ArtistGNDphotography

This article was prepared by Navyanshi Nayan in collaboration with Dilantha De Silva.

Investing in stocks is not just about focusing on company fundamentals. Identifying and analyzing business sectors that are well-positioned to grow exponentially in the future is often the first step in unlocking multibagger investment opportunities. The solar industry is no longer a hidden gem as solar companies have been around for decades. That being said, the industry is far from mature, which leaves ample room for leading solar companies to grow. In this analysis, we will evaluate the long-term prospects for the industry before introducing three companies that we believe are worth monitoring closely.

Is The Solar Industry Growing?

The solar energy industry has grown rapidly in response to growing concerns about climate change and the demand for cleaner energy sources. The Biden administration intends to decarbonize the United States by 2035. Solar is the fastest-growing clean energy segment, and it is expected to be the primary source of energy by mid-century. Furthermore, the government signed the Inflation Reduction Act, which includes $369 billion in funding for energy, security, and climate change initiatives, making it the largest investment in combating climate change in U.S. history. The funds allocated to national clean energy production also include the continuation of the $30 billion production tax credit and the $10 billion investment tax credit for clean energy manufacturing, which includes solar power, wind power, and energy storage. Experts predict that the solar market in the United States will nearly triple in the next five years. Europe has also stepped-up efforts to build renewable energy infrastructure.

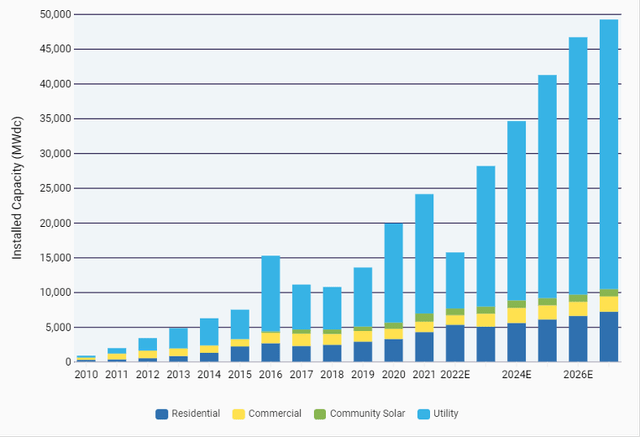

Exhibit 1: Installed solar energy capacity by country (2021)

According to a report released in September by the Solar Energy Industries Association and Wood Mackenzie, solar has experienced an average annual growth rate of 33% and has added the most electricity-generating capacity to the grid for three consecutive years. Solar accounted for 46% of all new electricity-generating capacity added to the grid in 2021, and it has ranked first in new electricity capacity additions for the last nine years. Solar’s share of total U.S. electricity generation has now increased to over 4% from just 0.1% in 2010. The data also shows that the U.S. market will grow by 40% more than pre-IRA projections through 2027. As the cost of installing solar power solutions has declined significantly, the industry installed 4.6 GW of new solar in the second quarter of 2022, up 12% sequentially.

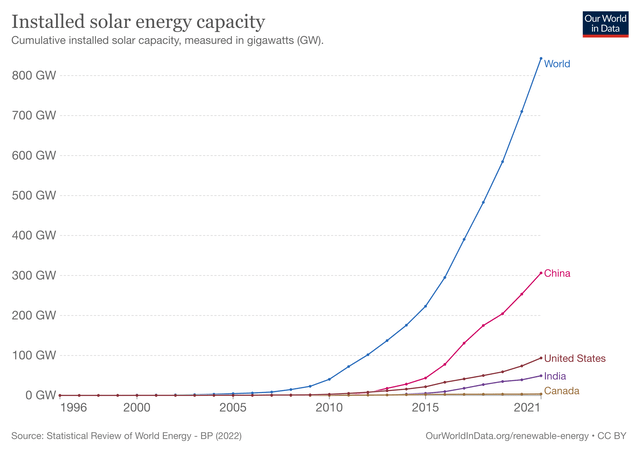

Exhibit 2: U.S. Solar PV deployment forecast

Solar Energy Industries Association

Growth has decelerated this year due to supply chain challenges, which are expected to remain a major pain point in the near term, limiting the market growth. The global pandemic, trade insecurity, rising interest rates, and inflation have all contributed to price increases in the solar industry in the United States. As a result, solar PV deployment forecasts for 2022 fell from 30 GW to 15 GW. It is significantly lower than the totals for 2020 and 2021, and approximately the same as the total for 2016. Based on the assumption that the Investment Tax Credit will be extended until 2032, the solar industry can be expected to report robust growth once some of these challenges are addressed.

Is Solar Energy A Good Long-Term Investment?

As authorities in the U.S. begin to roll out incentives related to fighting climate change, solar energy is beginning to rebound after falling off from pandemic-driven hype for more than a year. The Invesco Solar Portfolio ETF (TAN), an exchange-traded fund that tracks the MAC Global Solar Energy Index, has slightly outperformed the overall market and provided annual returns of 18.5% on average over the last decade.

Despite supply chain challenges, several companies are continuing to build renewable energy plants as countries focus on and promote eco-friendly power generation solutions to reduce carbon emissions. Solar energy is one of the most affordable renewable energy sources today, and many governments are investing millions of dollars to expand the availability of and access to solar energy. As previously stated, supportive government policies will be critical to market growth. According to the SEIA’s annual Solar Means Business report, major U.S. corporations such as Apple Inc. (AAPL), Amazon.com, Inc. (AMZN), Walmart Inc. (WMT), Target Corporation (TGT), and Alphabet Inc. (GOOGL) are investing in solar and renewable energy. By the end of 2019, Apple had the most installed solar capacity in the country and many other tech giants remain committed to ESG goals that center around the use of renewable energy.

Corporate solar adoption has accelerated as the cost of installing an on-site commercial solar PV system has fallen in recent years. This has enabled corporate solar buyers to boost their corporate climate targets as well. Today, 15 of the top 25 companies in the country have publicly committed to using 100% renewable energy in the long run.

Even though the solar market will continue to suffer from global supply chain and inflation issues as well as trade disputes in 2022 and 2023, the IRA’s long-term tax incentives and manufacturing provisions will provide the market with some much-needed boost to keep the industry moving forward. Because the long-term macroeconomic environment looks promising, the solar energy sector seems a good long-term investment for growth-oriented investors.

3 Solar Energy Companies To Look Out For

First Solar (FSLR) is one of the most popular names in the solar industry. The company is a leader in the development of solar energy solutions, offering solar panels and photovoltaic power plants. First Solar provides construction and maintenance services, as well as recycling of solar-related equipment. The company’s manufacturing plants are expected to operate at 100% capacity through 2024, and sales contracts have been signed through 2026. As First Solar continues to invest heavily in expanding manufacturing capacity, the company is likely to see rapid growth in revenue and earnings in the coming years. First Solar gains a competitive advantage by not using polysilicon and instead producing solar cells with cadmium-telluride technology, which allows the company to avoid one major supply chain bottleneck. The company’s manufacturing process also has a lower carbon footprint than that of companies using polysilicon panels, which is a good reason for ESG-oriented investors to choose First Solar over some of its closest rivals.

Enphase Energy (ENPH) is another company to monitor. Enphase is an energy technology company that develops and sells software-driven home energy solutions. Enphase is the world’s leading provider of solar and battery systems based on micro inverters.

Sunrun Inc. (RUN) is the leading residential solar energy company and the largest retail solar provider in the United States. The company specializes in the design, development, installation, sale, ownership, and maintenance of residential solar panels, battery storage, and energy services. Sunrun offers solar panels for both sale and lease. As the company collaborates with major automakers to install home charging stations for their EV models, Sunrun has the potential to be a significant player in the residential solar energy market in the long run, which makes it another company to monitor closely.

Takeaway

The long-term outlook for the solar energy industry is brightening as countries strive for an emissions-free future. Favorable regulatory decisions will encourage consumers to combat climate change by embracing renewable energy sources while making the most of incentives offered to solar buyers. Successfully navigating the challenging operating environment today will pave the way for the industry to enjoy a few decades of rapid growth, which makes the solar industry an appealing bet for growth investors.

Be the first to comment