ALEAIMAGE/E+ via Getty Images

I did something in August that I never thought I’d do. I sold some Apple (AAPL), one of the highest quality companies in the world. The sale wasn’t entirely by choice. It was more of a pre-emptive strike and taking advantage of Apple’s relatively high valuation.

It was a pre-emptive move on my part, as a work situation will likely make me a forced seller of Apple, even though I will have no contact with the company. Strangely, members of Congress have few limitations on trading companies even as they pass laws, have appropriate money, and have more inside information than most of the company’s employees. But this is the world in which we live.

I took advantage of the large upwards move by Apple at the end of July by selling covered calls against part of my position. Little did I know, the company would continue its march higher. I ended up getting called out at $167.50 and $170. I was hoping to roll the calls for a bit, but I still think the company is overvalued at those prices.

The other reason I started selling the calls was to try and raise money to cover my taxes if I became a forced seller. I had a very low-cost basis in these shares, and taxes will be significant. Had these shares been in a sheltered account, I wouldn’t have been so concerned with the sale. However, I’m not terribly disappointed, as I explain below.

5 Reasons I’m Not Upset About Selling Apple

- As many readers know, the goal of my portfolio is to double the income every seven years while reinvesting dividends and every ten years without reinvestment. This requires a dividend growth rate of 7%. Apple’s recent raise of 5% was below this mark, and as I wrote about earlier this year, I’m not convinced of their commitment to the dividend.

- Apple has a minuscule dividend rate of only 0.52%. I invested in Apple for the dividend and the potential for dividend growth. When I invested, the company was yielding close to 3%. Today’s meager yield and slower dividend growth make it a difficult fit in my portfolio.

- Even after taxes, I only need to invest in companies yielding 0.7% to match the income provided by Apple. This low bar opens up nearly the entire universe of dividend-yielding companies as potential replacements. I could reinvest entirely in Microsoft (MSFT) or Visa (V) and increase my overall income.

- Apple had grown to over 11% of the total portfolio. While this isn’t overly concerning, as I am focused on income growth, it’s still a massive portion of the portfolio generating only 1.7% of the income.

- It made sense to hold Apple over the past decade. While I focus on dividend growth, capital appreciation is nice as well. The current PE of Apple is approaching 30. If the company can grow by 10% annually, it will add nearly $60 billion in revenue yearly by 2027. For perspective, this is bigger than the GDP of the smallest five states! And this is at 10% growth. I’m not sure a company only growing at 10% deserves to sport a 30 PE. At some point, the large numbers will catch up to Apple shares.

The top reason I’m disappointed to let some Apple go is the sheer quality of the company. Factors I consider in quality are dividend safety, the potential for future dividend growth, and commitment to the dividend. Of course, several other factors go into determining dividend safety and the potential for dividend growth. While I question Apple’s commitment to the distribution, on the other two, Apple is top shelf.

While nearly any company can provide a better income, few can match the overall quality of Apple. Of the companies I currently hold, I only rate Microsoft so highly. Closely behind, I consider Visa, Mastercard (MA), BlackRock (BLK), Automatic Data Processing (ADP), and Texas Instruments (TXN).

While it’s tempting to buy a couple of thousand dollars’ worth of Altria (MO) or Enterprise Products Partners (EPD) and dump the remainder into Microsoft, I decided not to follow this route. Although to be fair, most of the cash has not yet been redeployed. I have only invested enough to replace the lost income and then some.

Typically when I sell a position on overvaluation, I spread the funds out over a few companies. In this case, I chose four companies to establish new positions. At the end of August, these are still micro positions. I consider micro positions as less than 0.5% of the portfolio. Over time these will all be expanded to at least 1%.

Additionally, some of the funds will be invested on a valuation basis to positions in the portfolio that I want to expand. Since the four new purchases will cover the lost income, there is no rush to invest the rest of the funds. At this time, the companies I would most like to add to are Visa, Microsoft, Texas Instruments, Broadcom (AVGO), Home Depot (HD), Snap-on (SNA), and ADP.

When I make regular purchases from dividends received, I generally purchase companies that I see as a bargain. I loosen this a bit when reinvesting funds from sales as I am more focused on spreading the risk, replacing the income, increasing dividend growth, and maintaining quality. Below I discuss the four companies in which I initially reinvested.

BlackRock

As the world’s largest asset manager, BlackRock has been a proven leader for decades. While it doesn’t have the margins of Visa (few companies do), it has healthy operating and gross margins. While the company has a few operating segments, the fact is that as an asset management company, they take a beating when the market is down. If we see a further downturn later in the year, I will add more as the price drops.

Blackstone (BX) has been raising the dividend for 13 years at an impressive clip. The 3, 5, and 10-year growth rates are over 11%, and the most recent increase was 18%! More importantly, they have been doing this without expanding the payout ratio. The payout ratio has consistently hovered in the mid-40% range, although I expect to see a spike with the market downturn.

During June and July, BlackRock was a fantastic bargain. Today, it’s much closer to fairly priced. However, the current yield is many times that of Apple. Everything points toward the long-term success of this company, and it is a solid choice to anchor my basket of replacement stocks.

CME Group (CME) & Intercontinental Exchange (ICE)

These two exchange and derivative operators are in an industry with relatively high barriers to entry. Both are highly profitable companies with histories of dividend growth. CME has raised the dividend for twelve years, having frozen the distribution during the GFC. ICE has increased the dividend yearly since beginning payouts, and the streak stands at ten years.

Both companies, on the surface, appear to be relatively low yielding. However, as these are highly profitable companies, they generate a lot of cash. CME regularly pays a special dividend, averaging $2.55 over the past ten years, with last year’s at $3.25 per share, pushing the yield above 3%. On the other hand, ICE opts to use the excess cash to make regular acquisitions and has operating segments beyond the exchanges.

While neither of these companies is particularly great bargains, I expect both companies to continue growing the dividend at near double digits well into the future.

Fortune Brands Home & Security (FBHS)

Adding Fortune Brands to the portfolio fills a couple of roles. The portfolio is very light in industrials. Aside from Lockheed Martin (LMT), the portfolio has micro-positions in Honeywell (HON) and Snap-on. And unlike the latter two, FBHS is trading at a very attractive valuation, as shown in the Fastgraph below.

Fortune Brands only has a 10-year dividend growth streak. I prefer to invest in companies that raised through the GFC, but FBHS has only been a standalone company since 2011. However, with a payout ratio near 20%, the company has plenty of room to absorb some shocks.

The company only has a market cap of about $8 billion, making it one of the smallest companies I hold. However, I don’t use company size as a determinant in picking stocks for this portfolio. In fact, I welcome the diversity as it’s easy to overlook some great smaller companies for dividend growth.

How is 2022 Shaping Up?

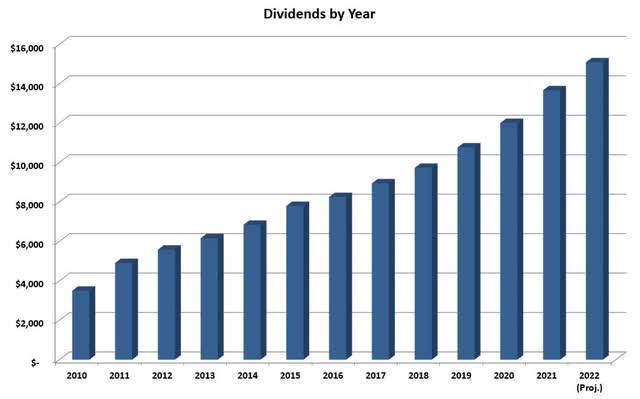

The current income projection for the year stands at $15,383, a 12.6% increase over last year. The income will continue to grow as dividends are reinvested and can increase substantially if Blackstone follows up with another massive increase in Q4 and as the funds from the Apple sale are reinvested.

It should be noted that this is a closed portfolio, and no new capital has been added since 2016. The chart below shows the dividend growth over the years.

August’s Dividend Increases

There was only one expected increase for the month, but it was a big one. Altria (MO) is the single biggest income provider in the portfolio. The company announced a 4.4% increase, slightly exceeding my expectation in the 3-4% range. While this was well below its 5-year average increase, I expect this to be more the norm in the future.

There was one surprise increase last month. Simon Property Group (SPG) announced its second increase of the year! It raised the dividend another 6%, on top of the 3% raise earlier this year. While the company has yet to match its dividend before the cut in 2020, it is steadily closing the gap.

September’s Expected Increases

September is a huge month for increases. Not only in number but in significance to the portfolio as many large positions, large income producers, or faster dividend growers set new dividend rates. Below is the rundown of all my expectations.

Honeywell

Honeywell is one of the smallest positions in the portfolio. The position was started in 2017 and has been too expensive to add more. It presently is a micro position at less than 0.5% of the portfolio. Honeywell has a five-year dividend growth rate of 9%; however, I expect this year’s raise to be similar to last year’s 5.4%.

Lockheed Martin

As one of the ten largest holdings and ten largest income producers in the portfolio, LMT’s annual raise is important to meeting my goals. In each of the last four years, the company has given a $0.20 raise. I expect the company to do the same again this year and then increase it next year. A twenty-cent raise this year will equate to 7%. Look for a better increase next year.

Microsoft

With the sale of some Apple, Microsoft becomes the third largest holding, behind Ameriprise (AMP) and Blackstone. Unlike Apple, however, MSFT has shown a commitment to growing the dividend with a 20-year growth streak and consistently raising in the 10% range. Expect another 10% raise this year.

Texas Instruments

Another top ten in size and income contribution, TXN, is a cornerstone company in the portfolio. Texas Instruments investors have gotten used to some monster dividend growth rates, usually well over 10%. However, I think the company will take a more conservative stance this year. Look for TXN to build on its 18 years of dividend growth with a raise in the 7-10% range.

Philip Morris (PM)

As the third largest income producer, trailing only Altria and Blackstone, PM’s raise is essential to meeting the overall goals of the portfolio. It seems like the company is battling exchange rate issues every year, and this year is no different. The company has a 5-year dividend growth rate of 3.4%, and I expect a raise in the 3-4% range once again.

STORE Capital (STOR)

The STORE Capital position was established as a replacement for Preferred Apartments earlier this year. STOR remains one of the smallest positions due to its short dividend growth history of only seven years. The company has a 5-year dividend growth rate of close to 6%, and I look to see something similar this year.

Sales in August

The sale of two lots of Apple made last month very unusual. I rarely make any sales. Companies are purchased with the intent to hold them forever. Last month there were no other changes.

Regular Purchases

August was a slow month for purchases. Most of the month continued July’s run-up in prices, and bargains were slim. I continued to accumulate dividends expecting better prices in September. Shown below are the few purchases made in August. Note the prices shown are average prices.

- 2 Shares of Medtronic (MDT) @ $89.64

- 1 Share of Prudential (PRU) @ 99.45

- 2 Shares of STORE Capital @ 27.56

What Else Am I Looking At?

Since this is a closed portfolio, I can’t buy everything that looks interesting. I use this section to cover what I purchase and consider in my other portfolios. The other portfolios have different goals and rules but are also dividend growth portfolios.

At the end of August and into early September, prices began to come back down. While some bargains are showing up, the markets are still above the lows seen earlier this year. I believe we will match and exceed these lows in the coming months. However, I’ll take a bargain whenever it comes, as my holding period is forever.

While banks and insurance companies are not down to their lows of the year, they still offer good value. While I have been nibbling on Prudential and Morgan Stanley (MS), many others are at bargain prices, especially if you comb through the regional banks.

Best Buy (BBY), Tractor Supply (TSCO), and Lowe’s (LOW) all look very attractive. While I’m not afraid of them here, they could fall considerably further. They are at historically good buy points, but there could be a lot of pain in the coming months.

Long-time dividend champions Medtronic and T. Rowe Price (TROW) remain at historically high yields. Despite the short-term headwinds, these are proven long-term winners. These companies have raised dividends through various challenges, and betting against them in the long run, seems like a fool’s bet.

The chip makers are at good but not great prices. Broadcom and Texas Instruments are both interesting here, but I would like to see them come down further to add to my positions. Intel (INTC) is interesting at nearly a 5% yield. I would consider initiating a starter position as a contrarian play if I didn’t already hold it.

Final Thoughts

All in all, I was disappointed to lose some Apple shares. This is because I buy with the plan to hold forever. However, I am excited to boost the portfolio’s overall yield with the funds. For the time being, I will hold on to my remaining shares and see how the work situation shakes out. Apple remains a top ten holding in the portfolio.

I expect to see much better prices in the coming months. The situation with Russia cutting off gas from the EU has me spooked. I can’t see any way that this doesn’t end badly for the world economy, not to mention all the human suffering that is coming. Of course, things rarely play out the way I expect them to. Will everyone flee the European markets and dump money into the US markets, causing the markets to jump?

It’s the unknowns that keep me buying when companies offer reasonable prices. While I am cautious with my purchases, I also know that the markets will do what they want. New highs could be right around the corner just as quickly as new lows. A good price today is a great price twenty years from now when you focus on quality companies.

Be the first to comment