Keith Lance/iStock Unreleased via Getty Images

I came across JAKKS Pacific Inc. (NASDAQ:JAKK) while screening for low-valuation stocks that are trading near their 52-week highs.

JAKKS Pacific is an interesting micro-cap toy company that appears to be on the mend with improving operations since the COVID pandemic lows. Its valuation still screens cheap, and the stock has strong momentum. However, investors need to be mindful of a possible shift of seasonal sales into Q2 that has artificially buoyed operating results. With the whole retail landscape laser-focused on inventories and margins, the back half of the year may be more challenging. I think current valuations deserve a speculative buy, but cautious investors may want to wait until after Q3 results.

Company Overview

JAKKS Pacific, Inc. is Santa Monica-based micro-cap toy manufacturer that has been around since the 1990s. JAKKS Pacific’s core strategy is to license high-profile IP from well-known franchises such as Disney’s (DIS) princesses, Nintendo’s (OTCPK:NTDOY) Super Mario, and Sega’s Sonic the Hedgehog to make toys and costumes. JAKKS Pacific sells its products to mass-market retail stores, department stores, toy stores, and other channels. Walmart (WMT) and Target (TGT) accounted for 27% and 28% of 2021 sales respectively.

JAKK Has Been Struggling For A Decade…

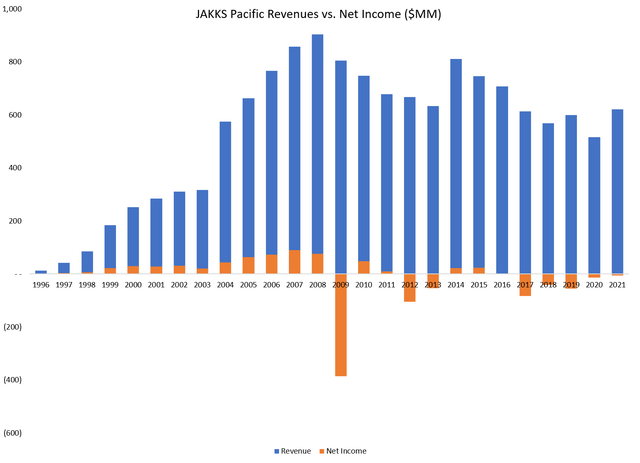

Since revenues peaked in 2008 at $903 million, JAKKS Pacific’s financials have been struggling for over a decade. Revenues have declined to $621 million in 2021, and Net Income has been hovering around breakeven. JAKK has produced a cumulative net loss of $314 million in the decade to 2021, and cumulative net loss of $158 million since it went public in 1996 (Figure 1).

Figure 1 – JAKK Historical Revenues & Net Income (Author created with data from roic.ai)

… But Operations Have Been Improving For The Past 2 Years

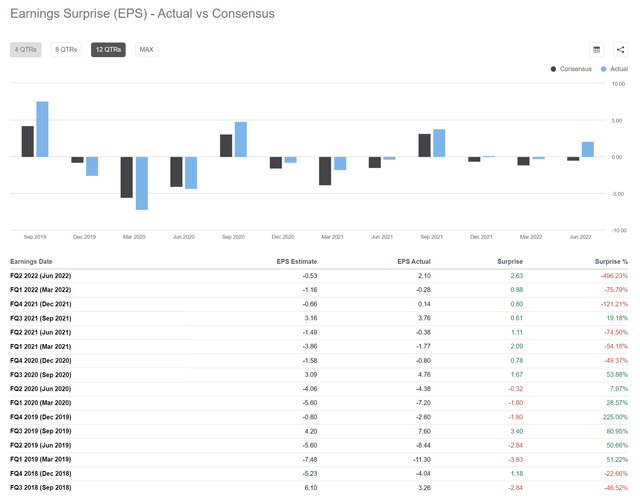

Although historically profitability has been lacking, JAKKS Pacific has beaten analysts’ overly pessimistic estimates for the past 2 years with some hit toys based on popular IP like Disney’s Encanto and Sega’s Sonic The Hedgehog (Figure 2).

Figure 2 – JAKK has been beating estimates since Q3/2020 (Seeking Alpha)

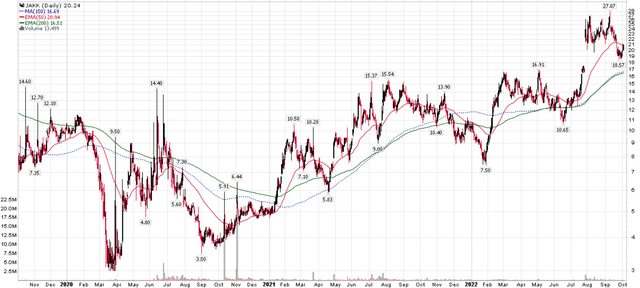

This has buoyed the stock price. Since bottoming sub-$5 in the aftermath of the COVID pandemic (note, the shares underwent a 10-for-1 reverse stock split in July 2020), JAKKS Pacific’s share price has rallied almost 5-fold, to a recent $20 / share (Figure 3).

Figure 3 – JAKK stock price has rallied with improving operations (stockcharts.com)

The most recent quarterly results released on July 27th were especially well received, pushing the shares up by over 40% in a single session.

Was The Latest Quarter An Aberration?

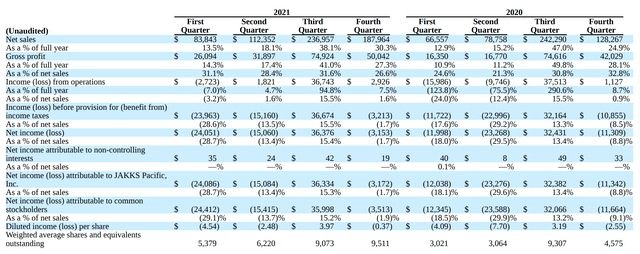

Seasonally, 65-70% of the company’s sales are made in the 3rd and 4th quarters, as retailers ramp up inventory for the critical holiday period. Studying 2020 and 2021’s financial performance by quarter, we can also see that the 3rd quarter is really when JAKKS Pacific makes the majority of their yearly profits (Figure 4).

Figure 4 – JAKK Seasonality (JAKK 2021 10K Report)

However, in 2022, this seasonal pattern appears to be out of sync, as the company reported especially robust Q2/2022 results with sales almost doubling from the prior year’s quarter.

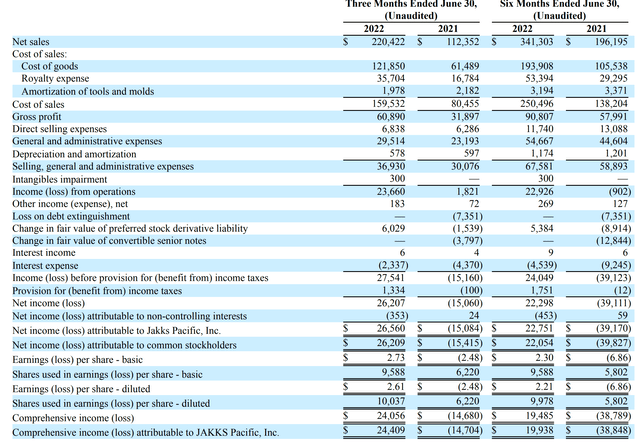

Figure 5 – JAKK Q2/2022 Earnings (JAKK Q2/2022 10Q Report)

This allowed JAKK to report a quarterly profit of $2.10 / share, smashing analyst estimates of a $0.53 / share loss.

Encouraging But Don’t Pop The Champagne Just Yet

While the quarterly result was certainly a surprise and very encouraging, investors are cautioned from celebrating just yet. Recall the retail landscape from earlier this year: After horrific shipping delays in Q3 of 2021 due to the COVID pandemic, retailers were facing another summer of shipping delays as China locked down major cities like Shanghai in late March. Therefore, many retailers ordered their seasonal merchandise earlier than usual and placed double and triple orders to ensure they have merchandise for the critical 2022 holiday season.

In fact, listening to the second quarter earnings call from JAKKS Pacific, my conclusion is that a significant part of the seasonal Q3 business was brought forward to Q2. (note, I have highlighted the relevant texts from the transcript):

As we discussed last quarter, we have been seeing exceptional demand for our current product lineup. We’ve applied tremendous focus to enabling our FOB customers to secure product with enough lead time to avoid the supply chain bottlenecks that negatively impacted everyone in the second half of last year. And at the same time, we’ve done everything we could to take advantage of off-peak shipping windows to secure the manufacturing and inventories we plan to sell domestically in the second half of this year.

– CEO Stephen Berman on the operating results, Q2/2022 Earnings Call

Thanks. I think most of the year, we’ve been talking about how we see the front half of the year would be much bigger for us on a percentage basis than it has been in recent years. So I don’t know that I have a real clear sense to steer on that front. It’s certainly the case that with some of the really hot breakout properties that those are performing exceptionally well on a year-to-year basis. The comment I made about kind of shipping early and often in so many words, certainly kind of holds true. But at the same time, we still have plenty of shipping left to do this year.

– CFO John Kimble on the timing of sales, Q2/2022 Earnings Call

Walmart And Target Both Warned Of Bloated Inventories

Coincidentally, both Walmart and Target warned of bloated inventories throughout the last few months. JAKKS Pacific’s strong Q2 results could simply be a shifting of seasonal sales into the second quarter. Investors will need to be careful with the upcoming Q3 earnings, as that will be the proof in the pudding regarding seasonal sales. Currently, analysts are expecting $266 million in revenue (12% growth YoY) and $3.14 in EPS (-16% decline YoY) for the upcoming quarter.

If a stock can rally 40% in a session due to earnings beat, it can also fall dramatically on an earnings miss.

Valuation Remains Cheap

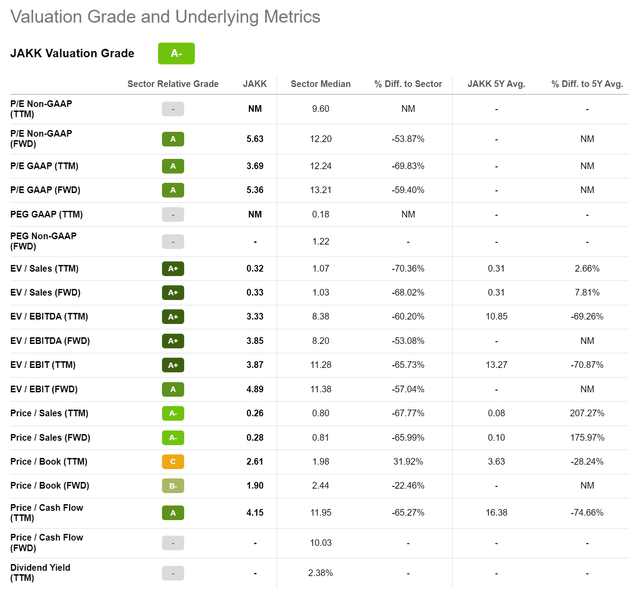

With regards to JAKK’s valuation, the stock continues to screen cheap on common valuation metrics. It is currently trading at a 5.6x non-GAAP Forward P/E, a significant discount to the discretionary sector’s 12.2x. On forward EV/EBITDA, it is trading at 3.9x vs. 8.2x for the sector.

Figure 6 – JAKK Valuation (Seeking Alpha)

Risks

The biggest near-term risk to JAKKS Pacific is that retailers of all stripes and colors have been warning about excess inventories in the past few months. Even industry heavyweights like Nike Inc. (NKE) warned recently on inventories and margins. JAKK itself has acknowledged it has excess inventory (author highlighting relevant texts from the Q2 transcript):

Our quarter end inventory level is $124 million, of which $36 million is in transit to our warehouses. Although this is a high level for Q2, it is reflective of our planning to mitigate potential exposure to our higher second half spot container rates and extended transit times. Given our strong sell-in and sell-throughs to date and reviewing the insights into retail demand for the second half of the year, we are quickly pivoting our attention to ensuring that we exit the year with tight inventories at retail and within our own warehouse infrastructure worldwide. There has been a lot of discussion around the outlook for the economy, retail inventories and the mindset and spending power of the average consumer. There are several areas of business we’ve been focusing on. It is well known that the toy industry often shows higher resilience than other consumer areas when spending power is challenged.

– CEO Stephen Berman on inventories, Q2/2022 Earnings Call

The worry is that JAKK will have to take a margin hit to clear out the excess inventory.

Another risk to JAKK is that the company currently has $85 million outstanding in long-term debt that pays interest at LIBOR plus 6.50-7.00%. While the absolute amount of debt outstanding has been dramatically reduced in recent years (in 2019, JAKK had $175 million in debt outstanding vs. just $16 million in EBITDA) and is manageable relative to its current cash flows, it still pays a punitive rate of interest.

On the positive side, JAKKS Pacific has been riding a wave of popularity of recent hits such as Disney’s Encanto and Sega’s Sonic The Hedgehog. If current operating momentum continues, I think 2022 could see the company return to full-year profitability, the first such feat since 2016.

Conclusion

In conclusion, JAKKS Pacific is an interesting micro-cap toy company that appears to be on the mend with improving operations since the COVID pandemic lows. Its valuation still screens cheap, and the stock has strong momentum. However, investors need to be mindful of a possible shift of seasonal sales into Q2 that has artificially buoyed operating results. With the whole retail landscape laser-focused on inventories and margins, the back half of the year may be more challenging. I think current valuations deserve a speculative buy, but cautious investors may want to wait until after Q3 results.

Be the first to comment