JHVEPhoto

Dear readers/Followers,

I actually haven’t written on Stanley Black & Decker (NYSE:SWK) before despite owning the stock. The reason is fairly simple – I’ve been unsure and in “mulling” of when was a good time to invest more heavily. I’ve held a watchlist, slightly larger, position for some time. But the current market environment coupled with better deals, combined with the frankly worrying fundamental trends I’ve been seeing have held me off from going all that deep into SWK – as well as giving a firm opinion on the stock.

I mean to change that here. It’s a good time to do so because SWK has now gone beyond what was the COVID-19 lows for the stock.

Let’s review what we have going for the company, and what could happen to SWK.

Stanley Black & Decker – What is the company and the upside?

SWK barely needs an introduction. The company is one of the market-leading businesses in power tools, among other things.

SWK is A-rated. It has a yield of 4.3% at today’s valuation. It’s a dividend king, meaning it’s paid an uninterrupted, growing dividend for at least 50 years. This is one of only ~35 stocks in that position. That means whenever this company faces any sort of downturn, investors are likely to flock to it based on a knee-jerk “cheap-dividend-king” response. The same thing happened here when SWK started declining.

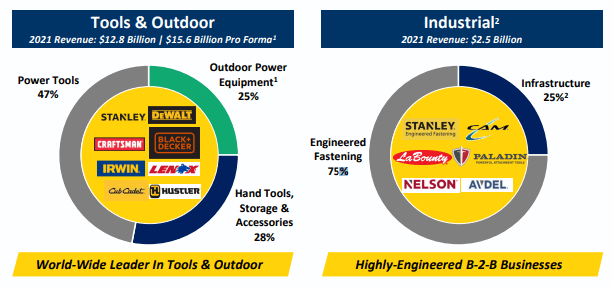

SWK currently has a market capitalization of around $11B for revenues of $15.3B for 2021 (you’ll know what that means), with a revenue split hailing from the following areas and mix.

SWK IR (SWK IR)

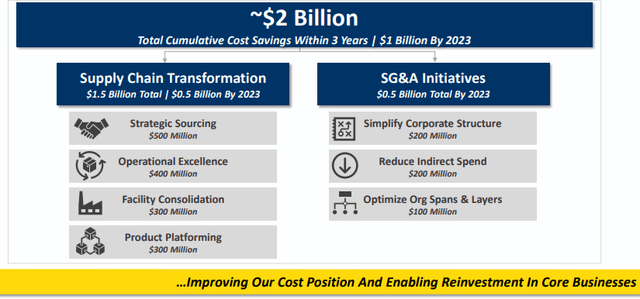

The company is loved by consumers/hobbyists and professionals alike, with an international albeit US-centric revenue mix of around 60% across the segments. The company is in the midst of streamlining its operations, divesting several non-core units while increasing its focus on the outdoors. A massive, global-based cost reduction plan is fully ongoing, and SWK expects to save $2B through an appealing mix of measures.

SWK expects a full supply chain-side transformation within 3 years, delivering 75% of those savings. But what exactly happened to the company that necessitated these things? What turned SWK from a flying-high stock to a doldrum/dumpster-diving stock in less than a year?

Because that’s really all that it’s been – a year. Less than 12 months ago with a current 55%+ decline, you could read contributor pieces titled things like “Stanley Black & Decker: A Rare Quality Company, Still Fairly Valued“. This wasn’t at all a bad piece, so what happened?

Well, a combination of things, really.

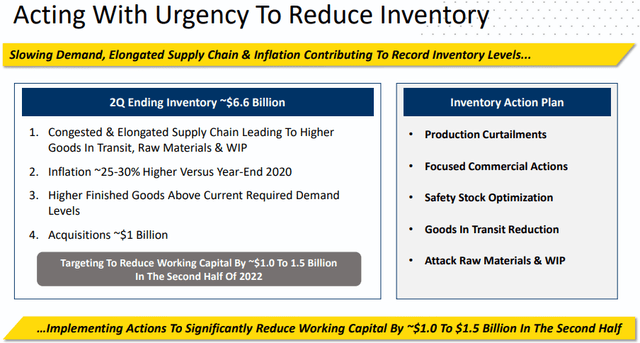

- Supply Chain disruptions due to massive delays in China. Because SWK is a very China-centric company in terms of its manufacture (imports them back to US/EMEA), the company doubled down on orders, essentially filling its warehouses up to the gills with products due to freight uncertainty. The company essentially over-ordered products to save itself from empty warehouses. But sales didn’t come as expected, leaving SWK with full warehouses and fewer people interested in buying.

- These pushes negatively impacted FCF and Working Capital during a time when interest rates started climbing, while at the same time industries and housing markets started to cool off – the essential customers wishing to buy SWK products.

- Inflation started happening as well, right as the company was doing exactly that.

So, to sum it up, the company should be given a medal for possibly some of the worst timing in its history. They invested in what they saw as extraordinarily strong customer growth across the board, only to see that demand, and the corresponding metric collapse like a house of cards in a tornado. They built up inventory during an increasing rate cycle based on what proved to be false expectations for demand.

Margins are taking hits. Working Capital is taking hits. The company can’t move the product it bought, essentially. Gross margin alone is down 8% YoY, which for a company this size is almost ridiculous.

From an accounting/financial point of view, overstocking and low demand leads to a very scary cash conversion cycle – meaning the company can’t convert its purchases of inventory into sales cash flow. This is counter-intuitive to how modern businesses make money. They want money from customers faster than they pay suppliers.

SWK currently has the exact opposite.

The only positive situation about this is that the company sells non-perishable goods.

SWK needs to get out of this – and the measures that I’ve presented from the company are how SWK intends to do exactly that, including direct action to decrease its inventories and increase its cash conversion cycle.

And the company is making progress on this in 3Q (Would be scary if they didn’t).

One, our headcount reductions are largely complete. Two, inventory is coming down. Three, cash generation was positive in September, and we believe this can continue in the fourth quarter and next year. And four, gross margin will be the last to turn as we face the high cost of destocking, but we expect to be through that and pivot to better performance by the middle of next year.

(Source: SWK Earnings Call, Don Allan)

So, turning away for a moment from the disaster, we focus on what SWK actually has going for it – because it has a lot.

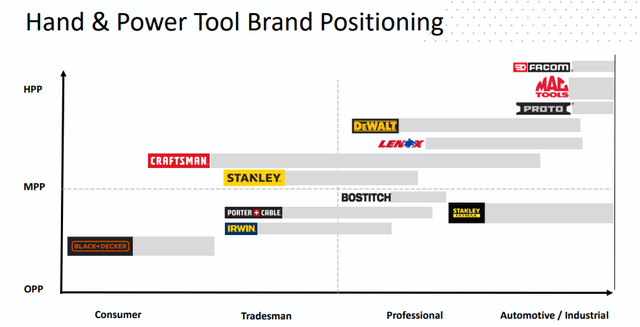

SWK owns some of the premier global franchises, with some of the best reputations and usage out there. The company had, before this situation, an impressive value creation model that technically still works fine – if the company wasn’t facing the current headwinds. Brand power in SWK is significant, with many well-known brands under its belt.

To me, the question has never been if the company is an attractive investment. Stanley Black & Decker is absolutely an attractive investment.

The question has been, from the beginning when this started, how do we discount for the current situation?

What becomes clear is that the current situation won’t resolve itself over the next quarter or so. The company’s stock and share price remain very heavily punished. As I said, we’re looking at price levels that are below even what we saw during COVID-19.

And this, to my mind, does not reflect where the company’s brands stand for the long term when you consider the company’s overall mix of positioning, which covers the entire overall spectrum.

My point is to state here, that SWK despite its inventory/CCC debacle is actually still a very solid company. In an environment where sentiment leads the charge, it’s very easy to start over-focusing on the negatives that is affecting a company, without putting enough focus back on actual positives and strengths. It’s my view that this is what’s happening for SWK.

We’re all so consumed by its current inventory worries that we don’t see what the potential reversal could bring once things do normalize – because normalize they will, even in this environment.

3Q22 wasn’t the normalization that we were looking for, that much is clear. While the company managed some key improvements, including using money from strategic divestments, headcount reductions, a lowering inventory, and September-positive cash flows, indicating a potential reversal for the CCC, the company’s forecasts and guidance for the full year still took the icing from the cake and sent the shares tumbling lower.

In addition, the macro remains challenged, with soft markets in both EMEA and NA. Cost inflation is still a challenge, and one the company like most has difficulties overcoming, with top-line revenues down 2%.

The thing is, that if you “BUY” the company when things have already turned around, you’re likely to get the company at a far higher price than what you might get in a moment of weakness.

That’s what we’re going to look at now.

Stanley Black & Decker Valuation

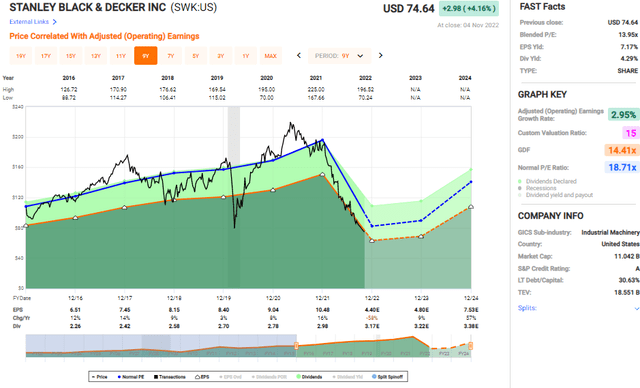

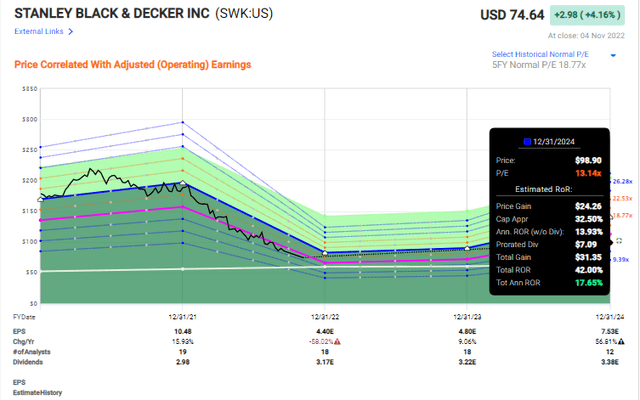

The company has declined massively in line with its troubles and currently still trades at a normalized/blended P/E of 14x, thanks to the next few years of forecasts.

SWK Valuation (F.A.S.T graphs)

There is no doubt that entering the company as an investment at this time may indeed be premature – the company may, and I do mean “may” go even lower. But at this point, I also believe and state clearly that most of the downside is probably in here.

We’ve reached a point where many previously bullish people and investors seem to be throwing in the towel – and while SWK may indeed trade negatively for the next 4-9 months, I do believe in the company’s guidance that an inflection point will arrive sometime in 2023.

Once that does, I believe the journey goes back north – and that’s when we want to be on the SWK train. Because normalizing to even impaired 10-year average EPS rates, this company is set to potentially double your investments, while being an A-rated dividend king with a 4.3% yield.

We don’t even need to accept the company’s premiums for this to be likely. Even if you forecast at a 13-14x P/E, returns are here showing market-beating potential tendencies with a potential annual RoR of 17.5%, and totals of 40%+

The long-term potential of this investment is nothing short of astounding when you look at the adjusted risk/reward ratio of what the company actually offers. I see two ways to handle the investment here, and each is suitable for a different type of investor.

You can either decide to go into the investment now. This risks buying at a time where it still may go even lower, resulting in short-term losses and potentially missing out on better yields, but staking out a position in a fundamentally solid company. Because if you do not believe SWK to be fundamentally solid, I really want to hear why.

You can also decide to wait until the first signs of an actual turnaround come around. I argue that the first quarter of positive cash flow, September, might be such a sign, which is also why I’m taking a more positive stance on the company here. But if you’re more conservative, you might even wait until the first positive quarter with reversal KPIs across the board. However, it’s my belief that at such a time, the company could potentially bounce off 7-15% from its lows, leading to a materially worsened investment outlook.

My choice, based on 3Q22, is to slowly start to “BUY” SWK here, and work with the stock based on a 2.5% allocation target for the long term. I’ve allocated capital, and mean to buy more in the coming week.

Other analysts have various price targets for SWK following a 60% 1-year decline in the share price. From average PTs of $240/share less than a year ago, the company is now average-valued at $86.6/share, showcasing just how unreliable many of these analysts can be. Only 4 out of 15 analysts are at a “BUY” or equivalent rating, compared to 11 out of 14 back in January of 2022, with a PT of $230/share, encouraging you to pay a massive premium for SWK.

At that time, I was out.

Now I am in.

I am giving SWK a long-term PT of $120/share, based on a 15x P/E reversal based on 2024E forecasts, growth rates that I view as realistic, and assuming a 2023 normalization. Until that normalization, I’m getting paid a 4.3% yield from a dividend king with a market-leading position in several fields.

This is a good enough thesis for me, and it will form the foundation for me going into SWK here.

Thesis

My thesis for SWK is as follows:

- SWK is a market-leading company in tools. A massive timing issue and over-purchase of inventory have led to the company being pressured down more than 60% in a single year, despite what are inarguably A-quality company trends that have significant fundamental value.

- SWK was never a 20-22x P/E stock for me – but it is a 14-15x P/E stock under these circumstances and these forecasts. I expect a 2023 normalization towards historical levels.

- Based on this, I give the company a $120/share price, and a “BUY” rating here.

Remember, I’m all about:

Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

This company is overall qualitative. This company is fundamentally safe/conservative & well-run. This company pays a well-covered dividend. This company is currently cheap. This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment