Lu Zhang

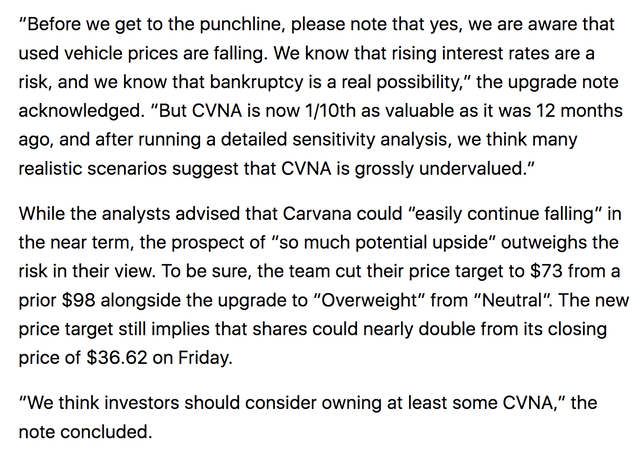

Piper Sandler (PIPR) recently released a note stating that Carvana (NYSE:NYSE:CVNA) stock is grossly undervalued with a 100% in upside potential. Based on our analysis of the note and our previous coverage of Carvana, we find Piper Sandler’s take on Carvana stock highly questionable. As such, we’ve decided to publish an article identifying the faultlines in the investment bank’s central argument.

The Note Itself

Piper Sandler’s note is somewhat confusing as it starts off by warning about the ongoing global economic risk but soon traverses into how Carvana is undervalued and could soon double in market value. It’s all a bit unaligned and confusing to me.

Here’s the note in full.

Let’s take it from the top by outlining the current economic concerns and how they could coalesce with Carvana stock to cause a further drawdown.

Cyclicality

The economy (which is inextricably linked to the stock market) isn’t a linear accumulation of value. In fact, the economy is highly cyclical, with repetitive peaks, bottoms, and troughs.

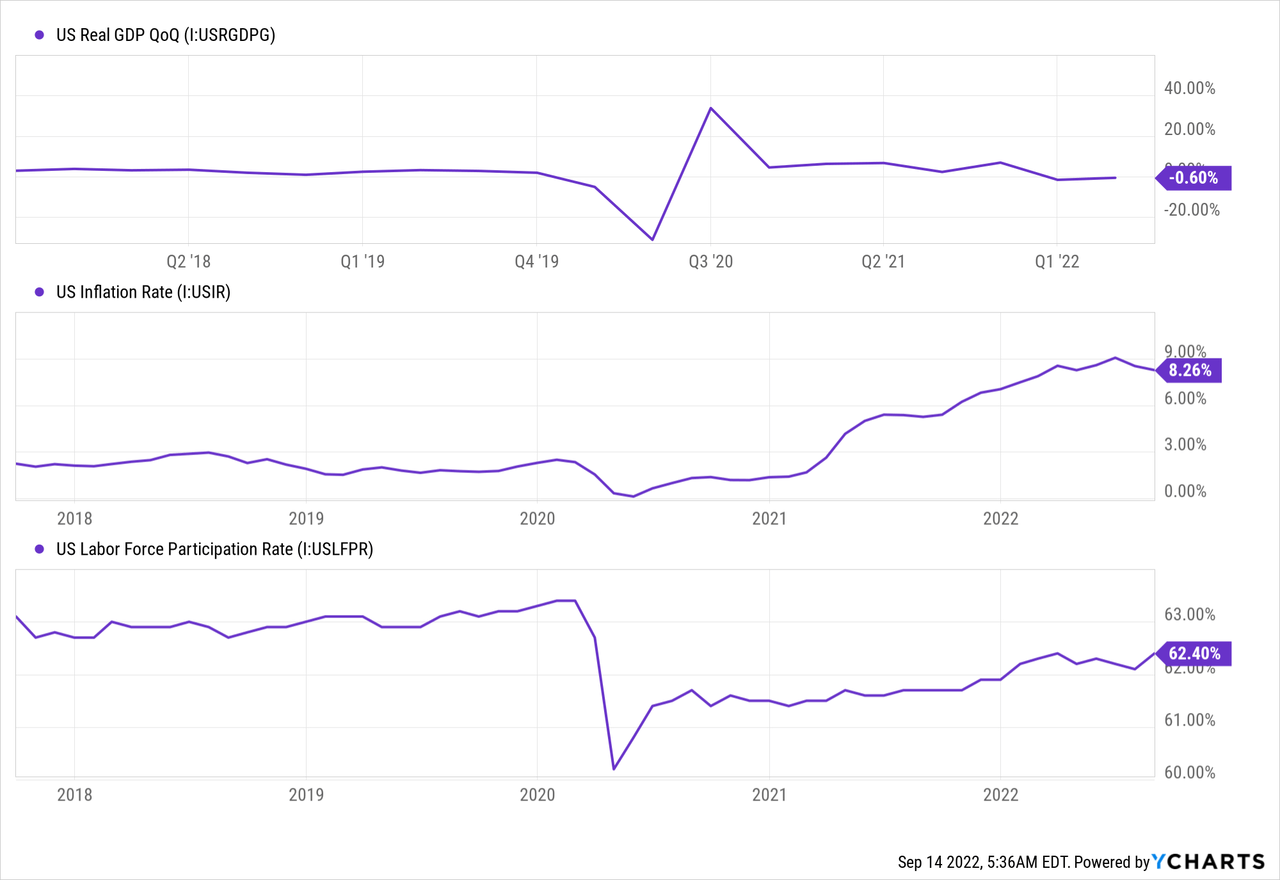

Based on parsimonious data, the U.S. economy is clearly on a downward trajectory. For instance, GDP’s softening, inflation remains resilient, the labor force is still tight, and there’s a pending energy crisis.

What do the fundamentals mean for Carvana?

Apart from common knowledge that vehicle sales slow during an economic downturn, there’s overwhelming evidence that durable and industrial goods sales soften in a rising interest rate environment.

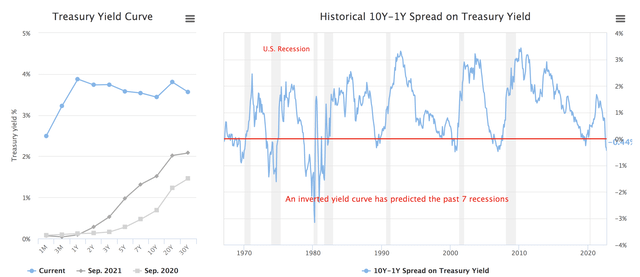

The bond yield is showing signs of flattening, which means that long-term interest rates will likely settle lower than short-term rates. This essentially means economists expect a prolonged stagnation of the economy, which is terrible news for cyclical stocks such as Carvana as they tend to tick around expected earnings.

Valuation Concerns

Piper Sandler’s base case is that Carvana is fundamentally undervalued. The only valuation metric I found aligned with the claim is the stock’s price-to-sales ratio, which is at a 4.35x discount compared to its threshold. However, this can’t be looked at in isolation as it’s a poor gauge of volatility.

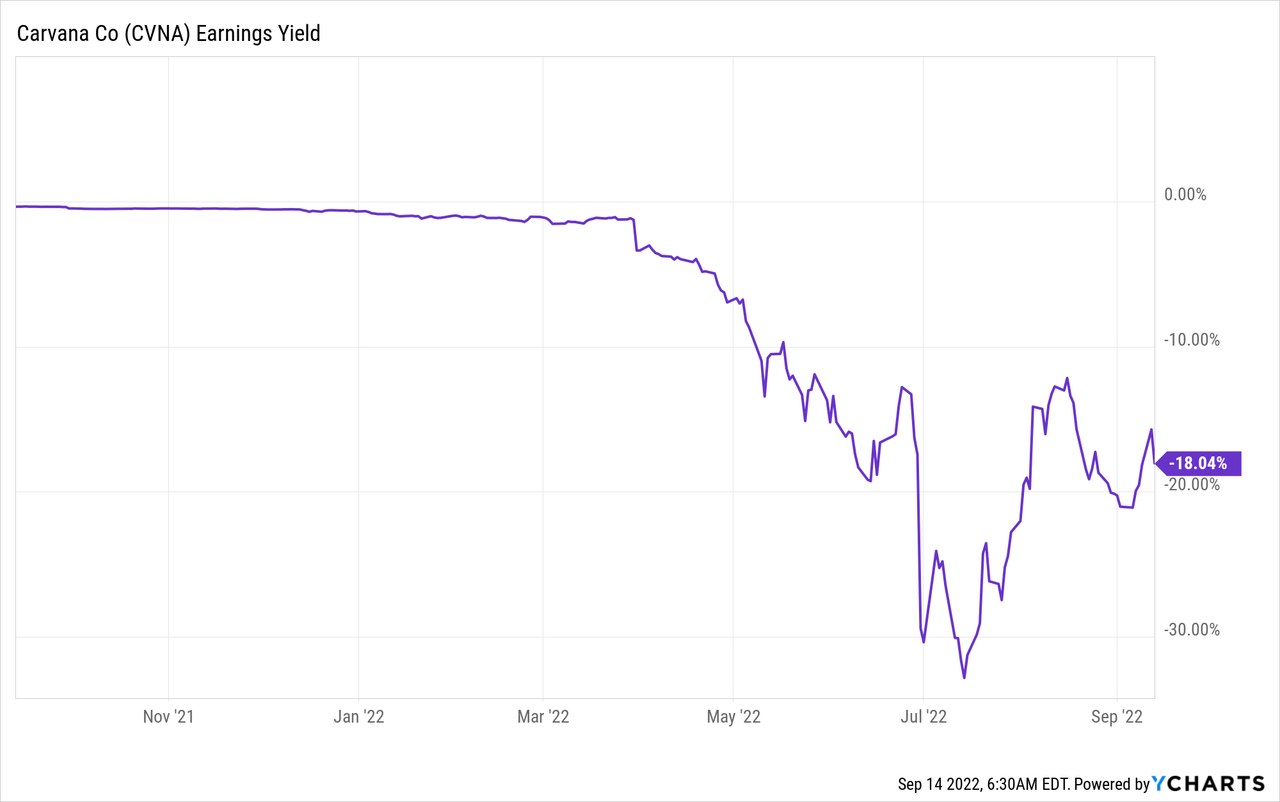

To enhance my valuation analysis, I observed Carvana’s earnings yield. I did this because I wanted to observe the company’s price-to-earnings. However, because the firm’s unprofitable and in a growth phase, I used the reciprocal (earnings yield) to draw a conclusion. Based on its earnings yield, Carvana is in horrible shape as it exhibits a poor bottom line, therefore diluting its investors’ residual value.

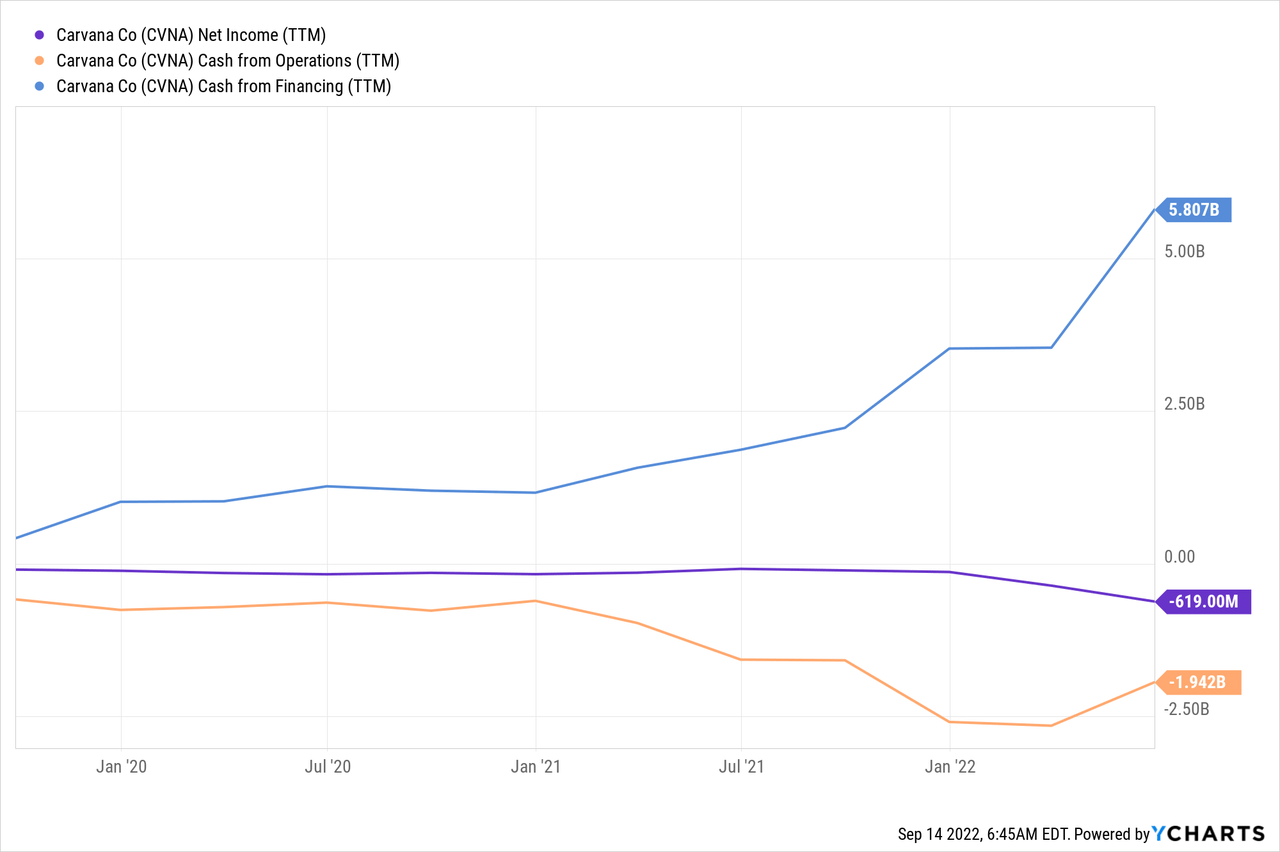

A final matter I’d like to point out on the topic of valuation is the company’s income accruals. Income accruals refer to the disconnect between a company’s reported net income and its cash flow (from operations and investing). Carvana’s net income is sky-high versus its operating and investing cash flows, implying aggressive earnings recognition.

How does Carvana backfill its income statement?

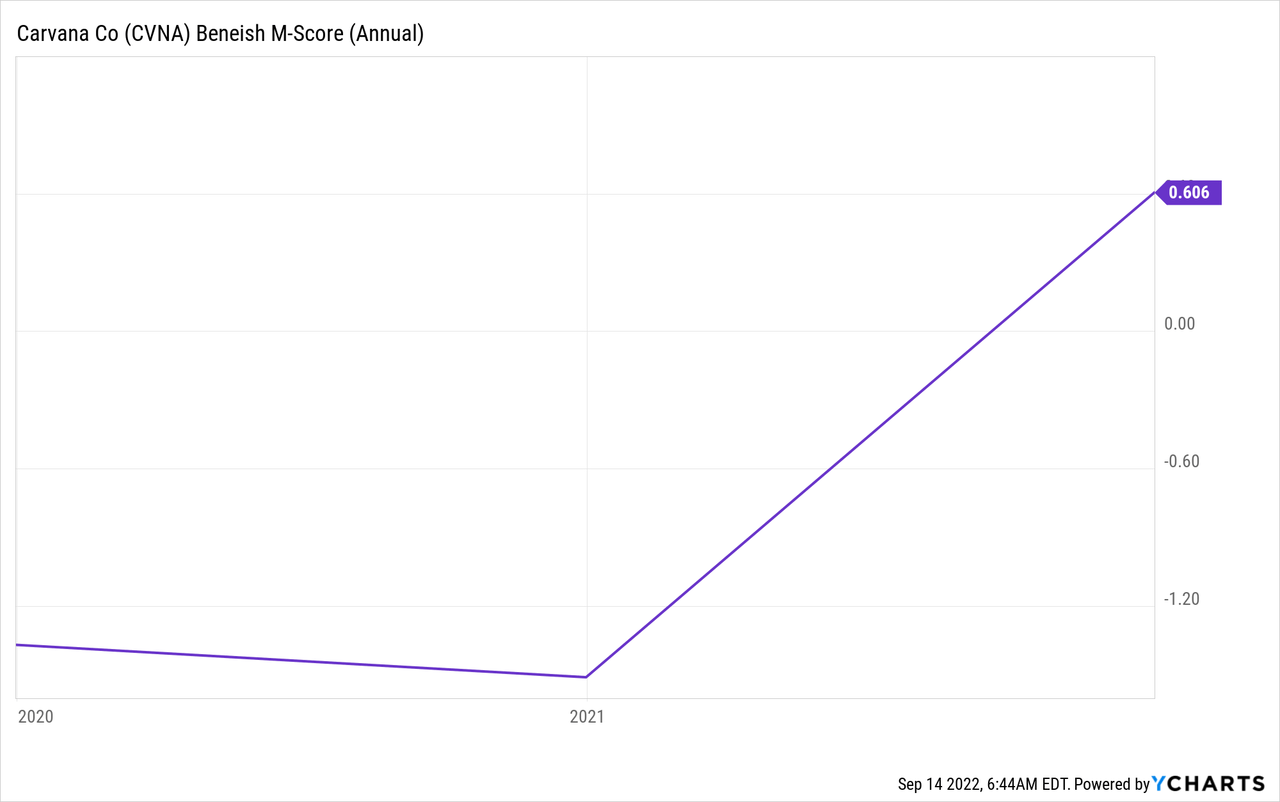

In a nutshell, Carvana seemingly does so via a combination of aggressive accounting procedures (indicated by its Beneish M-Score of 0.606) and financing cash flow. The latter is quite concerning as Carvana holds a large amount of debt on its balance sheet that’s priced at yields north of 10% (which is exorbitant).

A Potential Counterargument

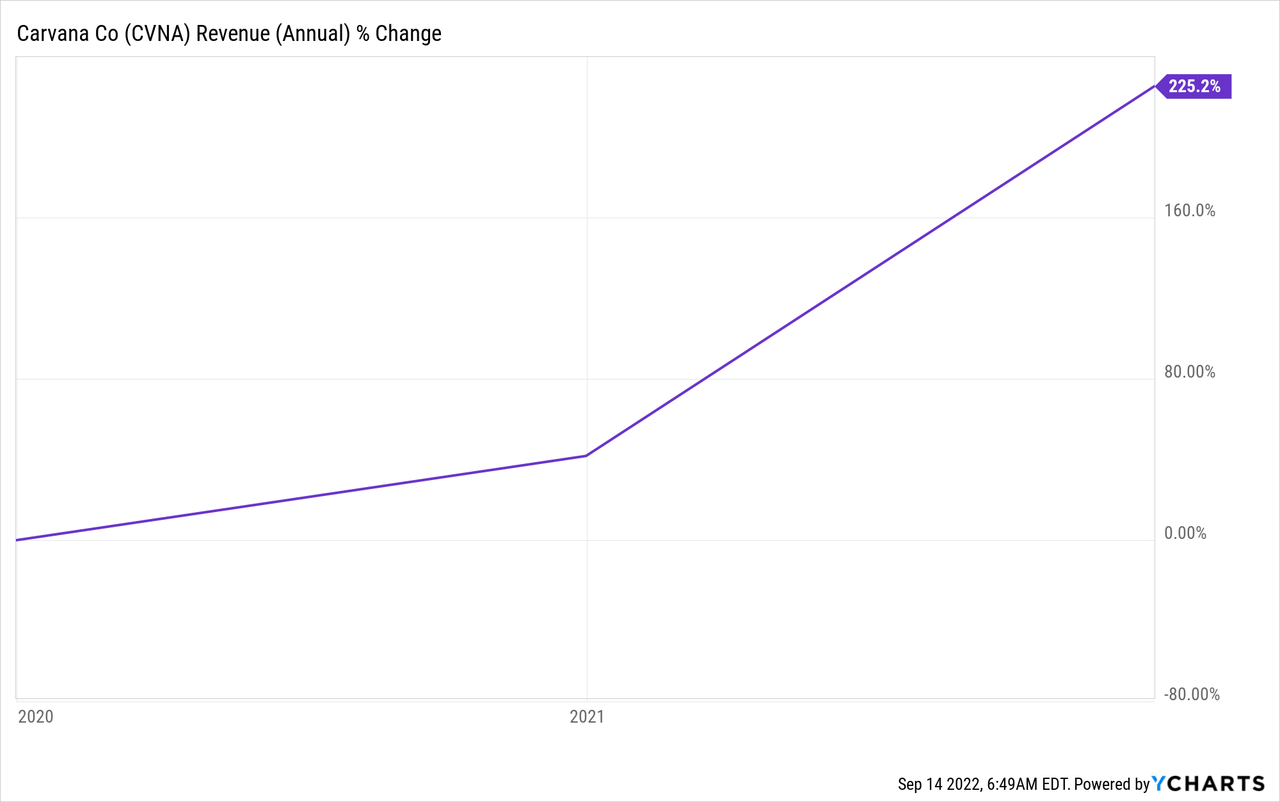

A counter to my argument would be that Carvana’s scaling quickly through various segments, with a 5-year revenue CAGR of 91.05%. Furthermore, the online car sales industry is expected to grow at a CAGR of 12.2% until 2029, with Carvana expected to reap much of the benefits as an industry leader, with JPMorgan (JPM) expecting the company to obtain a market share of roughly 35%.

Another aspect to consider is the “buy the dip” opportunity the stock presents. Many modern-day investors trade the markets based on historical price movements alone. Carvana’s relative valuation multiples are at a discount, and I won’t be surprised if numerous market participants load up on the stock just because it’s suffered a significant drawdown in the past year.

| Metric | Value | Discount to Avg. |

| Price-Sales | 0.23X | 82.75% |

| Price-Book | 7.22X | 81.49% |

Source: Seeking Alpha

Concluding Thoughts

Piper Sandler’s bullish rating on Carvana is slightly confusing. The current economic climate doesn’t play into cyclical growth stocks, despite many of them being fundamentally undervalued. Furthermore, Carvana’s bottom line valuation metrics are a mess, and its income accruals are getting out of control. As such, we reiterate our sell rating on Carvana.

Be the first to comment