Scott Eisen

Right now, an open debate is up in the air: will we have a recession or not? Various investors and corporate leaders seem to stand in both camps. In either scenario, however, I find it very unlikely that weakened companies like Blue Apron (NYSE:APRN) can claw their way out of deep-seated problems.

Blue Apron is a familiar household name for many, but for those investors who are unfamiliar with the brand: Blue Apron was one of the original meal kit companies that gave you everything you needed to cook 1-2 recipes in a single weekly shipment. It grew in popularity until a slew of nearly-identical alternatives popped up into the market (HelloFresh, Home Chef, and Freshly are some of the best-known competitors), the market began to spread out. Meal kit popularity got a temporary lift during the pandemic which saw a boost of in-home cooking, but in the post-pandemic world it seems that Blue Apron has been unable to sustain that demand boost.

After going through multiple leadership transitions and refinancing to keep its balance sheet today, Blue Apron is still struggling to determine if it’s still relevant today. Year to date, the stock has lost more than 40% of its value. While it’s tempting to want to believe in a turnaround story for this name and buy on the dip, I think Blue Apron still has much more to lose.

I remain bearish on Blue Apron and am in favor of soft short tactics to bet against the stock (I’ve been buying puts on the name). Here’s a recap of the bear thesis on this stock, which has only worsened with the company’s most recent quarter (which we’ll cover in detail in the next section):

- Blue Apron is bleeding customers. Revenue declines are worsening quarter over quarter, and each quarter also sees a fresh bleed-out of customers as overall demand in the meal-kit category is dwindling.

- The company is struggling in an inflationary environment. Raw food prices are skyrocketing, as are wages for the company’s heavy headcount in logistics and distribution. Due to the intense competition in the meal-kit space, Blue Apron doesn’t have much room to pass on these increases to customers; hence, gross margins are taking a heavy hit.

- Limited liquidity. Blue Apron’s $56 million of balance sheet cash as of its most recent quarter puts the company in a rather precarious position. This is especially true as raising fresh capital in today’s market is not only difficult, but expensive even if achieved.

- Recent “Hail Mary” strategies to resurrect demand may backfire. Blue Apron recently stepped up marketing spend in an attempt to win back customers, as well as unveiling a new Breakfast menu. These strategies may drive unfruitful spend/unnecessary menu complexity that put Blue Apron further in the hole.

As a reminder, Blue Apron has been in “turnaround mode” since 2019 when it first started noticing declining demand, and which is also when current CEO Linda Findley took the reins from former CEO Brad Dickerson. Some of the primary goals that Blue Apron’s turnaround plan aimed to achieve were to improve menu diversity to attract a wider pool of customers, while also boosting marketing spend efficiency (the company has since reversed course on marketing, deciding it needs to step up marketing spend in 2022).

Three years into this supposed turnaround, Blue Apron is still dancing on thin ice – suggesting that no matter the efforts that the company is putting in, Blue Apron may be well past its expiration date.

The bottom line here: Blue Apron remains a highly risky stock, with limited liquidity, growing losses, and a waning brand. Exercise extreme caution here, and buying puts on the name may be a good way to capture additional downside.

Q1 download

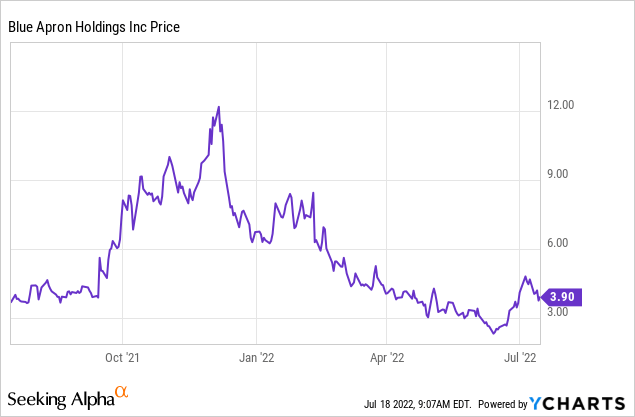

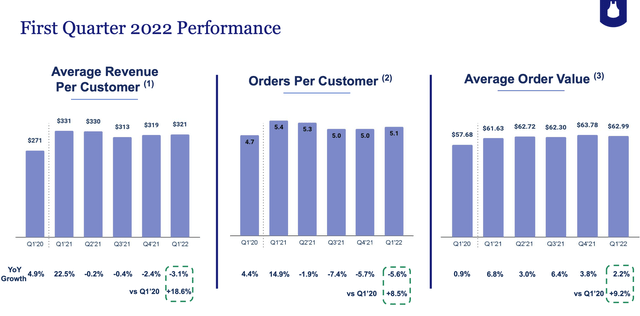

Let’s now cover Blue Apron’s latest quarterly results in greater detail. The revenue trend is shown in the chart below:

Blue Apron revenue trends (Blue Apron Q1 earnings deck)

Blue Apron’s revenue in Q1 declined -9% y/y to $117.8 million, missing Wall Street’s expectations of $125.1 million (-4% y/y) by a huge five-point margin. This also represents two further points of revenue deceleration versus -7% y/y decline in Q4, which in turn decelerated sharply from a -2% y/y decline in Q3. The picture here is evident: Blue Apron continues to do worse with each passing quarter.

This is in spite of the company’s increased marketing spend, which may not have the power to reverse customer behavior. As can also be seen in the chart above, Blue Apron stepped up its spending on marketing by 40% y/y to $27.9 million, representing 24% of revenue versus just 15% in the year-ago Q1. To me, what this says is that Blue Apron has to significantly increase its marketing spend just to retain a flat revenue base, and even flat is something it’s failing to do.

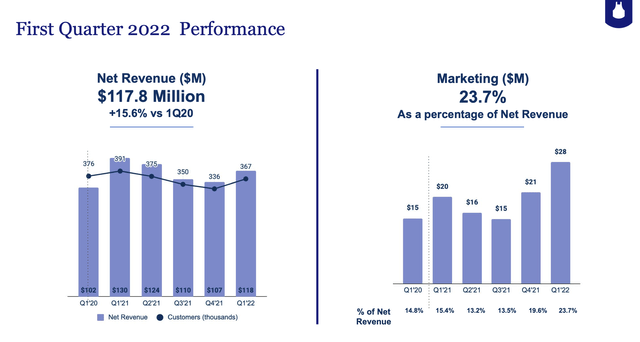

Customer metrics also trended worse in the quarter, with average revenue per customer declining -3% y/y and order frequency declining -6% y/y:

Blue Apron customer metrics (Blue Apron Q1 earnings deck)

Margins were also at risk in the quarter. Blue Apron’s variable margin, which it has started using in place of gross margin (essentially a “pro forma” gross margin that is calculated as revenue less cost of goods sold, excluding depreciation and amortization within COGS), dropped -460bps y/y to 32.5%, driven by continued inflationary pressures. That’s also much worse than 35.3% in Q4.

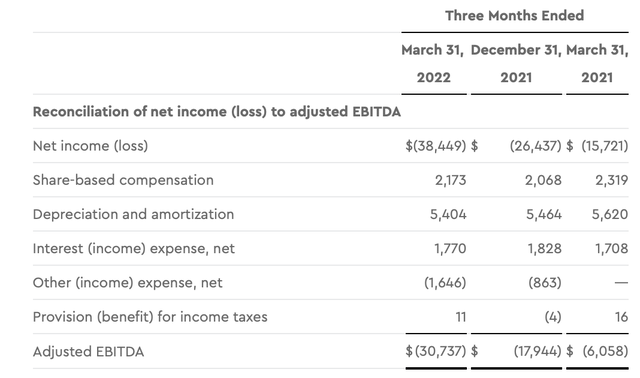

Adjusted EBITDA losses also ballooned to -$30.7 million, more than 5x the year-ago loss of -$6.1 million. In addition to that, free cash flow burn in the quarter was -$30.1 million, leaving just $56 million of cash left on Blue Apron’s balance sheet (weighed against $65 million of debt).

Blue Apron adjusted EBITDA (Blue Apron Q1 earnings deck)

The company achieved a minor financing just after the end of the first quarter to bridge its cash needs. Per CFO Randy Greben’s prepared remarks on the Q1 earnings call running through the details of the raise:

Subsequent to the end of the quarter, we announced a $40.5 million equity raise, of which $20.5 million has closed and the successful refinancing of our debt, which includes $30 million of new senior secured notes that mature in May 2027. We utilized the proceeds from the senior secured notes and cash on hand to repay our prior term loan.

We expect to close the remaining $20 million private placement by the end of this month and immediately following that closing, we expect to have approximately $80 million of cash on hand. Further, as of May 5, all of Blue Apron’s debt is classified as long term.

The successful refinancing of our term loan should be seen as another encouraging sign of the progress against our turnaround. Our new debt comes with a significantly lower cost of capital. We’ve reduced our coupon rate by more than 160 basis points per annum, assuming we meet the specified bond ratings for the debt, and are in an interest-only environment for the next three years.”

To me, however, this raise is just a minor band-aid on a wound that hasn’t stopped bleeding. The ~$40 million of new equity (no net change in cash position from the debt raise, as that was a pure refinancing) barely covered Q1’s cash burn.

Key takeaways

Unless you believe that inflation is set to cool and Blue Apron will suddenly see an influx of customers due to its marketing binge (both need to be true), this company remains in treacherous waters. Prepare for further downside here.

Be the first to comment