15.4% of total holdings.

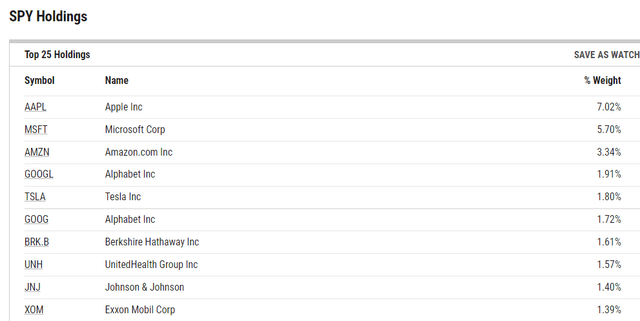

SPY Top ten holdings % (YCharts)

In contrast, the SPY has familiar tech names and higher valuation names in its top ten holdings. Stocks like Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN) take its top three spots. Even Tesla (TSLA), whose NTM P/E is 39x, accounted for 1.8% of its holdings.

Furthermore, the SPY’s top ten holdings accounted for 27.5% of its total holdings, given its market-cap-weighted composition.

Is JEPI ETF A Buy, Sell, Or Hold?

JEPI last traded at a forward P/E of 16.2x, above the SPY’s forward P/E of 15x. But, investors need to understand that the defensive sectors in JEPI’s portfolio have a higher P/E than the market average. Therefore, the market attaches a premium to less volatility if it delivers a superior total return. JEPI’s TTM dividend yield of 11.02% also outperforms the SPY’s TTM dividend yield of 1.65%.

JEPI’s YTD total return of -10.1% has outperformed the SPY’s YTD total return of -20.3%. However, investors are encouraged to use a forward-looking perspective when considering JEPI’s forward outperformance potential.

We assess that JEPI could potentially offer a superior risk-adjusted total return. Still, the assessment should be evaluated over a full market cycle, as highlighted by the managers, to be more meaningful.

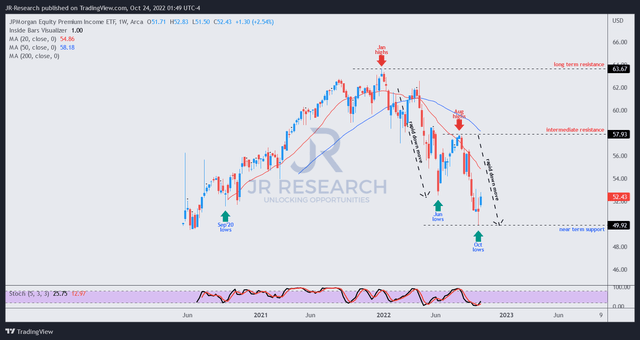

JEPI price chart (weekly) (TradingView)

We gleaned that JEPI has attempted to stage a sustained bottom from its recent October lows and had a validated bullish reversal last week. Therefore, the market has set the stage for JEPI to continue its recovery from here.

However, JEPI remains in a bearish bias, and therefore, investors should continue to expect near-term downside volatility.

Despite that, we are confident that investors should leverage the current bottoming process to add exposure, capitalizing on the early bullish reversal. Investors waiting for a “confirmed uptrend” could end up adding at much higher levels as they wait for the moving averages to move in sync. Investors should always remember that technical indicators are usually lagging. Hence, the most critical leading indicator is still price action.

Accordingly, we rate JEPI as a Buy.

Be the first to comment