PM Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on August 12th, 2022.

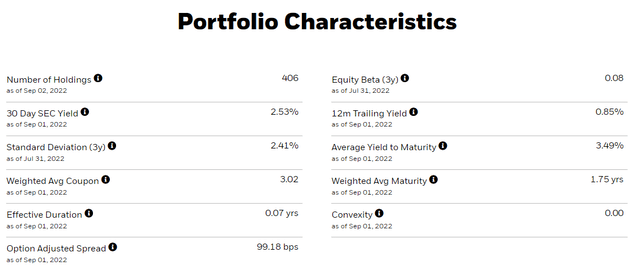

The iShares Floating Rate Bond ETF (BATS:FLOT) is a diversified floating rate bond index ETF. FLOT focuses on investment-grade floating rate bonds with short maturities, minimizing credit risk, interest rate risk, and overall volatility. FLOT’s holdings are quite safe, and the fund has low volatility, but dividends are quite low too, with a 2.5% forward dividend yield. In my opinion, FLOT is appropriate for more conservative investors looking for cash-like funds, inappropriate for most others.

FLOT – Basics

- Investment Manager: BlackRock

- Forward Dividend Yield: 2.5%

- Expense Ratio: 0.15%

- Total Returns CAGR 10Y: 1.2%

FLOT – Overview

FLOT is a simple floating rate bond index ETF. The fund invests in most relevant dollar-denominated, investment-grade, floating rate bonds with remaining maturities between one month and five years. These three characteristics tell us basically everything we need to know about the fund and its holdings, so let’s have a deeper look at each.

Floating Rate Bonds

Some context first.

Most bond and bond funds pay a fixed rate of interest for their entire duration, until maturity. When the Federal Reserve hikes rates, or when rates move in anticipation of Fed hikes, only the interest rate payments on newly issued bonds change. Older bonds retain their original interest rates.

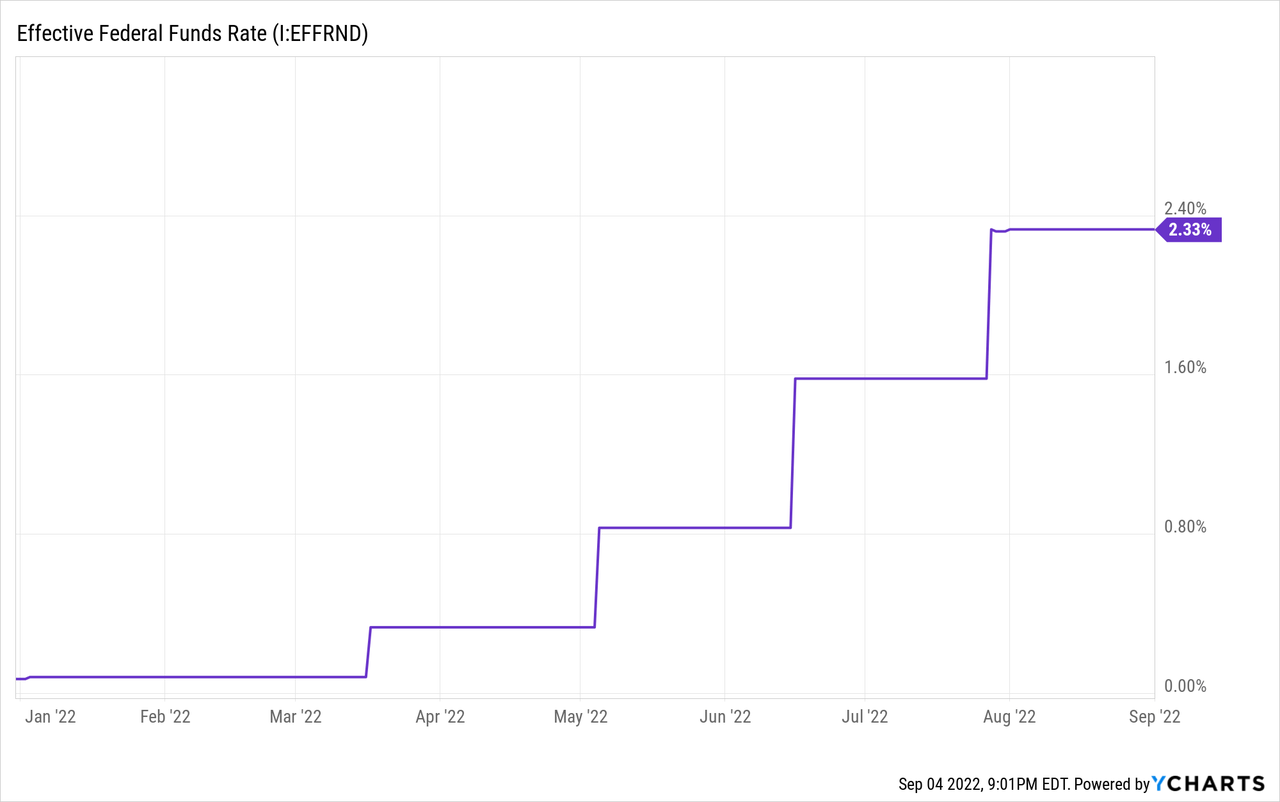

Floating rate bonds, on the other hand, pay a floating rate of interest. Interest rate payments are indexed to a reference rate, usually LIBOR. LIBOR is technically a measure of interbank lending rates but, for all intents and purposes, is equivalent to the Federal Reserve target interest rate. Federal Reserve hikes rates, floating rate bond interest rate go up, and vice versa.

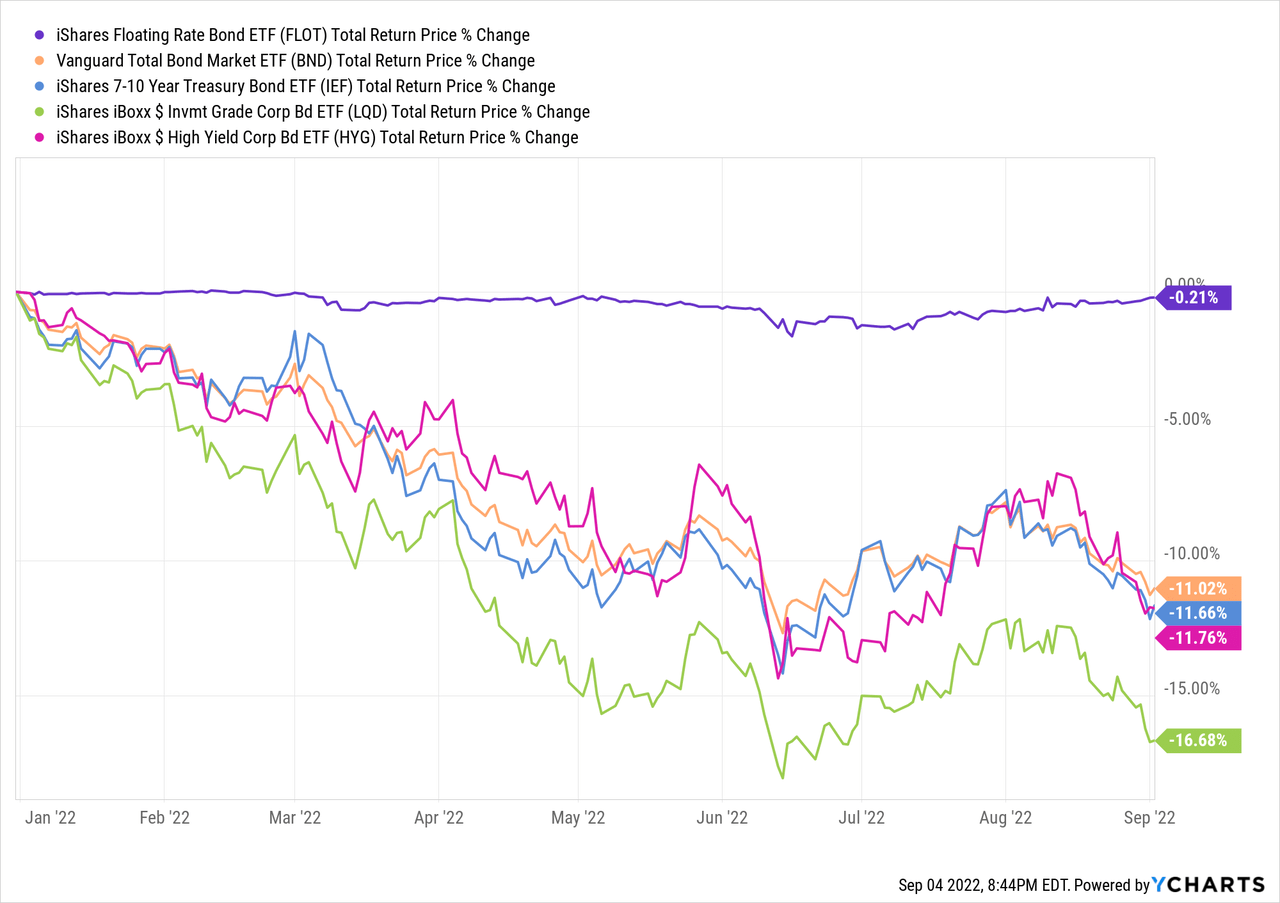

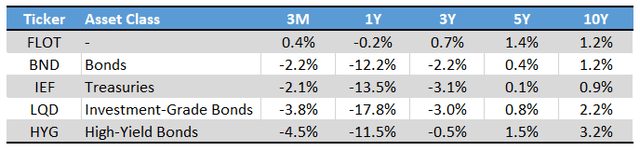

Due to the above, fixed rate bonds and floating rate bonds behave very differently when interest rates are rising. Fixed rate bonds tend to see cratering prices when rates rise, as investors sell their older, lower-yielding bonds, to buy newer, higher-yielding alternatives. Floating rate bonds, on the other hand, see rising interest rate payments when rates rise. As such, floating rate bond funds tend to outperform comparable fixed rate bond funds when rates rise. FLOT itself has outperformed relative to all relevant fixed rate bond index ETFs YTD, as expected.

FLOT’s outperformance during periods of rising interest rates is a significant benefit for the fund and its shareholders, and FLOT’s most important differentiator. Most bond funds will suffer losses when interest rates rise, FLOT will not, so the fund might make sense for investors wishing to avoid said losses / concerned about further interest rate hikes.

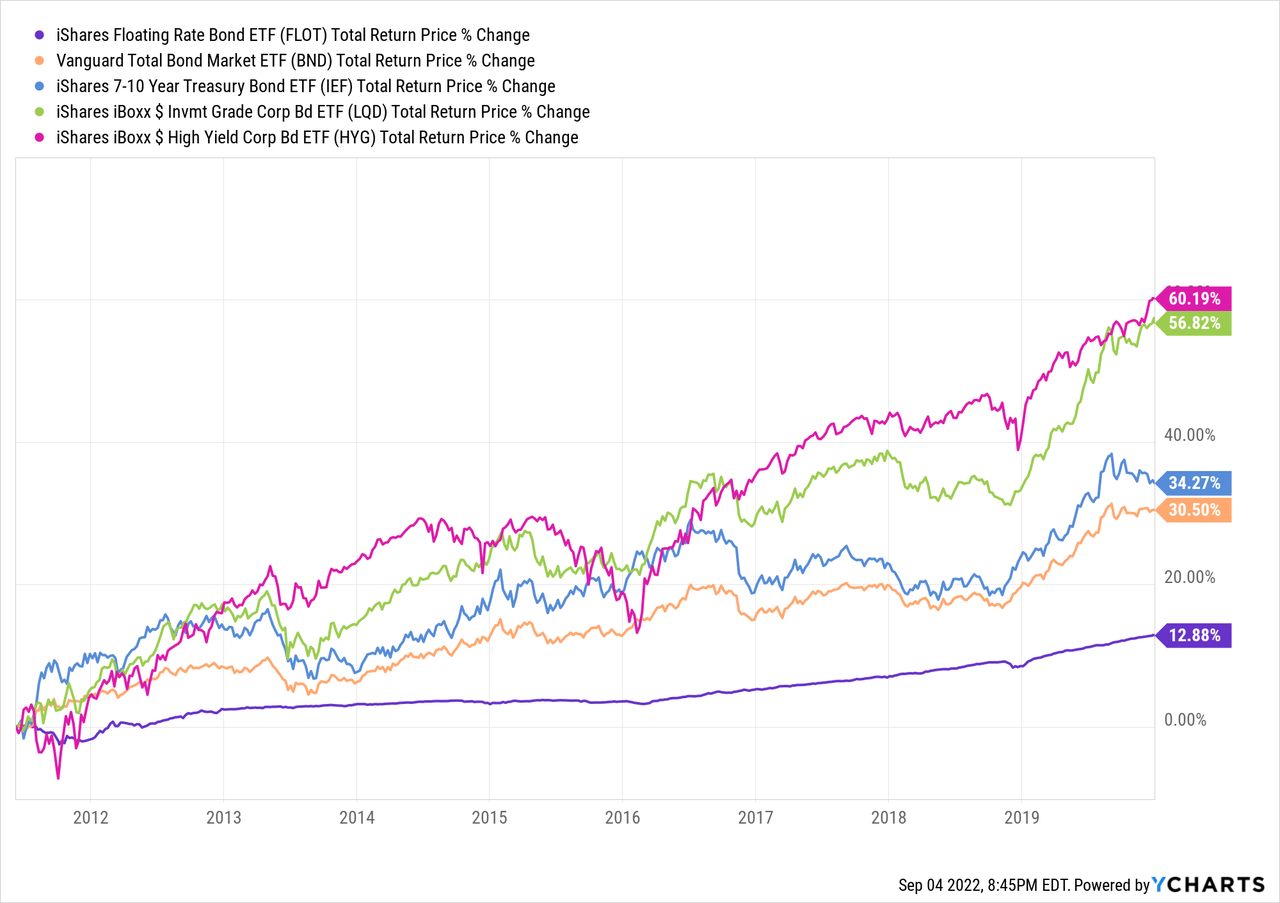

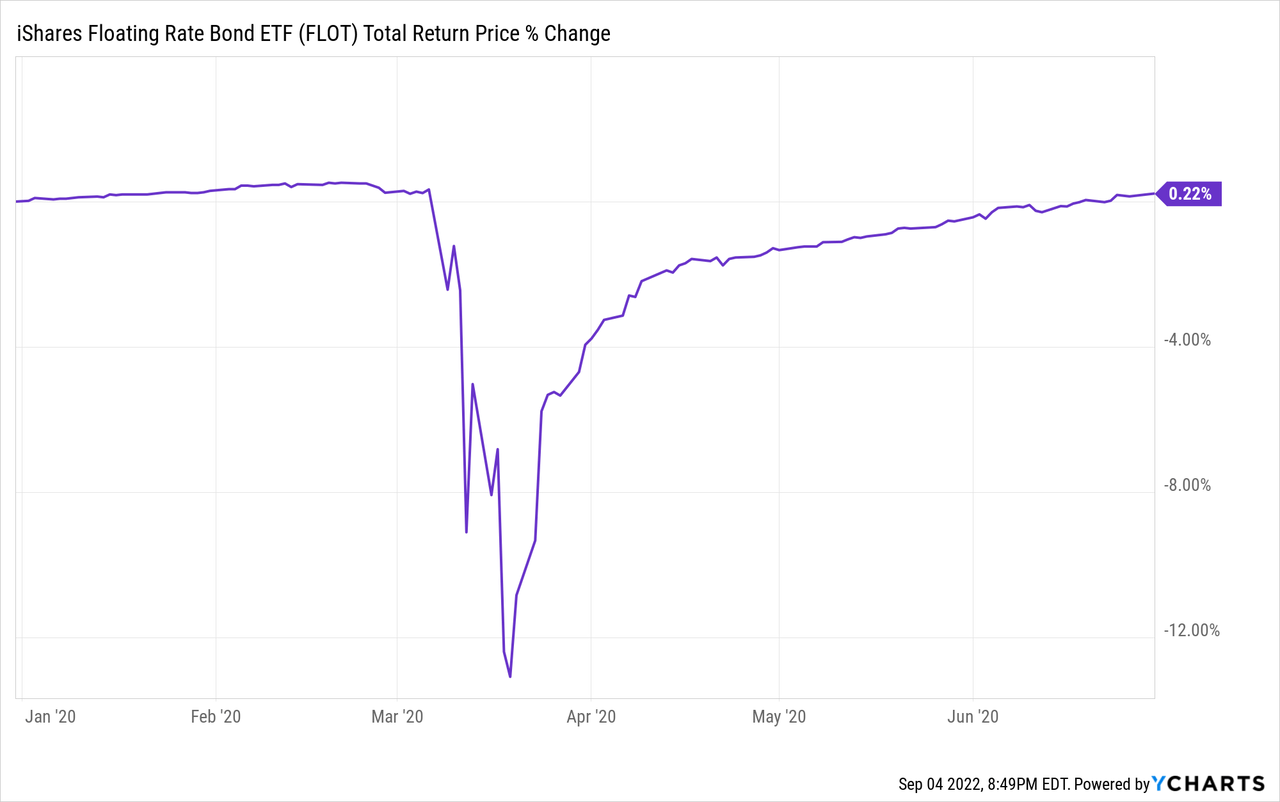

On the other hand, FLOT will generally underperform when interest rate decrease. Although interest rate cuts seem incredibly unlikely under current economic conditions, conditions can always change, and the long-term trend is towards lower and lower interest rates, due to secular stagnation, population plateaus, and more efficient, deeper capital pools. Interest rates have mostly declined during the past decade, during which FLOT has underperformed, as expected. The graph below goes until 2020, so as to focus on periods of declining interest rates, excluding pandemic volatility and recent interest rate hikes.

Investment-Grade Bonds

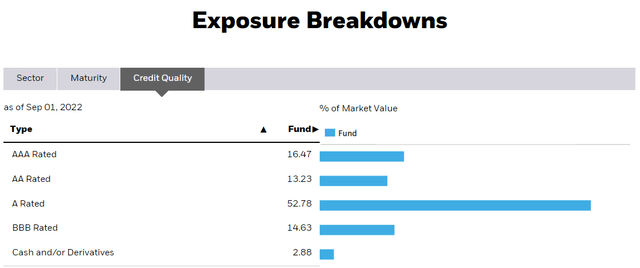

FLOT exclusively invests in investment-grade bonds with strong credit ratings, and issued by companies with solid financials and balance sheets. FLOT’s holdings sport an average credit rating of A, compared to the investment-grade average of BBB. It is a strong credit rating, an higher than average for a fund of its kind.

FLOT

Strong credit ratings reduce credit risk, default rates, and potential losses during downturns. As such, the fund should perform reasonably well during downturns and recessions, as was the case during early 2020, the onset of the coronavirus pandemic. FLOT suffered losses of about 5.0%, peak to through, but had completely recovered from these by June. Results were quite good, all things considered.

Short-Term Bonds

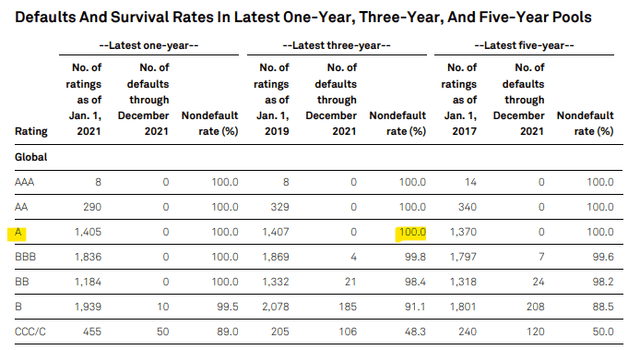

FLOT focuses on short-term bonds, with maturities between one month and five years, and a weighted average maturity of just 1.8 years. Focusing on short-term bonds serves to massively decrease credit risk, as strong companies with solid balance sheets and financials rarely go bankrupt in a short amount of time. In fact, two year default rates for investment-grade bonds are effectively zero, and are zero for bonds rated A.

S&P

Investment-grade corporate bonds do, sometimes, suffer from defaults, but rarely in a 2-year time frame. A more common occurrence is for investment-grade issuers to enter into financial difficulties, suffer from credit downgrades, and go bankrupt a few years later. Said process takes time, usually more than two years. FLOT focuses on short-term bonds, can avoid these issues, and suffers significantly lower defaults than funds focusing on long-term investment-grade corporate bonds.

FLOT’s floating rate, investment-grade, short-term bonds are safe securities, with extremely low credit, interest rate, and default risk. As such, and in my opinion, the fund is a relatively safe investment opportunity, particularly appropriate for more risk-averse investors.

FLOT – Dividend Analysis

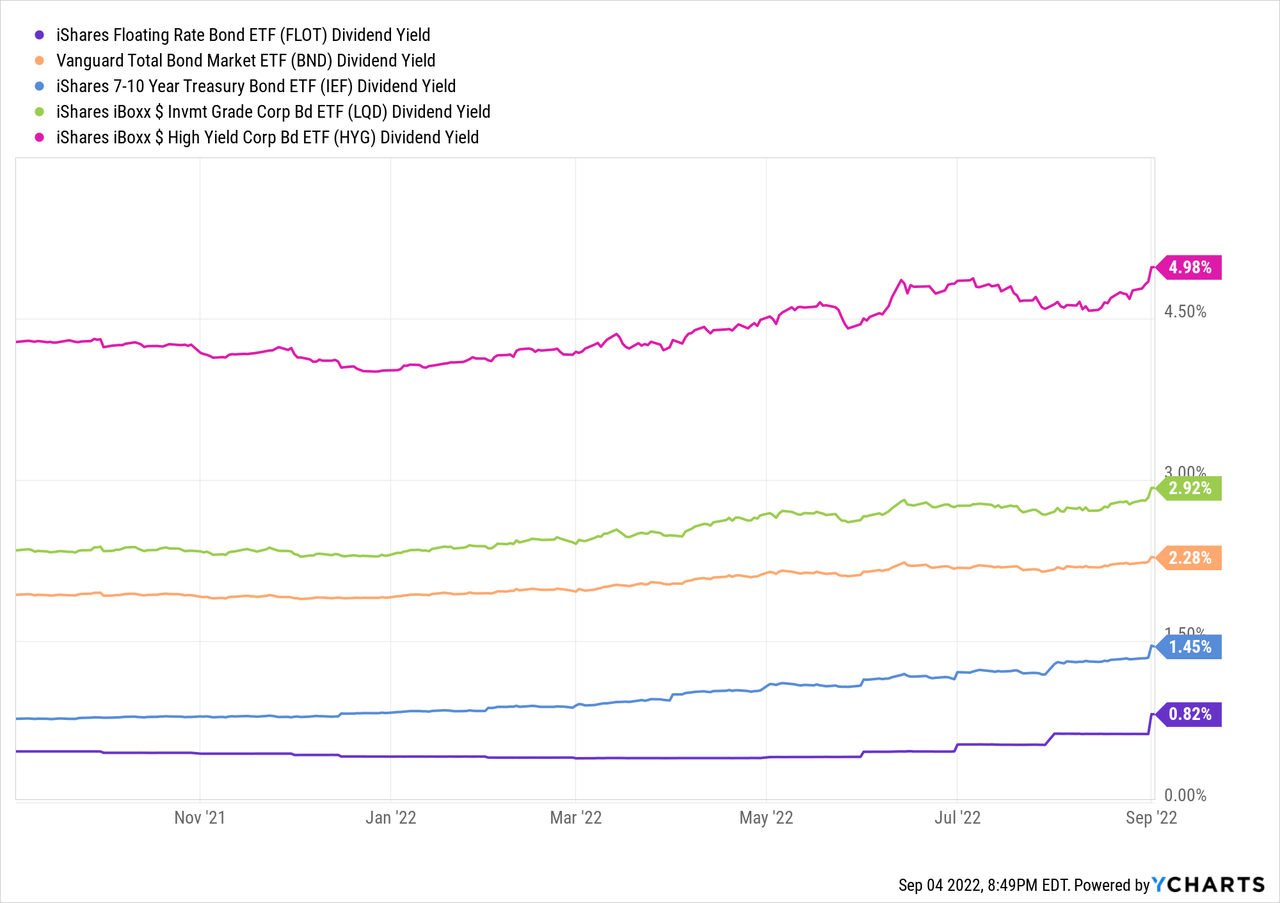

Safe, low-risk securities and funds tend to sport low dividend yields, and that is the case for FLOT. The fund currently sports a trailing twelve-months yield of 0.82%, an incredibly low figure, and significantly lower than that of its peers.

FLOT

Approximately all expected dividend growth has already materialized as well, with the fund’s dividend sixtupling YTD. Annualize the latest dividend payment, and I arrive at a 2.5% dividend yield, equivalent to its current SEC yield.

Notwithstanding the above, the fund’s (expected) dividends are low, and quite a bit lower than average. FLOT is a safe fund, in my opinion, but also a low-yielding one. The combination might make sense for more risk-averse investors and retirees, less so for others.

FLOT – Performance Analysis

FLOT’s performance track-record is, well, about what one would expect from a safe, low-yielding, floating rate bond. Long-term returns are low, and quite a bit lower than average, due to the fund’s low yield. As the fund’s current and expected yield remain quite low, investors should expect further long-term underperformance. On the other hand, the fund has significantly outperformed YTD, as interest rates have risen. Insofar as interest rates continue to rise, the fund should continue to outperform.

ETF.com – Chart by Author

Conclusion

I believe FLOT is a safe fund, with low credit, interest, and default rate risk. On the other hand, the fund’s yield is quite low, with a 2.5% forward dividend yield. As such, and in my opinion, the fund is appropriate for more conservative investors looking for cash-like funds, inappropriate for most others.

Be the first to comment