krblokhin/iStock via Getty Images

Jackson Financial (NYSE:JXN) is a $2 billion annuity company that is unknown and a recent spin-off from Prudential PLC (PUK). It currently leads the U.S. in annuity sales and touts the best operational efficiency compared to its peers. The company’s value metrics rate it extremely cheap, and Prudential’s sell down of shares is coming to an end.

It looked as if Jackson’s stock price was set up to make a run, but when I took a deep dive into their financials to confirm the numbers, I learned that the majority of its TTM profits were derived from hedging and were not sustainable in my opinion. In light of this news, JXN was not as deep of a value stock as I initially thought, and did not earn itself a buy rating.

Company Overview

If you haven’t heard of Jackson Financial before, it provides a number of annuities to retail investors through a suite of subsidiaries. Jackson was founded in 1961, but in 1986 it was purchased by the London-based insurance company Prudential. While JXN was under Prudential’s umbrella, it increased its assets by more than 10x, going from ~$100 million to more than $1 billion. But that wasn’t good enough for the activist investor Dan Loeb at Third Point. In 2020, Loeb pushed for Prudential to split up its Asian and U.S. businesses, eventually leading to Prudential selling 11.1% of Jackson to Athene in July 2020 and all but 19.7% being spun out or demerged in September 2021. Since most of Jackson’s history and growth was within Prudential, there has only been a short period of time for new investors to get to know the business and the new management team.

Selling Pressures Due to the Spin-Off Might Be Subsiding

Prudential’s spin-off set Jackson up for an uphill climb as it gave one share of JXN for every 40 shares of Prudential. So not only did shareholders of Prudential get a share of something they didn’t know, it was immaterial in comparison to the 40 shares they received of Prudential. On top of the immateriality, JXN was literally foreign to most investors and could cause other complications. Prudential is registered in the UK, Hong Kong, and Singapore while JXN was American listed on the NYSE.

Would most shareholders like to research an immaterial and foreign stock that was given to them? In addition to Prudential’s shareholders not being incentivized to hold their new shares of JXN, Prudential announced that it was going to sell down its remaining 19.7% of JXN in the next 12 months, putting undue pressure on JXN’s stock price. I tracked Prudential’s position throughout the past year and it has been doing what it said it would, and might be selling its last shares as I type this. When Prudential is finished selling along with non-committed longstanding Prudential investors, this could ease sell-side pressure on JXN.

Operating Excellence

This is an area that I do not have a lot of inside knowledge of, partially because I dislike annuities and their commission-based sales process. But according to LIMRA, Service Quality Measurement Group, and FUSE research, JXN is the leader in its field:

- JXN was the 2021 leader in annuity sales in the U.S.

- JXN had best-in-class operational efficiency vs. its peers, based on 2020 statutory expenses to assets.

- JXN earned multiple service awards from Service Quality Measurement Group.

- JXN won Contact Center of the Year in 2019 and 2020.

- FUSE research network ranked Jackson in the top 10 in terms of quality insurance wholesalers.

These were the strongest signals I found (becoming known, subsiding selling pressure, and operational excellence) pointing to potential JXN stock price appreciation.

Fundamentals – Value Play in Question

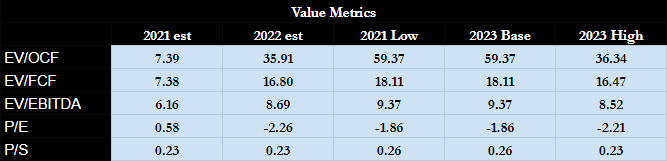

This is where I saw a few past JXN write-ups go astray, and why I spent the time to write this in the hopes that I can provide a better valuation and outlook for those still interested in JXN. On HIT Capital’s valuation screener, JXN came up in the top 1,000th percentile (cheapest of the cheap) in terms of EV/EBITA, EV/OCF, EV/FCF, P/E, and P/S. However, when I reviewed the financials in detail, the majority of the earnings and cash flow correlating to the cheap valuations came from hedging. I could not do a deep dive on these derivatives from what is reported in the 10-Q and 10-Ks, but if JXN does what it says my research confirmed that the hedges will protect JXN from systemic market risk. When the market goes down, the hedging profits go up (and vice versa).

I was particularly interested pulling out JXN’s operating cash flow and net income without the effects of hedging, as I believe that would be more representative of future earning potential (though I’m open to other guidance here). So, to get a better understanding of JXN’s true operating cash flow I removed the hedging earnings and losses. This adjustment provided a much different story than what the initial valuations insinuated.

HIT Capital JXN Valuations (author)

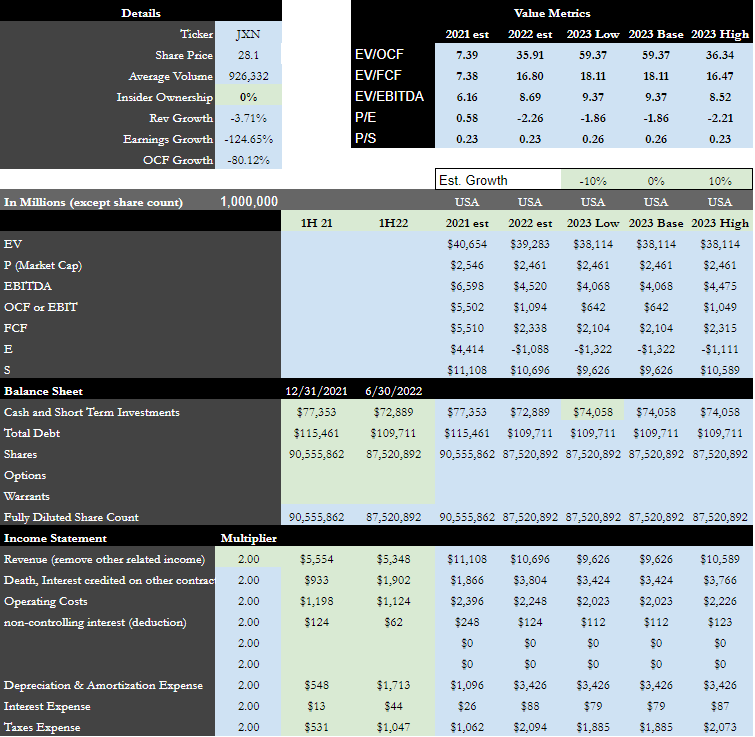

The new valuation metrics with hedging removed were derived from the first half of 2021 and 2022 income sheets and the Dec. 31, 2021, and June 30, 2022, balance sheets. I went ahead and made 2023 estimates assuming 10% shrinkage, no growth, and 10% growth (low, base, high). Don’t take these metrics as absolutes because, as you can see, the P/E is negative in 2022 and beyond. That’s because I didn’t back out the taxes from the realized hedges, but the numbers were different enough to adjust my opinion and know that JXN was not in the 1,000th percentile in value as I previously thought.

On top of the increase in valuation, the company’s adjusted revenue and earnings had shrunk year over year. It appeared the business that Prudential was previously using JXN for, before the spin-off, was slowly leaving JXN. The following snapshot shows the numbers I used for the valuation calculations and to ascertain that the businesses earnings (minus hedging) had shrunk year over year.

HIT Capital – JXN Financials (author)

Conclusion

Jackson has solid momentum rolling into 2023 associated with its operational excellence, becoming more known, and its legacy shareholders running out of shares to sell. However, the lack of growth and cheapness when hedging is removed was too much for me to recommend JXN as a buy. This will be one of those investments and recommendations better left to the experts in the space, of which I am not. So, rather than rating this a buy on the initial catalysts, I am rating it a hold/sell because it doesn’t fit my sustainable growth at a reasonable price or deep value thesis.

Be the first to comment