Drew Angerer

The growing disconnect in founder and CEO Mark Zuckerberg’s view of reality is a clear and present danger to Meta Platforms, Inc. – Facebook (NASDAQ:META) shareowners. His previous insistence on anything-goes political views, and lack of an adult-like plan to police conspiracy theories and misinformation on social media platforms, have been a turnoff for many. Considering the mind-alerting influence of websites and apps run by Meta, scores of potential users have decided against participating on company services in response, while hordes of investors are now refusing to own the stock.

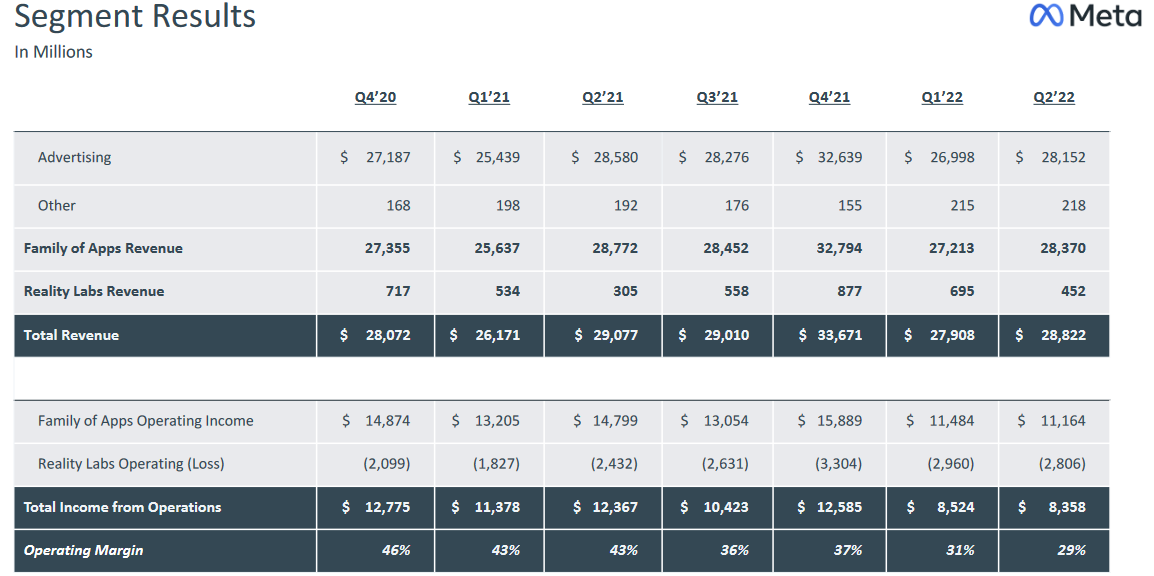

However, this article will focus on the bottomless pit of spending by its Reality Labs division, the “metaverse” brainchild of Zuckerberg a few years ago. While boom times in the stock market and economy before 2022 allowed for some extra spending on pet projects and pipe dreams from this technology wunderkind, the latest stock quote implosion during an evolving recession is screaming enough is enough. On top of this year’s cyclical downturn, Meta appears to be betting the future of the company on a computer-based, online virtual reality [VR] that only a small segment of the population wants anything to do with. Over the past 12 months, Reality Labs has spent $13 billion in shareholder capital developing a service with a minor $2.5 billion in annualized revenue, that is not guaranteed to be a hit in any form or fashion.

The result of VR losses piling up into the tens of billions of dollars over time is that investors have tired of the nuttiness, sending Meta’s price well under the $200 share price I figured earlier in the year would prove a durable bottom area. My view is Meta can again trade above $200, and perhaps eclipse $300 in an eventual economic turnaround for America. But, to reach these attainable goals, Zuckerberg has to dramatically cut spending on the metaverse, or even completely shut down the project.

Why Close Reality Labs?

That the nearly 8 billion people of planet earth can barely deal with their present, physical and financial reality is the reason to slow down Meta’s crazy spending push. I know estimates of fantastical growth are out there for the metaverse intersection of virtual reality and human endeavors, even by respected Wall Street firms that in other sectors of the economy are far more conservative in their analysis. I know social media took off like a rocket ship a decade ago, but it was basically a shift in media away from television toward news/gossip/opinion sharing online for individuals and businesses, between family, friends and customers.

To say we are all going to now live and work in a virtual universe is a HUGE leap of faith few people I talk with desire to do on a massive scale, as a justification for Reality Labs spending. Youngsters can believe that’s the next step for the Internet’s revolution/evolution, but if tens of millions of people lack a job (with sharply higher unemployment approaching) or monetary help from parents and friends to pay rent, buy food, or make a monthly car payment during a deep recession or prolonged period of weak economic growth, shouldn’t society tackle pressing earthly issues first?

Meta Quest Website – Horizon Worlds, Social Metaverse

Will virtual reality be an escape, the next level of gaming if you will? Sure, it already is taking place. But to throw out estimates of tens of trillions of dollars in commerce done in the metaverse is beyond absurd, it’s a function and extrapolation of the “easy money” economy worldwide of the past decade that may never return in our lifetimes. To me, anyway, cryptocurrencies and metaverse get-rich-quick dreams would not be possible without the greatest intervention in money markets by governments and central banks in mankind’s history following the Great Recession impetus of late 2008. I am arguing we have lived in an “alternate reality” economically the past 14 years. Yet, normalized free-market economics are returning with all types of consequences, mostly putting a stop to the fantastical ideas of wealth creation like what Zuckerberg is chasing.

That’s not to say a metaverse won’t develop over 20 or 50 years as the next level of human existence. But at this point in time, the sums of money being expended by Meta are a waste of resources, which may never be recouped. Don’t take my word for it – a steady decline in the stock quote all year is proof of my view, based on math and a little bit of common sense.

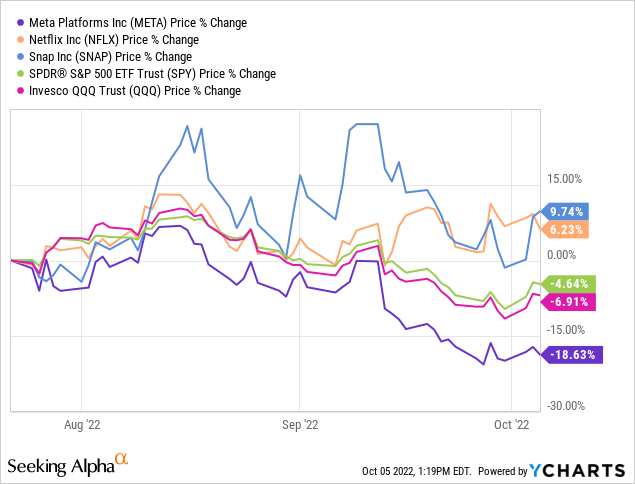

Earlier in the year I suggested investors buy Meta and Netflix (NFLX), as both were suffering from investor over-enthusiasm and operating problems that needed fixing. Well, Netflix has actually changed course, putting together a cheaper ad-supported streaming version to keep/grow customer counts in 2023. Netflix shares have bottomed in price and are rising in value again, today higher than my April article writeup. Yet, Meta continues to plow losses into Reality Labs, and the stock has declined another -30%. Management’s acceptance of the metaverse sinkhole for funds will only hold Meta’s stock quote back.

All told, I am quite optimistic on Netflix, and quickly growing social media Snapchat app provider Snap Inc. (SNAP), as investment ideas. Snap announced a major restructuring and cost-cutting effort in August, with a refocus on what’s working. Both should outline outsized gains next year. I fear investing ungodly sums into insanity will likely restrain Meta’s stock quote, even with a rebound in ad spending on Facebook and Instagram. As an investor, you have a choice between rejuvenated growth and struggling, straitjacket headway.

YCharts – META, NFLX, SNAP Price Changes vs. Market Indexes, Since July 22nd, 2022

Valuation Breakdown

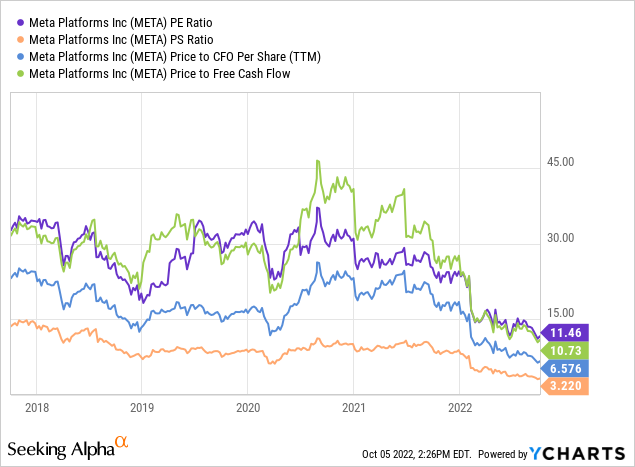

The best news for shareholders is that Meta’s valuation on trailing business results is at an all-time low. You can see this positive setup on the graph below, looking at price to earnings, sales, cash flow, and free cash flow. Consequently, it’s a stretch to call the stock a Sell under $140 per share. Clearly, my pessimism is not a valuation call.

YCharts – Meta Platforms, Fundamental Valuation Ratios, 10 Years

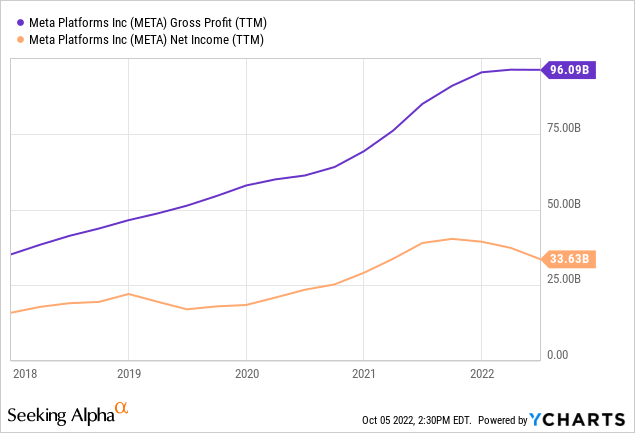

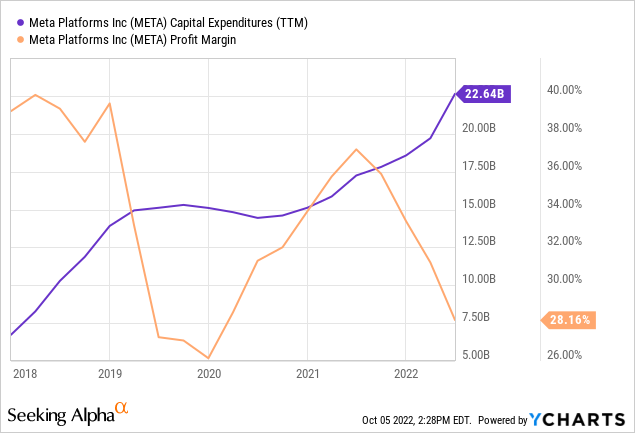

The data points Wall Street has decided to sell are elementary in nature. Profit margins are compressing from wild spending on sales teams, middle managers, developers, coders, data center builds and the Reality Labs investment spree. You can review the expanding spread between gross profit and final income levels below, over 5 years. Also, a meaningful correlation between rising capital spending and falling profit margins are reasons banking institutions and smart investors continue to get out of Meta.

YCharts – Meta Platforms, Gross Profits vs. Net Income, 5 Years

YCharts – Meta Platforms, Capital Spending vs. Profit Margins, 5 Years

Below is a slide taken from the June Q2 income report, which shows Reality Labs operating losses growing over time, while revenues have been stagnant for years.

Meta Q2 2022 Earnings Release

Technical Chart Collapse

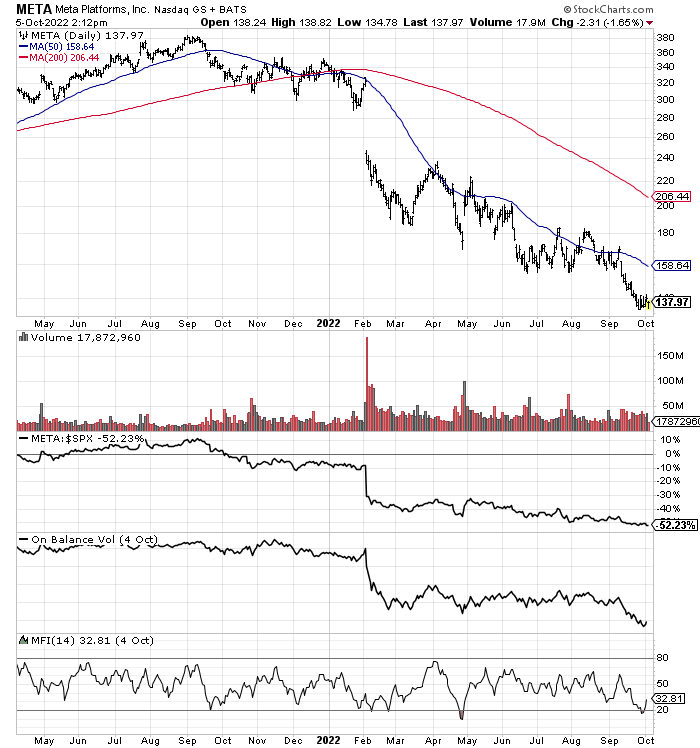

Facebook/Meta is down a staggering -70% from last September’s high trade above $380. Imprudent capital spending during a recession, from a point of overaggressive investor optimism are the excuses. The good news is investors are now more sanguine about the enterprise’s long-term future, valuations are definitely better, and the economy will eventually turn higher. The one variable controlled by management to kick the stock back into gear is a reduction in Reality Lab expenditures.

Below is an 18-month chart of daily trading changes. Notice the incredible underperformance of -52% vs. the S&P 500 index, and On Balance Volume bearishness again in September-October. The only bright spots are found in various “oversold” momentum measurements like the 14-day Money Flow Index, which have a spotty record of highlighting short-term price bounces this year.

StockCharts.com – Meta Platforms, 18 Months of Daily Changes

Final Thoughts

How to fix Meta Platforms? Here are my suggestions, none of which will be acted upon: (1) change the company name back to Facebook, (2) reduce annual spending at Reality Labs back to $3 billion or less, (3) slash ad pricing on all social media platforms using the $10 billion saved from the metaverse thing as a cushion to increase business interest and spending, and (4) clamp down on all divisive political conversations from users with more than 5,000 followers (while generic political ads without commentary will still be allowed). A refocus on family-oriented content, and business/commerce activities would clean up the Facebook/Instagram image, locking both into our useful lives for decades to come.

I have argued for years that completely-untethered-to-the-truth, unregulated and uncensored social media would have widely negative ramifications for society. Previously, the ability to broadcast views over the airwaves has been regulated by the FCC, with a license and balanced content rules that must be maintained. We are all grappling with how to proceed with social media censorship and regulations. Perhaps the most-fair decision would be to effectively ban every political view that is broadcast to mass media lists in great numbers, especially without a license or training in the appropriate ways to present them to vast impersonal groups of readers/eyeballs. If you want to debate/influence your immediate family and friends on Facebook or Instagram, free speech rights come back into play (assuming you have a normal following). If you want to print crazy ideas on a piece of paper and hand them out at the street corner, go right ahead. If you want to spread conspiracy theories, you are free to start your own website.

Zuckerberg may be suffering from a recency bias, based in one-of-a-kind wealth accumulation. He may believe any future he can dream up will be the one we all want to live in. Heck, his social media company creation was an amazing hit. What if the social media transition was an isolated outlier event for mankind, and the metaverse world has zero chance of mass acceptance? Clearly, investors of all types think the Meta CEO has a fiction vs. reality problem. I suggest the company pivot its focus to profitable accounting math and ways to grow the successful and heavily-used media platforms/apps already in existence.

Assuming a trip back to the reality we all inhabit hits Zuckerberg and the board of directors, a major cost-cutting decision on the metaverse would be welcome news. I would turn bullish on the stock’s future, and likely buy my stake back (I bought in the low-$200s and sold around $180 earlier in the year for a small loss). Until then, the highest rating I can give the stock is a Hold/Neutral setting for stubborn owners. I have a 12-month price target of $160 with metaverse spending remaining excessive vs. $230 with a sizable cut made (returning to a 5-year valuation ratio average on basic fundamentals).

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment