pinstock

Thesis

Discover Financial Services (NYSE:DFS) is a company with an all-around solid value proposition based on its business performance and shareholder returns. We like the company’s history of growth and improvements in key lines of its business. However, in our first coverage of this stock, we are recommending a “HOLD” as we believe that current economic uncertainties beg caution. We believe waiting to see the real impact of interest rate hikes and tightening monetary conditions is favorable at this moment. We will update investors as earnings results come out or the macroeconomic environment has changed meaningfully.

Company Overview

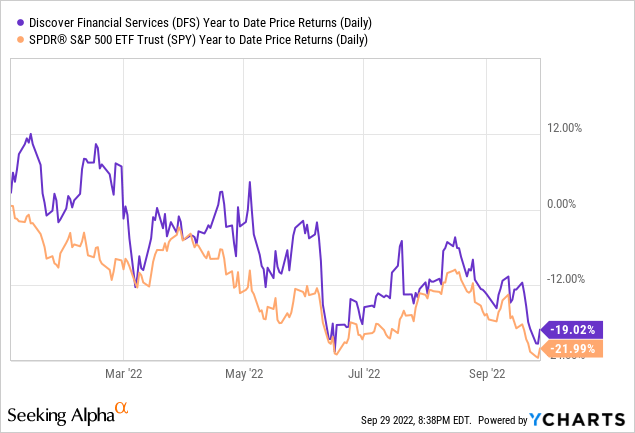

Discover Financial Services is a company that provides digital banking and payment services to consumers and companies. The company issues credit cards, most notably the Discover Card, but also offers other services like loan services such as private student loans, personal loans, home loans, and other banking services. Year-to-date, the company has tracked the performance of the S&P 500, declining -19.02% compared to S&P 500’s decline of -21.99%. As of the time of this writing, Discover Financial Services has a market capitalization of $24.97 billion.

Current Positives

Strong History of Dividend Growth

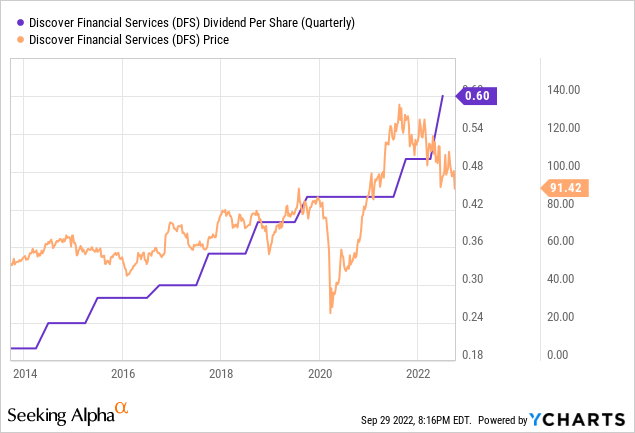

Discover Financial Services has had a strong history of dividend growth in the past 10 years, regardless of the movements in the stock price. The company currently pays $0.60 per share at an annualized yield of $2.40. Based on the current stock price, the current quarterly dividend translates to an annualized dividend yield of 2.63%. Such dividend rate is higher than the measly 1.69% dividend yield of the S&P 500. In addition, compared to 10 years ago, the quarterly dividend has tripled from $0.20 per share to $0.60 per share. Such increase represents a solid dividend CAGR of ~11.6% over the past ten years. We believe that the company’s dividend yield and growth are among the company’s main merits.

Modest Growth In Key Metrics

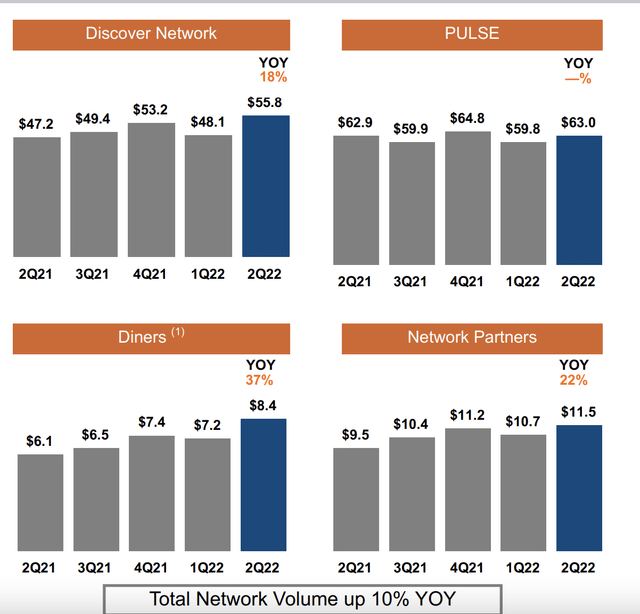

In the company’s Q2 earnings report, the company has shown some solid growth in key areas. As a digital banking and payment services business, the company’s bottom line is highly tied with payment volume. The higher the payment volume, the more money the company can generate on those volumes. 2Q22 purchase volume increased 10% YoY with outsized growth in key segments such as Discover Network and Diners, with an 18% YoY and 37% YoY growth, respectively.

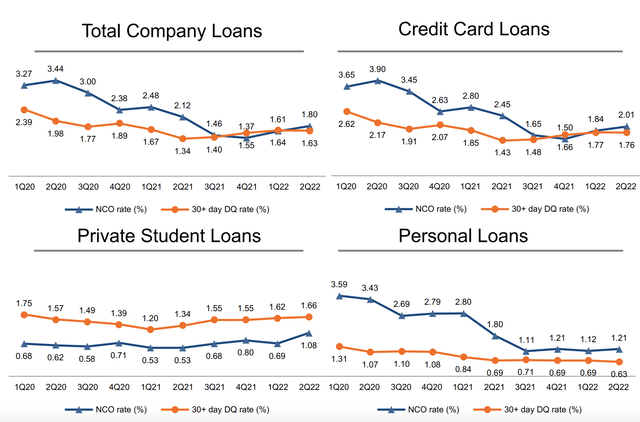

Stable Asset Performance

The company’s loan performance as of last quarter remained solid, with stable delinquency rates all across the loan segments. Despite the economic turmoil throughout the past year, it’s been good to see metrics remain stable over the past few quarters. Net charge-offs have also remained stable over the past few quarters, though it’s worth noting that net charge-offs have increased meaningfully for the private student loans segment. Regardless, we see past loan performance as a good sign with regard to the company’s underwriting standards, and the company has roughly $6.76 billion in allowance for credit losses.

Risks Ahead

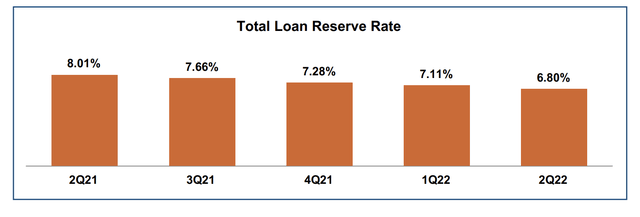

Despite the previously good performance, our bearish viewpoint stems from the declining economic fundamentals. As the Federal Reserve continues to raise rates at a rapid pace and chances of a major recession increase, Discover Financial Services’ fortunes can turn around quickly as credit losses pile and consumers halt spending. In our view, we remain vigilant of high yields in the short-term treasury market as it indicates the tightening monetary conditions for the near term. What worries more is the fact that the loan reserve rate currently stands at 6.80%, which declined from 8.01% during Q2 of 2021. We believe that the decline in the loan reserve rate when the economy is about to get worse is not a good situation for shareholders.

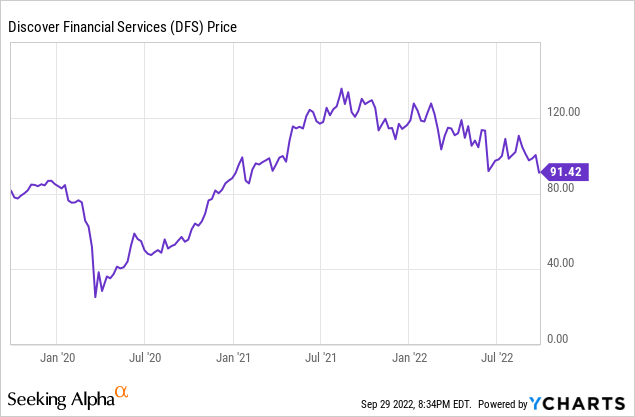

In terms of downside, we think that the crash during the pandemic can be a good example of what the price of the share will be in the event that a worse-than-feared recession becomes a reality. In March 2020, Discover Financial Services traded at near ~$25 per share, which is 72% lower than the current stock price. Though we do not expect such a major crash as a base case scenario, we believe that the previous stock declines can demonstrate the potential downside of the company when the market believes that we are headed to a major credit-negative event. Based on this potential downside, we believe that the risk/reward is skewed to the downside, given that the stock is only 32% below its highs in November of last year.

Conclusion

Though Discover Financial Services has had good performance in the past few years, mostly through friendly shareholder policies and solid growth in many segments, we believe that recession risk remains too high for us to recommend the stock. We believe investors should wait until the next couple of earnings reports come out before taking a position on the stock. We will monitor this stock and update investors as more news comes out and/or economic uncertainties diminish.

Be the first to comment