Maksim Labkouski

Jefferies (NYSE:JEF) is yet another non-bank financial company that we keep our eye on from time to time, and its undergoing some changes that warrant its consideration. While some of its transaction-based activity has taken a hit, it is trying to monetize its merchant banking portfolio. Indeed, it already has monetized some parts of it, but there’s more to come that could act as a 10% value catalyst to the company. With Jefferies also becoming a more important and respected full service bank, actually close to the vaunted bulge bracket status, and with resilience in the mid-market, we actually think it’s a solid buy.

JEF Q2 Notes

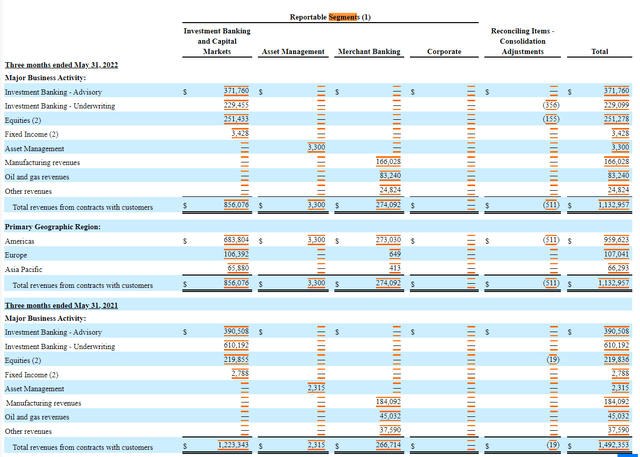

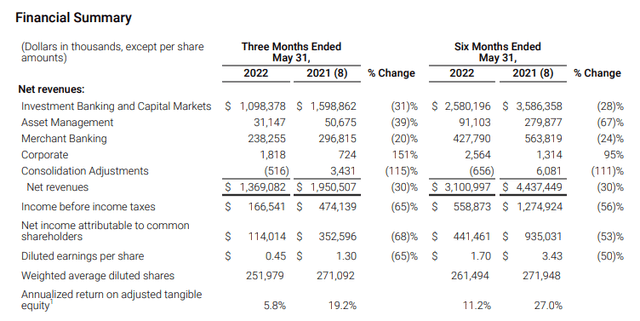

Before we discuss merchant banking, let’s address the Q2. Much of what you’d expect happened. There’s a 28% decline in the IB and CM businesses on a 6 month basis. The advisory business, which alone is about 33% of JEF’s revenues, declined by less than 10%. The part that fell dramatically was the equity capital markets and the debt capital markets business, which accounts for about 20% of revenue, and fell almost 60%.

Revenue Split (sec.gov (10-Q))

These markets basically shut, especially ECM. DCM at least has the benefit of being a market where corporates can lock in rates that are still low. However, with banks likely pricing in further rate hikes, customers are unlikely to get that much benefit at this point from debt raising.

PR Revenue Split (different from the 10-Q disaggregation) (PR Q2 2022)

Asset management fell by a lot according the press release data. This is driven firstly by declines in their own investments, where investments in debt and equity fell as rates rose and markets crashed. Placement activity, where they connect institutions with allocators, went pretty well, but it is a marginal contributor.

Merchant banking declined, apparently because of mark-to-market accounting associated with derivative contracts in the Vitesse energy business.

Merchant Banking

Let’s briefly discuss the Merchant banking business. This is a ‘legacy’ business that is in the process of being monetized. It is being managed and held separately as it gets hewn apart.

How is this going?

They’ve made two big decisions since the Q2: Idaho Timber got sold for more than 2x its book value at about 2.6x revenues. We don’t know its profit contribution, but it is likely to have sold at a pretty good multiple, probably in the low double-digits. Unsurprising. The timber markets have steadily improved, with less volatility than lumber. Also, the book value will of course understate values now that private markets especially pay dearly for assets.

Vitesse Energy also has a development, which is that it is being spun off into a standalone entity that will trade on the NYSE. It accounts for 33% of the net book value of the merchant banking portfolio. It produces about $300 million annually in revenue where it is entitled to earnings from interests in oil assets in the shale basins in the US, obviously supported by the current commodity price environment. We think the business could be valued at around $700 million, but possibly more depending on the margin profile. Still, that’s 10% of the market cap getting added to JEF stock accounts, and a 50% revaluation from book value.

Conclusions

Ultimately, JEF doesn’t look so bad. Naturally, it is absorbing the effects on capital markets from the current economic environment. Higher rates are hurting its portfolio of fixed income assets, of which it has lots. It is also affecting DCM and ECM activity, markets which are dead right now. Advisory is doing pretty good still, showing strength in that franchise. Rates will have to keep rising, and the direction still doesn’t look great for advisors which gives us pause, but a 10x PE isn’t bad for the company. With shareholders receiving oil and gas interests with Vitesse that could see meaningful revaluation, there is something to look forward to. With more in the merchant banking portfolio, there could be more realizable value to put in JEF shareholder pockets, perhaps enough to account for 25% of market cap, including the Linkem shares and the real estate portfolio.

Be the first to comment