onlyyouqj

Introduction

In August 2022, I wrote a bearish article on Seeking Alpha about a high-dividend gold producer named Fortitude Gold Corporation (OTCQB:FTCO). I said then that its golden age was set to end around the end of 2024, as reserves at its flagship project are low.

The company just released its financial results for Q3 2022, and I think that the progress made on the exploration front seems underwhelming. In addition, Fortitude Gold faced headwinds from low gold prices and production slumped to just 9,500 ounces of gold. Overall, I view the Q3 results as disappointing and I remain bearish on Fortitude Gold. Let’s review.

Overview of the Q3 2022 financial results

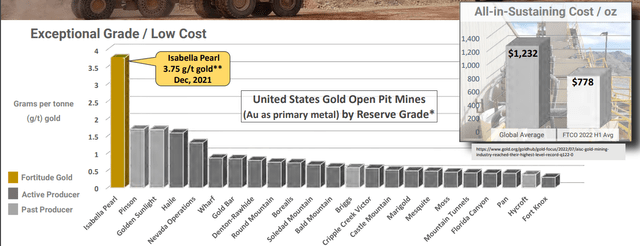

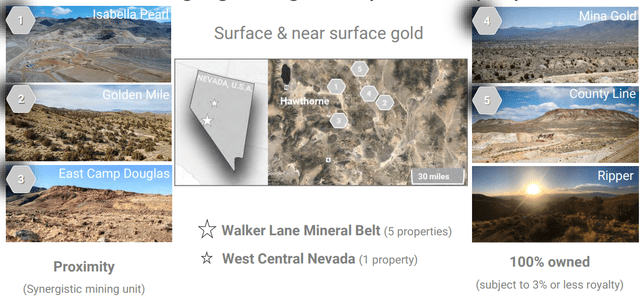

In case you haven’t read any of my previous articles about Fortitude Gold, here is a short description of the business. The company owns the Isabella Pearl gold mine in the Walker Lane Mineral Belt in the state of Nevada, which has an annual output of about 40,000 ounces of gold. It’s a small but profitable open pit mine, as the high grades allow Fortitude Gold to keep all-in sustaining costs (AISC) below $800 per ounce of gold. For comparison, the global average is above $1,200 per ounce.

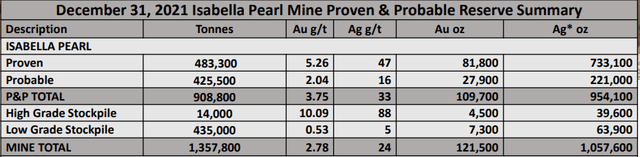

Fortitude Gold pays out a monthly dividend of $0.04 per share, which translates into an annual dividend yield of 8.8% as of the time of writing. It’s unusual to see dividends this high in the gold mining industry, and if you’re wondering why the market valuation isn’t higher, the answer is that the reserves are limited. You see, Isabella Pearl had proven and probable reserves of less than 110,000 ounces of gold as of December 2021, which means that the mine life runs out at the end of 2024.

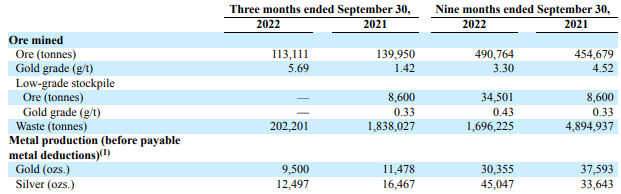

Moving on to the latest production and financial results, the company blended high-grade material with more low-grade stockpiles during Q3 2022 in line with the mine plan, and this negatively affected production and costs. Production was also negatively impacted by lower leach pad recoveries due to the timing of material placed under leach. However, AISC slumped by 13.4% thanks to less waste mining during the period. Yet, I find it concerning that the amount of ore mined was low.

Fortitude Gold Fortitude Gold

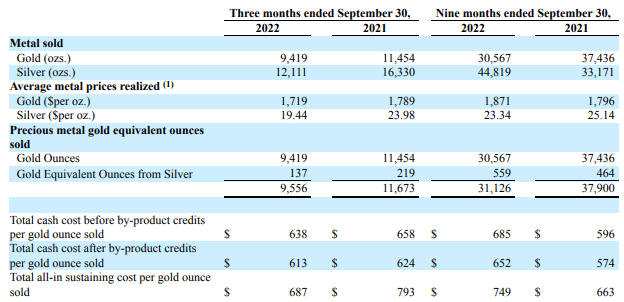

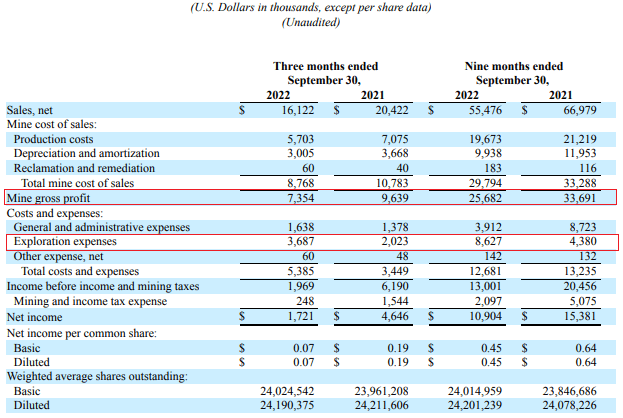

As gold prices dived below $1,700 per ounce in September, the mine gross profit slumped to $7.4 million, but this amount was still more than enough to enable Fortitude Gold to pay out $2.9 million in dividends during the quarter once again.

Fortitude Gold

As you can see from the table above, the company increased exploration spending during Q3 2022 to $3.7 million from just $2 million a year earlier as it accelerates its plan to extend the mine life of Isabella Pearl through the development of nearby deposits. In Q3 2022, the focus was on the Golden Mine, County Lane, and Ripper targets. For Q4, Fortitude Gold plans to focus on Golden Mile, the Isabella Pearl trend, Country Lane, and East Camp.

All future project processing plants will be built to take gold to the carbon phase only, and the material will then be trucked to the existing absorption, desorption, and refining (ADR) plant at Isabella Pearl for final ore production.

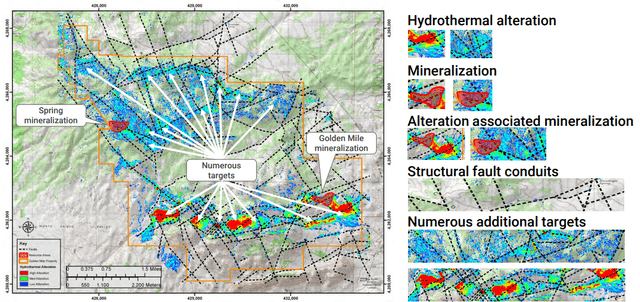

Exploration during Q3 2022 included 10 reverse circulation (RC) drill holes totaling 956 meters at the Pearl open pit to define the limits of gold mineralization and transitional zone oxidation. Fortitude Gold also drilled 22 RC holes totaling 4,647 meters at Golden Mile, which is the most advanced undeveloped deposit at the moment with indicated resources of 78,500 ounces of gold. There are various exploration targets at the property and the company aims to update its resource estimate and potentially convert mineral resources to mineral reserves in late 2022 or early 2023.

The deposit is open on strike and depth, so resources are likely to increase substantially in the resource update, but the main issue here is that the grades look underwhelming. The average grade of the indicated resources is just 1.13 g/t, which is less than a third of the proven and probable reserves at Isabela Pearl. This raises questions about whether production here would be economically feasible at today’s gold prices of $1,650 per ounce.

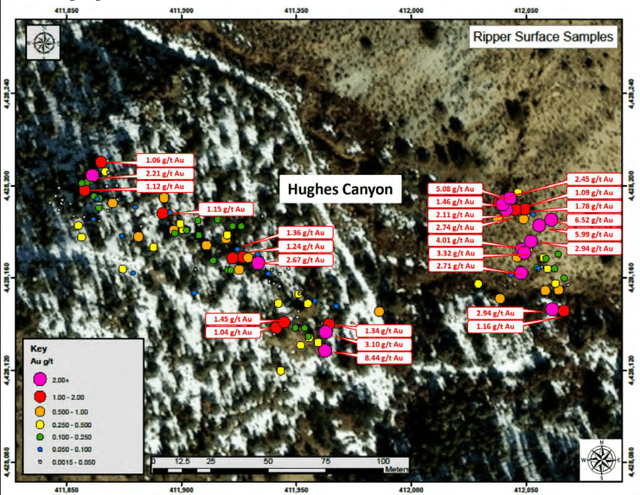

Fortitude Gold also completed 31 RC drill holes totaling 2,855 meters at County Line as well as 2 RC holes totaling 169 meters at East Camp Douglas. However, the grades at these targets are also lower than the Pearl deposit. The surface samples at Ripper look promising and the company commenced detailed mapping and sampling of known gold mineralization at the target in Q3, with a first drill program is targeted sometime in 2023.

However, I think that the exploration activities there are nowhere near advanced enough for the deposit to be put into production when Isabella Pearl runs out of reserves.

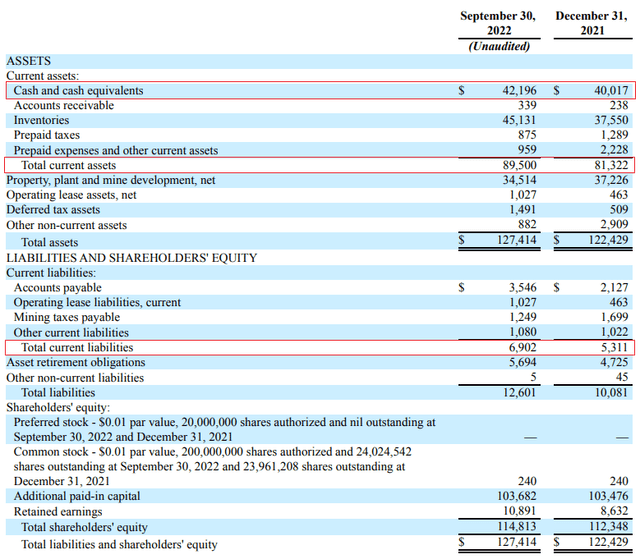

Turning our attention to the balance sheet, I think the situation looks good, as Fortitude Gold finished September with $42.2 million in cash and cash equivalents and no debts. The company had $82.6 million of working capital at the end of Q3. Yet, considering Fortitude Gold is valued at $137.7 million as of the time of writing, I think the company looks overvalued.

Yes, the enterprise value is just $95.5 million and Isabella Pearl is profitable even if gold prices drop by 50% but significant funds will be invested into exploration in the coming years. The major issue is that Fortitude Gold is running out of time to extend the mine life of Isabella Pearl and progress made during Q3 2022 seems insufficient. Golden Mile remains the only deposit that is ready for commercial production and I doubt its margins are good enough due to the low grades.

That being said, the prices of commodities are notoriously volatile, and I think that short-selling companies in this sector is dangerous. It could be best for risk-averse investors to avoid Fortitude Gold.

Investor takeaway

Fortitude Gold’s revenues and net income declined in Q3 2022 due to lower gold prices as well as blending more low-grade stockpiles, but the balance sheet still looks strong.

I think that the pace of exploration is too low at the moment, as Golden Mile is still the only deposit that is close to a production decision. The grades there are much lower than the current reserves of Isabella Pearl and the deposit is unlikely to be economically feasible unless gold prices increase significantly in the coming years. Avoid Fortitude Gold Corporation stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment