Parradee Kietsirikul/iStock via Getty Images

By Somya Sharma

Note: The first time we write about an ETF, we issue an ETF profile report. Use this link to see that profile, as it will provide helpful background for this ETF update report.

Summary

In the last few years, it seemed everyone was buying everything. Stocks were at an all-time high, the IPO market broke records, and retail investors saw a boom in numbers. However, this year, the market has been on a rollercoaster ride; the reasons are many, from Russia/Ukraine to raging inflation on a global scale, to fed policies and market sentiment. There was no place to hide!

This volatility gave investors many chances to profit, but at a higher risk. As we said in the previous article, ‘for those seeking a potentially smoother ride, though still with plenty of equity market risk, Invesco S&P 500 Low Volatility ETF (NYSEARCA:SPLV) aims to deliver a less-volatile ride than the full S&P 500 index.’ It pursues that by investing in the 100 least volatile stocks of the S&P 500. The ETF determines the “least volatile” by examining the entire S&P 500 component stock list over the past 12 months.

Despite the attempt to reduce volatility, this ETF is highly-correlated with the broad equity market, which means it moves in a similar direction as SPY. As of mid-December, SPLV is a rarity within the Equity ETF world. It is close to breaking even for the year. However, that strong performance has quickly brought SPLV’s collective portfolio to a less-attractive valuation level. We are still skeptical about the intermediate-term outlook for the stock market. And, while SPLV might hang in there for a while, there are likely to be better Equity ETF opportunities in the months ahead. So, we maintain SPLV’s rating as Sell.

SIP Proprietary ETF Grades & Ratings*

Grades

- Offense/Defense: Offense

- Segment: Thematic Equity

- Sub-Segment: Low-Volatility

- Concentration: Low

- Correlation: Moderate

- Liquidity: Very High

Quantitative Ratings

- Risk: Average

- Reward: Average

- Fundamental: Average

Technical Ratings

- Short-Term rating (next 3 months): Hold

- Long-Term rating (next 12 months): Hold

Review of Key Factors

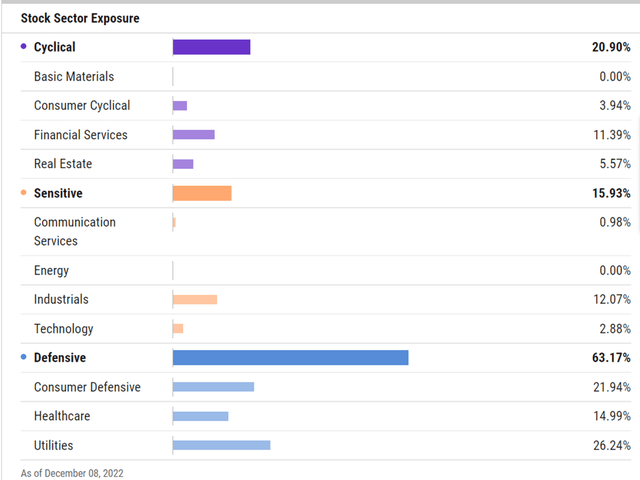

SPLV’s strategy to capture the lowest volatile stocks from S&P 500 offers investors the opportunity to capture the benefits regardless of the sector it may hold. With the recent adjustments in the index, the fund’s holdings are now spread across 9 of the S&P’s 11 sectors, as Energy was removed since the last quarterly index reconstitution, and the Basic Materials sector remains absent. The highest current concentration is in the Defensive sectors (Consumer Staples, Healthcare, Utilities) at 63%. This structure is not surprising in an ETF that aims for low volatility.

SPLV Sector Exposure (Ycharts)

While the fund’s holdings are not equally-weighted, the ETF’s weighting mechanism results in a portfolio that is close to equally weighted. This, along with the more defensive nature of the holdings, represents a visible pair of risk-reduction attempts that SPLV makes.

The percentage of assets in the top 25 holdings is 28%, with the highest allocation in Johnson & Johnson (JNJ) at 1.28%, followed by Coca-Cola (KO) and PepsiCo Inc (PEP) at 1.19% and 1.16%, respectively.

Recent Highlights

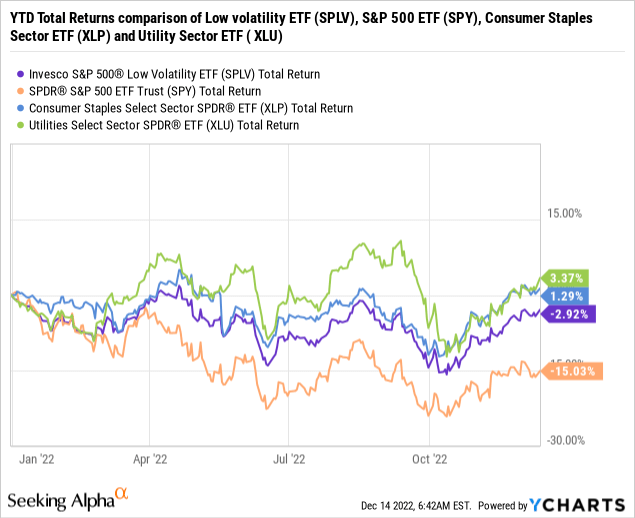

SPLV has been in existence since 2012. Since then, it has underperformed the overall market by a considerable margin. The reason is easy to understand: the past decade was driven by higher-volatility growth stocks, the exact segment of the S&P 500 that this ETF aims to exclude. However, during 2022, the fund’s defensive exposure was a blessing. As of this writing (12/12/22), it has nearly broken even for the year-to-date. It has captured less than 1/10 of the decline in the S&P 500 Index, at precisely the right time.

In an environment where few price moves seem to last, the Consumer Staples (XLP) and Utilities Sector (XLU) have positive returns YTD. The counter-cyclical nature of these industries has helped SPLV to maintain consistent outperformance to the broader market throughout 2022.

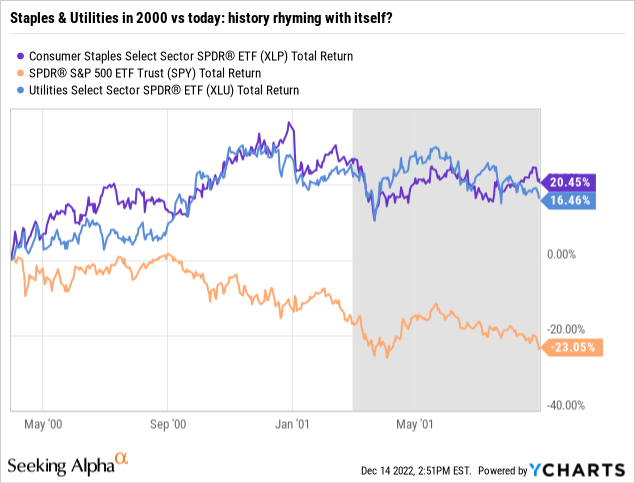

Current Bull Case

In the bear market of 2000-2001, investors were rewarded for owning the Consumer Staples and Utilities stocks in their portfolios. This has been the case in many, but not all recessions. Those sectors are better-positioned than much of the stock market, when consumer purchasing power falls, and they react by reducing spending on discretionary goods. We expect another recession soon, so the case for defensive sectors is currently strong.

Current Bear Case

However, what remains to be seen is whether 2022 was the peak positive performance for those defensive sectors. As the above chart shows, 2000 was a great year for them. 2001 was another year of strong relative performance, but moderate absolute performance. So 2023 may not be as vibrant as 2022 was for these market areas.

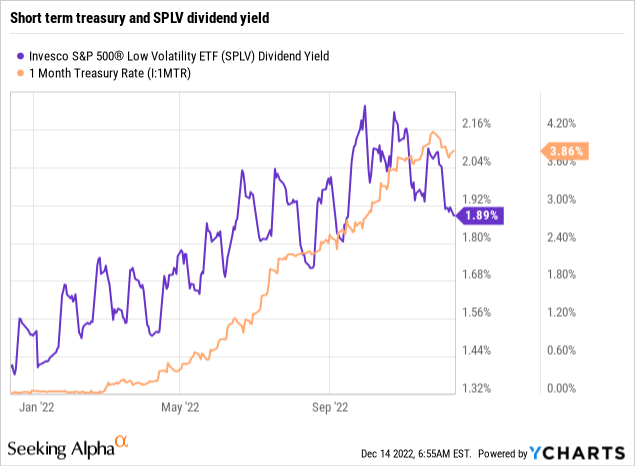

SPLV’s major exposure to defensive sectors is a two-way sword. These sectors face many critical risks varying from rising interest rates and high material and labor costs, affecting companies’ valuation and profitability. So, unless there is a significant change in SPLV holdings, it is less likely to be treated by the market as a “Safer alternative to SPY” for too much longer.

SPLV has provided consistent dividend growth to investors in the past. And the dividend payment is higher for SPLV (1.9%) than it is for SPY (1.1%). However, a yield around 2% is not nearly as strong an alternative to T-Bills and other cash-equivalent investments, when those are paying in the 4% range. In the chart below, you can see that 1-Month T-Bill rates crossed above the trailing 12-months dividend yield for SPLV during the second half of 2022.

Current Investment Opinion

SPLV is a solid choice for relative stability (versus the broader S&P 500) and less lower price fluctuation during bull market cycles. However, this is a bear market. In a bear market, all sectors ultimately become unstable. SPLV is often less volatile, but it still provides exposure to stocks from S&P 500. So an investor in SPLV does not avoid market risk, they merely aim to reduce it on a long-term basis. Therefore, while we like the low volatility concept, we would maintain the Sell ratings given the current market climate.

Be the first to comment