bungoume/iStock via Getty Images

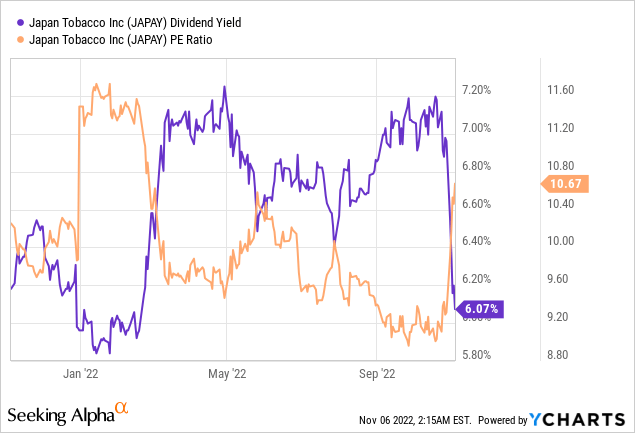

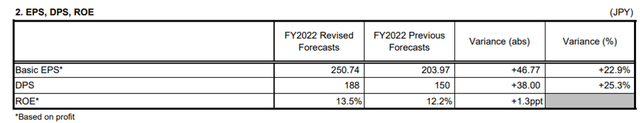

Japan Tobacco (OTCPK:JAPAY) recently raised its full-year guidance on the back of favorable FX benefits and a stronger volume/price outlook than expected for the tobacco business (even on an FX-neutral basis). Perhaps more importantly, the full-year DPS guidance was also raised to JPY188/share, based on a 75% dividend payout assumption. The caveat is that this dividend level incorporates long-term profit levels, which may not sustain, along with the assumption that the company will continue to operate in Russia. While no spinoff plans have been made just yet, I suspect it will be difficult to keep the Russian business operational over the mid to long term, particularly in light of the current geopolitical tensions. Plus, cost inflation remains a concern, as higher for longer input and distribution costs threaten to outweigh any fixed cost savings management has unlocked thus far. All in all, I would fade the ~7% fwd yield (~6% currently).

Q3 Earnings Report Surprises Positively

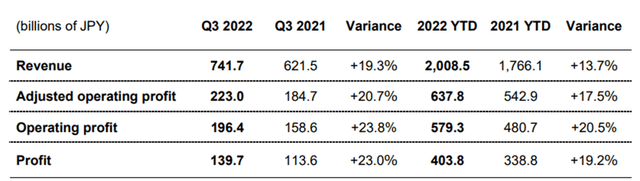

Japan Tobacco saw its adj operating profits rise 21% YoY in Q3, up 4% on an FX-neutral basis and outpacing consensus expectations for a YoY decline. Key drivers include market share gains in the tobacco business, along with surprisingly resilient sales in the EMA cluster (i.e., Eastern Europe, Middle East, and the Americas) despite the challenging macro and consumer weakness. The core tobacco business was the standout, posting adj operating profits growth of +20% YoY, accelerating from 14% in H1 2022 following successful price hikes in Russia (in June) and Turkey (in July).

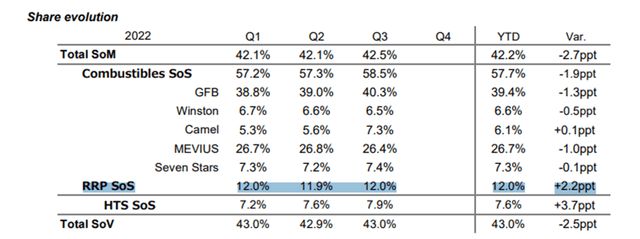

Elsewhere, Reduced-Risk Products (RRP) sales volume in Japan was up 30% YoY, though sales momentum was flattish relative to H1 2022 levels. Somewhat disappointingly, Japan Tobacco’s market share of the domestic RRP market has stabilized at ~12%, virtually unchanged relative to prior quarters, despite the Ploom X rollout. That said, management seems content, citing Q1-Q3 2022 sales running broadly in line with plan. No full-year RRP sales guidance yet, but with a joint venture now in place with Altria (MO) to market and commercialize heated tobacco stick (HTS) products, I would expect some form of guidance to take shape soon. Pending visibility into its overall RRP strategy, though, I would be hesitant to underwrite successful RRP market share gains solely on account of the partnership.

Upward Earnings Revision Accompanied by a Dividend Hike

Having already revised up its full-year guide previously, management again increased its FY22 guidance for adj operating profits to JPY728bn (+19% YoY). Even adjusted for the more favorable FX assumptions (JPY132/USD vs. JPY127/USD previously and RUB69/USD vs. RUB82/USD previously), the updated guide is still calling for an impressive +8% increase, reflecting the underlying strength. In line with the earnings upgrade, Japan Tobacco’s dividend guide now stands at JPY188/share for the full year (implied dividend yield of ~7%) in accordance with a 70%-80% payout ratio target range based on long-term profits.

The higher dividend announcement is a positive surprise – for context, the company had previously guided to YoY declines in the adj operating profits of the tobacco business on an FX-neutral basis. Instead, within the space of a few months, management now sees a sharp upward revision as warranted due to its success in finding alternative supplies for raw materials as well as its ability to sustain exports to Russia through the ongoing geopolitical conflicts. That said, I am concerned about the pace of the revisions, given input cost and distribution cost inflation have not abated and could lead to adj operating profits missing the raised bar in H2 2022. Beyond the near term, the dividend could also come under pressure in the likely scenario that the Russian operations suffer disruptions or if tobacco probability declines are not sufficiently offset by RRP growth.

Elevated Russia Risk

With regard to its Russian operations, Japan Tobacco has been contemplating its options for a while now. The most logical course of action, in my view, is to spin off the Russian unit from group operations, but for now, management seems content with the current state of things. Of note, the Russia business will now be continued through FY22, as raw material procurement remains uninterrupted – per management, raw material imports and finished product exports have already been arranged through the end of the year. Commentary on the call seems to indicate the company will be able to procure raw materials into FY23 as well, so I would pencil in a status quo scenario for the next few quarters. That said, I suspect it will be challenging to keep the Russian business running sustainably over the mid to long term, particularly if geopolitical tensions ramp up. Thus, an eventual spinoff scenario makes the most sense to me. Given Russia is guided to account for >10% of consolidated sales and >20% of full-year profits, though, a spinoff would likely entail a lower dividend down the line.

Fade the ~7% Yield

Overall, Japan Tobacco’s profitability and dividend outperformance will be well-received by investors. Not only has the company raised its full-year guidance on a more favorable FX backdrop, but the fundamental outlook (volume/price) for the tobacco business also looks strong – even in currency-neutral terms. That said, I suspect the shareholder return policies could prove unsustainable down the line. For one, they appear to take into account a more optimistic view of long-term profit levels (vs. the terminal decline you’d expect for a tobacco business). The dividend outlook also includes the Russian business, which will be hard to operate sustainably amid worsening geopolitical pressures. Finally, management’s call for higher raw material costs next year and more RRP-related spending could weigh on operating profits. Net, I would fade the ~7% fwd yield (~6% current yield) at this juncture.

Be the first to comment