simpson33

Investment thesis

Cliq Digital (OTCPK:CLQDF) is a German streaming services company that few of us have heard of as its growth has accelerated very recently. The company is steadily increasing its number of subscribers thanks to aggressive marketing campaigns, which are translating into growing sales, EBITDA, and operating cash from operations. This has made it possible to establish a new dividend, which is growing at a dizzying pace thanks to a cash payout ratio of ~50% and growing cash from operations.

The current drop in the share price has left a dividend yield on cost of 6.21%, which suggests that this could be a good entry point for investors looking for a growing dividend income stream. Still, it’s important to understand the risks involved in investing in such a fast-growing small-cap streaming company at this moment, including the possibility of slowing growth sooner than anticipated, inability to retain the customer base acquired from aggressive marketing spending, high competitiveness in the industry, recessionary risks, and substantial potential changes in how the industry works.

A brief overview of the company

Cliq Digital is a global streaming entertainment provider focused on the performance marketing of mass-market entertainment products. Members of Cliq Digital have access to movies, series, music, more than 10,000 audiobooks, sports, and games. The company, which is headquartered in Düsseldorf, Germany, was founded in 2003 and has offices in Amsterdam, London, Paris, Barcelona, Toronto, and Florida, employing over 150 workers. Its current market cap stands at €115 million.

Cliq Digital products (Cliqdigital.com)

Cliq Digital is constantly partnering with content providers in order to increase its offerings on its platforms. In February 2022, it licensed 14 new complete series from Palatin Media for German and Austrian audiences, and in March, it signed a new deal with LEONINE Studios to offer major Hollywood movies and series. Later, in May 2022, it partnered with Sportdigital to offer three dedicated TV sports channels covering international football, fun and action sports, and horse riding.

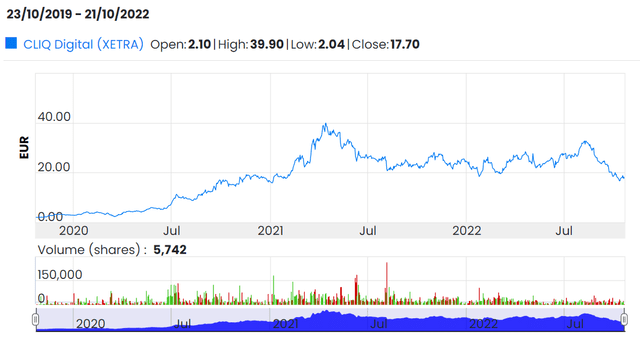

Cliq Digital share price (Cliqdigital.com/investors/stock)

Currently, shares are trading at €17.70, which represents a 57.14% decline from all-time highs of €41.30 in April 2021. Still, it is important to note that the number of shares outstanding increased by 5.17% in 2021. Normally, such a large drop in the share price is associated with relatively serious problems in a company’s operations or forecasts of slowing growth, but in the case of Cliq Digital, this is not an applicable reality. The German stock market is suffering big declines as a result of the war between Ukraine and Russia, which has pushed down the DAX30 by more than 20%. This has driven the share price of many companies down, including Cliq Digital. In this sense, the company’s operations remain intact, growth continues to be significant, and the only added risk in the short and medium term seems to be recessionary fears, which could lead to reduced consumer spending.

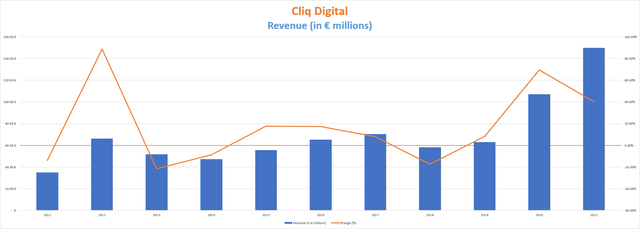

Revenues are experiencing explosive growth rates

Net sales increased by 40% in 2021 to €150 million. The goal of the management is to reach €500m in annual revenue by 2025, which would represent a major increase compared to 2021.

Cliq Digital revenue (Annual reports)

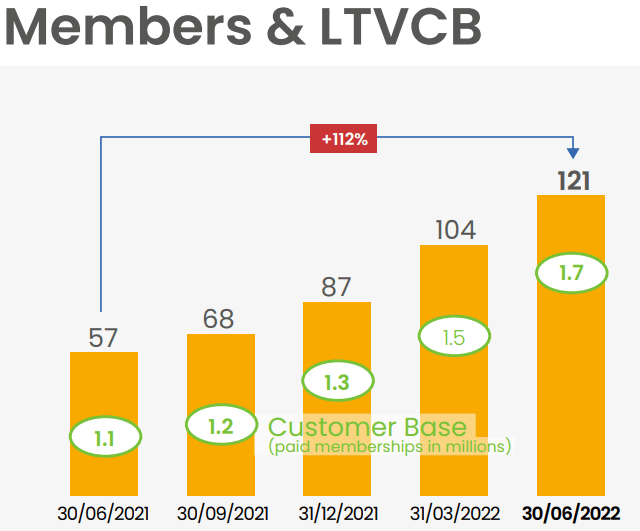

During the second quarter of 2022, paid memberships increased by 205,000 quarter to quarter to 1.7 million, and revenue grew by 94% compared to the same quarter of 2021 to €64 million, and by 22% quarter to quarter. This news comes after announcing an increase of 170,000 new customers during the first quarter of 2022, so growth is actually accelerating. Using the second quarter of 2022 as a reference, 59% of the company’s revenue is generated in North America, whereas 36% is generated in Europe and 4% from the rest of the world.

Cliq Digital customer base (Q2 2022 Quarterly report)

In this sense, the company is poised to exceed the trailing twelve months’ €250 million revenue mark in the near future and is on a good track to reach €500 million per year by 2025 considering the current growth rate.

After increasing its content offerings in the first half of 2022, the management plans to launch its Cliq.de platform at the end of 2022. The product was expected to be launched in September 2022 but has finally been postponed by a quarter. It is considered by them as the best value-for-money streaming solution for mass-market entertainment in Germany as it is expected to be launched with a reduced membership monthly fee of €6.99. It will be available on the web and through a native app for mobile and TV devices, and will include more than 500 cloud games from Blacknut, over 200 concerts, live sports from Sportdigital, and movies and series from Leonine and Palatin.

The company is highly profitable

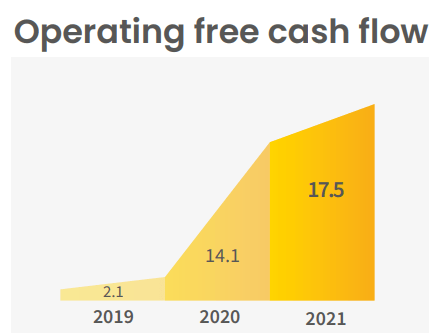

The company’s operating free cash flow has increased at a breakneck pace from €2.1 million in 2019 to €14.1 million in 2020 and €17.5 million in 2021.

Cliq Digital Operating free cash flow (Annual Reports)

During the first quarter of 2022, the company generated €0.2 million in operating free cash flow due to higher marketing spending of €22.5 million vs. €9.1 million during the same period of 2021. And during the second quarter, the company declared a free cash flow from operations of €-1.1 million due to higher marketing spending of €29.6 million vs. €11.9 million in the previous year and €2.4 million investments in content and the CLIQ.de platform.

So far, such high investments in marketing are resulting in a growing number of subscribed customers. Furthermore, the EBITDA increased by 60% to over €10 million during the second quarter of 2022 thanks to an EBITDA margin of 16%. In this sense, the company has a great ability to convert its sales into actual cash, although currently all the cash is being used to ensure a good customer base, which should allow for much higher cash from operations in the future despite high marketing efforts.

A solid balance sheet

With bank borrowings of €11.89 million and cash and equivalents of €6.17 million, the company is currently in a good debt position considering cash from operations was €17.5 million in 2021. Furthermore, trade receivables of €15.88 million are significantly higher than trade payables of €9.90 million and offset the company’s borrowings. Following this line, total current assets of €55.25 million and total assets of €118.65 million are higher than current liabilities of €38.8 million and total liabilities of €53.34 million, which shows big viability signs of the business even in the current stage marked by growth and high investments.

Still, aggressive marketing investments have recently caused a significant increase in bank borrowings as they were only €4.96 million during the second quarter of 2021, and I expect debt to keep increasing as the management is determined to keep increasing the customer base in order to reach the €500 million revenue goal by 2025. This increase in debt is not bad in itself because if it is accompanied by growth in the customer base the company should not have problems paying down its debt pile thanks to its wide margins, but it does increase the risks of significant impacts on the company’s operations should the company show inability to retain acquired customers as interest expenses will rise as a consequence of the acquired debt.

The dividend looks safe

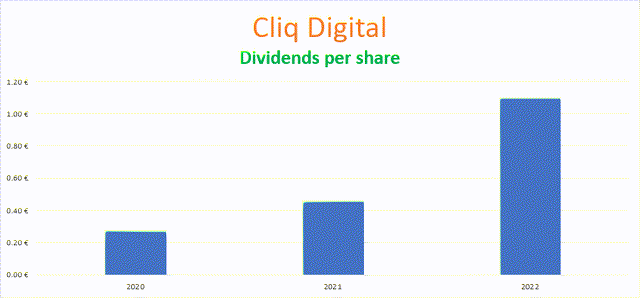

The company initiated a dividend of €0.28 per share in 2020, which increased to €0.46 in 2021 and €1.10 in 2022. Its dividend policy stipulates that ~40% of earnings per share will be paid in the form of dividends.

Cliq Digital dividends per share (Annual Reports)

At the current share price of €17.70, investors will enjoy a dividend yield on cost of 6.21% as long as the company keeps paying the current dividend of €1.10 per share. This dividend has a cost of ~€7 million per year, which is around half of the company’s operating free cash flow generated in 2021. In this sense, the company generates more than enough resources to cover the dividend and keep marketing expenses relatively high, so the dividend will keep growing should the number of base customers keep growing.

Still, the company’s dividend policy of paying ~40% of earnings per share to shareholders requires a certain tolerance for volatility in the dividend. If earnings per share declines and the management decide to stick to its dividend policy, this would result in lower dividends. Unlike many companies that decide to pay a fixed dividend with small increases year after year without taking into account short-term operational performance, Cliq Digital has a dividend policy that more easily accepts changes in the dividend payout based on short-term performance, which is good for preserving good balance sheet health at the cost of issuing fewer dividends when earnings decline.

Risks worth mentioning

The company operates in an industry with fierce competition. Key players like Netflix (NFLX), Disney+ (DIS), or Amazon Prime Video (AMZN) have a market penetration much higher than Cliq Digital and offer unique content for their subscribers. More companies could offer new streaming services in the near future, which could directly compete with Cliq Digital’s services.

Another risk I would like to mention is that the company’s debt pile has increased by €4.94 million year over year during the second quarter of 2022 as the management is eager to increase the customer base. Until now, this has translated into enormous growth in sales, but the customer base achieved through marketing campaigns needs to be retained in a large proportion in order to make it possible for this debt to be repaid relatively easily in the future or, failing that, ensure that the interest expenses of the debt are easily covered.

Also, the proportion of cash from operations allocated to marketing must be reduced in the medium term in order to achieve positive operating free cash flows, which could translate into a lower increase in the number of subscribers or, in the worst-case scenario, a stagnation or even decrease, which would hinder the company’s ability to meet the debt incurred in order to increase the number of subscribers through marketing campaigns.

And finally, the management needs to continuously increase the amount of content it offers to subscribers in order to achieve an acceptable retention rate once growth rates decline. This new content will have a cost for the company and brings the risk of not matching the tastes of consumers.

Conclusion

Cliq Digital is in an expansive stage marked by a growing customer base and increasing sales, EBITDA, and cash from operations, so the current dividend could continue to grow in the near future. The current share price decline of 57.14% represents a good opportunity to get a fair dividend yield on cost of 6.21% with high growth potential.

The company is investing large amounts of cash in marketing in order to increase the number of subscribers, which is working well so far. But its ability to retain these subscribers will be crucial in order to be able to reduce the proportion of cash used for marketing campaigns and thus generate positive operating free cash flows in the future without it resulting in a decrease in the number of subscribers.

Even so, the wide EBITDA margins place the company in a very advantageous position to find a healthy balance between the cash generated and the cash used for marketing campaigns while maintaining a large customer base, with which investors could continue to enjoy the current dividend, which has the potential to be increased significantly in the future as the growth stage is not over yet in my opinion.

Be the first to comment