RichVintage/E+ via Getty Images

Introduction

Flotek Industries, Inc. (NYSE:FTK) has made a couple of strategic moves that could enhance its viability as a going concern. In my last article, I suggested that the company was headed for bankruptcy and investors should steer clear. I no longer hold that opinion.

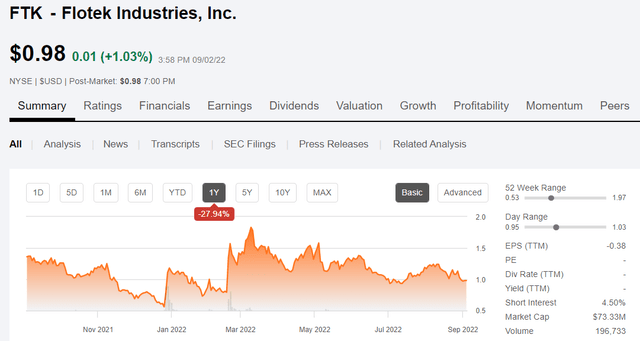

Price chart for Flotek (Seeking Alpha)

Oilfield companies have a way of finding ways to survive, and that has been the case for FTK with their agreement with ProFrac Holding Corp, (PFHC). Effective the first of April 2022, this agreement to supply chemistry on an initial 8-fleets of PFHC frack equipment has already paid dividends. Revenue was up 128% QoQ, and 230% YoY. The agreement brings an estimated $200 mm in revenue per year, has a run-period of ten years and an implied backlog impact of $2 bn. John Gibson, CEO of FTK, comments in regard to the ProFrac deal –

Over the next decade, we anticipate this agreement should create backlog of more than $2 billion in revenue for Flotek, including anticipated revenues well in excess of $200 million in 2023.

In this article, we will examine some of the potential impact of this deal to help determine if it is indeed a catalyst for a return to growth.

The thesis for Flotek

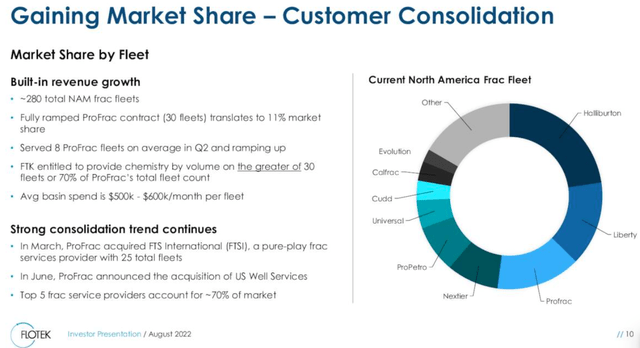

There is no question that the company pulled in a Hail Mary pass when it landed the ProFrac deal. With an estimated 44 fleets when it completes the acquisition of U.S. Well Services (USWS) later this year, PFHC is positioned to be one of the larger frac companies in the U.S.

Flotek 2-Q investor deck (Flotek)

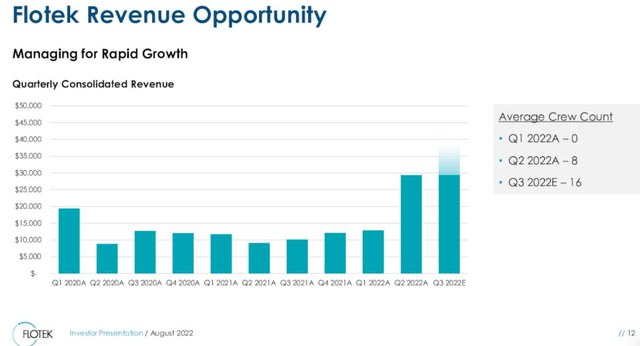

From what I can determine, the core products FTK will be supplying are surfactants that will reduce friction pressures while pumping. This is pretty common and the chemistry is low margin, high volume. FTK notes in their slide deck that revenues of about $500-$600K per month/fleet are anticipated. With 8 fleets serviced in Q-2, that tracks pretty closely with the increase in revenue reported of $29.2 mm, over Q-1. An additional 8-fleets will be added for Q-3, so revenues should be up commensurately. Ryan Ezell, COO of FTK, commented in regard to potential volumes associated with the ProFrac deal –

ProFrac was conservative in their assumptions on the calculated volumes per fleet when we designed and negotiated the contract. And to date, the delivered volume per fleet has run ahead of our expectations. In other words, it’s very possible that we’ll be able to fulfill the contracted volumes at a fleet count that is less than 30. Additionally, this provides potential upside throughout the 10-year life of the partnership.

The ProFrac deal appears to have some upside for FTK based on Ezell’s comments. Meaning that revenue and EBITDA could surprise to the upside as well.

Flotek 2-Q investor deck (Flotek)

The company also pointed out the opportunity to sell higher margin chemistry on these jobs. That sounds a little spongy to me. Fracking is a story of brute force breaking down the rock. Other than the friction reducers, typically a little bit of O2 scavengers, iron sequestrants, flow back enhancers, and corrosion inhibitors make up the bulk of the rest of the chemistry on a typical water-frack job. Gel-fracks, done less these days with increased stages, will add some additional chemistry in the form of gelling agents and viscosity breakers. None of these are particularly high margin items. So we will just have to see what they report in Q-3 before we assign any value to this aspect.

It was also noted in the call that ProFrac will be utilizing up to 20 of the company’s JP3 Verax Flow analyzers. This is a great application for some technology that management way overspent to buy a couple of years ago, and subsequently wrote down. With the increased focus on ESG reporting, these analyzers will keep track of the diesel vs a field natural gas blend being used, and help certify Tier IV EPA emissions performance in ProFrac’s DGB units. Rental items like this can be a pretty high margin ticket. This is something that is scalable and has applications beyond the ProFrac deal. Good on management for identifying and capitalizing on this opportunity!

Risks

The primary benefit is also a risk. As ProFrac’s fortunes go, so go FTK’s. It will be a challenge to sell chemistry to other fracking companies. When there is a relationship as tight as this, other companies are reluctant to buy. The aversion of feeding a competitor is pretty strong, and there are many sources for this same type of chemistry.

Having the Wilks Bros in control carries risk. With the upfront cash payment of ~$19 mm through a PIPE investment in February 2022. With this came 10% convertible notes that mature next year. Under the expanded agreement just executed in June, FTK issued another $50 mm in convertible notes that could deliver 48% of the company to ProFrac, once converted in 2023. The current float is 74.8 mm shares, so this will be very dilutive to current shareholders. ProFrac will also control 4 of 7 FTK board members.

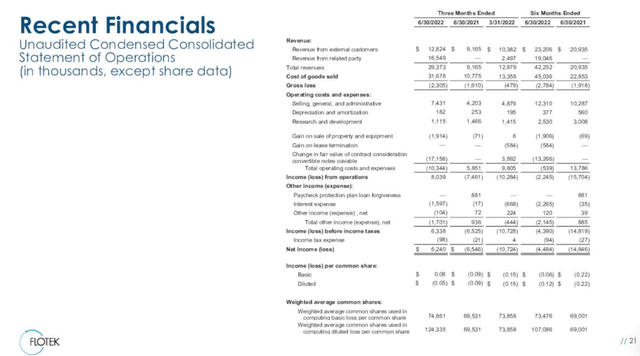

FTK is back to generating EBITDA for the first time since 2019, of $8 mm on a non-GAAP, basis, but this was driven by a non-cash gain on the convertible notes. On a non-GAAP adjusted basis, the EBITDA number was a negative $7.2 mm, which was driven by ramp up costs for the ProFrac agreement. On the plus side, thanks to this deal, they have built cash to $33 mm, up from $26 mm in Q-1. The company has a minuscule amount of debt, $3.1 mm. As service company balance sheets go, FTK’s is fairly clean.

Flotek 2-Q investor deck (Flotek)

Your takeaway

As FTK is not yet generating positive cash flow or EBITDA, we have to value it on a Price to Sales basis. The enterprise value (“EV”) of FTK is about $110 mm at present. With a reasonable projection of revenues of $200-220 mm on an annualized basis, that puts the multiple at <1X on this basis. A respectable number. For reference, a competitor to FTK, Select Energy Services (WTTR), trades at a GAAP EV/EBITDA multiple of 5.3, and a price to sales ratio of <1X.

Only one analyst has rated the company as Buy, but with a price estimate of $2.50 per share. I expect the lack of coverage is due to FTK being in delisting territory, price-wise. Q-2 and so far Q-3 have been horrific for service providers, thanks to concerns about the economy and the direction oil prices would take. I think some of those concerns are alleviating and prices will rebound.

I think the tide has shifted for FTK stock and have to give them a buy rating at present prices. The fracking story is firmly entrenched in this country, and should have a long tail. There is also potential to expand to other countries with these products. Notably, Argentina is experiencing growth in its Vaca Muerta shale play. If they are doing 2-3 mile fracs, they are going to need friction reducers and ancillary chemistry.

Be the first to comment